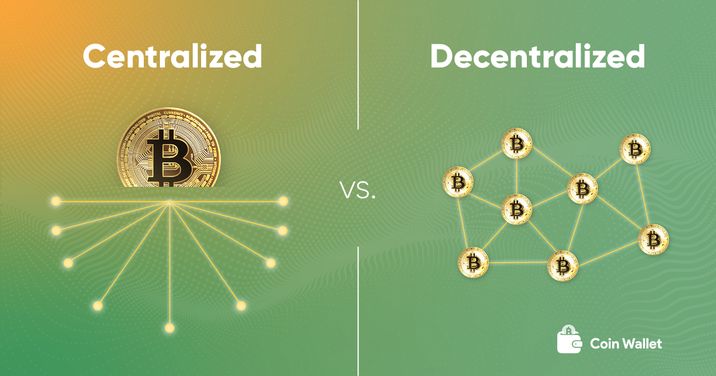

Centralized vs Decentralized Exchanges

DeFi is one of the most talked about categories in cryptocurrency. The number of DeFi users is approximately over four million and while that's still relatively small compared to traditional financial standards, DeFi is growing fast. Like most cryptocurrency services and protocols, the future of exchanges seems to be shifting towards total decentralization. But while some believe that centralized and decentralized exchanges will co-exist, others argue that centralized exchanges will soon be replaced indefinitely.

The argument favouring centralized exchanges is that they’re more user friendly and focused. These exchanges are truly very easy to use, even for those less tech savvy. On top of that, they also tend to offer better liquidity and as they make most of their money from trading fees, they’re incentivized to make the user experience as good as possible so users continue to come back. That is why they have dedicated support teams and that is why they continue to make improvements to their user interfaces.

But because these exchanges hold your cryptocurrency’s private keys for you, they are the ones who are in total control of your funds. For some people, this is ideal. Securing a private key themselves might be a tedious task. But for others, this is something that is risky and unwise, which is why they stay away from storing crypto on exchanges.

Aside from storing crypto on exchanges though, centralized exchanges also perform terribly when it comes to spikes in user volume. For instance, when there is a big influx of users, centralized exchanges tend to crash which prevents users from entering or exiting positions that they wanted to. Not being able to buy, sell or access your funds because an exchange has crashed is a horrible and frustrating experience. And what makes it even worse is that sometimes it can take days for these exchanges to get back up and running, which by then, the market sentiment will most likely be completely different.

Then we also have the issue of frozen funds and assets. There have been countless cases where a user’s fiat bank has messed with an exchange that has then caused an exchange to mess with a user. Because of a lack of regulation and global uncertainty surround cryptocurrency and crypto exchanges, the whole process of moving from fiat to crypto and crypto to fiat is complicated and it can leave users facing the same problems commonly found in the legacy banking system.

And finally, another typical issue with centralized exchanges is the fees. They are often expensive, sometimes even reaching up to 4%. While that might not seem a lot of an occasional transaction, for users that trade often or invest substantial amounts of money, the fees really do add up.

So this brings us to decentralized exchanges (DEXs). DEXs are similar to centralized exchanges as they allow users to easily exchange cryptocurrencies, but they work very differently.

For a start, orders are executed on-chain directly powered by smart contracts and the users do not give up custody of their funds at any point. They do not transfer, deposit or withdraw anything. They simply connect their wallets to the DEX and the smart contracts do everything in the background.

Using a DEX has a whole heap of benefits, with the most significant being anonymity. To trade on centralized exchanges, users had to give up a lot of private personal information, including ID. But with DEXs, users only have to hand over on-chain information.

DEXs are also censorship resistant. One of the core principles of cryptocurrency is decentralisation and this idea thrives on the idea that no one central authority has control over a network. And unlike centralised exchanges, DEXs cannot be censored. They’re also super private as they also cannot be tracked further than a user's public address.

On top of this, DEXs are very secure because they exist across a network of computers which makes it more complicated to attack due to the lack of a single point of failure. Because of this lack of a single point of failure, even if multiple network operators go down due to an attack or maintenance, the DEX will stay up and running. This means that there is almost zero down time, thus making them more reliable than centralised exchanges.

What makes decentralised exchanges so great however is that not only can you buy and sell on them, but you can also get paid to provide liquidity. Providing liquidity means putting up both pairs of a trading pair at a 1:1 ratio and then having rights to an equivalent percentage of the pool that you can redeem at any time.

Final Thoughts

Decentralized exchanges have undoubtedly gained a lot of attention and crypto savvy users so far. However, we still have some ways to go before we can safely move on from centralized exchanges altogether. In the meantime however, the possibilities of decentralized exchanges show us that we are at least moving in the right direction. And as the total number of cryptocurrency holders increase, we can assume that, naturally, so will the number of DeFi users too.