Why Smart People Fall for Rug Pulls — and How You Can Avoid Them

If you’ve been in crypto for more than five minutes, you’ve probably seen a story that starts with “promising project” and ends with “devs disappeared.” Welcome to the world of rug pulls — one of the nastiest tricks in the crypto playbook.

Key Takeaways

-

Rug pulls thrive on emotion, not logic. Scammers exploit excitement, greed, and FOMO far more than they rely on technical tricks. Staying calm and skeptical is your best defense.

-

Hype isn’t proof. Even viral projects backed by influencers or “big communities” can vanish overnight. Always check who’s behind the code and whether the liquidity is secured.

-

Due diligence beats luck. Take time to research, read, and think before you buy. In crypto, patience and critical thinking are worth more than any “next big thing.”

What Is a Rug Pull in Crypto?

A rug pull is a type of exit scam in the crypto world where a project’s creators abruptly abandon the venture and run off with investors’ funds, leaving behind worthless assets. In decentralized finance (DeFi), this often involves developers launching a token or protocol, promoting it to attract buyers, then suddenly withdrawing all liquidity or tokens for cash. The result is a sharp collapse in the token’s price and investors are “left holding the bag” with virtually no value.

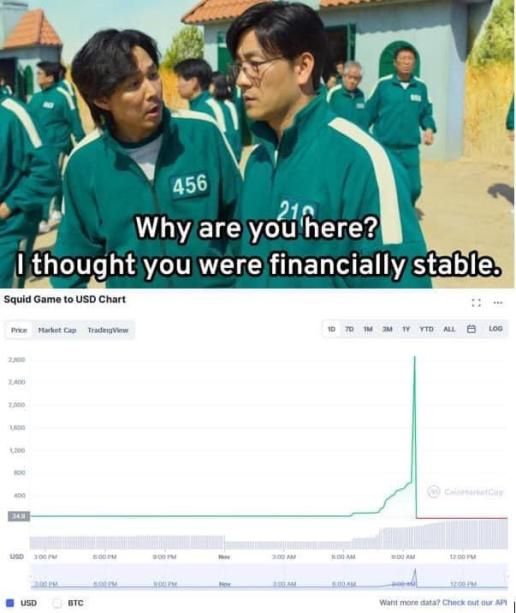

Case 1. Squid Game Token

In late 2021, the world was obsessed with Netflix’s Squid Game. Scammers spotted an opportunity and launched a token claiming to be part of an upcoming play-to-earn game.

At first, everything looked exciting: the price of SQUID skyrocketed from a few cents to over $2,800 in less than a week. But there was a catch — investors soon realized they couldn’t sell their tokens. The contract blocked selling for everyone except the developers.

Within hours, the team dumped everything, pulled out about $3 million, and deleted their website and Twitter. The token’s price crashed 99.99%. Thousands of investors were left staring at charts that looked like a cliff.

How Rug Pulls Work

It’s like the old magic trick: they pull the rug out from under your feet and vanish. Technically, it often means the creators drain the liquidity pool of a token or empty the project’s wallet. Socially, it’s built on hype, shiny promises, and a whole lot of FOMO.

Scam developers exploit the openness of crypto markets and investor enthusiasm. They might design smart contracts with malicious functions (for example, code that prevents investors from selling the token or allows only the creators to withdraw liquidity).

In many cases, developers do not lock liquidity in the token’s pool, meaning they retain the ability to remove all the funds at will. On the social side, rug pull artists rely on deception and hype. They create professional-looking websites and white papers to appear legitimate, often remaining anonymous or using pseudonyms to avoid accountability.

Through aggressive social media marketing, they drum up excitement — sometimes even fabricating endorsements or using paid influencers — to cultivate FOMO (fear of missing out) among investors.

Early investors see the token’s price surging and more people piling in, which reinforces a false sense of security and legitimacy. Once a critical mass of money is in, the scammers execute the «pull» — draining crypto wallets or liquidity pools in an instant. With little to no regulation in the crypto space, these perpetrators can vanish behind the anonymity of their blockchain addresses, leaving the community stunned as the token’s value plunges to zero.

Case 2. AnubisDAO — The $60 Million Meme That Vanished

Just a few months before, another project called AnubisDAO raised over 13,000 ETH (around $60 million) in a single day. It looked like a spin-off of the famous OlympusDAO — complete with a cute dog logo and DeFi buzzwords.

But there was no white paper, no website, and no product. Investors still piled in, driven by tweets and the promise of “next-generation decentralized money.”

Twenty hours later, the project’s wallet was drained. All the ETH was gone. No one ever found out who ran it. It was one of the biggest rug pulls in DeFi history — and a masterclass in how trust and greed can blind even experienced crypto users.

Some common red-flag characteristics of rug pull projects include

-

Unrealistic returns or hype: Promises of outsized profits (“100x” gains, extremely high yields) that sound too good to be true often accompany rug pulls. Scammers prey on greed by pitching a “can’t miss” opportunity.

-

Unknown team with no track record: Rug pull projects frequently have anonymous developers or fake team profiles with no verifiable history. Lack of transparency about the founders is a major warning sign.

-

Limited ability to sell or withdraw: If a token’s code restricts selling (as seen in some scams) or if liquidity isn’t locked, investors may find they cannot exit their positions. This is often by design — for example, the infamous Squid Game token implemented an anti-sell mechanism so only the creators could cash out.

-

Overreliance on hype and influencers: The project is heavily promoted on Twitter, Discord, YouTube, etc., often by social media influencers or celebrities who create buzz. Scammers leverage this social proof to legitimize the project and lure in followers.

-

Abrupt disappearance of communication: Just before or immediately after the scam, the project’s online presence vanishes — websites go down and developer/influencer accounts go silent or get deleted. This sudden radio silence is the final telltale sign that a rug pull has occurred.

By understanding these technical tricks and social manipulation tactics, investors can better grasp what a rug pull looks like in action.

Case 3. SafeMoon — The Slow Rug Pull

Not every rug happens overnight. Sometimes, it’s a slow fade.

SafeMoon, launched in 2021, branded itself as a “safe” memecoin that rewarded holders and promised to “take you safely to the moon.” Influencers and musicians hyped it like crazy.

At its peak, SafeMoon’s trading volume exploded more than 1,000%, and its market cap hit billions. But behind the scenes, insiders allegedly dumped large amounts of tokens while encouraging the community to “hold.” Prices collapsed over 80%, lawsuits followed, and the dream of “safe” profits turned into one of the biggest disappointments in crypto history.

Why Do People Still Fall for It?

You’d think after all these stories, nobody would fall for another rug pull. Yet, they keep happening. Why? Because these scams don’t just target your wallet — they target your emotions.

- FOMO: The fear of missing the next big win makes people rush in without thinking.

- Social proof: “Everyone’s buying it, so it must be real.”

- Trust in influencers: When your favorite YouTuber or rapper promotes a coin, it feels safe — even when it’s not.

- Greed: The promise of 100x returns is hard to resist.

- Illusion of control: Many investors believe they can spot scams or sell in time. They usually can’t.

How to Protect Yourself

You don’t need to be a blockchain engineer to stay safe from rug pulls. The first thing to check is who’s behind the project. If the developers hide behind fake names or empty LinkedIn profiles, that’s already a bad sign.

Reliable teams are transparent about their identities and past work. It also helps to look for an independent audit or proof that the project’s liquidity is locked — without that, the creators can simply pull the funds and disappear.

Another smart move is to review the contract, or at least have someone technical take a look, because some tokens are coded so investors can buy but not sell. And don’t get carried away by celebrity endorsements or influencer hype; paid promotions are everywhere in crypto, and they rarely mean a project is legitimate. In the end, the best protection is common sense and intuition. If a deal sounds too good to be true, it probably is.

Final Thoughts

Crypto can be exciting, but excitement is exactly what scammers use against you. Rug pulls remind us that technology doesn’t erase human weakness — it often amplifies it.

So before you ape into the next “can’t-miss” token or NFT, take a breath, do your homework, and remember: in crypto, the only thing that should be pulled fast is your hand away from the “Buy” button when something smells off.