Are People Afraid To Use Crypto Wallets? History Has Taught Us Banks Are Riskier

There is no doubt that cryptocurrencies are here to stay, and they hold a promising future. However, conventional investors are still afraid of using crypto wallets because of the risk that interplays with this emerging market and the underlying technology.

While it’s true that cryptocurrencies and crypto wallets will always be attractive scammers and fraudsters, especially if you hodl or transact large amounts, history has taught us banks are riskier.

In this article, we will delve into some of the reasons why crypto wallets and cryptocurrencies are risky and why traditional banks are riskier. Let’s dig in.

Risks of using crypto wallets

Note that there are two types of crypto wallets in existence. They include hot wallets and cold wallets. Each comes with its own risks. Therefore, none guarantees the total safety of your crypto coins.

The major difference between the two crypto wallets is that hot wallets are connected to the internet, and cold wallets are not.

When using hot wallets like online/web wallets, mobile wallets, and desktop wallets, some of the risks involved include;

- High possibility of hacking attempts and scams

- High possibility of downloading viruses

Because hot wallets rely on the internet, they are usually exposed to internet risks.

Worst Crypto hacks

Mt. Gox Hack

Mt. Gox was once the biggest Bitcoin exchange in the world. Launched in 2010 and based in Shibuya Tokyo Japan, the exchange faced a series of undercover attacks between 2011 and 2014. The attacks cost the exchange and private users close to 850,000BTC, which was worth around $460 million back then. As of 2019, the stolen Bitcoin would be worth $6.12 billion.

NiceHash Hack

NiceHash, a Slovenian Bitcoin mining platform, was attacked by hackers in 2017 who stole 4,700 BTC, which amounted to about $64 million at the time.

BitStamp Hack

Bitstamp is another Slovenian Bitcoin exchange startup that was founded way back in 2011 as an alternative to Mt. Gox. However, just like Mt.Gox, the exchange was hacked in 2015 by anonymous hackers who made away with 19,000BTCS worth $5 million at the time.

On the other hand, some of the risks involved when using cold wallets like Trezor, Ledger, CoolWallet, and Keepkey include:

- Possibility of the hardware device getting damaged, lost or stolen

- Imperfect implementation of the hardware device could allow hackers to gain access to your crypto coins

- The compromised production or shipping process of the hardware device could result in loopholes that hackers might use to gain unauthorized access to personal information.

Risks of using cryptocurrencies

Although cryptocurrencies have the full backing of blockchain, which offers impeccable security levels, they are not without risks. Some of the risks involved when using cryptocurrencies include;

Instability of value: The high volatile nature of cryptocurrencies makes them quite unstable. Their value keeps changing out of the blue, making them a highly risky investment venture.

Transaction errors: It is highly possible to send crypto coins to the wrong wallet, especially if you are not keen on what you are doing. The wrong transaction details mean you could lose thousands in a single transaction without any recourse.

Theft and scams: The crypto space has, for the longest time, been highly unregulated. This means the market is susceptible to lots of fraudulent activities. And because transactions rely on the internet, hacking attempts are not uncommon.

Compliance risks: Not all countries in the world have openly welcomed the use of cryptocurrencies.

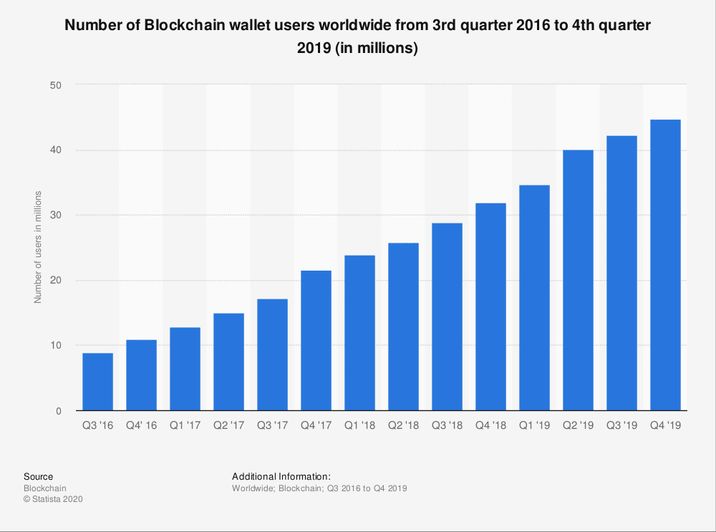

As you can see, cryptocurrencies and crypto wallets have several risks that make people shy away from them. Nonetheless millions of people use crypto wallets and cryptocurrencies as can be seen in the graph below.

However, compared to traditional banking, which is riskier?

Risks of using traditional banks

One of the major risks of using traditional banks is exposure to illegal activities. For the longest time, traditional banks have faced a lot of criticism because of many illegal activities like fraud, scams, and money laundering, which has left many people penniless.

Examples of Scams by Big banks

Wells Fargo Fake-Account Scandal

In September 2016, the federal bank regulators revealed that Wells Fargo employees had secretly created millions of fraudulent savings and checking accounts on behalf of customers without their consent. The bank was hit with a $185 million fine.

As of January 2020, John Stumpf the former CEO of Wells Fargo has been banned for life from banking and ordered to pay a $17.5 million fine for his involvement in the scandal.

Australian Banks fee-for-no-service scandal

In Australia, four of the nation’s largest banks, Commonwealth Bank of Australia (CBA), Westpac Banking Corp (WBC), Australian and New Zealand Banking Group (ANZ) and National Australia Bank (NAB), have been accused of improperly collecting fees for services they never provided. The banks would have to return as much as AUS$ 1 billion as well as face criminal charges for their behavior.

Gold and Silver Price fixing

In 2016 Deutsche bank agreed to pay $60 million to settle the US gold price-fixing case. The German bank also paid $38 million to settle similar litigation over alleged silver price manipulation.

However, the bank was not the only one to be sued by investors. Other banks to be sued by investors included Barclays Plc, Bank of Nova Scotia, HSBC Holdings Plc and Societe Generale.

Besides the risk of illegal activities, traditional banks also come with market risks that can be financially detrimental. Banks like Lehman Brothers and Washington Mutual went bankrupt because of wrong financial strategies.

Evidently, one of the main reasons why traditional banks are riskier when compared to crypto wallets and cryptocurrencies is the human factor.

Most of the illegal dealings that have plagued traditional banks are due to the manipulation of documents and data, which with blockchain’s immutability capability, is highly impossible.

With cryptocurrencies and crypto wallets, individuals also get benefit from transparency that promotes credibility. It is quite hard for anyone to mess with any financial transaction without anyone knowing. There is also automation that reduces much involvement of people in the transaction processes.

Other benefits that come with crypto wallets and cryptocurrencies include trustless transactions that eliminate intermediary vulnerabilities and decentralization that eliminates a single point of failure.

Final word

It is no secret that new technology always faces some opposition before it is accepted. The same applies to cryptocurrencies and crypto-wallets. However, when compared to traditional banks, crypto wallets and cryptocurrencies offer a safer option of transaction.

The elimination of third party reliance and introduction of automation makes the digital coins a safe bet for financial transactions and crypto wallets a safe storage option. If the case of Wells Fargo is anything to go by, then manual financial systems and institutions leave a lot to be desired.