Ethereum Staking in 2025: Yields, Risks, and Best Practices

Ethereum has fully transitioned to Proof-of-Stake, and staking is now a core part of its ecosystem. By 2025, more than a third of all ETH is already staked, and conversations about yields, risks, and strategies are everywhere — from Telegram chats to conferences like Devcon.

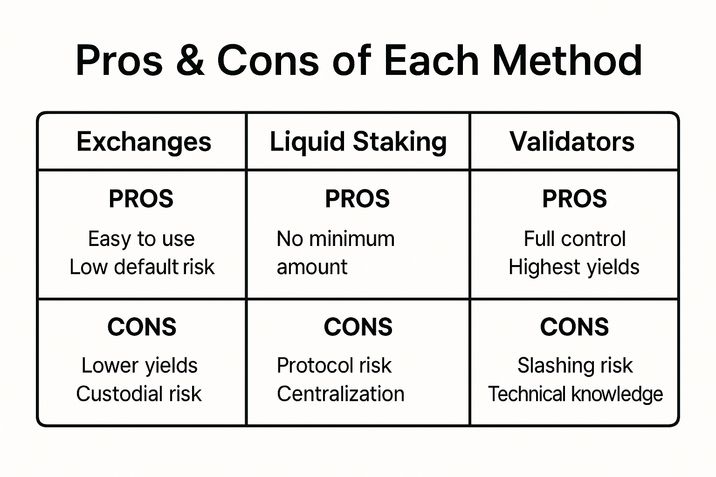

For many investors, staking looks like a blockchain version of a bank deposit: you lock ETH and earn interest. In reality, it’s more complex. There are several ways to stake, each with different trade-offs. Some people use exchanges for simplicity, others prefer decentralized protocols with liquid tokens, while advanced users run their own validators to keep full control.

Key Takeaways

- Staking ETH in 2025 gives moderate yields (about 2–4% APY), with different levels of risk depending on the method.

- Exchanges are easiest, liquid staking offers flexibility, and running your own validator gives the most control.

- Vitalik Buterin stresses decentralization — solo stakers remain essential for Ethereum’s long-term security.

Centralized Platforms

The easiest entry point is staking through exchanges like Coinbase or Binance. For beginners, it’s convenient: just a few clicks, and your ETH starts generating rewards. The downside is that yields are modest. Coinbase currently offers around 1.8% annually, while Binance is closer to 2.7%. These numbers change over time but usually stay in the 2–3% range.

The biggest drawback is trust. You hand over your ETH to a centralized company. If the exchange faces technical, financial, or regulatory issues, your assets may be at risk. Slashing (penalties for validator mistakes) is covered by the exchange, but their service fees lower your profits. In short, you gain simplicity and reliability but lose independence and potential returns.

Liquid Staking and Decentralized Protocols

The next option is protocols like Lido or Rocket Pool. They solve two problems at once: no need for the 32 ETH minimum to run a node, and you get liquidity. When you deposit ETH into Lido, you receive stETH, a token that increases in value compared to regular ETH. You can use it in DeFi, sell it, or borrow against it. Rocket Pool works similarly with rETH.

Average yields in 2025 are around 2.5% — a bit higher than exchanges, but not risk-free. Smart contract bugs are always a possibility. Centralization is another concern: Lido controls about a third of all staked ETH, which worries both the community and Vitalik Buterin himself.

Read more: How to Pay Taxes for Staking and DeFi in the U.S. and EU: The Short Guide

Withdrawing also differs by protocol. In Lido, a withdrawal request can take several days to process, though stETH can always be sold instantly on the market. Rocket Pool is usually faster: if liquidity is available, you can swap rETH for ETH immediately. If not, the transaction fails and you simply try again later.

For intermediate users, liquid staking is a good balance of yield, flexibility, and decentralization. It also allows diversification: you can hold some ETH in stETH and some in rETH and reduce risks.

Running Your Own Validator

The most independent option is to run a validator yourself. You need at least 32 ETH plus technical skills and the ability to maintain a node 24/7. Rewards are slightly higher than with other methods: usually between 3% and 4% annually. Most importantly, you keep all the profits with no middlemen.

But the risks here are real. Misconfigured nodes or dishonest behavior can lead to slashing penalties. Even downtime costs money. While minor mistakes bring small fines, repeated issues can eat into your deposit.

Another challenge is withdrawals. Since the Shanghai upgrade, validators can exit and withdraw, but there is a queue. In 2025, waiting times are often more than a month. Vitalik Buterin explained this as a safety feature: “We cannot let an army of validators leave the battlefield in one day.” This waiting period protects the network from sudden exits and attacks.

Read more: ETH Staking in 2025: Which Provider Really Fits You?

How to Choose a Strategy

The right choice depends on your goals and experience. Beginners are usually better off with exchanges or Lido. Yields are smaller, but the process is simple and relatively safe.

If you already know DeFi, liquid tokens like stETH or rETH open the door to more advanced strategies — from farming to collateralized loans. They can boost returns but also require more caution.

For those with the funds and technical know-how, running a validator is the purest way to stake. It offers the best control and independence, but it’s a responsibility. You need to monitor updates, protect your server, and be ready to handle technical issues.

Read more: 10 Best Wallets for Staking Crypto Securely 2025

What Vitalik says

Vitalik Buterin has recently emphasized the dangers of centralization. In his talks, he points out that solo stakers bring real resilience to the network. Even a small percentage of independent validators can make Ethereum much stronger.

He also warns about MEV (Maximal Extractable Value), the extra income validators earn from transaction ordering. Big players capture most of this, which attracts smaller stakers to join them and further increases centralization. Vitalik’s “barbell strategy” is his response: keep Ethereum’s base layer simple and secure, while pushing complexity and scaling to Layer 2 solutions.

The Bottom Line

By 2025, Ethereum staking is no longer an experiment but a mature financial tool. Average yields are around 3% — similar to traditional bonds or savings accounts. But staking is more than just interest: it’s active participation in securing the network.

Each approach has pros and cons. Some prefer the ease of exchanges, others the flexibility of liquid staking, and some go all-in with their own validators. Whatever you choose, remember: staking is not just about returns. It’s about contributing to the security and decentralization of Ethereum itself.

Read more: How to Stake Ethereum for Maximum Returns in 2025