Do Cryptocurrencies Solve The Issue of Money Transfers? Depends Where You Live

As the world has experienced a technological boom that has changed the way we do the majority of the things in our lives, it is only natural that in this modern era, the way we transfer life’s most useful commodity, money would also change.

Despite this, even now, transferring money between locations can be difficult, especially if you are transferring money between countries. A number of different factors contribute to this, especially lack of technological infrastructure, the remoteness of your location and restrictive legislation and procedures. The rapid rise of cryptocurrencies since the major boom in 2017 has propelled virtual currencies into the limelight as a potential solution to the problems that normally arise as a result of transferring money digitally in our current system. Due to the fact that cryptocurrencies are still in their infancy, there is much debate about the validity of such speculation.

Why Where You Live Matters For Money Transfers

Location plays a huge role in the quality and the costs involved in transferring money between countries.

One of the reasons for this is because money transfer fees vary greatly from provider to provider; in a country where there are a lot of different banks and services to choose from, the customer has the freedom to find the cheapest rates, whereas in less developed areas the choice of provider is going to be much more limited, relegating customers to a select few options that may not be providing them with a good deal.

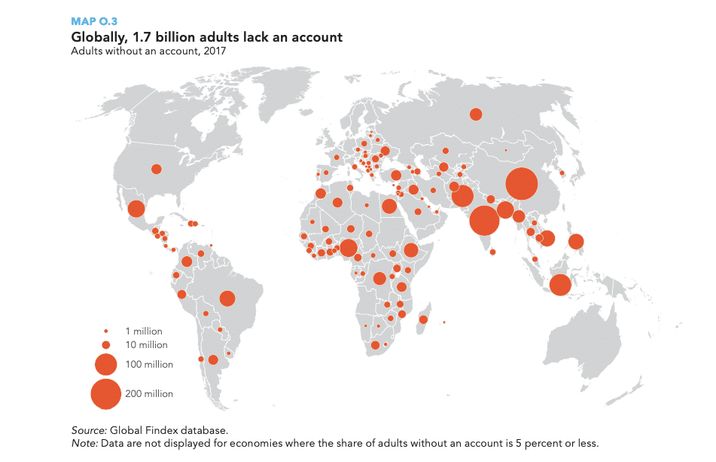

Your location will also have an impact on the convenience of services available to customers. This is because of the fact that in certain countries, a large number of people do not have bank accounts, in fact in Senegal only 181 people have a bank account per thousand.

This means that they will need to physically collect money that has been sent to them. In more remote locations, this can be a major inconvenience to customers due to the travel involved.

Do Cryptocurrencies Aid in Money Transfers?

The main problems that plague the money transfer industry are the regulations, the overwhelming number of “middle-men” and high commission fees. For example, fees have been so prominent that in 2017, migrants had sent $450 Billion back to their home country, with $32 Billion being claimed by providers as transaction fees.

This has severely hampered people’s access to the global financial system, with 40% of people saying that they have no access at all, primarily due to the expenses involved.

One of the ways in which experts suggest cryptocurrencies could improve the money transfer market for customers is by cutting down the costs of transferring money.

The cost of remittance on a cryptocurrency transaction can be either hundreds or thousands of times cheaper for customers, making it easier and more cost-effective for people to transfer money. Despite all of the public support for cryptocurrencies in this aspect, there are still very influential members of the community that believe that the effect of cryptocurrencies on the transfer of money is going to be minimal, at least in the short-term.

One of the main problems touted by experts is that foreign exchange rates will be incredibly volatile due to the nature of cryptocurrencies, meaning the value of a transaction can fluctuate massively, even whilst it is in progress. This represents the potential for customers to lose money. Furthermore, another issue that is commonly explored is that there are some that believe that the process of transferring money through cryptocurrencies creates friction for the customer, especially in a market such as money transfer where the ease of the customer’s experience is a huge USP.

The issues stem from the process of converting fiat money to cryptocurrencies, transferring to the recipient’s wallet and then converting the funds back into fiat currency.

Is There An Ideal Solution?

For cryptocurrencies to successfully become the driver for global financial change that some experts believe it can be, there are a number of issues that businesses will need to find solutions to.

One possible solution to the problem of erratic cryptocurrency values reducing the value of a transaction would be to send the money through the form of stablecoins. There are still some concerns over stablecoins that de-value beyond their pegging, although this is not nearly as pronounced as it is in regular cryptocurrencies. The issue of improving the general ease of the user experience is a more complex matter. Solving this problem would require a lot of leg-work and collaboration between customers and coin providers.

To make the process as quick and easy as possible would require some form of infrastructure which would allow for the automatic conversion and deposit of cryptocurrencies into fiat currency.

Even if this was brought into practice, the benefit would not be entirely clear in LEDCs whereby many people do not have bank accounts. To get around this, a cryptocurrency provider may need to specifically create a service dedicated to allowing customers to exchange their cryptocurrencies for fiat currency in branches across the world, which is a very unlikely prospect. As it stands, nobody has found the winning combination to fully integrate cryptocurrency into money transfer services, however, with the infantile nature of the market, you may be pleasantly surprised to see businesses and customers break the barriers in coming years.