Why Bitcoin Goes Up and Down — Meme Edition

Bitcoin (BTC/USD) traded at $102,299 on Thursday, May 15, slipping over 1%. Experts have been linking that to U.S. regulatory developments. However, there are a lot of other factors that impact the Bitcoin price. In this article, we'll break that down.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Supply and Demand

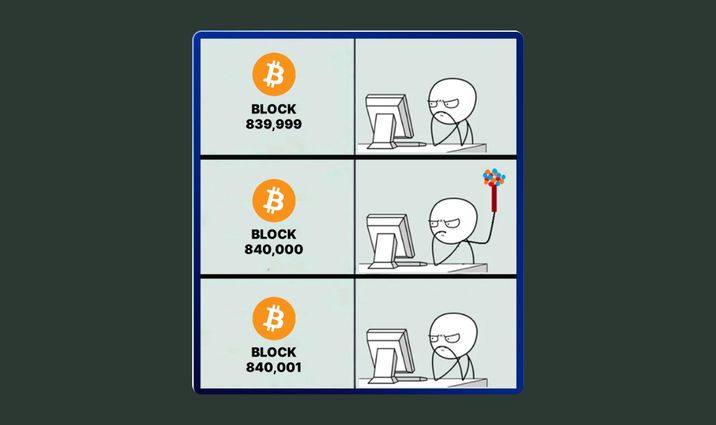

The supply of Bitcoin is strictly limited by protocol — once 21 million coins have been mined, no more will be added. Every four years, a so-called halving takes place, which halves the reward for miners and slows down the issuance of new coins.

The cycles following each halving have led to new all-time highs: analysts at Bloomberg Intelligence and Matrixport have calculated that the next halving could theoretically cause the exchange rate to rise by “at least 81%”, all other things being equal.

In general, supply constraints mean that “almost all movements in price can be explained by changes in demand”.

Institutional Investment

In recent years, large investors and funds have played an increasing role in Bitcoin’s market dynamics. One of the turning points was the approval of spot Bitcoin ETFs in the U.S. and other countries. Such funds are required to buy and hold actual Bitcoin, leading to a massive influx of money into the crypto-asset. According to CoinDesk, Galaxy Digital analysts predict that the new ETFs could raise between $14 and $40 billion in Bitcoin in the first three years of operation alone.

According to the authors, the influx of funds from major players increases the overall demand for Bitcoin and stabilizes liquidity, making the exchange rate less prone to spikes.

Regulatory Developments

The legal status of Bitcoin and other cryptocurrencies is one of the most important sources of uncertainty. Clear regulations can attract investors as soon as the rules are established, but restrictions can temporarily curb demand.

In the long term, however, new regulations — such as the introduction of controlled accounts, transparent transactions, and the recognition of ETFs — may facilitate the inflow of institutional and retail investors.

Impact of Hash Rate and Mining Complexity

In the Bitcoin technical model, the mining difficulty automatically adjusts to the network's aggregate hash rate, maintaining a constant rate of new coin issuance. The rate of issuance does not change regardless of the number of miners — if the network's hash rate increases, mining becomes more difficult; if it drops, mining becomes easier. According to CoinShares, this mechanism ensures a strictly inelastic supply of Bitcoin.

At the same time, changes in price affect the composition of miners and the network's energy consumption. When prices are high, miners expand their capacity because mining remains profitable. As capacity increases, so does difficulty — but the reward per 1 TH/s can grow even faster when prices are rising. Conversely, when prices drop, less efficient or expensive miners leave the network. This reduces the hash rate and restores the profitability of the remaining miners.

Investor Behavior

The price of Bitcoin is largely subject to the mood of market participants and crowd psychology. Increased interest from private investors during periods of crisis or “media hype” reinforces bullish movements, while massive sell-offs driven by panic cause prices to drop.

Since 2021, S&P Global has emphasized that Bitcoin has been particularly “in step” with investors’ risky strategies; there has been a stable positive correlation with high-risk stocks.

This means that during periods of market “greed”, Bitcoin often rises alongside technology and emerging market indices. However, during times of turmoil — such as capital outflows or tightening monetary policy — Bitcoin may decline.

Additionally, media and social media activity generate “FOMO” and “FUD”, causing short-term spikes and drawdowns. For instance, significant tweets or news of large purchases or sales often quickly impact the price, though these effects are usually temporary.

Long-term trends are formed more by the gradual, cumulative buying of Bitcoin by long-term investors than by mood swings.

The Role of News and Expectations

News events (both economic and specialized) can cause short-term market movement. Expectations surrounding a Federal Reserve interest rate decision, the release of significant macroeconomic data (e.g., inflation), regulatory announcements, and the introduction of financial products (e.g., ETFs, futures, and large ICOs) frequently result in market volatility.

In other words, the price may rise or fall by a few percent or more based on news, but a sustainable trend develops based on real economic and technological factors.

The Bottom Line

In addition to the above, Bitcoin’s value is influenced by broader trends. For instance, an expanding user base and growing infrastructure (wallets, exchanges, and payment gateways) reinforce the network effect — the more widespread Bitcoin becomes, the greater its network value. Technological upgrades, such as improvements in scalability or privacy, can increase the asset's appeal. Competition with other cryptocurrencies and asset classes also plays a role.

Bitcoin is often compared to gold and is sometimes perceived as a digital safe haven when traditional finance deteriorates. Finally, global macroeconomic events — such as financial crises, geopolitical tensions, and trends toward fiat currency devaluation — can stimulate capital flows into Bitcoin in search of an alternative safe haven or divert investors to more conservative instruments.

The Bitcoin price is collectively set by the balance of these fundamental forces. Changes in demand or supply, influenced by macroeconomic, regulatory, sentiment, and technological conditions, lead to different market cycles and trends.

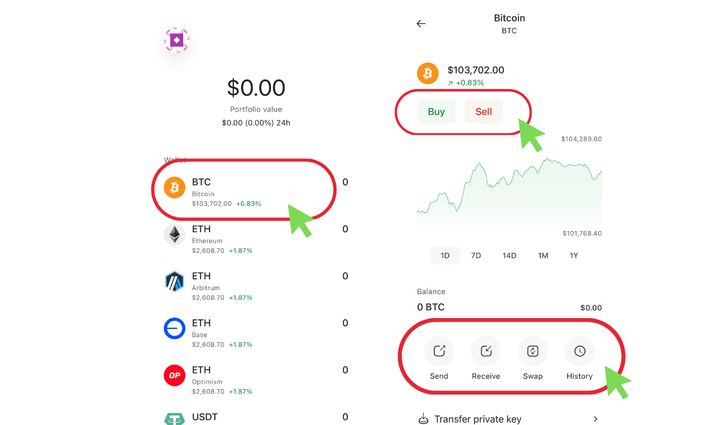

Of course, you can buy, sell, send, receive, and swap Bitcoin in Coin Wallet. You just need to log in to the app and select the coin from the list.