10 Best Wallets for Staking Crypto Securely 2025

After the Ethereum Pectra Upgrade, staking has become more popular than ever. That’s no surprise — staking allows crypto holders to earn passive income simply by holding and locking their assets. But before you start staking, the first step is to choose a secure and reliable crypto wallet. In this article, we present a curated list of the best wallets for staking in 2025.

Top staking wallets 2025

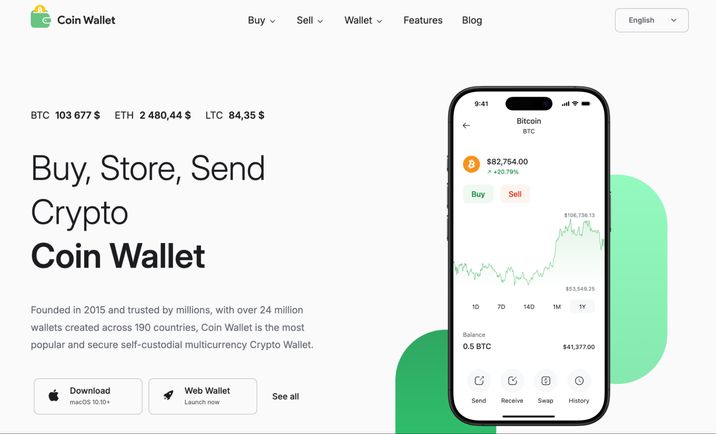

1. Coin Wallet

Coin Wallet is a non-custodial, open-source, multiplatform wallet. It uses AES-256 encryption and the BIP39 standard, and it supports hardware security keys. Private keys never leave the user's device.

Ethereum staking is supported through integration with Everstake. Delegation takes place directly from the wallet, without handing over control to a third party.

Cons: Currently, staking support is limited to ETH only. Delegation for SOL, ADA, and other PoS coins is not yet available, which may limit functionality for active stakers. However, support for additional coins is actively expanding.

Read more about how to stake ETH by Coin Wallet:

How to Stake Ethereum for Maximum Returns in 2025

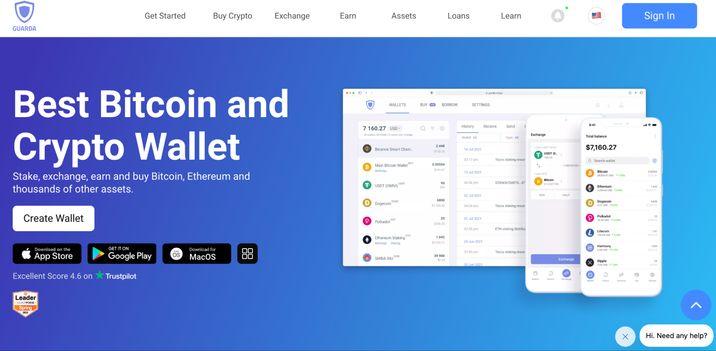

2. Guarda Wallet

Guarda is a non-custodial, multiplatform wallet with Ledger integration. It supports seed phrase protection and offers staking for dozens of coins. Delegation is available directly through the wallet interface, with validator selection.

Cons: Rewards may sometimes be delayed in appearing or being received. ETH staking is implemented custodially via the Guarda staking pool — not natively or through liquid staking. The interface may feel complicated for beginners.

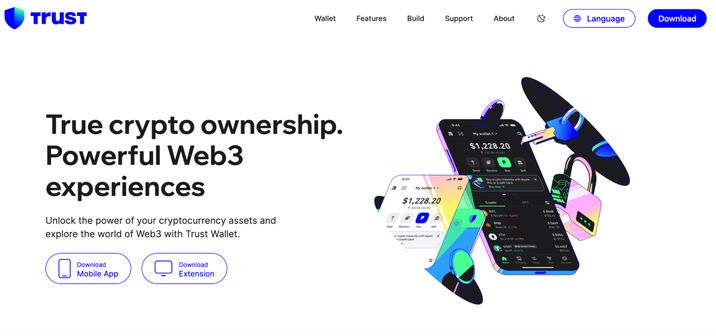

3. Trust Wallet

Trust Wallet is a fully non-custodial and secure wallet that stores your private keys locally. It supports both PIN and biometric authentication. Its open-source core ensures transparency and trust.

Staking is implemented natively for over 20 coins. You can select a validator, track rewards, and manage staking directly from the wallet interface.

Cons: There is no liquid staking option (e.g., Lido). On some networks, validators are limited to a default list, so users cannot always delegate to any node. The wallet also lacks advanced analytics for tracking rewards.

4. Exodus

Exodus is a convenient, non-custodial wallet that offers enhanced security through Trezor integration. Your keys are stored locally on your device.

Staking is available for Solana, Cardano, Algorand, and more via built-in staking pools. Delegation can be done with just one click.

Cons: Users cannot manually select a validator — the wallet uses partner pools by default. This limits control and may affect profitability. Exodus also lacks advanced features or detailed analytics for staking rewards.

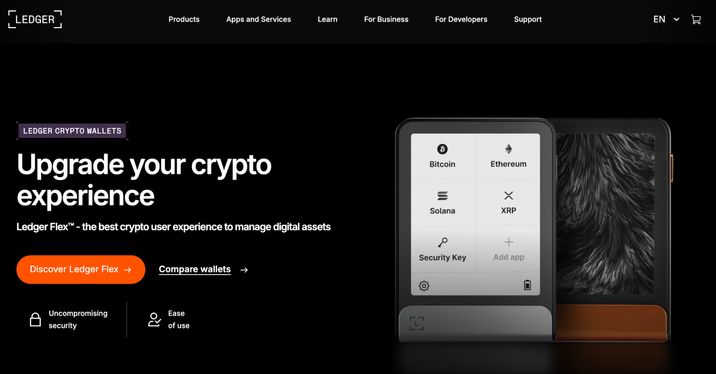

5. Ledger + Ledger Live

Ledger is a hardware wallet that offers a high level of security through its Secure Element, PIN, and optional passphrase protection. Ledger Live serves as the companion asset management interface.

Staking is available for ETH, SOL, DOT, ADA, ATOM, and more. You can choose validators and access DeFi integrations directly through Ledger Live.

Cons: The list of coins with native support in Ledger Live is limited. For example, staking ADA requires using a third-party interface like Yoroi. The staking process may also be challenging for beginners, as it involves customization and connecting third-party applications.

6. Trezor + Trezor Suite

Trezor is an open-source hardware wallet that offers offline storage and PIN protection. The Trezor Suite interface allows you to securely manage your assets.

Staking is available for ADA, SOL, XTZ, and more through the built-in interface, and for ETH via external services.

Cons: Staking support is limited and less developed compared to Ledger. Native ETH staking is not available — third-party platforms are required. The interface can be complex, especially when interacting with DeFi protocols.

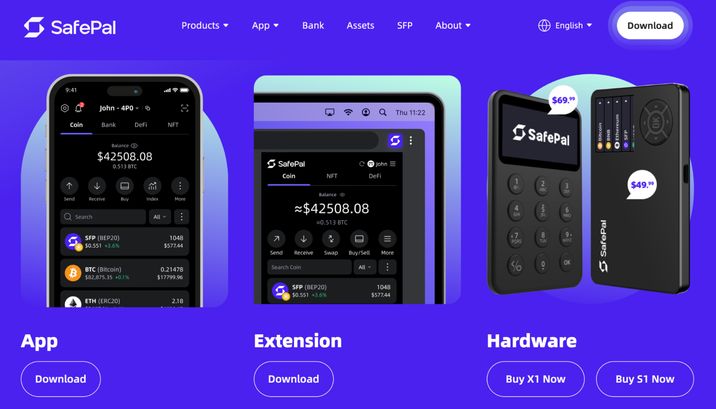

7. SafePal (App + Hardware)

SafePal offers both a mobile wallet and a hardware device — the S1 — which provides complete offline isolation. Your private keys never leave the device. It includes PIN protection and a built-in self-destruct mechanism.

Staking is available for dozens of coins, with access to DeFi staking and Binance Earn directly from the app.

Cons: Some staking features, including ETH and ADA, are implemented through custodial solutions like Binance Earn. Certain assets require interaction with Web3 ecosystems, which can be complex for some users. The hardware wallet does not support Cardano.

8. Kraken Wallet (Exchange)

Kraken provides a high level of security for exchange-based wallets, including cold storage and robust security protocols. Staking is available for approximately 25 coins, with instant activation and automatic reward payouts.

Cons: Kraken Wallet is custodial, meaning users do not control their private keys. Staking relies entirely on trust in the exchange. Some assets may be locked and unavailable for withdrawal during certain periods. Users also cannot manually select a validator.

9. Binance Wallet (Exchange)

Binance offers centralized security features, including two-factor authentication (2FA), cold storage, and the SAFU fund. It supports fixed, flexible, and DeFi staking for over 300 coins.

Cons: Binance Wallet is custodial, meaning users do not control their private keys. All staking actions occur on the exchange’s side, and in the event of account lockouts, users may lose access to their funds. There is also a lack of transparency in validator selection.

10. Atomic Wallet

Atomic Wallet is a non-custodial wallet that encrypts and stores your keys locally on your device — meaning you fully own your funds. It supports staking for over 15 coins, and delegation can be done directly within the app. Liquid staking for Ethereum is available via Lido.

Cons: Atomic is a closed-source wallet, which reduces transparency. There have also been past complaints regarding support and wallet recovery. ETH staking is implemented through a third-party service (Lido) rather than natively, and in some cases, validator selection is not available.

Frequently Asked Questions

📌 What is the best wallet for staking crypto in 2025?

The best wallet for staking crypto in 2025 is the one that fits your personal needs and aligns with your security standards. For example, if you value simplicity and control, a self-custodial wallet like Coin Wallet might be ideal. There’s no one-size-fits-all solution — it all depends on what matters most to you: security, convenience, supported assets, or staking rewards.

📌 Can you stake crypto safely with a hardware wallet?

Yes — staking with a hardware wallet is considered one of the safest methods available. Devices like Ledger and Trezor let you sign transactions offline, keeping your private keys fully secure throughout the staking process.

Read more: Cold and Hot Wallets: How to Make a Choice

📌 What cryptocurrencies can you stake using wallets?

Popular options include Ethereum, Solana, Cardano, Cosmos, Polkadot, and many others — depending on the wallet you use.

Read more: Why are there several different types of ETH in Coin Wallet?

📌 Are non-custodial wallets better for staking?

Yes — non-custodial staking wallets give you full control over your private keys and funds. This is generally considered safer than using custodial options like exchanges, which involve additional third-party risk.