Crypto Scams: How to Stay Safe Online

Today, when global financial markets have been going through tough times, you should be especially cautious because bad actors often exploit cryptocurrencies for financial crimes, especially in investment fraud and money laundering. In this article, we’ll look at how to recognize and avoid cryptocurrency scams.

Types of crypto scams and examples

Crypto scams are becoming more elaborate and difficult to detect, but we can group them into a few types.

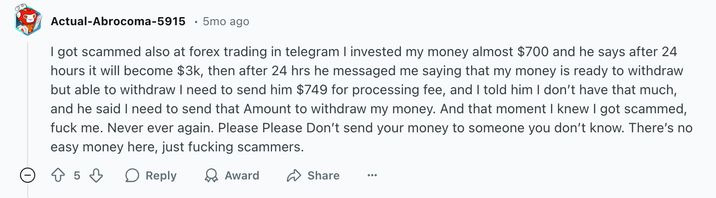

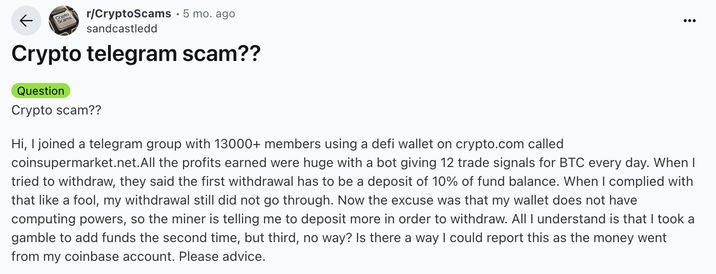

Crypto Telegram and Other Social Media Scams

You’re invited to a Telegram chat with over 10,000 followers, promising easy money. A Telegram bot in the chat sends daily trading signals for various cryptocurrencies, such as BTC, and you see your profits steadily increasing.

But when you try to withdraw your assets, the chat admins ask you to deposit an additional 10% of your balance. You, of course, agree, hoping to get your money — but then the bot shows an error or claims there’s a wallet issue. As a result, you have just given your money to scammers. Besides, the profits you made are fake; they just want you to deposit more.

Fake giveaways and “live” streams on Facebook or YouTube operate in a similar way. These scams are often run by accounts posing as celebrities like Elon Musk or popular crypto exchanges. You send your coins to take part—and they’re gone forever. The fake “live” streams are even more elaborate and can be harder to detect.

Scammers find old videos of online events from well-known companies (such as Apple) or interviews with prominent figures in the crypto space (like Vitalik Buterin or other crypto founders). They stream these videos on YouTube or Facebook, adding their own text and graphics to make it appear like a brand-new live event.

They use the live chat to trick viewers with messages like, “Send our company 1 ETH, and we’ll send you 2 ETH back while we’re live.” Of course, nobody sends you coins.

Phishing: Fake Wallets, Exchanges, Investments Advisors — and Even Seed Phrases

The main goal of scammers is to convince you that their platform — whether it’s a wallet, exchange, or advisory service — is legitimate so that you’ll send them your coins.

Fake investment advisors use a different tactic. They claim to share their successful crypto strategies out of kindness and a desire to help new investors. Of course, they recommend using specific platforms — which, unsurprisingly, are fake and run by scammers. For example: “Bro, try this platform — it already made me $40,000 this month!”

The seed phrase scam is more sophisticated and relies on human greed. For example, during P2P trading, you might get a message like this: “Oops, sorry, I accidentally sent you my seed phrase. Please, don’t use it.”

If you try to access the wallet using that seed phrase and move its funds into your own wallet, you’ll need to send some crypto to it first to cover transaction fees. And that’s it — your assets are gone.

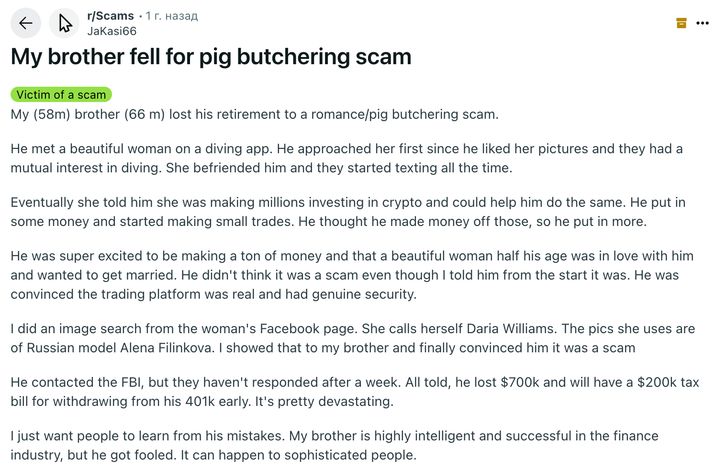

Pig Butchering Scams

It is a long-term scam where scammers use fake online personas to manipulate their victims. Scammers spend weeks or months building a relationship with the victim, feigning romantic interest or financial expertise. Scammers sometimes try to copy the victim’s language, interests, and opinions to build a connection and make the person feel comfortable. They may also send small gifts or nice messages to make the victim trust them and feel emotionally connected.

When trust is established, the scammer convinces the victim to download a supposed crypto app or visit a fraudulent platform to make an initial deposit. After that, the scammer vanishes with the victim's assets. In some cases, they continue manipulating the victim, dragging the scam out to extract as much money as possible.

A Fake Support Service

Scammers pose as support agents from the crypto platform you usually use. For example, you might receive messages like, “Your wallet has been hacked.” “This is an official support representative. Do you need assistance”?

They often ask you to send your seed phrase, transfer coins to prove ownership of your account, or share personal documents such as your passport or ID card.

Ponzi and Pyramid Schemes

A Ponzi scheme is a type of fraud in which earlier investors are paid returns using the money from new investors, rather than from actual profits. For example, a fake crypto project might promise huge returns such as “Guaranteed 10% a week!”

A pyramid scheme is similar to a Ponzi scheme, but it focuses on recruitment rather than investment returns. Each participant must recruit others to earn money, and those people must recruit even more. As a result, the system collapses — and most participants lose their money.

Tips to Avoid Cryptocurrency Scams

- If someone asks for your passwords, seed phrase, or personal documents, they’re a scammer. Legitimate support staff will never request this information.

- Always research any platform, wallet, or exchange before using it. Don’t trust suspicious ads or unsolicited recommendations from strangers.

- Be cautious when using dating platforms — scammers often use them to build trust before defrauding victims.

- Avoid using Telegram or other social media as sources for investment advice or trading signals. Unfortunately, scam activity is widespread on these platforms.

- If someone suddenly starts offering you investment advice, don’t trust them blindly — always verify independently.

- Don’t confuse Ponzi or pyramid schemes with legitimate referral programs. In scams, there’s usually little or no official information about the platform or product.

- Before investing in new cryptocurrencies — especially memecoins — research the company and its products thoroughly. Sure, we’ve all heard “No risk, no reward,” but think carefully about where you put your money.

- Avoid storing your assets on an exchange for extended periods.