Inactive Bank Accounts Are Bigger Than You Think

Given the prevalence of bank accounts in the modern world, and the necessity of having one in first world countries, it would be easy to assume that there are only a small number of people on the planet without a bank account. This assertion would be incorrect, in fact, a large number of people do not have a bank account at all. Considering the huge buzz centered around cryptocurrencies, it is also surprising to see that there are a large number of inactive accounts within the cryptocurrency space.

Inactive Bank Accounts

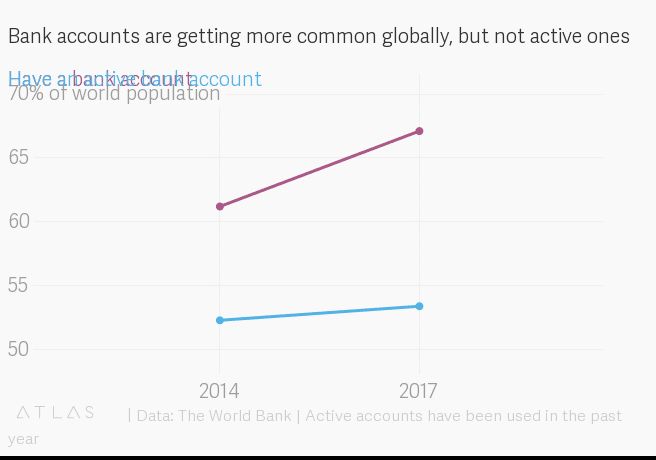

In 2018, the World Bank released information pertaining to the current climate for global financial inclusion. The provided figures give an unprecedented look into the subject. The data from the World Bank showed that despite the fact that 67% of the world’s population had a bank account in 2017, up from 61% in 2014, growth may be slower than we think. Of the increase in that three year period, 80% of those new accounts are currently inactive. Meaning that they have had no ingoing or outgoing transactions for over a year.

When you only apply active accounts to the percentages, the share of people with a bank account increased from 52% to 53%, which is a much smaller improvement. The survey from the World Bank included answers from 150,000 participants.

The number of inactive accounts is of concern to financial institutions because if a user doesn’t consistently utilize their account, they will not be able to attain the benefits that the account provides, furthermore, those accounts also provide minuscule value to the issuers of the accounts. Only inactive accounts with large balances will be able to generate value for the bank and the customer.

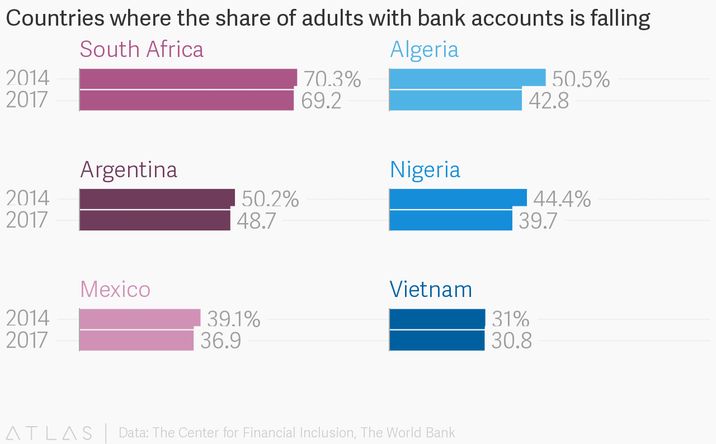

Out of all of the different countries surveyed, it was found that the countries with the largest populations, China and India were also the countries with the most financially excluded people. The survey also gave the participants the opportunity to explain their reasons for not having a bank account. The figures show that the main reasons for exclusion are a lack of access to money, the cost of using the services, access to services and a lack of trust in financial institutions.With the World Bank only having one more year left until the deadline for their Universal Finance Access by 2020, they will need to think about the realistic deadline for UFA and how the steps they are going to take to achieve this goal. The World Bank has pledged to aid the inclusion of 1 Billion people, Visa, Mastercard, and GSMA have pledged a collective 1.5 Billion people, along with other institutions also making pledges.

Inactive Crypto Accounts

It is obviously going to take a lot longer for cryptocurrencies to see universal use across the world than it is for bank accounts, however, that does not mean that cryptocurrencies are doing badly with the accounts that they have now.

In fact, Bloomberg, using information gained by market research firm Flipside Crypto has stated that an unprecedented number of previously inactive Bitcoin wallets have become active again. Delving further into the figures shows that the number of Bitcoin wallets that have been inactive for a period of 1-6 months had dropped by 40% between March and April 2019. This caused a surge in the price of Bitcoin at the time and was indicative of people warming up to the idea of buying Bitcoin again.

One of the biggest concerns with inactive cryptocurrency accounts within the market is those of large cryptocurrency Whales. These are individuals with huge cryptocurrency holdings, with the transfer of said holdings being able to directly influence the market price of Bitcoin. For example, there are currently concerns about a dormant Bitcoin Whale, holding 80,000 Bitcoins. This is worth over $700 Million and if this Whale decides to cash in on their holdings, it could cause a market crash, according to analysts at Whale Alert.

People in the market are valid in their concerns about previously inactive Whales, as it was found in December 2018 that $1.5 Billion worth of Bitcoin was transferred from previously dormant cryptocurrency wallets, with a concerning number of these transactions being from the top-20 Bitcoin wallets. For example, one such wallet has been dormant since 2013 and moved over 60,000 Bitcoin, worth $245 Million to an unknown address. The concerns stem from the fact that Whales are also known to crash the market price after selling, so they can purchase more cryptocurrencies at a lower price, holding until they can flood the market again.

In fact, the top 3 cryptocurrency wallets that have been dormant for 5 or more years have a collective total of over 150,000 Bitcoins, which is a mind-boggling amount. Outside of the top three, there are a number of users with holdings of over 10,000 Bitcoins. This is a large amount of value stored within inactive wallets.

One of the biggest questions that normally surrounds these inactive wallets is the reason for the wallet being inactive in the first place. Due to the high level of anonymity behind cryptocurrencies, we rarely ever learn the reasons for this inactivity, although the most commonly given reasons are, the loss of private keys, the incapacitation of the wallet holder, the holder is continuing to hold for a future sale, or the owner forgot about their holdings.

Only time will tell as to whether or not these dormant accounts will “wake up” in the future and sell their holdings, although the marketplace is aware of the potential consequences of such an event occurring.

Feature Photo by AJ Colores on Unsplash