All You Need to Know About the CLARITY and GENIUS Acts

“So now my granny can buy 1 stablecoin for 1 dollar and invest it, can't she?” — asked members of the crypto community after the U.S. Congress passed, and President Donald Trump signed into law, the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act).

The answer is both yes and no. But we're pretty convinced that using USDT legally in the U.S. isn't very likely. Why? Let’s break it down below.

What Are the GENIUS and CLARITY Acts?

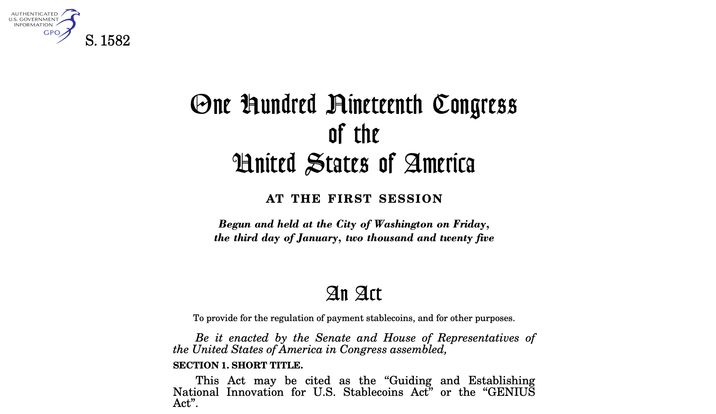

On July 17, 2025, the U.S. Senate and House of Representatives passed federal legislation S.1582 — the GENIUS Act — aimed at clarifying regulation of the nation’s stablecoin market. The next day, on July 18, 2025, the bill was officially signed into law by U.S. President Donald Trump. These acts marked a major breakthrough during what became known as “Crypto Week.”

The GENIUS Act is legislation designed to regulate stablecoins. The bill would require that stablecoins be backed by safe, liquid assets such as cash or U.S. Treasury debt, and would create a legal pathway for banks to issue their own stablecoins.

The GENIUS Act is set to take effect on January 8, 2027. However, if the necessary bylaws are adopted earlier, the law will go into effect 120 days after their approval.

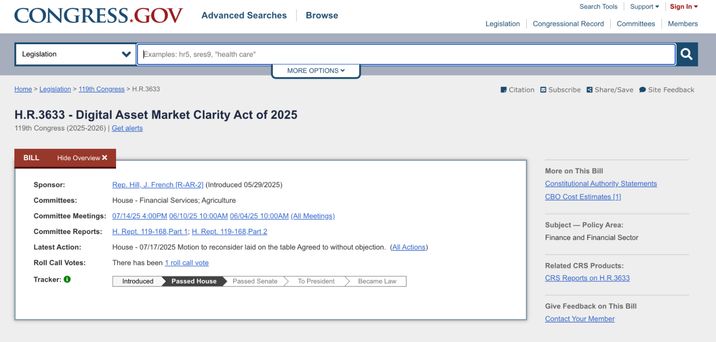

The CLARITY Act aims to clarify which asset class cryptocurrencies fall into — a question that has left many entrepreneurs and investors in regulatory limbo.

A third piece of legislation, the Anti-CBDC Surveillance State Act, is intended to address concerns that if crypto becomes an integral part of the financial system, it could lead to a scenario where authorities can monitor or even control the activities of individuals and institutions. According to Barron’s, access to how people use digital currencies could potentially reveal a significant amount of personal data.

📌 How The GENIUS Act Regulates Stablecoins

Who Can Issue Stablecoins in the U.S.?

According to the bill, “It shall be unlawful for any person other than a permitted payment stablecoin issuer to issue a payment stablecoin in the United States.” (Sec. 3(a))

“It shall be unlawful for any digital asset service provider to offer, sell, or otherwise make available in the United States a payment stablecoin issued by a foreign payment stablecoin issuer unless the foreign payment stablecoin issuer has the technological capability to comply, and will comply, with the terms of any lawful order...” (Sec. 3(b)(2))

This means only registered issuers are allowed to issue stablecoins; any issuance without approval can result in fines of up to $1 million and up to 5 years in prison. Yes, essentially, using USDT issued by Tether might be illegal — because the company isn’t registered in the U.S.

Reserves Requirements

“A permitted payment stablecoin issuer shall —

(A) maintain identifiable reserves backing the outstanding payment stablecoins... on at least a 1-to-1 basis, with reserves comprising —

(i) United States coins and currency (including Federal Reserve notes)...

(iii) Treasury bills, notes, or bonds —

(I) with a remaining maturity of 93 days or less;” (Sec. 4(a)(1)(A))

This means all stablecoins must be backed by reserves at a minimum 1:1 ratio. For example, 1 stablecoin should be backed by 1 U.S. dollar, or by equivalent assets such as Treasury bills, notes, or other bonds.

Reserves backing stablecoins must be held in their “pure” form — they cannot be used as collateral for other transactions by the issuer. However, the issuer may temporarily use part of the reserves to provide liquidity for redemptions, but only subject to prior regulatory approval.

Disclosures and Audits

“Publish the monthly composition of the issuer’s reserves on the website... including the average tenor and geographic location of custody of each category of reserve instruments.” (Sec. 4(a)(1)(C)).

This section outlines mandatory transparency requirements for stablecoin issuers. This means all issuers must disclose and publish detailed information about their reserve composition on a monthly basis, certify their senior executives, and publish the results of an independent audit conducted by a registered auditing firm. Issuers of stablecoins with a market cap over $50 billion are also required to provide extended financial statements.

Issuers with a turnover of up to $10 billion can operate under state-level regulatory oversight, while all others fall under federal jurisdiction. However, the law also allows for joint state–federal regulation.

Bank Secrecy Act, Taxes, and Payments

“A permitted payment stablecoin issuer shall be treated as a financial institution for purposes of the Bank Secrecy Act, and as such, shall be subject to all Federal laws applicable... including —

(i) maintenance of an effective anti-money laundering program...

(vi) maintenance of an effective economic sanctions compliance program...” (Sec. 4(a)(5)(A))

This means stablecoins would be integrated into the U.S. banking system.

The market for payment stablecoins will be regulated by the Department of the Treasury, the Federal Reserve, and banking supervisors including the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the National Credit Union Administration (NCUA).

However, stablecoins are not recognized as legal tender.

“A payment stablecoin that is not issued by a permitted payment stablecoin issuer shall not be —

(1) treated as cash or as a cash equivalent for accounting purposes;

(2) eligible as cash or as a cash equivalent margin and collateral...

(3) acceptable as a settlement asset to facilitate wholesale payments...” (Sec. 3(g))

And yes — if you make a profit by trading stablecoins, you’ll still have to pay taxes.

📌 How The CLARITY Act Works

The Three Categories of Tokens

The law clearly categorizes digital assets to eliminate confusion over whether they fall under the jurisdiction of the SEC (Securities and Exchange Commission) or the CFTC (Commodity Futures Trading Commission).

The law defines three main categories of tokens:

-

Investment contract asset is a token that falls under the definition of an investment contract (under the Howey test). It's regulated by the SEC

The Howey Test is the test from SEC v. Howey (1946) that determines whether an asset is an “investment contract.” It looks something like this: investment of money → in a common enterprise → with the expectation of profit → from the efforts of others

-

A digital commodity is a decentralized, mature token that is no longer dependent on developers. It will be regulated by the CFTC. The document puts it this way:

H.R. 3633 would define mature blockchain as "a blockchain system, together with its related digital commodity, that is not controlled by any person or group of persons under common control."

-

A restricted digital asset is a token that is temporarily in the process of becoming or is restricted in circulation. It will be regulated by both services

Registration Requirements for Market Participants and Exchanges

The law requires organizations that offer trading in digital commodities to register with the CFTC. This ensures that crypto exchanges follow rules similar to those in traditional commodity markets — and that users are protected.

What it means for market participants:

- Disclosure: sharing transparent information with users

- Recordkeeping: keeping detailed records

- AML/KYC: complying with AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements

- Custody rules: safeguarding client funds

Mature Blockchain Exemption

If a token runs on an open, decentralized blockchain, has been around long enough, is not dependent on a single entity, and has a broad market presence or trading volume, it may be exempt from SEC registration as a security and fall under CFTC jurisdiction as a digital commodity.

This is important, for example, for tokens like Ethereum (ETH) and Bitcoin (BTC). If they’ve proven that they are not investments but commodities traded on exchanges, they don’t need to register with the SEC.

🪙 What About Your Granny and Her Money? And Your Money Too

Why did American authorities decide to pass these laws? There are a few reasons.

The first is improving reliability and safety for crypto users. The idea is that you can use stablecoins knowing they’re secure and regulated — with less risk of losing your money.

“The reason you would never recommend grandmother use a stablecoin is she would have to give away a dollar that’s protected by the federal government and deposit insurance, which comes with a ton of consumer protections, and which pays interest in her banking account, in exchange for a stablecoin that doesn’t have any of those things,” said Corey Frayer, director of Investor Protection for the Consumer Federation of America.

So in the long run, your grandmother might actually be able to buy crypto and invest in it.

On the other hand, the world could face the same risks that led to the crashes of 1929 and 2008.

“The reason that banking insurance and consumer protections exist is because of the Great Depression and the Great Recession,” said Corey Frayer, director of Investor Protection for the Consumer Federation of America. “If we go back to a system with a whole bunch of unregulated banks being allowed to issue stablecoins, we will end up with another financial crisis.”

The second is a major step toward strengthening U.S. financial sovereignty, reducing risk and making the country a technological leader in digital finance.

And the third is about ensuring taxes, transparency, and risk control.

The Bottom Line

User privacy has been significantly restricted since the law passed:

- All regulated stablecoins are now fully transparent to the state

- Full financial autonomy is now only possible outside the system — through anonymous cryptocurrencies (like Monero or Zcash), offshore accounts, or even physical caches

All transactions on licensed stablecoins are traceable, identifiable, and verifiable. If you use such a token, your financial activity can be monitored, analyzed, or even frozen by government decision.

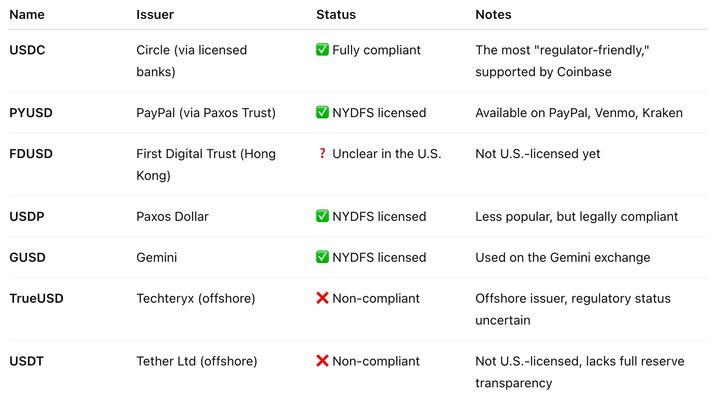

Legal and Illegal Stablecoins in the U.S. (Under the New Law)

The NYDFS is the “gold standard” among U.S. crypto regulators. If a stablecoin is licensed by the NYDFS (BitLicense or Trust Charter), it means it has been thoroughly vetted, the issuer is monitored on an ongoing basis, and the asset is considered “regulatory clean” in the U.S. — suitable for legal use.