Is Bitcoin Dead? No.

By AJ Nelson, @ajnelsonco is an independent contractor for Coin.Space Wallet

Bitcoin has "died" 93 times since it's inception, according to mass media outlets. You can see all of the times here. You've read "Bitcoin is dead" over and over again in every major media outlet around the world. Why did Bitcoin fail a few weeks ago? One of the one-hundred core developers left the project. One of the so-called "top" developers of Bitcoin. Yes, you're reading that correctly. One developer out of one-hundred, who had the 92nd most activity out of the 100 Bitcoin core developers on Github. No disrespect to Mike Hearn, he was great, but in all reality he committed (a commit is the making of a set of tentative changes permanent in a codebase, in other words getting your work published) 3 times. The top developer of Bitcoin has made 1,205 commits. Mike left in a tirade and made the price dip ~15% while grabbing headlines everywhere.

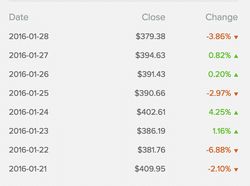

The good news, the price has rebounded, hovering around the ~$400 price in the last few weeks as shown below.

I'm relatively new to the Bitcoin universe. I bought my first Bitcoin back in 2012, was busy running a company and didn't have all that much time & interest to do the deep dive. As of recently I've taken the time to learn the ins and outs, go to conferences/meetups, and I've come out astonished of how well Bitcoin is doing. The Bitcoin movement has some 10,000 evangelists supporting it. I'm writing this blog post to speak to the mainstream person who has only seen the headlines, "Bitcoin is dead", and haven't heard anything else. I'm writing this to show you why Bitcoin is thriving.

What is Bitcoin?

As defined by Coindesk:

"Bitcoin is a form of digital currency, created and held electronically. No one controls it. Bitcoins aren’t printed, like dollars or euros – they’re produced by people, and increasingly businesses, running computers all around the world, using software that solves mathematical problems. It’s the first example of a growing category of money known as cryptocurrency."

The Size of the Network

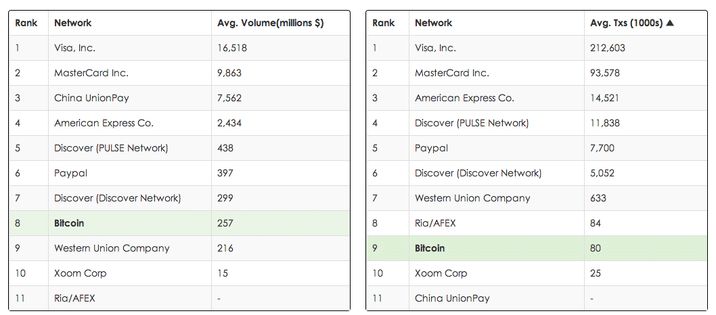

The charts below show two things. First, on the left, it is showing purely the amount of money being moved via Bitcoin in comparison to others. As you can see BTC is currently top 10 in the world (it's only 7 years old). Secondly, on the right, it's breaking down how many average transactions are happening per day compared to other financial networks.

Bitcoin will move more money daily than Discover Credit Cards in 2016. It may even pass the 800-pound gorilla in the room, Paypal. Paypal serves almost 200 million people every year. It should be noted that the above graphs are showing the raw numbers of average daily volume/transactions, and things like moving money from one bitcoin address to another (the same person) could be counted in these figures. You get the point here, the sheer size of Bitcoin is something we must pay attention to.

Are you starting to see the trend here? Bitcoin has moved beyond the 'early adopters', and is moving on to the 'early majority'. Numbers don't lie. When an open sourced, decentralized system enters the top 10 in the world in anything it's time for people to wake up, and start listening.

When's the last time a decentralized system became this large? Ever heard of this thing called the internet?

As Bitcoin's daily transactions, daily volume, and the number of unique users sending money continues to rise, the system gets stronger and stronger. Take a listen to Bitcoin evangelist Andreas Antonopoulos' thoughts on this at 49:50.

"Tell me how someone can take down the Internet?... It's simply not possible...If you understand why you can't take down the Internet, that's why you can't take down Bitcoin. Bitcoin is the internet. It's the internet of money."

Who Endorses Bitcoin?

Some of the smartest people in the world understand what is happening. Ashton Kutcher (early stage tech investor), Bill Gates, Peter Thiel (created Paypal), Marc Andreessen (created the internet's first popular browser Netscape), and many more have endorsed bitcoin as the next biggest revolution in technology. They are not the only ones taking notice. Some large institutions that we use daily are as well.

The Banks Are Scared of Bitcoin

Really smart people aren't the only ones taking notice. The banks are. Yes, the banks. The same banks that got bailed out by the US Government in 2008, the same banks that have been running the world for decades. They are investing tens of millions of dollars right now into trying to mimic bitcoin's technology because to be very forthright, they're scared shitless about Bitcoin.

They have started a consortium or sorts, called R3. R3 is trying to mimic Bitcoin's blockchain technology, the vision is this way they can completely avoid Bitcoin and do it privately themselves. For many different reasons, this doesn't make a lot of sense. It's similar to how large companies introduced 'intranets' (as stated above from Marc Andreessen) instead of adopting the internet, in the beginning, days.

Members of R3:

- J.P. Morgan

- BBVA

- Bank of America

- Morgan Stanley

- Royal Bank of Canada

- Wells Fargo

- Northern Trust

- Commonwealth Bank of Australia

- & many more..... full list here

Why Are the Banks Afraid of Bitcoin?

- It's decentralized (No one owns it, similarly to the internet. It's run and operated by Bitcoin nodes & miners)

- It's incredibly inexpensive to move Bitcoin, literally costs fractions of a penny (No more wire, transfer fees, or paying Western Union)

- It is eliminating online identity theft & fraud (learn more here), making it the most secure money ever created

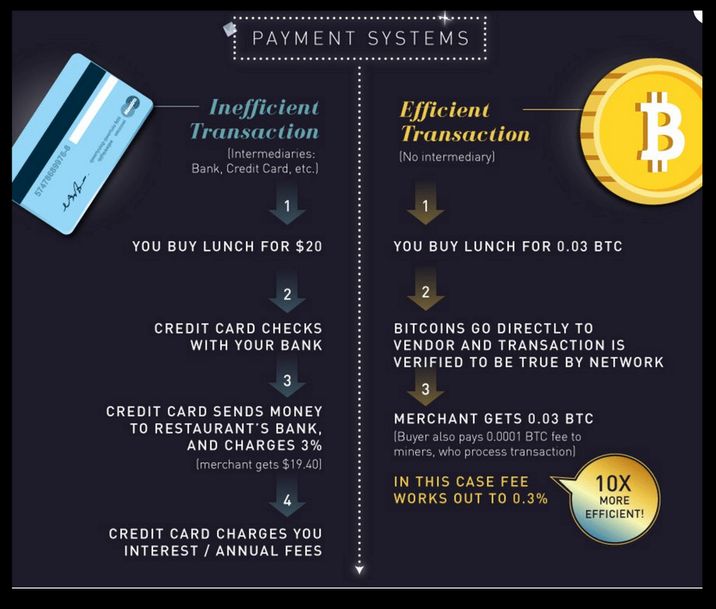

- There are no third parties it has to operate with (how our entire banking system is structured creates inefficiencies, see infographic below)

Now that Bitcoin has the ears of millions around the world, it's time to listen. Bitcoin has the potential to be the biggest innovation since the internet. It is the internet of Money. It can do to "store of value" what internet did to "information". Bitcoin is in its earliest days. How long did it take for the internet to have it's "killer" apps? Decades. Things like search engines, browsers, javascript, https, iOS, Android, Microsoft, Apple, the list goes on, needed to happen before Uber could exist. With Bitcoin, we are before the search engines, before the browsers. It's the group of engineers, libertarians, and eccentric people that are believing in it.

Does Bitcoin have flaws?

Of course. Everything does. The price is unreliably volatile right now. Making it very hard to imagine a merchant using it. There are a lot of companies out there currently solving this problem, who will settle your money in your local currency. Was this supposed to happen? A lot of people say yes. It was Satoshi's (the mysterious founder, or group of founders) vision to bootstrap Bitcoin, and along the way, it would have some growing pains. The more businesses, persons, and computing power Bitcoin has using it, the more Bitcoin's price will level out so the rest of the world will use it.

Is it being used for malicious payments (drugs, porn, terrorists)? To an extent, yes, but no more than other currencies. The $100 & $50 bills remain the most fraudulent pieces of currency that's ever existed, explained here by Bloomberg News.

To make sure I'm being fair and not lopsided, there are a bunch of rebuttals and arguments this article spun up against Bitcoin. The glaringly obvious thing? The good outweighs the bad. A merchant not having to pay 3% credit card fees means that you as a consumer can save that 3%. There are limitless possibilities what this technology can do.

Why Should I Care About Bitcoin? Why would I use it when I can swipe my credit card, and get 5% cash back? You're right. In the developed world, we have it pretty good. Think of a country like the Philippines where 70% of the population doesn't have a bank account. Or in Venezuela how their central bank's currency devalued 69% in one day. For family members from the US to send money home (overseas), they have to use Western Union or MoneyGram and pay high fees. With Bitcoin, they can send it for practically free (less than pennies currently), and it's done instantaneously. Bitcoin's applications will help every financial system in the world, but it seems to be more of immediate help to those who live in developing nations who don't have a sound central financial system. For these people, Bitcoin can increase their standard of living dramatically.

Conclusion

As a concluding point, there is a lot to learn about Bitcoin. It is in my opinion that it will do some great things for this world, but we have a ways to go. Currently Bitcoin is not user friendly, and is not built for any mainstream users yet. There are some companies, founders, and evangelists trying to fix this, but BTC needs more help. You should remember these layers of correct infrastructure take time. Do you remember when the internet first came out? Remember on Good Morning America, when they first talked about it? Watching that video it almost seems unreal that someone could think the internet was a joke.

I would suggest taking this course on Bitcoin (it's free), it does a great job of explaining 80% of Bitcoin for 20% of the effort/time. It's how I got started. There are many things I've left out, hopefully I've peaked your interest in Bitcoin, and given you enough fire to check it out. All you should do after reading this post is simply check Bitcoin out. Go to google, and start reading. Ask your friends what they think about it, maybe even buy some. You can spend it with more things than you think. Find a complete list here. The bottom line is Bitcoin is cheaper to move and store money, and no third party is in charge of it. That's why it's revolutionary.

💸