Secure Your Crypto: How to Transfer Funds From Exchange to Wallet

Even experienced users sometimes run into problems with something as simple as withdrawing funds from an exchange to a wallet. These issues are usually related to incorrect network selection, wrong wallet addresses, delays during high network congestion, or withdrawal holds when adding a new address (e.g., Bybit blocks withdrawals for 24 hours; Coinbase may place a hold for up to 72 hours). Network fees can also be a factor.

Below, we’ll cover how to properly withdraw crypto from an exchange to your wallet — and how to avoid the most common mistakes.

Transfer from Bybit to Coin Wallet

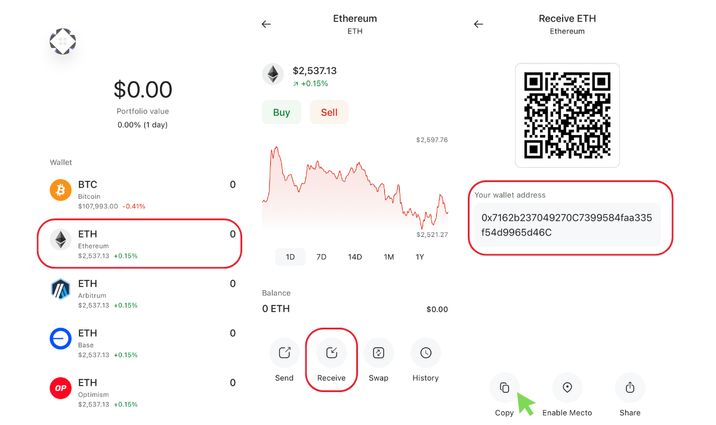

Step 1: Get Your Crypto Address from Coin Wallet

Open the Coin Wallet mobile app, select the cryptocurrency you want to receive (e.g., BTC, ETH, USDT), and tap the Receive tab. Your unique wallet address (as a string or QR code) will be displayed. Copy this address.

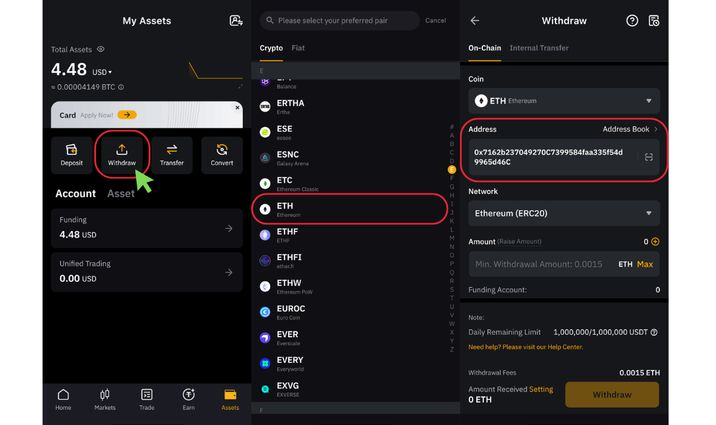

Step 2: Open Bybit and Start the Withdrawal

In the Bybit app, go to Assets → Withdraw from the home screen. If your coins aren’t in the Spot wallet, tap Transfer to move them to your Spot or Funding account. Then, tap Withdraw.

Step 3: Fill Out the Withdrawal Form

Select the cryptocurrency you want to send. In the Address field, paste the copied address from Coin Wallet. Make sure to choose the correct network type — for example:

- USDT → ERC-20 or TRC-20

- BNB → BEP-20 (BSC) or ERC-20

Bybit will warn you that choosing the wrong network can result in failed or lost transfers.

Step 4: Enter the Amount and Confirm

Enter the amount you want to withdraw. The system will automatically calculate and display the network fee (gas) and the minimum withdrawal amount. Pay attention to any prompts from Bybit (e.g., “Minimum fee: 1 USDT” in the screenshot above).

Tap Withdraw, and confirm the transaction using the code sent to your SMS/email, along with your Google Authenticator code (if the address hasn’t been previously verified). After confirmation, the request will be sent to the blockchain.

Step 5: Wait for Confirmation

The transaction time depends on the speed and congestion of the selected blockchain. For example, transfers on Ethereum might take a few minutes, while TRON or BSC networks are usually faster.

Make sure you have enough native tokens (ETH, BNB, etc.) in your Coin Wallet to cover network fees.

In Coin Wallet, select the same cryptocurrency and tap History to track the incoming transaction.

You’ll also see your updated balance below the currency chart.

Transfer from Coinbase to Coin Wallet

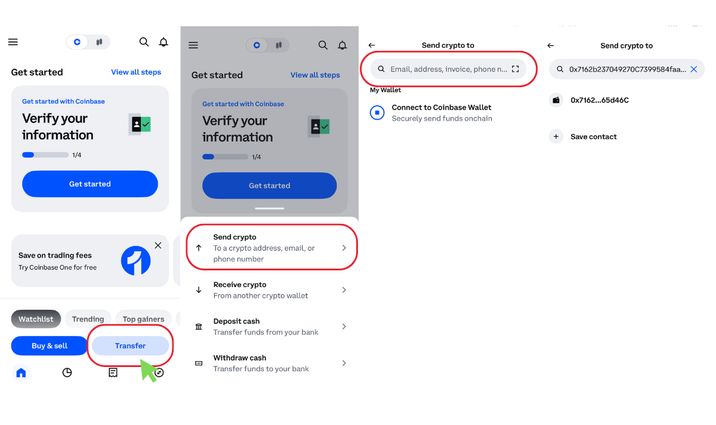

Once you’ve copied your crypto address from Coin Wallet, follow these steps:

1. In the Coinbase mobile app (not to be confused with Coinbase Wallet), tap Transfer → Send crypto, and paste your Coin Wallet address into the designated field.

2. Make sure the selected network type matches what Coin Wallet supports (e.g., BSC or ERC-20).

3. Enter the amount you want to send and confirm the transaction. Coinbase will automatically calculate the network fee and process the transfer. Once it’s sent, you can track the status under Transaction History in the Coinbase app.

4. As with Bybit, transfer times vary depending on the network. Typically, Coinbase transfers take anywhere from a few seconds (e.g., TRON) to a few minutes (e.g., Bitcoin or Ethereum).

FAQ 📌

What to Do If There Was a Network Error and You Lost Funds

For example, you might accidentally send USDT from Coinbase or Bybit via the BEP-20 network, while the receiving wallet or exchange only supports ERC-20. As a result, the funds won’t arrive at the destination address and may be considered lost.

To avoid this, always double-check which network types are supported by your wallet or exchange before sending. Be especially cautious with the Ethereum (ERC-20) network, as it's often the only supported option.

If the mistake has already happened:

- Coinbase offers an asset recovery service for a fee of up to 5% of the recovered amount

- Bybit provides asset recovery for amounts of $500 or more, charging a flat $200 fee

However, neither platform guarantees a successful recovery — so verifying network compatibility in advance is crucial.

What to Do If There’s a Delay in Withdrawing Funds

Withdrawal delays can range from several hours to a full day, especially on congested networks like Solana. Additionally, exchanges may manually review transactions — particularly if two-factor authentication (2FA) is not enabled or if you’re withdrawing to a new wallet address.

To minimize the risk of delays:

- Withdraw outside of peak hours

- Choose networks with lower traffic

- Enable 2FA in advance

If your transaction gets stuck, it’s best to contact the exchange’s support team directly.

What Should I Do If My Account Is Blocked or Frozen?

Some users from the U.S., U.K., and other regions report unexpected account blocks and frozen funds on platforms like Bybit. This often happens because the platform does not officially serve residents of these countries, and when users attempt to withdraw, the system may automatically restrict access to their funds. Even after completing verification, the exchange may request additional documents multiple times.

To avoid these situations:

- Use platforms that are officially available in your region

- Don’t wait until the last minute to withdraw your funds

If your account does get blocked, you’ll likely need to provide proof of identity and evidence of the source of funds to restore access.

What to Do If the Platform Asks for Confirmation of Wallet Ownership?

Users in EU countries are increasingly encountering a new requirement related to security regulations under the Travel Rule: they must confirm that the specified wallet address actually belongs to them. For example, Coinbase requires this verification before allowing the first withdrawal to a new address. To confirm ownership, users can either provide a digital signature (if supported by the wallet) or complete a small test transfer. It’s also a good idea to add trusted addresses to the whitelist in advance, keeping in mind that this process may take one to two business days.