Stablecoins Explained: What Are Tether, DAI, and Others?

Stablecoins Explained: What Are Tether, DAI, and Others?

Stablecoins, a burgeoning class of digital currency, could help crypto go mainstream. As of the beginning of the second quarter of 2025, the total supply of stablecoins in the global crypto market has reached about $238 billion. This shows that there is strong demand for stable digital assets, especially during times of economic and political uncertainty. In this guide, we will find out what stablecoins are and how they work.

What are Stablecoins?

How Do Stablecoins Work?

What is the difference between Tether, DAI, and others?

How Do States Try to Control Stablecoins?

What Are Stablecoins?

Stablecoins are a type of cryptocurrency that is backed by other assets, such as fiat money, other coins, or government bonds. For example, 1 USDT, USDC, or DAI = approximately 1 US dollar.

Stablecoins were created to provide price stability in crypto markets. Unlike Bitcoin or Ether, whose rates can fluctuate dramatically, stablecoins try to be pegged to stable assets, most often to the U.S. dollar, but sometimes to the euro, gold, or other currencies. There are several types of stablecoins.

- Fiat-backed: USDT (Tether), USDC, BUSD

These stablecoins are backed by real money or assets held in bank accounts. For each issued stablecoin, 1 dollar or another asset is claimed to be held in reserve.

- Crypto-backed: DAI

These are backed by other cryptocurrencies that are locked in smart contracts. To reduce the risk of price volatility, they usually require over-collateralization (for example, $150 in crypto to get $100 worth of DAI).

- Unbacked (algorithmic): the former UST (Terra)

This is a good example of how not to create stablecoins. They keep their price stable using algorithmic mechanisms — coins are issued or burned depending on supply and demand. This method is riskier, as shown by the collapse of Terra.

How Do Stablecoins Work?

The main goal of stablecoins is to avoid volatility and provide price stability in the crypto market. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, stablecoins are not mined. They are created in a centralized way — by a specific company (for example, Circle for USDC or Tether Limited for USDT), or by a decentralized protocol (like MakerDAO for DAI).

The process works like this:

- A user sends real dollars (or other assets) to the issuer.

- The issuer creates (or “mints”) the same amount of stablecoins and sends them to the user.

- Tokens can be destroyed ('burned') when users redeem them for dollars — the same amount is then removed from circulation.

To keep the price of a stablecoin close to $1, each token must be backed by a real asset — such as fiat money, cryptocurrency, U.S. government bonds, or another type of asset.

What’s the Difference Between Tether, DAI, and Other Stablecoins?

Interestingly, in just the first quarter of 2025, the stablecoin supply increased by more than $30 billion, showing the growing use of stablecoins for payments, risk protection, and decentralized finance (DeFi).

Today, the market leaders are:

-

USDT (Tether) — the largest stablecoin, with a market cap of around $144.8 billion. It remains the most liquid and widely used for trading and international transfers.

- Issuer: Tether Limited.

- Reserves: A combination of assets, including approximately $100 billion in short-term U.S. Treasury securities, over 82,000 Bitcoin (around $5.5 billion), and 48 metric tons of gold.

- Custody: Managed by Cantor Fitzgerald.

- Audit: A full audit has not yet been conducted, but Tether is working to engage one of the Big Four accounting firms.

-

USDC (USD Coin) — the second largest, with about $61 billion in circulation. It is considered very reliable because of regular audits and reserves kept in U.S. banks and government bonds.

- Issuer: Circle in partnership with Coinbase.

- Reserves: 100% liquid assets — cash and short-term U.S. Treasury securities.

- Custody: The majority of reserves are held in the Circle Reserve Fund (USDXX), an SEC-registered money market fund managed by BlackRock. Remaining funds are held at regulated financial institutions such as Bank of New York Mellon.

- Audit: Conducted by the independent auditing firm Deloitte & Touche LLP.

-

DAI — a decentralized stablecoin managed by the MakerDAO protocol. It is backed by cryptocurrencies and has a supply of around $3.25 billion.

- Issuer: Decentralized protocol MakerDAO.

- Reserves: Cryptocurrencies such as ETH, USDC, and other approved assets.

- Custody: Collateral is held in MakerDAO protocol smart contracts.

- Audit: A decentralized system where users can independently verify reserves on the blockchain.

-

USDe (Ethena) — a newer stablecoin that is growing quickly. Its market cap is now about $4.8 billion.

- Issuer: Ethena Labs.

- Reserves: Cryptocurrency assets such as ETH and BTC are used to pair with derivative positions.

- Custody: Custodial platforms such as Copper and centralized exchanges.

- Audit: A full traditional financial audit is not conducted. Instead, Ethena relies on public on-chain transparency — all positions and metrics can be tracked in real time — along with regular Proof of Reserves reports from third-party providers.

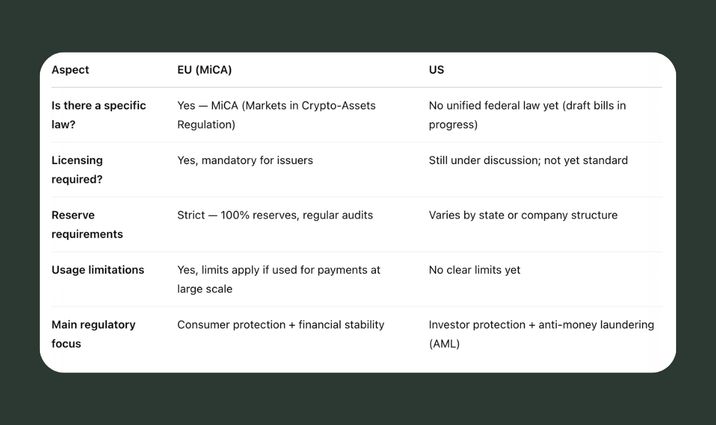

How Stablecoins Are Regulated in the EU and the USA

The MiCA (Markets in Crypto-Assets Regulation) has been in place in the EU since 2023, the first comprehensive law regulating crypto-assets across the EU. The MiCA says that stablecoins must obtain a license from a national regulator (e.g., BaFin in Germany or AMF in France), have 100% reserve coverage, have regular audits, and keep reserves in reliable European banks.

In the USA, there isn't a special law for regulating stablecoins, but the SEC (Securities Commission) and CFTC (Commodity Futures Trading Commission) are fighting for control.

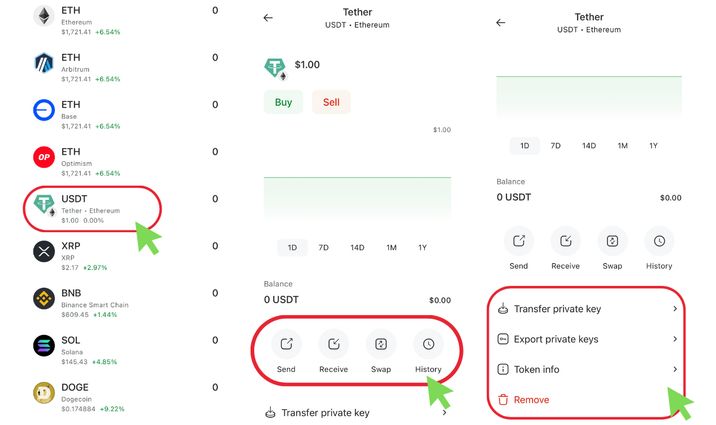

Stablecoins and Coin Wallet

Coin Wallet supports stablecoins, of course. To send, receive, or swap stablecoins, simply select the coin from the cryptocurrency list. Currently, USDT (Tether) is available on the Ethereum network.