5 Upcoming Crypto Industry Trends You Need To Know

The crypto industry is one of the fastest moving sectors that we have ever seen, completely exploding in popularity since the 2017 crypto boom. Because of the fast-paced nature of the crypto industry, it can be challenging to keep up to date with everything that is going on, especially concerning regulation. This is why we’re going to go over the trends that you need to know.

Thankfully, this year has been an incredibly eventful and eye-opening one for the crypto industry as a whole, and there is a lot of reason to be optimistic, even if there are some causes for concern.

Bitcoin Price Surge

There is a lot of reason to be excited about Bitcoin’s potential over the next few years, due to a massive surge in price on the 18th of November 2020, rising to above $18,000 per Bitcoin. This is the highest price that Bitcoin had reached since December 2017, which signaled the end of Bitcoin’s initial “bull run” when the crypto industry started in earnest.

It is unclear about all of the signals that caused this massive increase in value, although the run first began around the 21st of October 2020, when PayPal announced that it would allow its users to purchase, sell and carry Bitcoin with their accounts. This led to an increase in the value of 8%, which pushed it just under $13,000.

PayPal is just one of the few big-name brands that have come out in support of Bitcoin and it helped to sky-rocket its price. As more and more companies and banks might become tempted to make similar offers by the promise of new crypto-enthusiast users, these events will also likely drive the price up even further.

You should make sure that you’re ready to trade if you want to get involved by getting a crypto wallet and a platform to trade on.

PayPal’s Crypto Integration

As previously mentioned PayPal is allowing people to purchase, sell, and hold Bitcoin through their PayPal accounts. This feature has recently gone live in the United States, providing people with an easy and convenient method for interacting with cryptocurrencies. Namely, you are able to use Bitcoin, Ethereum, Bitcoin Cash, and Litecoin.

Currently, PayPal is expecting to distribute this functionality to Venmo and other international markets in early 2021, whilst allowing users to pay vendors in cryptocurrencies around that same time. This represents a massive potential increase in the number of people that will have access to cryptocurrencies and will also give them a familiar, trustworthy, and easy platform to use cryptocurrencies.

When you consider the fact that PayPal was suggested to have over 346 Million users in the second quarter of 2020, you can truly appreciate the scale of the potential users involved with cryptocurrencies as a result. This isn’t just good for Bitcoin, but the wider crypto industry.

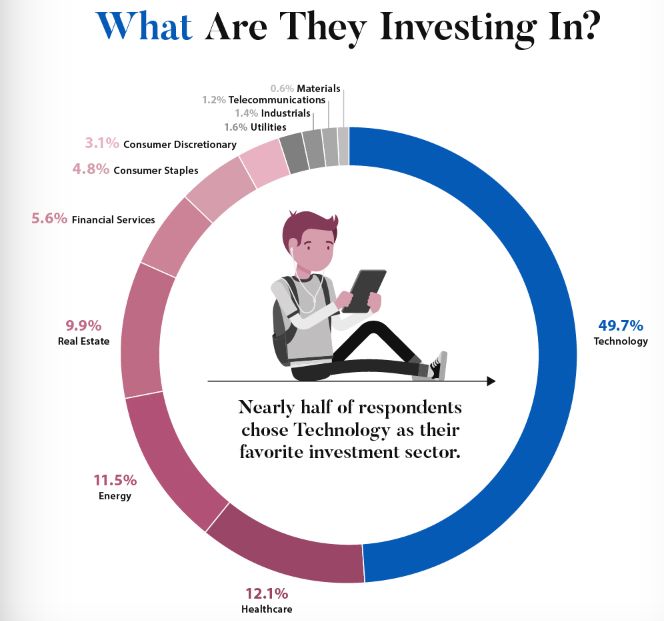

Crypto is Gaining Popularity in Financial Planning

Initially, there was quite a lot of resistance by financial planners to let their clients put more than 5% of their allocated funds into cryptocurrencies. This was mainly through fear of the admittedly volatile and unpredictable nature of cryptocurrency pricing.

Despite this initial hesitance, it is becoming more common for financial advisors to be willing to work with cryptocurrencies more. One of the main reasons that financial advisors are taking crypto and digital assets more seriously are due to the demographics of investors now.

For example, both Millenials, Gen X and Gen Z people have been using the internet for a long time, or even their whole lives for some. These are the people that will be interested in crypto.

If financial advisors don’t start now, they may miss out. 83% of millennials have been receptive to the idea of using alternative investment strategies, which include Bitcoin and other cryptocurrencies. This is because they are wary of fees that are paid on investments.

Due to the fact that this age group is set to inherit over $60 Trillion in the coming years, financial advisors would be silly not to assume that cryptos would play a big role for them if they want to keep that segment of the market as potential customers. Cryptos can also bring more clients to financial advisors by providing an investment avenue for people who aren’t “accredited investors”.

Crypto Exchanges Are Heading Closer To Being Regulated

Since evolving from a relative unknown, cryptocurrencies quickly appeared on the radar of regulators around the globe who realized that a massive amount of unchecked and unregulated value was moving between borders with ease. The common problem cited by regulators was that poor KYC and AML processes made cryptos unsafe and that they were too commonly used for criminal activity.

Despite the animosity between regulators and crypto exchanges, the crypto industry has been taking steps to become more legitimate in appearance, even back in 2018 when CoinBase received an e-money license from the Financial Conduct Authority, the financial regulator of the United Kingdom. The exchange has also received licensing in the Republic of Ireland.

Central Banks and government authorities are now also taking note of the applicability of digital currencies for countries in the modern-day. The United Kingdom, the United States, and China are all exploring the potential use for a Central Bank Digital Currency (CBDC). These currencies would be pegged to the fiat currency of the country of origin and serve to facilitate the improved transfer of money in a similar way to cryptos.

Stricter regulation is coming to the crypto industry and it may be the thing that pushes cryptocurrencies into the mainstream.

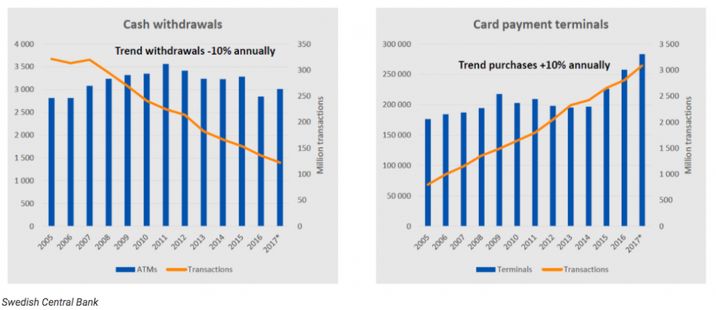

Crypto Will Benefit From The Shift To a Cashless Society

The modern world was already making headway in its transition to a cashless society, even before COVID-19. You could walk into a store and say with almost absolute certainty that you will be able to pay using a debit/credit card or some other form of digital payment. This has only accelerated during the COVID-19 pandemic, with many stores either refusing cash payments altogether or gently encouraging digital forms of payment.

Research has shown that we may actually see the first truly cashless society by 2023, according to a report by A.T Kearney. Cryptocurrencies will be at the forefront of a cashless society as they allow for the rapid transfer of money across borders in times that are much quicker than would be possible with traditional financial instruments. In addition, there will be no remittance costs and the cost of transferring money will greatly decrease.

If we do reach a cashless society in the new feature, cryptocurrencies will be a major driving factor in the new global financial system. Even if you were to worry about the value of a cryptocurrency dropping severely during a transfer, you would be able to use stablecoins pegged to a stable fiat currency to ensure the money keeps its value.

Conclusion

The crypto industry is moving fast, and in the next few years, bigger businesses are likely to follow the example of PayPal by integrating cryptocurrencies into their vending process and banks will also likely offer crypto functionalities. This will cause the value of cryptocurrencies to skyrocket when this happens.

Furthermore, the increased use of crypto amongst companies like PayPal will promote the use of cryptocurrencies for many more people around the world, allowing them to have access to cryptos when they may not necessarily have the knowledge or the willingness to stalk the internet to find a trading and holding platform that works for them.

Due to the changing investor demographic and future investor projections, many financial advisors are expecting Gen X, millennials, and Gen Z to take a more active interest in investing in cryptocurrencies than their older contemporaries. This has caused more financial advisors to begin learning about the crypto industry and take it seriously.

Cryptocurrency exchanges were previously seen as lawless businesses, however, to try and save the reputation of cryptocurrencies and exchanges, many larger exchanges have been trying to cooperate with regulators by seeking licenses and registrations to help their operations be seen as more legitimate. Governments are also seeing the potential of digital assets by researching CBDCs.

Finally, the eventual shift to a cashless society will accelerate the drive and growth of cryptocurrencies by providing people with a quicker, less expensive, and more private method of sending money both within borders and across borders. Crypto has the potential to turn the money transfer industry completely on its head.