Comparing Coin Wallet and Crypto.com: Which One Has Better Fees?

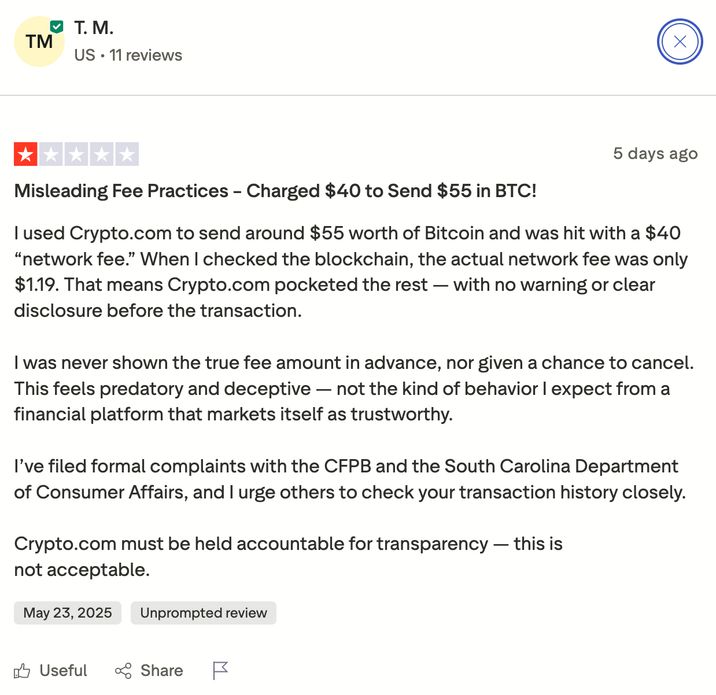

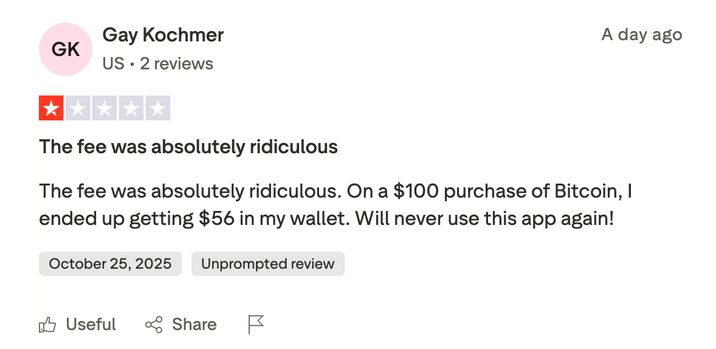

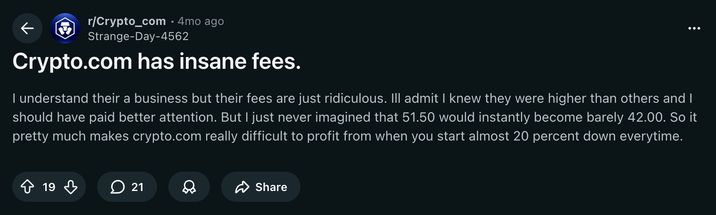

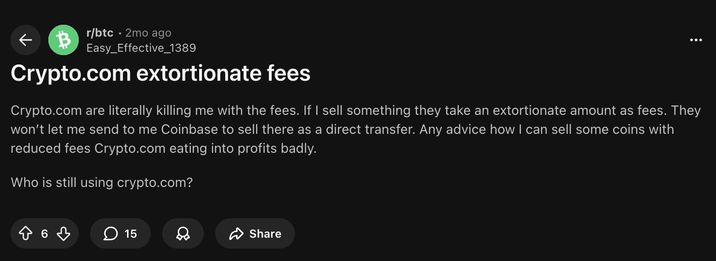

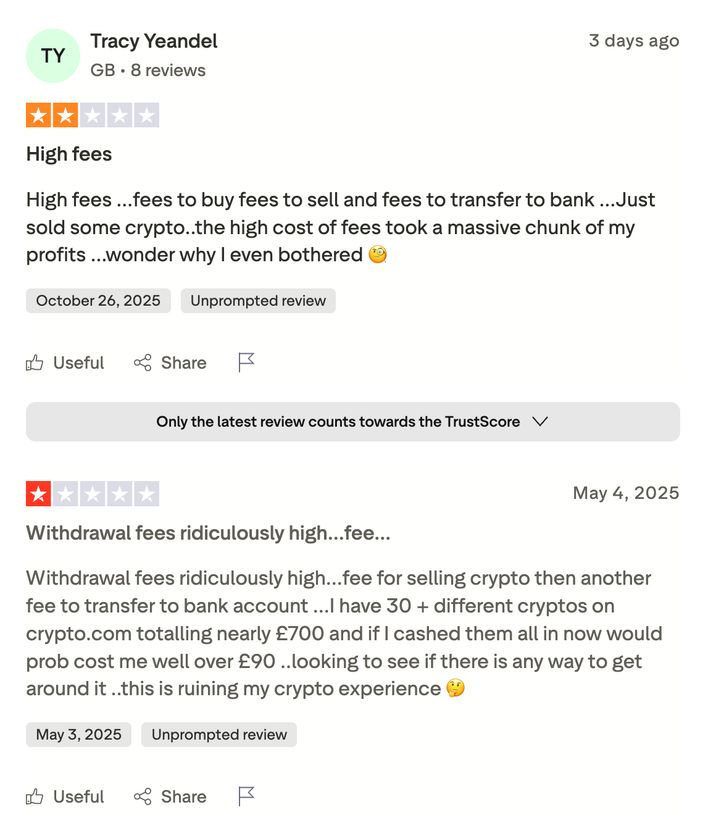

In recent months, users have been increasingly complaining about Crypto.com — especially about high fees and difficulties with withdrawals. On Trustpilot, Crypto.com has received over 9,000 reviews with an average rating of 1.3 out of 5 (73% of reviewers gave one star).

Some customers shared specific stories: one person paid $40 in fees to withdraw just $55 in Bitcoin, even though the real Bitcoin network fee was only $1.19. Another said that when buying $100 of Bitcoin, they received only about $56, with the rest lost to hidden fees and markups.

On Reddit and Trustpilot, users have made entire lists of Crypto.com issues — from frozen accounts to hidden commissions and even suspicions of inflated exchange rates (spreads).

We decided to compare Coin Wallet and Crypto.com to find out which one offers better fees and a more reliable, transparent service.

Key Takeaways

- Coin Wallet offers freedom and privacy; Crypto.com offers convenience and services but requires trust.

- Coin Wallet minimizes costs, but Crypto.com monetizes every transaction, so its fees might be higher than usual.

- Both are safe in their own way — one through self-custody, the other through corporate protection.

Custodial vs. Non-Custodial

Coin Wallet is a self-custody wallet, meaning private keys belong only to the user and are stored locally on their device. The app doesn’t require KYC — no registration, no email, no passport. User data isn’t stored on servers.

Transactions are signed on the user’s side, and private keys are protected with AES-256 encryption and a BIP39 seed phrase. In short, you fully control your funds — the platform provides an interface and extra tools but has no access to your coins.

Advantages are no intermediaries, no account freezes, complete privacy, and full control over your assets. Even if Coin Wallet’s servers are hacked, your funds remain safe because your keys stay with you.

However, independence also means responsibility. If you lose your seed phrase or password, you lose access to your crypto — support can’t recover it. This shows that security in a self-custodial wallet depends entirely on the user.

Crypto.com, by contrast, is a custodial platform — an exchange and wallet where the company controls private keys on behalf of clients. This makes it easy to buy or sell crypto for fiat, use staking, and get a Visa card. But convenience comes at the cost of trust: the company holds your funds and can freeze accounts or block withdrawals.

The platform also requires KYC verification. For some users, this is inconvenient; others complain about blocked accounts due to compliance checks.

- If you value control and anonymity — choose Coin Wallet.

- If you prioritize ease of use, fiat access, and integrated tools — Crypto.com may suit you better.

Fees: Buying, Selling, and Sending Crypto

The two platforms have very different approaches to fees.

Coin Wallet charges no fee for storing or receiving crypto — you only pay the blockchain’s miner fee. When sending crypto, there’s a small service fee (around 0.5% of the amount, min $0.10–$0.30, max $50–100) plus a small fixed network fee.

For Bitcoin, for example, that’s 0.5% + 0.0000192 BTC. Some coins, like Bitcoin Cash, have just a 0.05% fee, and for Ethereum and ERC-20 tokens, there’s currently no extra fee beyond gas.

Small transfers cost just cents; large transfers are capped at a reasonable maximum.

For swaps inside the app, Coin Wallet connects to external partners or DEXs, where rates include a spread or partner commission.

Crypto.com originally promoted itself as a platform with zero fees for buying crypto, but in practice, the real costs are hidden in spreads and transaction charges.

On Crypto.com, users face a multi-layered fee structure. For spot trading, fees depend on your 30-day trading volume and whether you hold the platform’s native token CRO: maker fees start at 0.25%, while taker fees begin at 0.50% for users with under US $10,000 volume and no CRO staked.

For crypto withdrawals to an external wallet, Crypto.com specifies that each coin or network has a fixed on-chain fee set by the platform and the blockchain; for example, the CRO token withdrawal fees are listed as 0.2 CRO, 0.001 CRO, or 70 CRO depending on network used.

Fiat withdrawals also incur fees: for example, in the U.S., retail users are charged a US $45 fee for USD withdrawal via SWIFT.

Additionally, purchase of crypto with a credit/debit card typically triggers a fee of about 2.99% in many regions.

All these fees mean that while base trading costs may seem low for high-volume or CRO-staked users, the fees for everyday actions like card purchases or crypto withdrawals can add up significantly.

Coin Wallet, in comparison, has no fixed withdrawal fee — only the small percentage plus network cost. So, for small transfers, Coin Wallet is much cheaper. For very large transfers ($50,000+), Crypto.com’s fixed fee might be slightly better.

Security and Fund Protection

Coin Wallet focuses on local security — your keys never leave your device. Data is encrypted with AES-256, and you can lock access with a PIN or biometrics. The wallet also supports hardware keys (like YubiKey) for added safety.

Because Coin Wallet doesn’t store user funds centrally, large-scale hacks are impossible. Risks are limited to malware or user mistakes. The project publishes parts of its code and claims regular security audits.

Crypto.com, being a large exchange, invests heavily in cybersecurity. It stores 100% of customer funds in cold wallets via Ledger Vault, insured for $750 million (Lloyd’s). After a $34 million hack in January 2022, Crypto.com fully reimbursed all 483 affected users and launched the Account Protection Program (WAPP) — insurance up to $250,000 per account if your funds are stolen after verified 2FA use.

The platform has all major licenses (FinCEN in the U.S., MiCA in the EU) and passes security audits.

Still, users report slow withdrawals and long KYC checks, especially in certain countries.

Conclusion: Which Should You Choose?

Your choice depends on your priorities.

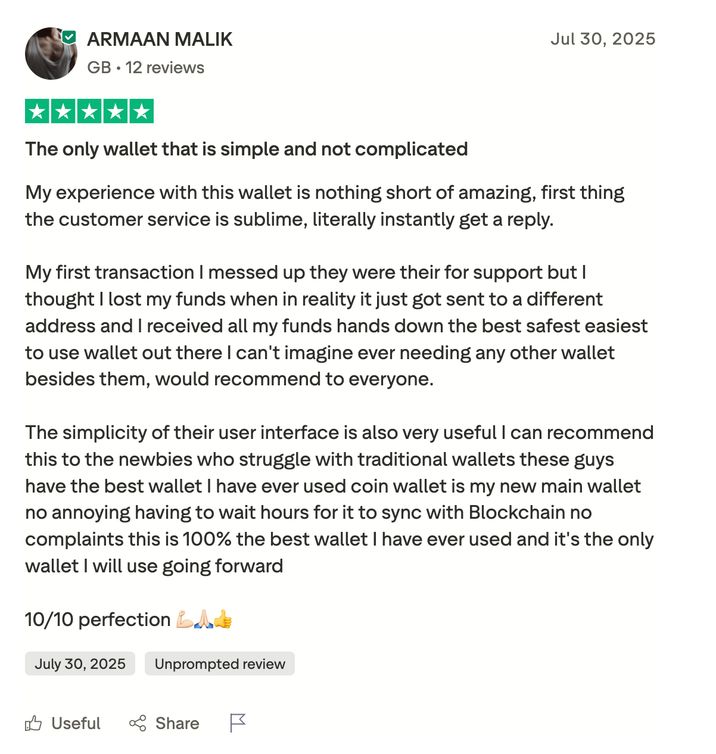

- If you want full control, privacy, and minimal fees, choose Coin Wallet. It’s ideal for long-term storage and independent users who don’t want to rely on a third party.

- If you prefer convenience, fiat integration, and extra services like cards and staking, Crypto.com offers a complete ecosystem — but you’ll pay for it in higher fees and stricter rules.

Both platforms are legitimate and secure in different ways. Many users even combine them — keeping main holdings in Coin Wallet and using Crypto.com for fiat conversions or everyday purchases.

Ultimately, the best choice depends on what you value more: freedom or convenience, low fees or advanced functionality.