There are more crypto ATMs than ever, but who actually use them?

The options for buying Bitcoin and other cryptocurrencies seem to increase on a daily basis. There are digital brokers, peer-to-peer marketplaces and a quickly growing amount of cryptocurrency ATMs.

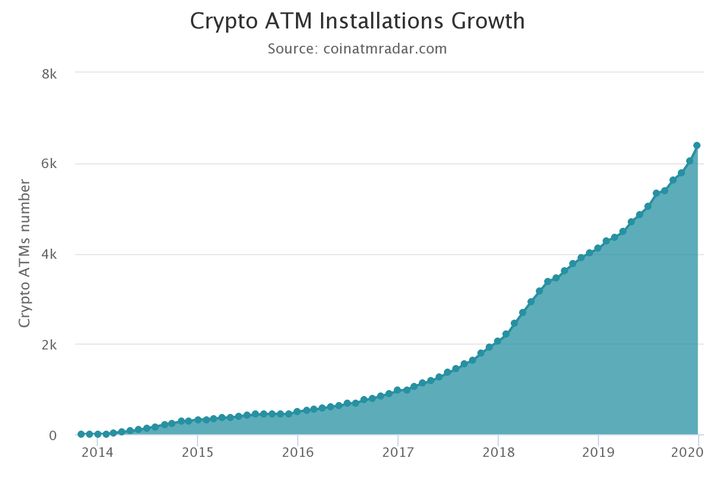

According to Coin ATM Radar, there are now over 6330 cryptocurrency ATMs globally, spanning 72 different countries. Bitcoin and cryptocurrency trading continues to see a state of flux through 2019 with wild trading volume and price swings.

Yet Cryptocurrency ATM numbers have been exploding with over 2000 new ones added since the start of the year

That seems quite extraordinary considering the growth of Bitcoin still flatters to deceive. With such a stunning growth of cryptocurrency ATMs, surely people must be using them, and if so, who?

The way in which ATMs are used appears to vary from location to location. In wealthier countries users almost solely use them as a means of buying crypto while economic turmoil results in a helpful way to cash out funds.

Despite this growth, the facilities are still few and far between for most people. In many innovative cities, you’re still likely to find people using them as a novelty ‘trying it out’ rather than for regular exchanges. Malls and shopping centers have also been installing ATMs in the hope to attract the wealthy, rather than a focus on selling Bitcoin.

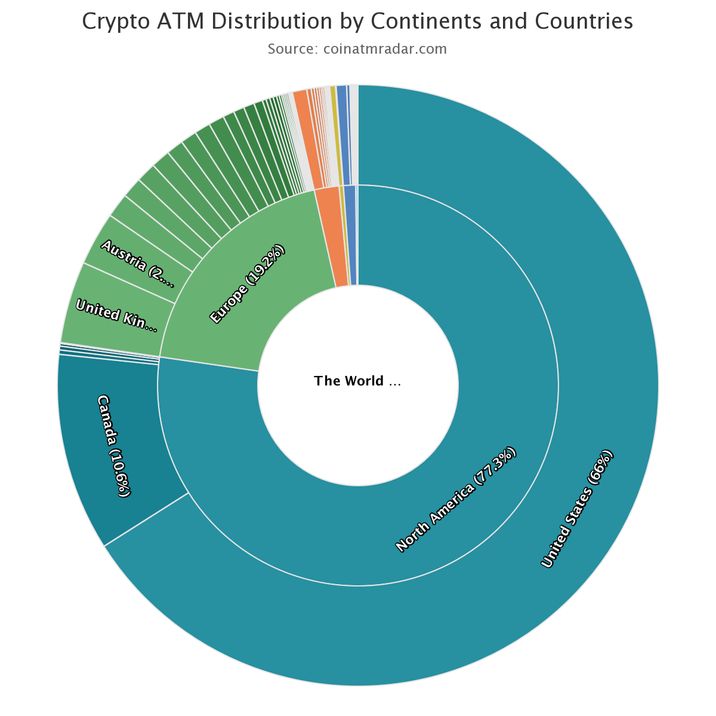

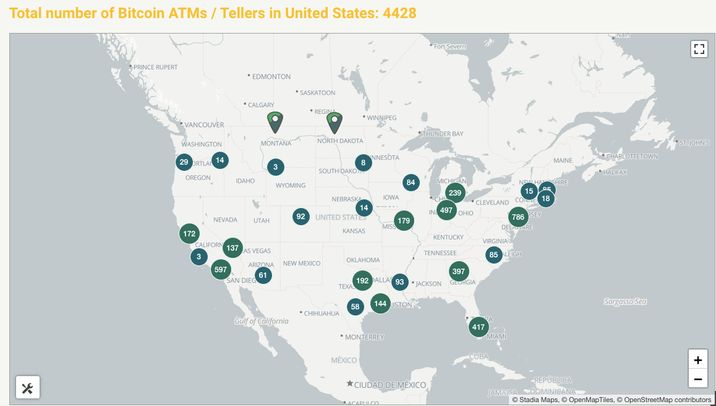

America leads the way with over 4300 of 6300 worldwide locations, some way ahead of any other countries. Canada offers around 750 while the UK even fewer at about 300.

Reasons for visiting a cryptocurrency ATM vary from place to place explains Matias Goldenhörn to Coindesk.

“In the U.S., clients predominantly use machines to buy bitcoin. In Colombia for example, it’s the other way around, people use the ATM to withdraw cash.”

With inflation rates skyrocketing in both Venezuela and Argentina in recent years, locals are quickly seeing the value of decentralized currency free from government manipulation.

Potential issues with Crypto ATMs

In theory, Cryptocurrency ATMs are quite simple, you put money in and receive coins to your wallet. Or vice versa.

Unfortunately, users have found a number of problems with this method of buying Bitcoin, particularly due to an assortment of scams.

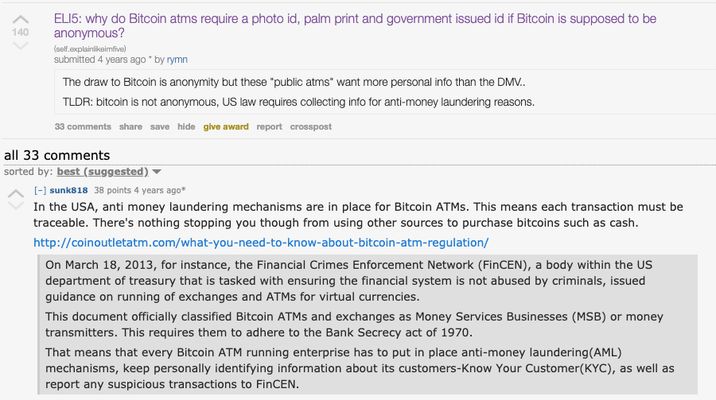

Discussions on Reddit flag up issues with modern ATMs. It seems that integral regulation is turning many people off using these growing numbers of physical exchanges. Once a place for anonymity, a demand of many users, now cryptocurrency ATMs must conduct due diligence on transactions. These regulations are helpful for authorities in stopping illicit activities such as money laundering. Identification and even fingerprints are often required to make a transaction.

As you can imagine, all sorts of scams exist to try and swindle people out of their cryptocurrency. Some are clever, others all too simple. ATMs are a particular focus for criminals as users tend to be uneducated in the world of cryptocurrency, particularly if they are just ‘trying it out’.

Two scams, in particular, have become common, the first is unsuspecting people being tricked into believing they owe money or have missed a bill. Victims are then instructed to use a Bitcoin ATM to quickly pay their debt, sending money to the fraudsters cryptocurrency wallet. Scammers pose as companies looking to settle bills quickly.

In Canada, an even more simple technique has been used with a simple ‘out of order sign’ directing users to deposit funds to the printed QR code instead of their own wallet due to a software upgrade.

Elsewhere, discussions on Reddit flag up some other issues with modern ATMs. It seems that regulation is turning many people off using these growing numbers of physical exchanges. Once a place for anonymity, a demand of many users, now cryptocurrency ATMs must conduct due diligence on transactions. Identification and even fingerprints are often required to make a transaction, destroying any previous anonymity.

IRS focuses on cryptocurrency ATM tax issues

In November 2019, the IRS turned its attention to cryptocurrency ATMs, sighting potential tax issues with the growing number of machines in the US.

The taxman is especially vigilant of compliance as these facilities fall under the same Know Your Customer and Anti-Money Laundering rules as online exchanges.

ATMs have become a particular problem, as anyone, anywhere, can put cash in and get Bitcoin out which creates massive potential for illicit activity.

“If you can walk in, put cash in and get Bitcoin out, obviously we’re interested potentially in the person using the kiosk and what the source of funds is.” discusses IRS Criminal Investigation Chief John Fort.

Using a cryptocurrency ATM safely

It is important to understand how you receive coins from an ATM. It happens in two ways, either you receive them directly to your mobile wallet or printed on a paper wallet directly from the ATM.

As discussed with the scams above, there are some important factors to be vigilant when buying cryptocurrency.

The number 1 rule - only ever send funds to your personal wallet/QR code. If asked to scan another QR code outside of your wallet (e.g. a note stuck to a machine or to pay a bill) it is a scam. There is no reason to ever send coins to a 3rd party wallet or pay a bill, no reputable organization forces customers to pay bills via a cryptocurrency ATM.

If you are processing a large transaction you’ll be required to input your ID, telephone and even fingerprints to verify your identity. Double-check the provider of the service is legitimate, even ask the shop or mall for more information before submitting sensitive data.

Cryptocurrency ATMs make it really quite convenient to buy or sell cryptocurrency. As we’ve discussed in South America, they could be vital to the continued growth of digital assets. Not only can you buy coins using cash but users can also cash out their coins on the go. Of course, where money exists scammers and criminals will look to benefit, so if you are using cryptocurrency ATMs then you should take just as much care as you would with a traditional bank.