What Is an Altcoin Season and How Can You Use It for Making Profit?

Altcoin Season is a phase in the cryptocurrency market cycle when alternative coins (altcoins) significantly outperform Bitcoin in terms of returns. In other words, instead of Bitcoin leading the market, investor attention shifts to other crypto assets, many of which experience exponential price growth.

Altcoin season is generally considered to have officially begun when roughly 75% or more of major altcoins (typically from the top 50 or top 100 by market capitalization) have outperformed BTC over the past 90 days. To quantify this phenomenon, analysts use special metrics known as Altcoin Season Indexes, which compare altcoin performance against Bitcoin’s.

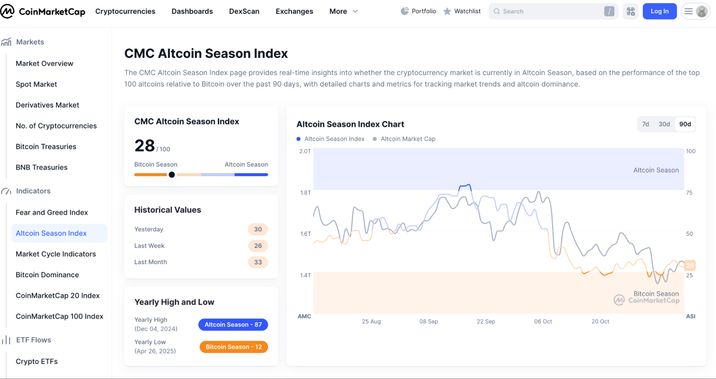

For instance, CoinMarketCap calculates an Altcoin Season Index that ranges from 0 to 100: values above 75 indicate an “altcoin season,” while readings below 25 signal a “Bitcoin season.”

In previous market cycles, these periods have delivered massive gains for altcoins. During one altcoin season in 2021, for example, major altcoins collectively gained +174% in a single quarter, compared to Bitcoin’s modest +2% over the same period.

Historically, altcoins tend to gain strong momentum once Bitcoin trades within about 10% of its all-time high. At the moment, Bitcoin is roughly 16% below its peak, and in similar conditions, BTC has outperformed altcoins in about 54% of cases. If the price climbs closer to $100,000, the likelihood of this scenario increases to around 58%.

Below, we’ll break down what this means and how understanding altcoin season can help you better interpret the dynamics of the crypto market.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Key Takeaways

-

Altcoin season marks a shift in market momentum, when most major altcoins outperform Bitcoin — typically confirmed once over 75% of top altcoins beat BTC’s returns over a 90-day period and Bitcoin dominance starts to decline.

-

Key indicators include a drop in Bitcoin and stablecoin dominance, rising trading volumes, and broad growth across multiple crypto sectors, from DeFi and NFTs to meme tokens — all signaling that capital is flowing into higher-risk assets.

-

The 2025 altseason was brief, ending abruptly in mid-October as Bitcoin dominance spiked back above 60%.

What Are Altcoins?

Altcoins refer to all cryptocurrencies other than Bitcoin — ranging from established leaders like Ethereum, Solana, and XRP to smaller tokens and even stablecoins. An altcoin season is defined by a broad market phase in which the majority of these assets outperform Bitcoin in terms of growth. Formally, it’s said to begin when at least 75% of top altcoins have outpaced BTC’s gains over the past three months, as mentioned earlier.

In practice, however, altcoin season feels like a euphoric market phase: prices of numerous altcoins surge “to the Moon,” portfolios post double- and triple-digit returns, and the news cycle becomes saturated with headlines about new all-time highs across various coins.

Typically, this phase lasts anywhere from two to six months, after which the bubble deflates. That’s why experienced traders tend to treat altcoin season as a time to lock in profits rather than open aggressive new positions. Historically, within just a few months after the peak, altcoins have often lost 70–90% of their value, erasing much of their previous gains.

Signs of the Beginning, Development, and End of an Altcoin Season

Declining Bitcoin Dominance

One of the key indicators to watch is Bitcoin Dominance — Bitcoin’s share of the total cryptocurrency market capitalization. When this metric consistently declines, it suggests that the rest of the market is growing faster or attracting more new capital than BTC. However, it’s important to understand why dominance is falling: stablecoins (like USDT) are also included in this calculation, so a shift of funds into stablecoins can reduce Bitcoin’s share without indicating real inflows into altcoins.

A true altcoin season typically occurs when both Bitcoin’s and stablecoins’ market shares are falling simultaneously — meaning that capital is actually flowing into higher-risk altcoins.

Altcoin Season Index > 75

Specialized indexes track the relative performance of altcoins compared to Bitcoin. When the index rises above roughly 75, it formally confirms that most major altcoins have outperformed BTC over the selected time frame. In practice, traders monitor this indicator alongside other factors.

A sharp increase in the index — especially after a prolonged period of low readings — signals a phase when most of the market starts outperforming Bitcoin. Conversely, a drop below 25 suggests that the majority of top coins are growing more slowly than BTC or even declining, indicating a “Bitcoin season.”

Rising Altcoin Volume and Market Cap

Another strong signal is a noticeable increase in trading volume and capital inflows into altcoins specifically. Analysts also track the growth of certain market segments — for example, a sharp rise in the market share of all altcoins outside the top 10 (the OTHERS.D index) often points to growing investor risk appetite and interest in smaller, lesser-known projects.

Altcoin trading volumes on exchanges tend to surge at the start of an altseason, reflecting the influx of both capital and speculative traders.

Simultaneous Growth Across Multiple Sectors

In a classic altcoin season, growth isn’t isolated to just one niche — it’s broad-based and market-wide. In previous cycles, several major sectors experienced rallies at once: DeFi protocols, Layer-1 platforms, Layer-2 solutions, NFT ecosystems, and meme tokens all saw explosive growth simultaneously.

Behavioral and Media Indicators

Altcoin season is always accompanied by a surge in retail interest and a shift in market sentiment. Mentions of altcoins hit record highs on social media and search trends, online forums buzz with discussions about “the next Ethereum,” and memes about easy wealth flood the internet.

Investors begin to experience FOMO (fear of missing out), rushing into rapidly appreciating coins. Speculative hype reaches such an intensity that even fundamentally weak or random tokens start to rise without clear reasons — a classic sign of market euphoria and overheating.

What Happened in September and October 2025?

However, by October 10–12, it had plummeted to around 51 points and lower (orange marker).

This indicates that the 2025 altcoin season was short-lived — a sudden market downturn in mid-October abruptly ended the altcoin rally. At the same time, Bitcoin dominance surged sharply from about 57% back up to roughly 62% at the peak of market panic, marking a swift end to altcoin outperformance relative to Bitcoin.

Such a surge in Bitcoin dominance is traditionally seen as a clear end to the altcoin season, as investors tend to pull capital out of higher-risk assets and move it back into more stable positions — typically Bitcoin or even stablecoins.

Following the October turbulence, several analysts believe the altcoin market could regain momentum by late 2025. However, nothing is certain at this stage — only time will tell whether another altseason will emerge before the year’s end.

The Bottom Line

Altcoin season is a time of great opportunities — and equally great risks. In 2025, we witnessed the early stages of an altseason fueled by a decline in Bitcoin dominance and a surge across several major coins. However, the market quickly reminded everyone that there’s no such thing as easy money, as altcoins crashed in October.

To profit successfully during an altcoin season, you need discipline and strategy: recognize the early signals, build your portfolio wisely, resist euphoria, and secure gains before the music stops. Even a brief altseason can significantly grow your capital — provided you avoid the traps that catch unprepared investors.