Mantra Meltdown: Price Crash Sparks Speculation of Scam

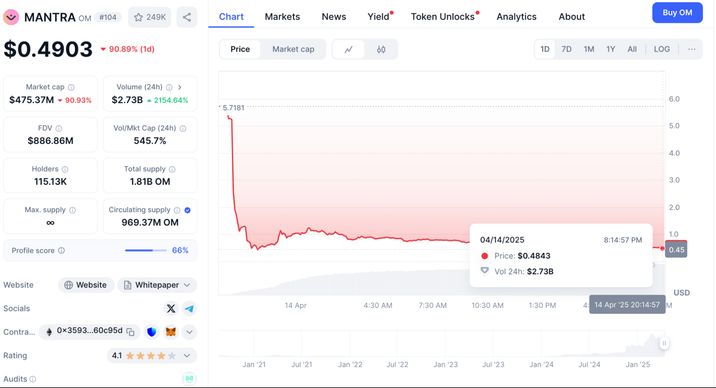

Mantra (OM) crashed 90% on Sunday, April 13th. OM dropped from ~$6 to ~$0.37 in less than two hours. This resulted in a loss of over $6 billion in market capitalization. On Monday, the token cost about $0.4843. The crypto community is in shock and discussing different versions of this collapse. In this article, we break down what happened with Mantra and why investors compare it to the Terra Luna project.

Timeline of Events on April 13th

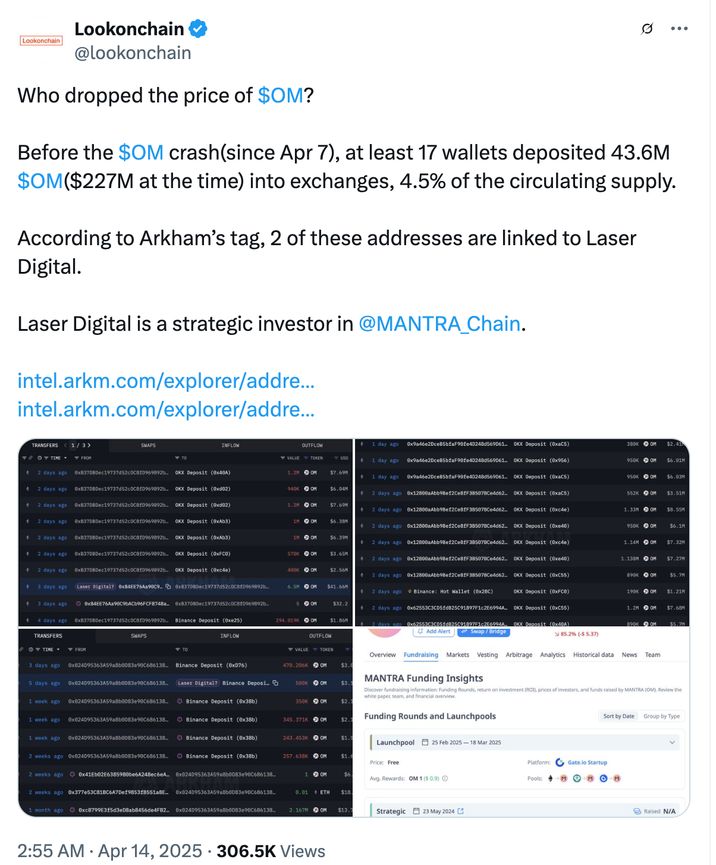

- Large volumes of OM were transferred to exchanges, including 43.6 million tokens (~4.5% of total supply). This led to speculation that the tokens were being dumped.

- On the evening of April 13, the price of OM began to fall rapidly. Within two hours, it fell by more than 90%, reaching ~$0.37.

- After the collapse, the price partially recovered to ~$0.77, but investor confidence was shattered. Many are calling it a scam and drawing comparisons to the Terra Luna collapse, where investors lost $40 billion.

What really happened?

To this day, no one knows for sure. But there are three different explanations being discussed.

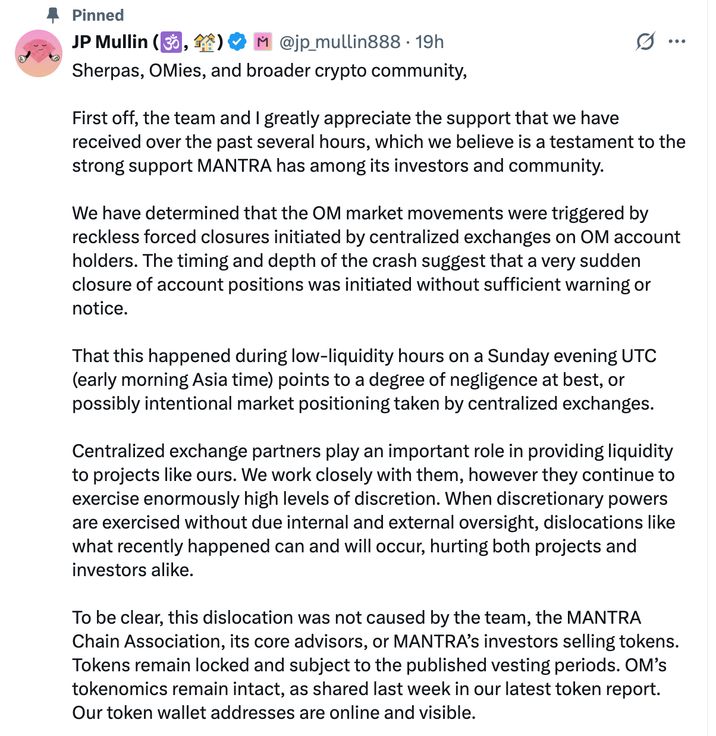

The first theory is that the collapse may have been caused by large token sales from insiders or strategic investors, as some have speculated. Mantra co-founder John Patrick Mullin stated that the team was not involved in the token sale and that all assets remain locked. He also promised an investigation into what happened.

The second theory comes from the Mantra team itself. According to the Mantra team, the collapse was caused by massive forced liquidations of positions on centralized exchanges amid low liquidity. Indeed, liquidations occur when the exchange forcibly closes a trader's position at a loss if the market moves against their position. This happens when a trader is unable to meet the collateral requirements for a leveraged position, meaning they don't have enough money to keep the trade open.

In this case, the team is convinced that positions were "closed without margin calls or notice," suggesting exchange actions triggered the cascade.

The team didn’t reveal which exchange was involved but denied the allegations against Binance.

The third explanation is related to tokenomics changes. Later, Mantra increased the total token supply and shifted to an inflationary model. That could be the reason for investors’ concerns.

Why the Comparison to Terra Luna 2.0?

Today, investors are comparing the Mantra crash to the Terra Luna collapse. The Terra Luna crash happened in May 2022. Its stablecoin, called UST, fell below its $1 peg, sparking panic. Many investors sold their Luna tokens, and the price fell almost to zero. People lost billions of dollars, and trust in the broader crypto market was severely shaken.

Additionally, on-chain analysts from Lookonchain found that one day before the crash, 43.6 million OM tokens (about 4.5% of the supply) were sent to exchanges, including wallets linked to the investment firm Laser Digital.

The main wallet holding around 90% of all OM remained untouched, and the team’s tokens were still locked. Lookonchain also suggested that the wallets may be connected to Shane Shin, a top Middle East venture capitalist from Shorooq Partners. Just days before the crash, Mantra’s founder spoke about a $1 billion partnership with Dubai’s DAMAC to tokenize real estate.

Despite bold plans and big speeches, this crash has already damaged trust in the entire RWA sector and shaken investor confidence across the crypto space.