What Western Investors Don’t Understand About Asian Crypto

If you don't know, Bitcoin was created by Satoshi Nakamoto. According to the official legend, he was Japanese. So, was crypto invented by Asians? Yes — you're absolutely right. Asians have already been living in the next century, from yogurt cartons to investments.

While European governments have been trying to regulate cryptocurrencies and increase transparency, the people of South Korea elected a pro-crypto president, Lee Jae-myung. For example, the new president pledged to allow crypto assets backed by the national currency — a move that makes South Korea one of the best-performing crypto markets in Asia.

What does this mean for us — the people of the West? What does it mean for the global crypto economy and your personal assets? And most importantly, how can this shift help you earn more? Let’s talk about it below.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The Most Popular and Highly Capitalized Asian Crypto

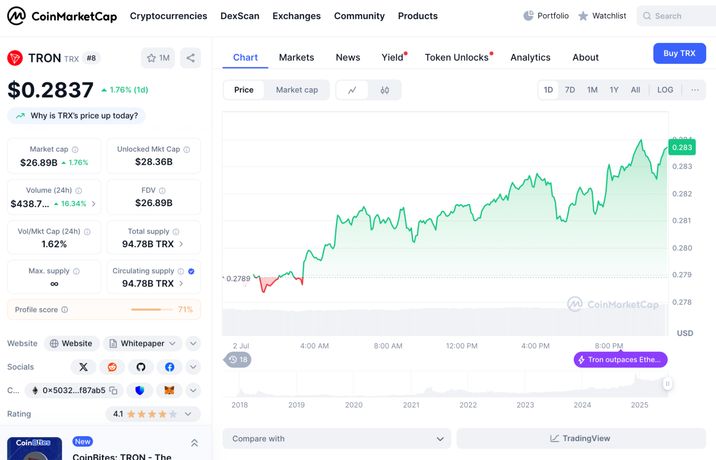

Tron (TRX) — Singapore

Tron is a decentralized platform founded by Chinese entrepreneur Justin Sun (Sun Yuchen) for creating and executing smart contracts and DApps (decentralized applications), with a particular focus on entertainment, gaming, and stablecoin issuance (e.g., USDT on the Tron network).

- Consensus algorithm: Delegated Proof-of-Stake (DPoS), where a limited number of delegates (validators) are elected by vote to produce blocks

- Market capitalization (June 2025): ≈ 26.25 billion USD

- Reasons for popularity: high bandwidth and low transaction fees, massive usage for stablecoin issuance and circulation (e.g., most USDT runs on the Tron blockchain), and a large user base in Asia. Tron has also gained attention through major collaborations (e.g., BitTorrent acquisition, crypto wallet startups, and use of the network for DeFi applications)

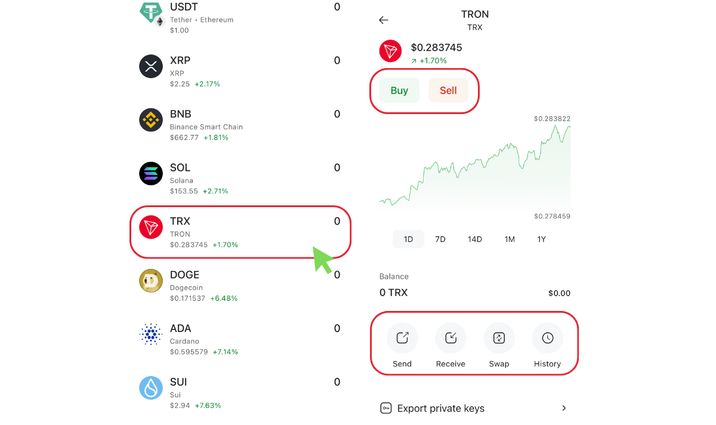

You can use TRON in Coin Wallet, of course. Just get the app on the App Store, Google Play, or the web. After downloading, log into the app and select TRX.

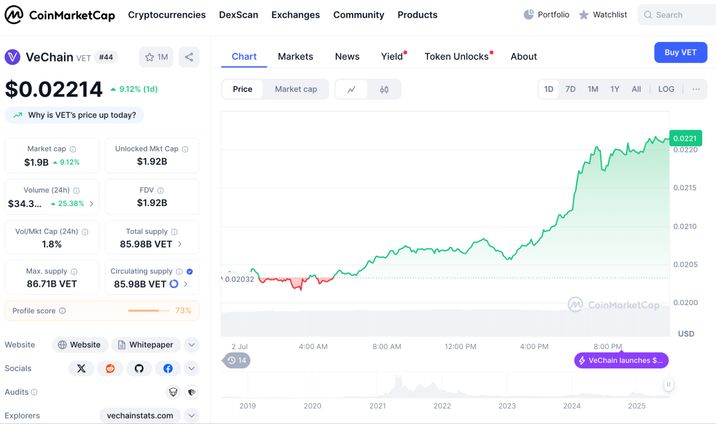

VeChain (VET) — China

VeChain is a blockchain platform for enterprise applications, focusing on supply chain solutions and real asset accounting. Launched by the China–Singapore VeChain Foundation, VET serves two functions: it acts as a “coin” for storing value and voting, while the secondary token VTHO is used to pay for gas (VTHO is generated by holding VET, and 70% of spent VTHO is burned).

The VeChainThor network is customized for business requirements: it allows tracking the origin of goods and transactions in the Internet of Things (IoT) through unique identifiers and sensors, ensuring transparency and preventing counterfeiting.

Among VeChain’s clients are major companies (BMW, LVMH, Walmart); they use VeChain to verify the authenticity of products.

- Consensus algorithm: Proof-of-Authority (PoA) — the network is verified by pre-selected authoritative nodes (“masternodes”), ensuring high speed and energy efficiency

- Market capitalization (June 2025): ≈ 1.78 billion USD

- Reasons for popularity: strong enterprise focus and multiple partnerships — VeChain was one of the first blockchains adopted by large businesses in Asia. Ongoing interest is driven by real-world use cases (logistics, commodity exchange, carbon footprint tracking). The dual-token model helps reduce the volatility of transaction fees, while integration with various industry standards (IoT, NFC) increases the project's practical value

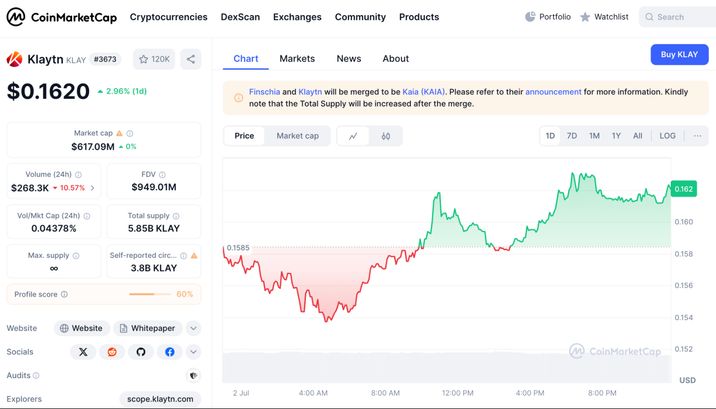

Klaytn (KLAY) — South Korea

Klaytn is a Tier 1 blockchain platform developed by South Korean IT company Kakao (GroundX). Launched in 2019, Klaytn is positioned as an “enterprise-ready” system offering high performance and developer-friendly tools. The network is focused on the mass adoption of Web3, supporting DeFi, real asset tokenization, gaming, and even a pilot program for the digital South Korean won (CBDC) in collaboration with the Bank of Korea.

- Consensus algorithm: Modified Istanbul BFT — an optimized version of the Byzantine fault-tolerant consensus protocol, featuring custom committees and fast finality. This allows for near-instant block finalization and high throughput (around 4,000 TPS), with minimal transaction failure

- Market capitalization (June 2025): ≈ 0.49 billion USD

- Reasons for popularity: strong corporate backing (Kakao is one of South Korea’s leading tech companies) and an actively growing ecosystem supported by a dedicated development fund and grants. Thanks to integrations with major projects (games, financial services, CBDC pilots), Klaytn has become widely adopted in Korea. The network's high usage (over a billion transactions across 300+ dApps) and emphasis on developer experience are also key factors

Why Is the Global Market Going Crazy for Asian Crypto?

Blockchains such as Conflux and Klaytn have official support from the Chinese and South Korean governments. This provides a unique advantage at a time when many Western blockchains are facing regulatory risks.

Major corporations like Kakao, LG, Samsung, Walmart, and BMW are partnering with Asian crypto projects — building trust and encouraging real-world adoption.

For example, Parataxis Holdings (a U.S. investment firm) recently announced the acquisition of a ₩25 billion (US$18.3 million) controlling stake in a South Korean biotech company and plans to become the first company in the country to create a strategic Bitcoin reserve.

In addition, the deputy governor of the Bank of Korea (BOK) noted that “it would be desirable for them to begin the gradual introduction of stablecoins.”

All of this is likely to lead to greater consolidation between Asian governments and the global crypto community. South Korea itself currently appears to be the most efficient market in the region.

Moreover, crypto communities in Asia — especially in China, Korea, and Japan — are extremely active, yet remain more insulated from global discourse. This creates localized waves of hype, which are later “exported” to the global market. For example, Tron is actively promoted in Chinese and Indian communities.

How Can Asian Crypto Impact Your Assets?

Your wallet reacts to Asian market spikes — even if you don't directly own any Asian coins — because Asian tokens are part of the global investment portfolio.

If you hold BTC, ETH, USDT, SOL, AVAX, etc., their prices are directly correlated with movements in Asian markets, since Asia contributes a significant portion of global trading volume. Bitcoin and Ether are traded 24/7, and Asian exchanges (Binance, OKX, Upbit, Bitget) account for more than 50% of global volume — especially during Asian trading hours. This means that if you hold BTC, its price depends not only on Coinbase and Kraken, but also on trader activity in Singapore or Seoul. Large pumps or dumps on Bithumb, Upbit, or Binance directly affect the entire market.

Even if you only hold stablecoins, you're still in the same boat with Asian demand, as many stablecoins operate on Asian blockchains — like TRX, for example. And today, stablecoins are a major point of contention between the U.S. and European governments and the crypto community.

What Should You Do Right Now?

-

Pay attention to overnight volatility. The Asian market is active while it’s nighttime in the U.S., and this is when large price movements often happen. Place limit orders in advance and monitor activity between 8:00 PM – 4:00 AM EST.

-

Keep an eye on Asian tokens and exchanges. Coins like TRX, KLAY, VET, CFX, or BGB tend to move first on Asian news. Even if you don’t trade them directly, they can signal where the broader market is heading.

-

Use Asian info signals. Follow a few media channels or X (Twitter) accounts that track Korea, China, and Japan. This will help you catch early trends and get into airdrops or staking opportunities before they go mainstream.