Why are there several different types of ETH in Coin Wallet?

If you look closely, you might notice other types of Ethereum in Coin Wallet. In this article, we’ll break down the difference between these coins.

Coin Wallet provides access to several types of Ethereum: Ethereum (ETH), Ethereum Arbitrum, Ethereum Base, Ethereum Optimism, and Ethereum Classic. These all come from the Ethereum ecosystem but serve different purposes and functions. Let’s take a look at these.

Key Takeaways

Logic of Layers

Ethereum Rollup Solutions

Ethereum Classic (ETC)

Ethereum Arbitrum

Ethereum Optimism

Ethereum Base

The Bottom Line

Key Takeaways

- The Ethereum network has two layers. Layer 1 is the base blockchain. Layer 2 is a superstructure above the base blockchain — examples include Optimistic and Zero-knowledge (zk-rollups). They help reduce network load and speed up transaction confirmations.

- Ethereum Classic (ETC) is a Layer 1 blockchain and a hard fork of the original Ethereum project. Its main goal is to preserve the original, immutable version of Ethereum — staying true to the principle that “code is law”.

- Ethereum Arbitrum is an Optimistic Layer 2 rollup designed to boost Ethereum’s scalability by increasing transaction throughput and lowering fees.

- Ethereum Optimism is an Optimistic Layer 2 rollup. Its mission is to make Ethereum faster, cheaper, and more accessible — while remaining secure and supporting the ecosystem through community-driven governance and funding public goods.

- Base is an Optimistic Layer 2 rollup with architecture nearly identical to Optimism. It’s designed to be fast, low-cost, and developer-friendly — and is closely integrated with the Coinbase ecosystem.

The Logic Behind Blockchain Layers

Blockchain networks tend to consist of multiple layers. The Ethereum network, for example, has two layers.

Layer 1 is the base layer of the blockchain that processes and confirms transactions directly. For example, Ethereum (ETH), Bitcoin, Solana, etc., are examples of Layer 1 blockchains. It provides a high level of security, but its throughput capacity might be limited.

For example, Ethereum has been processing about 20–30 transactions per second since the Proof-of-Stake transition. That’s not enough for mass adoption. To deal with slow transaction speeds and potential network congestion, developers work on scaling the blockchain. That’s where Layer 2 comes in.

Layer 2 is a superstructure above the base blockchain and helps reduce network load and speed up transactions. Transactions are processed on the Layer 2 network, then results are periodically posted to Layer 1.

This way, L2 networks inherit L1’s security while offloading most of the work off-chain. In Ethereum, this work is done by rollup solutions.

Ethereum Rollup Solutions

Rollup solutions are technologies that “roll up” or merge multiple transactions and record their final state on the main blockchain. In the Ethereum ecosystem, there are two types of rollups: Optimistic rollups and Zero-Knowledge rollups (zk-rollups).

Optimistic rollups assume transactions are valid by default, without immediate proof. This means transactions are posted to Ethereum without being fully verified upfront.

However, if a validator suspects fraud, they can submit a fraud proof. In that case, the disputed transaction is sent to Layer 1 for verification. If the transaction is found to be invalid, the validator who approved it loses their ETH stake. This dispute window lasts about a week, which many consider too long.

A Zero-Knowledge rollup (ZK-rollup) uses cryptographic proofs to validate each batch of transactions. The rollup generates a compact cryptographic proof that all transactions are valid and publishes it to Layer 1.

Because of this, ZK-rollups don’t need a challenge window — all data is already verified by the proof and considered final once that proof is confirmed.

This lets users withdraw assets instantly and speeds up transaction finality.

Ethereum Classic (ETC)

Ethereum (ETH), as we know it today, is a public Layer 1 (L1) blockchain used to run smart contracts and decentralized applications (dApps).

The main goal of Ethereum (ETH) is to be a decentralized global computer for launching smart contracts and blockchain-based applications. To achieve this, Ethereum uses the Ethereum Virtual Machine (EVM), which is the execution environment for smart contracts.

We won’t go into detail on Ethereum (ETH) here — you can read more in our latest posts:

- Ethereum Pectra Upgrade: Everything You Need to Know

- How to Stake Ethereum for Maximum Returns in 2025

Originally, Ethereum had a monolithic architecture — each node validated all transactions. However, on July 20, 2016, the Ethereum network split into two separate blockchains — Ethereum (ETH) and Ethereum Classic (ETC) — due to the exploitation of a flaw in The DAO project's smart contract software and subsequent theft of $50 million worth of Ether.

Ethereum Classic (ETC) is a Layer 1 blockchain that is technically almost identical to Ethereum as it was in 2015–2016. It also uses the EVM to run smart contracts and supports the same token standards as Ethereum. In fact, the current Ethereum network is a hard fork of the original Ethereum — which ETC continues today.

Ethereum Classic is built around the idea of blockchain immutability. The project stands by the belief that blockchain data should never be changed — even to undo a hack. The motto of the ETC community is “code is law”, emphasizing that protocol rules outweigh social decisions.

In short, ETC preserves the full history of the original Ethereum without rolling back the DAO transactions.

ETC is a monolithic Proof-of-Work blockchain. ETC miners solve computational problems using a modified version of the Ethash algorithm, generate blocks, and earn ETC as a reward. Blocks are generated roughly every 13–14 seconds, with an average block time of about 13.9 seconds.

Unlike ETH, where issuance is now reduced through burning, ETC controls supply through periodic reward reductions known as “fifthenings” — a 20% drop every few million blocks. The total supply is capped at approximately 210.7 million coins.

- As of the end of 2024, the ETC network was processing about 30,000 transactions per day. By comparison, Ethereum Layer 1 typically processes over 1 million transactions daily.

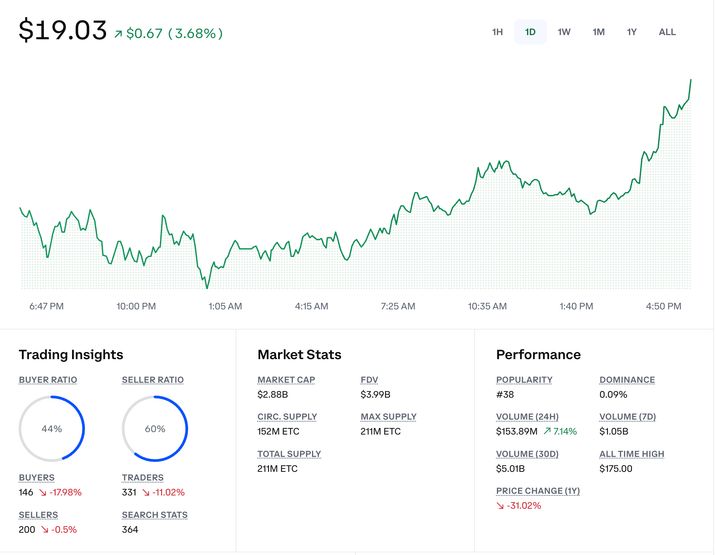

- Ethereum Classic currently has a circulating supply of 151,962,546 ETC — about 72% of its maximum (and total) supply of 210.7 million. Its market cap is $2.88 billion.

ETC is the native token of the Ethereum Classic blockchain. You can use it in Coin Wallet — just log in to the app and tap on the coin in the list.

Ethereum Arbitrum

Ethereum Arbitrum is an Optimistic Layer 2 rollup developed by Offchain Labs in 2019 to help Ethereum scale — increasing transaction throughput and reducing fees.

Architecturally, Arbitrum runs its own nodes that process transactions and create L2 blocks every 2–3 seconds. These blocks aren’t finalized on Layer 1 right away. Instead, the data and state are periodically rolled up and published to the Arbitrum Rollup smart contract on Ethereum.

A unique feature of Arbitrum is its multi-stage dispute resolution system. If a transaction is challenged, the system runs an interactive fraud proof that breaks the computation into steps, pinpointing the exact instruction in dispute — all to minimize the load on Layer 1.

This is more efficient than re-executing entire blocks and lets Arbitrum resolve disputes with minimal work on Ethereum.

- The native token of the blockchain is ARB, but it’s not used to pay for gas. ARB is used for voting in the Arbitrum DAO — a decentralized autonomous organization that governs the network’s development.

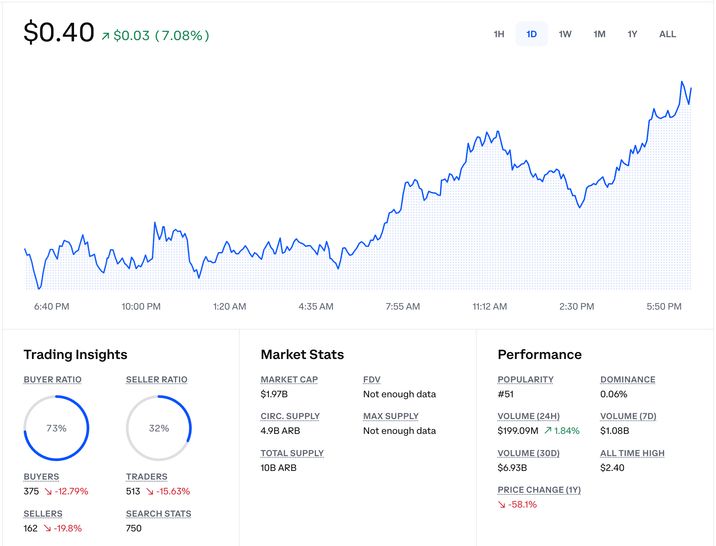

- As of May 18, 2025, ARB has a market cap of around $1.97 billion, with about 4.86 billion tokens in circulation.

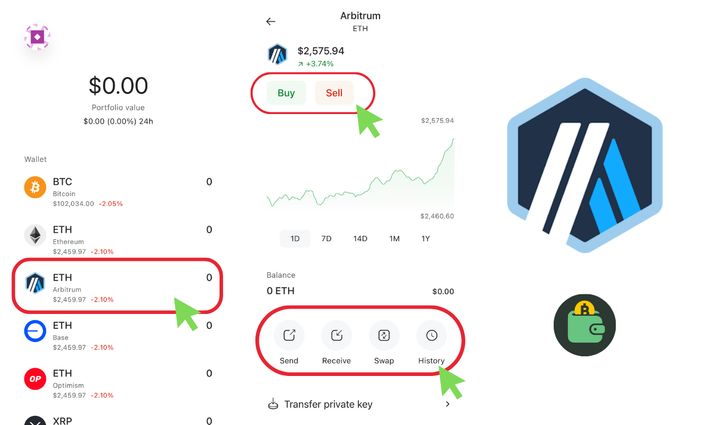

In Coin Wallet, the coin shows up as ETH because that’s what’s used to pay for transactions. When you interact with dApps or simply transfer tokens within the Arbitrum network (like Arbitrum One), you pay a fee in ETH — just like on the main Ethereum network.

To use Arbitrum in Coin Wallet, just select the coin from the list and choose what you want to do: buy, sell, send, receive, or swap.

Ethereum Optimism

Optimism is a leading Layer 2 platform for Ethereum, built on optimistic rollup technology and launched in 2021. Shortly after Arbitrum’s launch, Optimism came out with a focus on simplicity, high-quality development, open-source support, and funding for public goods.

The project started as part of Plasma research — an early Layer 2 approach — and later evolved into a full rollup solution. Optimism is also known for the OP Stack, a modular set of Layer 2 components that power Optimism and other networks like Base.

The Ethereum Foundation and community backed Optimism as more than just a startup — they positioned it as core infrastructure for the Ethereum ecosystem.

Optimism publishes all transaction data to the Ethereum mainnet, specifically to the CanonicalTransactionChain smart contract. This adds security by allowing full replication on Layer 1.

For users, interacting with Optimism feels just like Ethereum — same addresses, signatures, and transactions. Gas is still paid in ETH, just on Layer 2. Like Arbitrum, Optimism fees include L2 gas and a publishing fee on L1.

The project aims to make Ethereum more accessible and scalable while helping the ecosystem grow as a public good. It places a strong focus on funding infrastructure.

A portion of network fees goes to RetroPGF (Retroactive Public Goods Funding), which supports projects that benefit the Ethereum community.

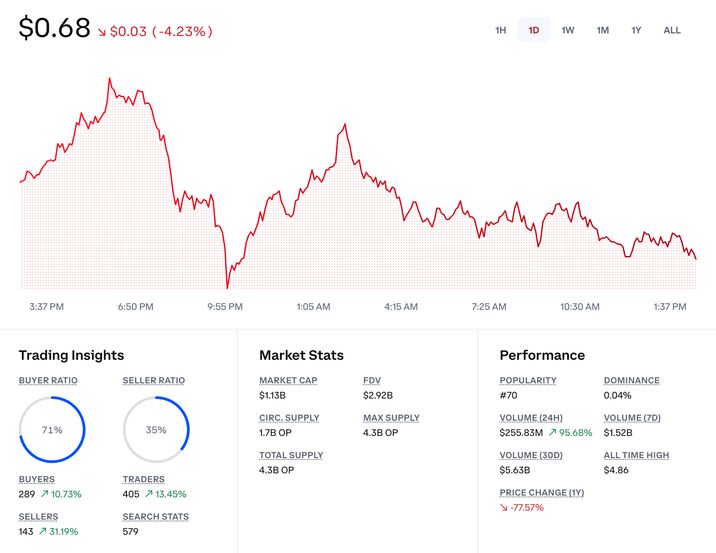

- OP is the native token of the Optimism network. It isn’t used to pay for gas — instead, it’s used for governance and to incentivize participants, like through gas discount programs for active projects.

- The circulating supply of OP is about 1.66 billion — roughly 39% of its max supply of 4.29 billion. OP’s current market cap is $1.23 billion.

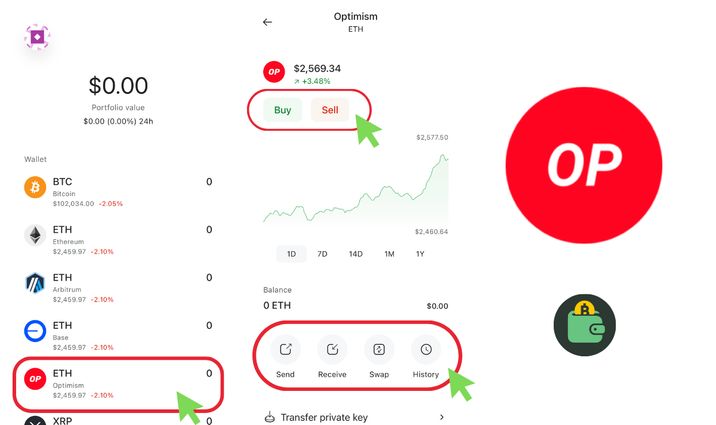

Optimism shows ETH in wallets because gas fees are paid in ETH — not in OP — when you send tokens, interact with smart contracts, or do swaps.

In Coin Wallet, just tap the coin in the list to get started.

Ethereum Base

Base is a new Layer 2 network built on optimistic rollups, developed by Coinbase — the largest crypto exchange as of 2023. Built using the OP Stack (Optimism technology), Base is designed to be a fast, low-cost, developer-friendly L2 that’s tightly integrated with the Coinbase ecosystem.

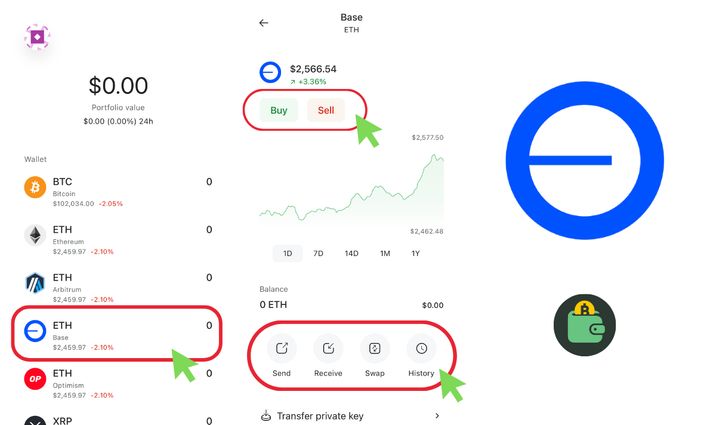

What sets Base apart is that it doesn’t have a native token. It uses ETH for gas and has no plans to launch its own coin — highlighting its practical, utility-first design.

Base aims to onboard new users to Web3 by bridging the gap between Coinbase’s centralized platform and decentralized Ethereum apps.

The launch of Base was part of Coinbase’s strategy to expand and diversify its services. The exchange wanted to give its ~100 million users direct access to DeFi and dApps through a Layer 2 it controlled.

Coinbase didn’t build Base from scratch — it used the open-source OP Stack, which allowed the network to launch quickly. Since launch, Base has been developed with Coinbase’s support, but there’s a plan in place for gradual decentralization. Like other L2 projects, Coinbase plans to eventually hand control over to the community.

Base is an optimistic L2 rollup with an architecture nearly identical to Optimism’s. It uses the same code stack: a sequencer orders transactions, data is published to Ethereum, and there’s a seven-day challenge period.

Blocks are produced roughly every 2 seconds, and the network supports EVM equivalence and the EIP-1559 fee mechanism. Because Base doesn’t have its own token, it uses ETH for gas and as collateral in smart contracts.

This sets Base apart from some sidechains that use their own tokens for gas. Base is fully integrated into the Ethereum economy.

To use Base in Coin Wallet, just select the coin from the list and choose what you want to do: buy, sell, send, receive, or swap.

The Bottom Line

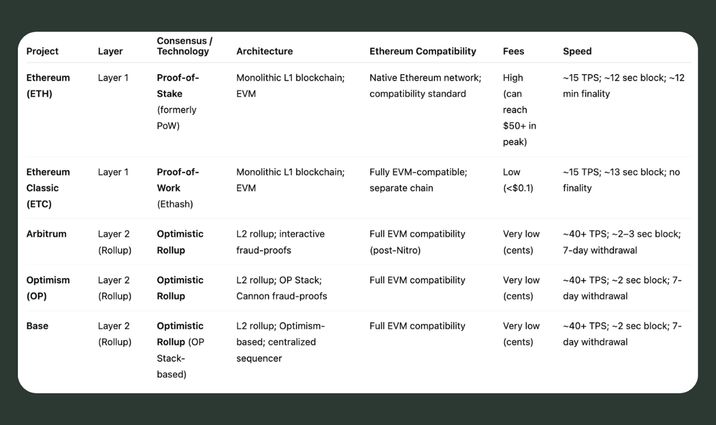

We’ve pulled together all the key info about Ethereum blockchains in one simple table.