COVID Impacts Crypto Market - New Trends To Keep An Eye On

The crypto market has been affected massively by the ongoing COVID-19 outbreak, as has every other form of asset class. Bitcoin trading has suffered a large dip on LocalBitcoins with a 37% decrease, with £537,318,670 traded between March 2019-June 2019 and only £337,300,758 traded in the same period during 2020.

This may seem like a bleak thing for the industry as a whole, however, there have also been some promising signs coming out of the cryptocurrency market too.

A report from the Head of Research for CoinShares highlighted the fact that Bitcoin has been performing better in the wake of the pandemic than many other assets, including gold - between March 12th (Black Thursday) and August.

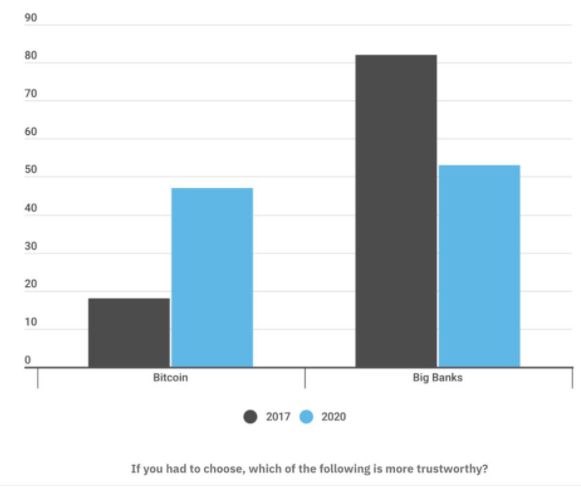

Furthermore, individuals’ trust in financial institutions has greatly diminished in the previous decade, whereas trust in cryptocurrencies over banks has actually been nicely increasing over the previous three years. The increase between 2017 and 2020 was highlighted at 29%. The ongoing problems of the COVID-19 pandemic and the resulting economic meltdowns have accelerated the process of banks losing and cryptos gaining trust.

On an organizational level, there have been several instances this year of organizations turning to cryptocurrencies in response to the COVID-19 pandemic. Unicef has invested 125 ether (approx, $28,500) in eight different companies that can assist with the global challenges brought by a coronavirus. Additionally, on March 12th the Italian Red Cross established a bitcoin-fundraiser to create a medical facility for coronavirus patients.

New Trends To Keep An Eye On

The impact of COVID-19 has assisted in the creation of new trends in the cryptocurrency market; with many of these trends being positive in the direction of cryptocurrencies being seen as legitimate.

Transitioning To A Cashless Society

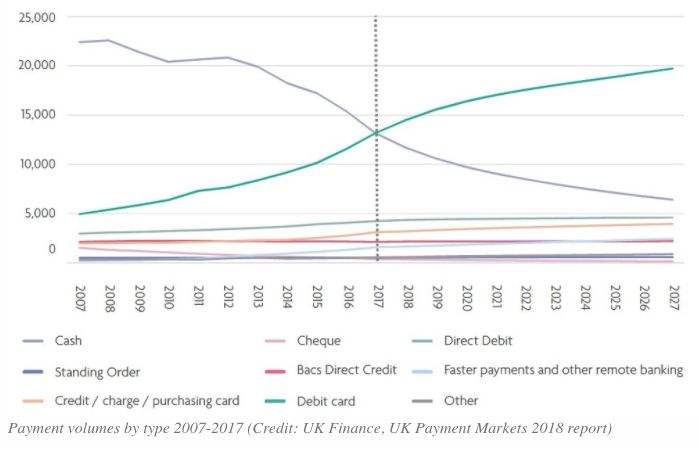

In modern society, the reality of moving to a cashless society was already being entertained before COVID-19, however, it was the outbreak that has accelerated the process of moving towards a cashless society; of course, paying with a card is safer than paying in cash.

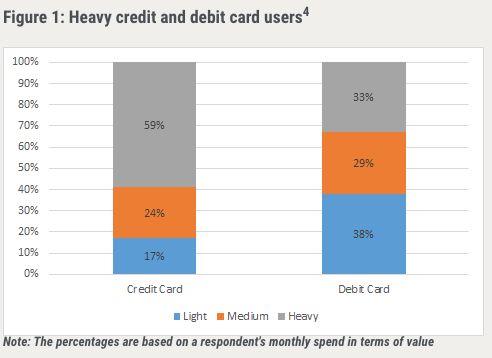

Canada is an example of a country that is rapidly approaching being cashless, with 90% of Canadians owning a credit and debit card.

Also, in the United Kingdom, cash withdrawals have been down 40% from the year before, showing a rapid change towards a cashless society, and card transactions had risen by more than three quarters in April 2020.

The benefits of cryptocurrencies are being more effectively explored in this transitioning cashless society as both individuals and institutions alike are increasingly using cryptocurrency wallets and most cryptocurrency apps will be simple enough whereby a customer can buy digital assets using their credit card.

Crypto is Entering The Mainstream

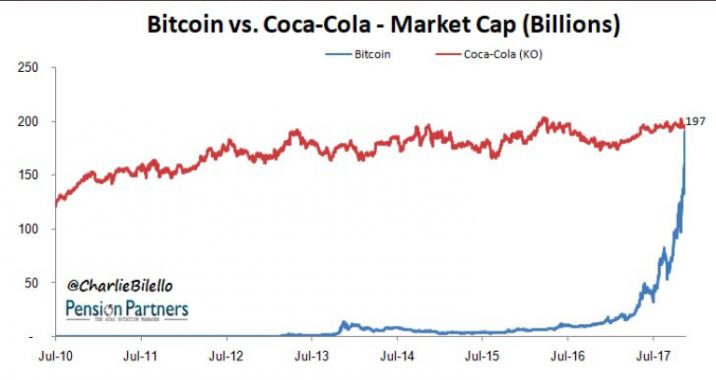

Cryptocurrency has previously had a reputation as a slightly underground, geeky endeavor; with few actually taking it and its applications seriously. This reputation has been changing rapidly, with Bitcoin and Ether no longer being considered a bubble. The market capitalization of Bitcoin has now eclipsed that of both Coca-Cola and Intel.

Furthermore, institutional involvement in cryptocurrencies is increasing as the demand for Bitcoin has increased over the COVID-19 pandemic. As the demand for cryptocurrency increases, mainstream users will need to have convenient interfaces to utilize cryptocurrency and these interfaces are on the way.

Crypto Debit Cards

During the middle of 2020, the Wirecard scandal rocked the Crypto Debit Card arena, after 1.9 Billion Euros went missing from the company accounts and the company soon after filed for insolvency. Later it was discovered the money didn’t exist and former CEO, Markus Braun was arrested on suspicion of market manipulation.

Out of the rubble of the Wirecard scandal, payment giants Visa and Mastercard have decided to jump into the Crypto Debit Card space. Mastercard has expanded their current cryptocurrency program, which should make it easier for crypto companies to issue cards with Mastercard. Visa is also currently planning to bridge the gap between merchants and cryptocurrencies. Finally, Binance has announced that their payment card will be available in the next year.

The race to dominate the Crypto Debit Card space has begun.

Blockchain Is Seeing Increasing Real Use Cases

In the fight against COVID-19, blockchain technology has seen increasing utilization by massive organizations around the globe; providing use cases for the technology, leading to it being taken more seriously.

A poignant example of this can be found in the World Health Organisation (WHO), which launched a partnership with several tech companies to launch a blockchain platform (MiPasa), which is aimed at facilitating private information sharing between a person, the state and health institutions. This is a great opportunity for blockchain technology to shine on the world stage.

Also, blockchain technology is being implemented into contact tracing to get ahead of potential outbreaks before they start; this project is being led by a professor with Villanova University’s Department of Electrical and Computer Engineering. The project itself works by facilitating private information sharing between medical institutions to keep track of who is infected and allow for contacting the infected.

The Rise of CBDCs’

Previously seen as a prospect that wouldn’t come to fruition any time soon, Central Bank Digital Currencies (CBDCs) are either currently in the works or being fiercely discussed in many countries around the world, China is currently storming ahead with testing for their CBDC, the digital yuan whilst the Federal Reserve in the USA is partnering with MIT to build and test a CBDC.

The rise of CBDCs around the world can have incredible benefits to the countries that adopt them. For instance, technological efficiency can be improved by cutting out the middleman (banks and clearinghouses) and allowing direct payment from Payer to Payee. Also, offering free, safe bank accounts through a central bank can increase competition in the banking sector, which should in theory improve overall performance.

Conclusion

In conclusion, it can be seen that the COVID-19 pandemic had a similar effect on the cryptocurrency market as was seen in other markets; at least initially. Later on, the consequences and problems of the pandemic provided cryptocurrencies with an opportunity to become more popular and for blockchain technology as a whole to become a more popular technological solution.