NFTs - The Future of Virtual Land Ownership and Gaming

NFTs (Non-Fungible Tokens) have been the hottest topic in the cryptocurrency world over the last few months. NFT projects like the CryptoPunks are selling for all time high prices.

Artists like beeple have become figure heads of the new crypto art world and it's not surprising there is so much buzz in the ecosystem when you see eye watering prices being achieved for NFT artwork. The CryptoPunk#3100 sold for a record breaking $7.6million on the 11th of March.

This article examines some of the more obscure use cases of NFTs that have not had the same exposure and press coverage as digital art.

What are NFTs?

Some background on NFTs: An NFT is a Non-Fungible Token. This essentially means that this token is unique and cannot be replaced with something else. For example, a dollar or a bitcoin is fungible. It can be traded or swapped for another dollar or bitcoin and you will have the exact same thing. This is not possible with an NFT as the NFT is unique. You cannot trade one cryptopunk with another and end up with the same cryptopunk.

The real genius in NFTs lies in the fact that digital ownership is now verifiable on the blockchain. You can prove that you own a particular asset online. Most NFTs are built on the ethereum blockchain and this is why you often see NFT prices quoted in ETH and not BTC or USD.

Can’t you just take a screenshot of the NFT artwork?

I hear this argument against the utility of NFTs a lot! NFTs are more about ownership than anything else. You can go to the Louvre in Paris and take a picture of the Mona Lisa and hang it in your room … but this doesn't mean you ## own the Mona Lisa. If the Mona Lisa sold you wouldn't get any royalties or commission. The same concept applies to digital artwork via NFTs.

What is virtual land ownership?

The concept of ownership becomes more pronounced when examining NFT projects beyond the digital art world.

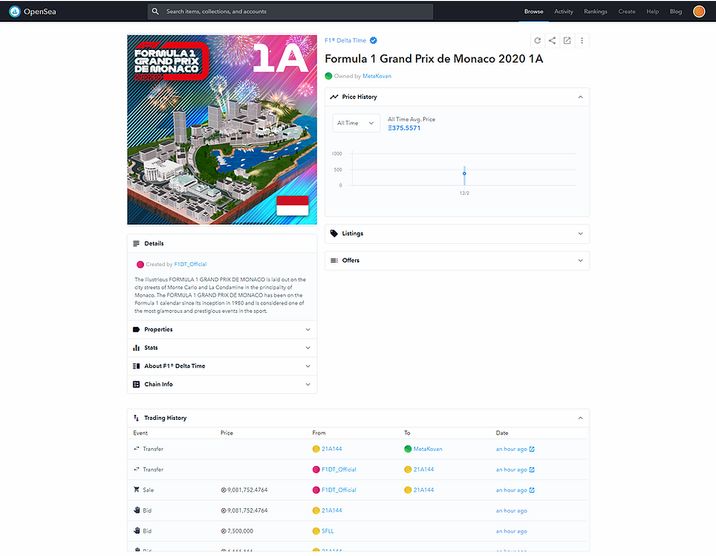

Virtual worlds are popping up where the users can purchase and monetize virtual land and real estate. An interesting example of this is the game F1 delta time. The Formula One racing game allows users to purchase digital race tracks. Owners of these digital tracks can earn dividends from activity from other users on the track. This includes entry fees for users and event fees for parties using the track for a virtual race event.

These dividend payments can range from 5% to 25% in some cases depending on the track and the demand of users.

The NFT token representing the ownership of the Formula 1 Grand Prix de Monaco track was auctioned on OpenSea in December 2020 and sold for $220,000.

This may seem like a large amount, however with the recent price increases of virtual artwork and virtual land ownership’s ability to generate income, the virtual land market could be relatively overlooked and undervalued.

Some other examples of platforms that offer the ability to purchase virtual land are Decentraland, Cryptovoxels and The Sandbox.

One argument for the further adoption of virtual ownership through NFTs is Gen Z’s familiarity with virtual worlds. We are all spending an increasing amount of time online whether that be surfing the internet, working or gaming. Owning virtual destinations appears to be the next step in the evolution of our technology.

Virtual Land Ownership Platforms

Decentraland

On Decentraland users can purchase “parcels” of land that are identified using cartesian coordinates (x,y). The parcels are owned by members of the platform and are purchased using the native Decentraland currency, MANA. The owner of each parcel has full control over the environment and the application they create. These apps can range from 3D scenes to more interactive applications or games.

Decentraland has seen more than $50 million in total sales to date. This includes avatars, usernames, wearables and land. A virtual plot of land sold on the platform in April 2021 for $572,000. A new record for the platform.

Decentraland has also hosted virtual events such as fashion exhibitions with Adidas.

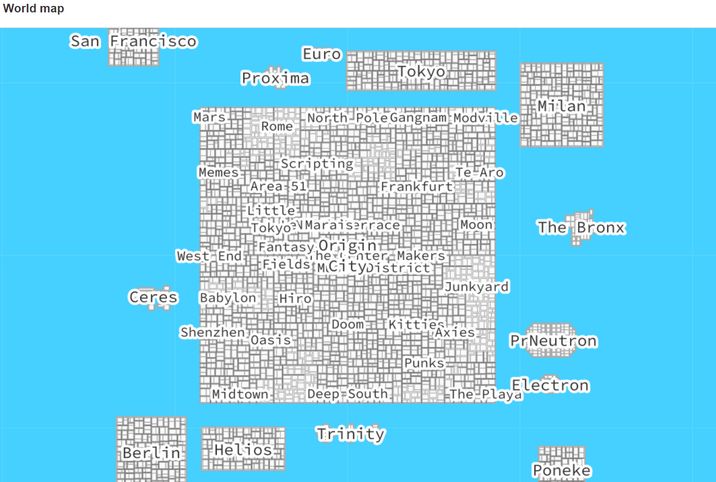

CryptoVoxels

CrytpoVoxels is personally my favourite digital land platform. It allows users to design their own virtual world. It is powered by the Ethereum blockchain. Users can buy land and build stores, art galleries or destinations for other users. You can create your own unique virtual avatar and interact with other users in this virtual world.

Many users link their opensea marketplace accounts and build virtual galleries for their digital art work.

CryptoVoxels is an easy to use platform with an integration with metamask which allows for excellent user experience.

Below is the “World Map” of the CryptoVoxels world:

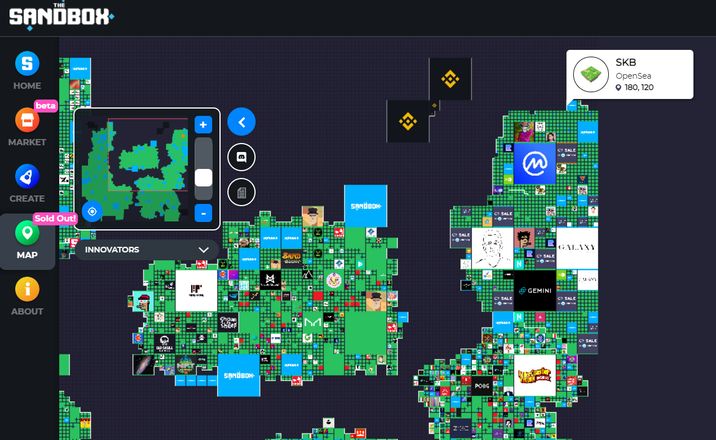

The Sandbox

The Sandbox also allows users to purchase “parcels” of land. The current map is sold out and land can only now be purchased on the secondary market. A lot of well known brands and companies within the crypto space have purchased large “chunks” of virtual land presumably to advertise their brand and potentially as an investment.

The Sandbox has a number of products in Beta and in the process of launching these soon. These future releases include a number of virtual games and a marketplace to facilitate trading of digital assets.

Future of the NFT space and possible “NFT winter”

With the recent hype surrounding NFTs it is difficult to imagine such a sustained excitement by the wider public for a very prolonged period. This brings in the possibility of an “NFT winter”.

What would an NFT winter look like and ultimately what would happen to the NFT ecosystem as a result? I think the most prominent NFT projects will retain much of their value throughout an NFT winter.

I think the smaller, newer projects that have had price run ups recently will take the brunt of the correction. People view projects like the CryptoPunks and the Crypto Kitties as internet history. This will help these NFTs retain much of their current day values.

In terms of the impact of the NFT winter on the virtual ownership and gaming ecosystems, I believe there would be a very muted realised impact on prices. This is primarily due to people using the platforms for gaming and the owners of the virtual land collecting dividends and income from their NFTs. This income will keep the price of virtual land within these platforms buoyant and therefore places virtual land in a much more resilient position if or when an NFT winter begins.

Summary

In conclusion, the NFT space remains new and exciting. I think sometimes the mainstream media are too focused on digital artwork and do not realise there are many projects utilising the full utility of NFTs in terms of verifiable digital ownership of assets.

If you are planning on buying some NFTs, virtual land ownership may be an interesting investment for the long term. I would suggest siding with the platforms and projects with a well established user base and advanced technology.