The Most Popular Memecoins on the Market Right Now

You've probably heard about Dogecoin, TrumpCoin, MelaniaCoin, and others. All of them are memecoins. Memecoins are cryptocurrencies inspired by viral internet memes. They’ve gained popularity thanks to crypto community support, investor hype, and, of course, viral marketing.

In this guide, we'll break down how these coins work. We're also going to find out why they are the most controversial investments in the crypto market.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Key Takeaways

- Memecoins are among the most controversial investments in the crypto market.

- Dogecoin has the largest market capitalization among memecoins, and you can use it in Coin Wallet.

- Shiba Inu is positioned as the Dogecoin Killer — aiming to repeat and even surpass DOGE’s success.

- Pepe coin is a relatively controversial token due to a past scam incident.

- $TRUMP is the first politically themed memecoin — and one of the most controversial, mostly due to media hype. It doesn't even have any infrastructure of its own.

- Bonk is a Solana memecoin whose success is linked to the growing influence of venture capital in Solana and the collapse of the FTX exchange.

Dogecoin (DOGE)

Shiba Inu (SHIB)

Pepe (PEPE)

TrumpCoin (TRUMP)

Bonk (BONK)

The Bottom Line

Dogecoin (DOGE)

Dogecoin (DOGE) is a cryptocurrency created in December 2013 as a joke alternative to Bitcoin. A picture of a Shiba Inu dog named Kabosu became not only a popular meme but also the official logo of the coin. Unfortunately, Kabosu passed away in 2024 (R.I.P.).

Still, this sad fact hasn’t stopped Dogecoin from having the largest market capitalization among memecoins.

Dogecoin’s low price and strong support from the crypto community helped it become known as "the Internet’s tip coin". In 2021, Elon Musk became an unofficial ambassador for Dogecoin after tweeting memes about the coin. To top it off, Tesla added Dogecoin as a payment option for branded merch in 2024. All of this reinforced DOGE’s status as the "people’s cryptocurrency".

Technical features

Dogecoin runs on its own blockchain, branching off from the Litecoin source code. It uses the Scrypt Proof-of-Work consensus algorithm (mining is merged with Litecoin), which provides fast and low-cost transactions. Block time is about 1 minute — much faster than Bitcoin.

Initially the block reward changed randomly but is now fixed. Each year, about 5 billion new DOGEs are issued. The coin has no maximum issuance limit, which distinguishes it from Bitcoin. This inflationary model is designed to incentivize spending rather than saving — that’s why it’s often called the "tip coin" in the crypto community.

Investors had better remember

-

Unlimited issuance. Unlike Bitcoin’s fixed supply, DOGE’s supply keeps growing (~5.256 billion coins per year), leading to inflation and reducing the long-term value of each coin.

-

Lack of unique technology. Dogecoin doesn’t offer major innovations — it’s essentially a fork of Litecoin that uses PoW, without much original development. This raises questions about its long-term advantage over other cryptocurrencies.

-

High volatility. DOGE’s price is extremely unstable and heavily driven by speculation. Social media activity — especially from Elon Musk — can cause price swings of 20–30% or more in just a few hours. This dependence on hype makes Dogecoin unreliable for savings or everyday payments, as a surge can be followed by a sudden collapse. However, it remains a great tool for quick daily crypto operations.

-

Concentration among large holders. Around 30% of all DOGE is held in just a few large wallets. These may belong to exchanges or early investors, but such centralization creates a risk of market manipulation — a single whale could theoretically crash the price by selling off a large volume of coins.

-

Meme reputation. The fact that Dogecoin started as a joke still prevents it from being seen as a serious asset. Institutional investors and regulators remain cautious, often viewing it as a purely speculative coin.

Shiba Inu (SHIB)

Shiba Inu (SHIB) was launched in August 2020 by an anonymous founder known as Ryoshi. It began as an experimental meme token on Ethereum.

The Shiba Inu dog became the coin’s symbol — a playful response to Dogecoin’s popularity. It was positioned as the "Dogecoin Killer", aiming to repeat — and even surpass — DOGE’s success.

The initial SHIB token supply was an astronomical 1 quadrillion tokens. Half of that supply (about 500 trillion) was locked in Uniswap to provide liquidity. The other half was sent to Vitalik Buterin’s wallet as a symbolic gesture of trust.

In May 2021, Buterin disposed of this "gift" — about 10% of the tokens (50 trillion SHIB) were donated to the India COVID-Crypto Relief Fund. The remaining 40% was permanently burned. This move significantly reduced SHIB’s total supply and caught the attention of the entire crypto community.

Strong community support also played a big role in the project’s growth. Its massive fan base — the SHIBArmy — promoted memes aggressively and attracted new followers.

By late October 2021, Shiba Inu reached a market cap of around $40 billion and entered the top 10 cryptocurrencies.

Technical features

As we said earlier, Shiba Inu coin runs on the Ethereum blockchain. Originally, SHIB operated under the Proof-of-Work consensus mechanism. The team also launched a decentralized exchange, ShibaSwap, where SHIB holders can stake their tokens and earn rewards. Two additional tokens, LEASH and BONE, were created to serve different roles within the ShibaSwap ecosystem. Shiba Inu now uses a Proof-of-Stake consensus mechanism.

In 2023, the team introduced Shibarium — a proprietary Layer 2 blockchain built on Ethereum and designed to enable faster and cheaper transactions with SHIB and other ecosystem tokens. The beta launch generated significant interest. By 2024, its interface was already updated to improve speed and accessibility.

All of this reflects the project's ambition to turn the memecoin into a full-fledged DeFi platform.

Investors had better remember

-

Huge supply and "cheap" price. There are about 589 trillion SHIB in circulation — an extremely high number. Its low price per token (fractions of a cent) gives inexperienced investors a false sense of affordability — even though the project's market cap is already in the billions. Even with token burns, it's nearly impossible for SHIB to hit significant price levels (like $0.01) unless its market cap also rises into the trillions. A massive supply demands ongoing burn mechanisms to create scarcity — as shown by Buterin’s own burn of 40% of the total supply. Without continued cuts, price growth remains limited.

-

Limited originality. At launch, Shiba Inu was a basic ERC-20 token with no unique tech — its value came entirely from meme-driven hype. Despite later ecosystem developments like ShibaSwap and Shibarium, critics argue that SHIB lacks the technological innovation found in platform blockchains.

-

High volatility and risk of collapse. Like other memecoins, SHIB is extremely volatile — it saw gains of tens of thousands of percent in 2021, followed by sharp pullbacks. Its price is mostly driven by hype, speculation, and crowd sentiment. For example, in 2022, SHIB dropped over 70% from its all-time high. Investing in SHIB remains highly risky.

Pepe (PEPE)

Pepe is an Ethereum-based memecoin launched by anonymous creators in April 2023. It’s named after the iconic internet meme Pepe the Frog, popular across various online subcultures.

The project launched without any pre-sales or major marketing — it was a stealth launch. 93.1% of PEPE’s total supply was added to liquidity on a DEX (Uniswap), and the LP tokens were burned to ensure a fair launch with no team allocations. The remaining ~6.9% was held in a multi-signature wallet controlled by the developers for listings and marketing.

PEPE has a max supply of 420.69 trillion tokens.

Pepe Coin took advantage of several factors. First, the meme frog was already widely recognized online and had its own fan base. Second, the success of Dogecoin and Shiba Inu set the stage — thousands of investors were looking for the next "super profitable" memecoin, and Pepe fit the bill in 2023.

The token quickly went viral on crypto Twitter and forums. Countless posts about huge profits drew in more and more participants. Importantly, Pepe initially had no transaction tax or complicated mechanics — it was a simple ERC-20 token, which made it easy to trade.

Technical features

Pepe runs on the Ethereum blockchain and follows the ERC-20 token standard. Like all Ethereum-based tokens, PEPE relies on Ethereum’s Proof-of-Stake consensus mechanism, introduced after the network’s transition to Ethereum 2.0.

The PEPE smart contract has a fixed supply and doesn’t include any extra features or control mechanisms.

It’s important to note that PEPE doesn’t support protocol-level staking — there’s no built-in function for it. However, some centralized platforms may offer temporary staking programs — these are run by the exchanges themselves and are not built into the token.

Investors had better remember

-

Lack of utility. Pepe lacks any utility or unique technology. In essence, it is a “coin for coin's sake”, the value of which rests solely on the faith of the community. The project has not presented a roadmap or product development plans — investors buy Pepe with the expectation of price growth only, which brings the token closer to the notion of a bubble.

-

Extreme volatility. The PEPE price is subject to sharp ups and downs. The May 2023 peak (when capitalization exceeded $1.5 billion) was followed by a deep correction. Any news or rumor can move the exchange rate by tens of percent within a day. Such unpredictability creates a high risk of losses for late buyers.

-

Developer actions. Although the launch was fair, about 6.9% of tokens remained under the control of the team.

In August 2023, an alarming incident occurred: 16 trillion tokens (about $15 million) were suddenly withdrawn from the team's multisig wallet for Pepe and transferred to exchanges, where they were sold. The price of the coin fell by about 20% against this backdrop.

One of the developers later claimed that “bad actors” from the team had done it — in fact, part of the team tried to profit by stealing the coins from the community. This case highlights the risks of centralized control: trust in Pepe was undermined, and although the project continued to exist, investors realized the possibility of a rug pull by insiders.

TrumpCoin (TRUMP)

$TRUMP was launched on January 17, 2025, just three days before Donald Trump's inauguration for a second presidential term. The coin was introduced as “Trump's only official meme”.

The interest in $TRUMP is primarily due to the political and media weight of Donald Trump. It became a kind of digital symbol of the campaign and a way to identify supporters. Buyers of the token were able to participate in private events with Trump, including dinner parties, rallies, and themed parties.

This gave the coin a unique value as a “pass to an elite club” and fueled the excitement around it in the run-up to the inauguration. The media actively discussed the appearance of the presidential memecoin, which helped ensure high demand in the first days of sales.

Technical features

Technically, $TRUMP is a standard Solana-based token with a total supply of 1 billion coins. 200 million of them were sold during the ICO, with the remaining 800 million left in the possession of two companies affiliated with Trump. The plan is to gradually sell these tokens on the market over the next three years.

However, the coin has no infrastructure of its own: no proprietary network, no DeFi products, and no reward accrual mechanisms.

Investors had better remember

-

Conflict of interest. The president’s coin launch raised concerns about possible personal use of his office.

-

Ethical issues. The ability of foreign investors to purchase the coin may violate the U.S. Constitution's prohibition on receiving gifts from foreign governments.

-

Speculative nature. The sharp rise and subsequent fall in the price of the coin have raised concerns about its stability and long-term value.

-

Lack of transparency. Information about the owners of large blocks of tokens and the coin's governance mechanisms is limited, raising questions from investors and regulators.

Bonk (BONK)

Bonk was launched in December 2022 and was the first truly popular memecoin in the Solana blockchain ecosystem. Its creation was largely a reaction to the growing influence of venture capital in Solana and the collapse of the FTX exchange.

The developers stated that they sought to put control of tokens back in the hands of ordinary users. Therefore, a significant portion of the initial BONK offering was given away for free to active participants in the ecosystem: developers, DeFi users, and NFT owners. This decision facilitated rapid decentralization of ownership and created a sense of a truly “people’s” cryptocurrency.

The success of Bonk can be attributed to several factors. First, its launch came at a time when the Solana community was in need of positive momentum, and Bonk became a symbol of revitalization.

Second, it gained widespread support due to the high speed and low cost of transactions provided by the Solana network itself. These qualities made the token attractive for micropayments and use in Web3 applications.

In addition, Bonk was quickly integrated into a variety of projects — from NFT platforms and DeFi to games and decentralized exchanges.

Technical features

On a technical level, BONK is a standard token on the Solana network with a total supply of 100 trillion coins. A periodic token burn mechanism is used to control inflation. Staking is also available, including a one-way model where users are rewarded without having to provide paired assets.

Investors had better remember

-

High volatility. Like many memecoins, Bonk is subject to sharp price fluctuations.

-

Lack of fundamental value. Despite its integration with DeFi, many believe Bonk lacks a sustainable economic model.

-

Speculative nature. Bonk prices are often driven by social media sentiment, which can lead to instability.

The Bottom Line

Investing in meme coins remains extremely risky. Their prices are driven primarily by emotion, cultural trends, and celebrity influence rather than fundamental value. Criticisms ranging from uncontrolled issuance to the potential for fraud require caution and careful research on the part of the investor.

Memecoins can produce both phenomenal gains and equally spectacular losses. They should be approached with a dose of humor, true to their roots, and cold calculation — without investing more than you are willing to lose.

In the end, the main lesson of the memecoin phenomenon is that community and meme culture can create economic value out of thin air — but few projects can sustain it over time.

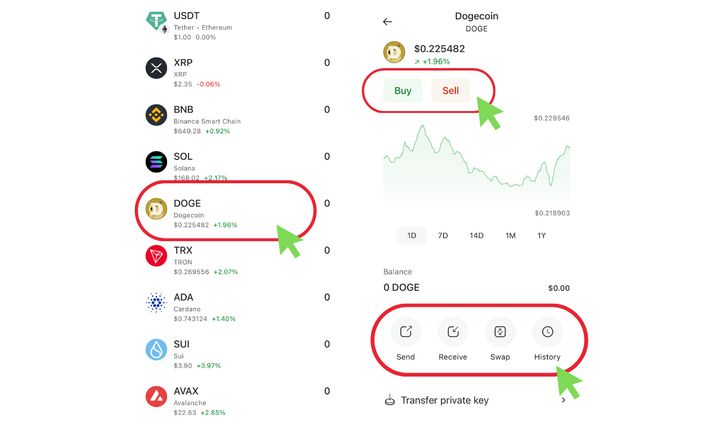

Using Dogecoin in Coin Wallet

If you’re thinking of investing in memecoins, Dogecoin is a good place to start — it’s available in Coin Wallet. To interact with the coin, log in to the app and tap the coin in the list.