Is Bitcoin Digital Gold?

When we think of gold, we think of it as one of the oldest assets of humankind. Be that as it may, gold still plays a vital role in today’s economy and has several utilities. But there are new means of payment that look to replace traditional payment methods. Cryptocurrencies are digital currencies that look to approach transactions in a decentralized manner so that additional fees are removed. When we think of such cryptocurrencies, we usually think of Bitcoin, the world’s first and biggest cryptocurrency in the world.

So how do Bitcoin and gold relate exactly? In today’s world, many refer to Bitcoin as digital gold. Many investors and even governments have recently shifted their focus from gold to BTC, using the latter as a safety asset. So is Bitcoin actually a digital version of gold? To answer this question, we need to go through both these assets and understand what they have in common, as well as their differences. Perhaps, you may begin to view Bitcoin differently than you used to, so let’s begin with brief information about gold.

Gold

Gold has been used as a means of payment for a very long time. This ancient asset has been valued highly due to its shiny color, which was then used for aesthetic purposes on jewels, decorations, etc. But as technology advanced, gold had other utilities. First, gold is considered a vital component in a country’s economy. To illustrate, the USD used to base its value on gold. Because of this, the USA strived to have more gold so that they have a better economy.

But gold also has other utilities that can be beneficial for people. Since gold is a metal, it conducts electricity. In fact, gold is a much better conductor of electricity than other metals such as copper, silver, etc. However, due to the limited quantity of gold, not many institutions practice gold in technological aspects. Because of that, gold still remains a determinant of a country’s economy. But why would people give so much value to assets such as gold when other elements can be just as important? This leads us to the paradox of value. Water, for instance, is one of the most essential components of our living, yet it is much less valuable than gold, despite being more important. There are a few reasons why this paradox of value exists.

First of all, we give a higher value to things that are harder to obtain. Mining gold is a very difficult process. Not only that a lot of technological costs are required, but also a lot of miners’ lives are risked. Furthermore, even land can be harmed during the acquisition of gold.

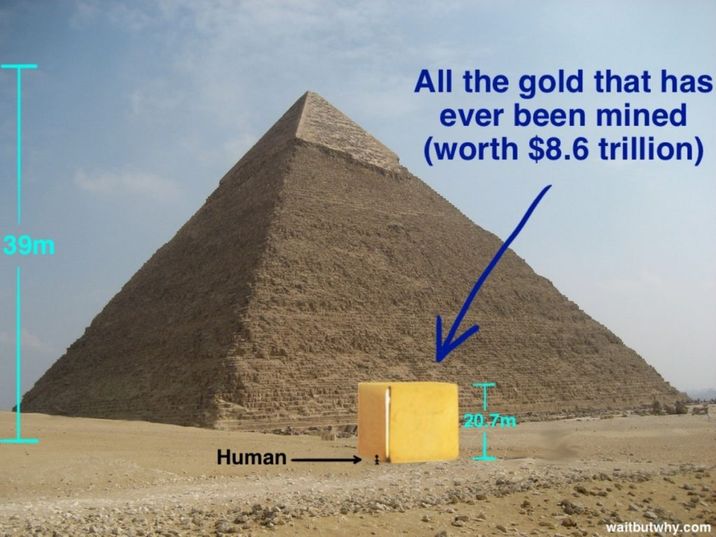

Secondly, gold is much scarcer than water. It is unknown how much gold is left to be mined. According to The Minted, around $8.6 trillion worth of gold has already been mined.

The limited quantity plays a huge role in determining the value of gold. Ultimately, the value of each asset revolves around supply and demand factors. The demand for gold is high because many people want to buy it to make jewelry, governments use it to prevent market inflations, and institutions such as NASA may use it for technological reasons.

Gold is also inversely related to interest rates. If the price of gold is higher, interest rates are usually lower. If the price of gold is lower, then interest rates are usually higher. So gold is the remedy for economic recessions.

Fiat Currencies

If gold was not practical enough to be used as a payment method, then fiat currencies could perhaps provide a solution. Fiat currencies are the contemporary means of exchange. Fiat currencies are manufactured through legal tenders, such as dollar bills, coins, etc. These legal tenders can be used for purchasing practically anything. However, some problems come with fiat currencies.

First and foremost, they are controlled by the government. The government decides the supply, ultimately affecting its value when compared to other fiat currencies. Secondly, legal tenders can easily be counterfeited. There have been numerous cases when people manufactured fake cash, resulting in indirect harm to a country’s economy.

The fact that fiat currencies are controlled by governments makes them centralized. This centralization could mean additional fees when it comes to exchanging them. Centralization also means less control over your money. But there is also a solution to such a problem: cryptocurrencies.

Bitcoin

Bitcoin is the world’s first successful cryptocurrency. The main goal for a cryptocurrency such as Bitcoin is to be decentralized by removing the need for a third party such as banks and governments. How does Bitcoin achieve that?

By using blockchain technology, the Bitcoin network consists of thousands of computer nodes that work together and do not rely on a single entity. These nodes attempt to solve advanced mathematical problems in order to confirm a transaction. If the nodes share a consensus after a transaction is conducted, then the block of information related to the transaction is added to a chain of other blocks, forming the so-called blockchain.

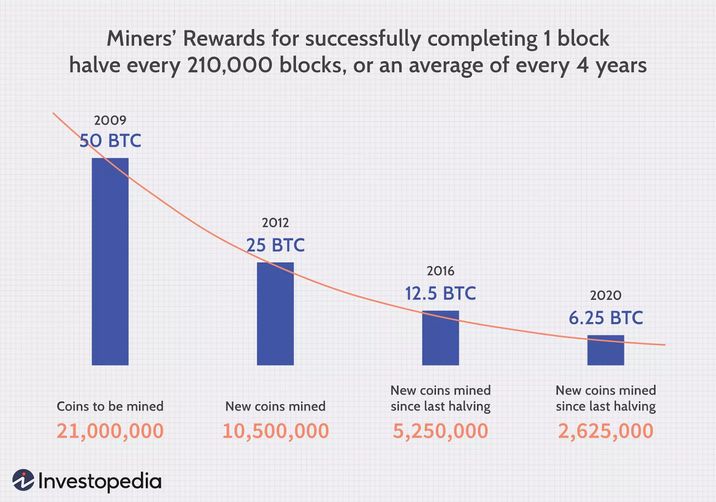

In blockchain technology, the nodes responsible for confirming a transaction are rewarded with additional BTC tokens as a means of reward for the technological costs involved during the process. This process is known as mining, and the nodes responsible are known as miners. Technically, nodes compete with one another when mining. The more powerful the processing power of a miner, the higher the chance of successfully mining BTC. As the Bitcoin network grows, mining becomes much harder. A block of transactions in the Bitcoin network is confirmed once every 10 minutes. The current block reward is 6.25 BTC. This amount is halved approximately every four years. In 2024, the mining reward is planned to be 3.125 BTC.

The halving process is done to avoid prince inflations. Currently, Bitcoin has a circulating supply of 18.7 million BTC and a limited supply of 21 million BTC. The full supply is expected to be reached in the year 2140.

Bitcoin and Gold: Where Do They Stand?

Similarities

The increased mining difficulty, as well as the limited supply, make Bitcoin similar to gold in some aspects. Moreover, similar to gold, BTC cannot be counterfeited. Blockchain technology entails that hackers need to control 51% of the network if they want to manipulate the data in the blockchain. While that may seem possible, it is technically unachievable because it would be insanely expensive.

In terms of price, both gold and Bitcoin are highly affected by external factors such as government decisions, values of fiat currencies, accessibility, etc.

If a government bans cryptocurrencies, it can adversely affect the price of BTC. The same can be said if the government takes a negative stance on gold. This is directly related to the accessibility factor. People of some countries do not have access to Bitcoin and other cryptocurrencies because the latter are banned. To illustrate, Bolivia, Denmark, Turkey, India, and many more countries no longer support the idea of cryptocurrencies. But some countries have bought Bitcoin as a means of improving their economy. For instance, the Bulgarian government holds more than 200,000 BTC. An increase in the price of BTC can highly favour the state of Bulgaria. If BTC reaches a price of $100,000, the Bulgarian government can have at least $20,000,000,000 worth of Bitcoin.

Liquidity is yet another factor that makes the two quite alike. Both gold and Bitcoin have liquidity, and they are efficient in terms of exchange.

Last but not least, both gold and Bitcoin have been linked to environmental problems. Understandably, mining gold requires destroying some of the world’s natural habitats. Moreover, natural resources (i.e. water) can be contaminated during the mining process. Let’s not forget that human lives are also at risk. It is this mining difficulty that gives gold more value.

Bitcoin, on the other hand, is a Proof-of-Work cryptocurrency, meaning that the computational power of the node determines the mining reward probability. Since the nodes compete with one another when mining, a lot of energy is wasted. This high energy usage is becoming a problem to the world, as miners leave carbon footprints that are potentially harmful to the environment. To fix this issue, a lot of miners are looking at ways of shifting to renewable energy.

But there are some major differences between gold and Bitcoin.

Differences

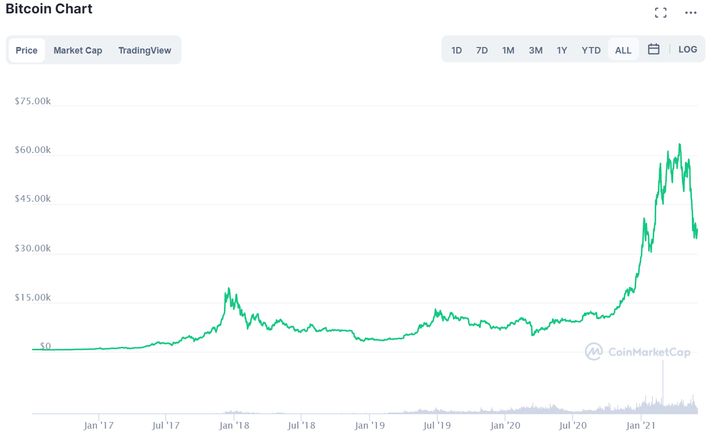

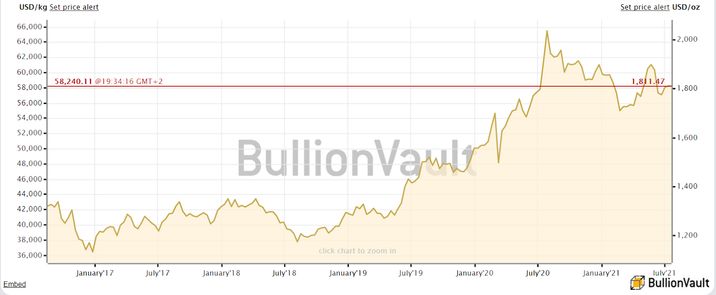

Volatility is the biggest difference that Bitcoin and gold have. The price of BTC can change in a matter of minutes, and that change can be drastic. Gold, however, is more stable when compared to gold.

In the last five years, the price of BTC may have changed by more than 10,000%, while gold has not even doubled its value in five years.

Another difference that the two have is security. The only ways that you are vulnerable from having your BTC tokens stolen is if the hacker gets a hold of your private keys, or if the hacker manages to control 51% of the network. The latter is technically impossible in a large network such as Bitcoin. Stealing your private keys would be possible only if you do not store them in safe crypto wallets. Cold (hardware) wallets are offline wallets that can ensure the required safety since they do not make your address vulnerable to online attacks.

Gold, on the other hand, is physical. It can be stolen, especially since it is usually controlled by central authorities. There have been many cases where gold has been stolen. Nevertheless, such cases are rare, and gold still remains very secure.

Lastly, transparency is another factor where the two differ. Bitcoin transactions are anonymous; only wallet addresses are accessible to the public, but no one can know the person behind an address. This anonymity is what made Bitcoin stand out from other payment methods.

Gold, however, is usually recorded when it is used for transactions. Both Bitcoin and gold can be tracked, but Bitcoin addresses remain anonymous while gold does not provide the same.

What Experts Think On The Issue

Anthony Pompliano - Pomp Investments and founder of Morgan Creek Digital

"Bitcoin is a 100x improvement over gold as a store of value. The world is realizing this and beginning to reprice digital currency in real-time. Although bitcoin has increased hundreds of percent in the last few months, it is likely to continue appreciating in US dollar terms over the coming years. I suspect that bitcoin's market cap will surpass gold's market cap by 2030. For this reason, I own no gold and have a material percent of my net worth invested in bitcoin."

Michael Saylor - Co-founder of MicroStrategy

“Bitcoin is digital gold, and it’s sitting on the world’s first digital monetary network. That network does the job of gold a million times better than gold. You can move it at the speed of light, you can program it a million times a second. And it’s been appreciating versus the US dollar more than 200 percent a year on average for a decade, so I think, at this point, Bitcoin has emerged as the institutional safe-haven asset.”

JP Thierot - CEO of UpHold

"Gold is, no pun intended, the standard if you want to measure purchasing power over millennia. The liquidity of gold has been consistent over time. Gold is what defines the X-axis of purchasing power over time. Bitcoin, while it shares defensive qualities with gold, has the additional attribute of being aspirational. What bitcoin would seem to possess is the potential to go up to multiples of a moonshot. No one thinks gold will moonshot. Bitcoin is also finite, unlike gold. No increase in demand can change that. There is zero elasticity."

WillyWoo - On-chain analyst

Pavel Matveev - CEO of Wirex

"The crypto bull run has seized the attention of millions of people who previously had never considered digital currencies like Bitcoin to be an alternative asset. While gold and bitcoin are both sometimes used as a means to diversify and hold a range of valuable assets, in many ways they are quite different. Bitcoin and other digital currencies can be easily traded on platforms. We have seen progressive global firms offering to receive payment in bitcoin and advocates such as Tesla taking an active role in promoting it. This liquidity, ease of exchange, and wider use in the modern economy are some of the major differentiators. Gold has a relatively defensive purpose- to hold value, whereas Bitcoin and other currencies are intended to have several uses, not least ease of exchange, purchase, and liquidity."

Conclusion

Whether Bitcoin is digital gold depends on how you view it. Nonetheless, most people are gradually shifting from gold to BTC, as the latter has proved to be quite efficient and safe. Moreover, this is only the beginning of cryptocurrencies. Bitcoin can easily go to the moon despite already being the biggest cryptocurrency in the market.