Warren Buffet and Charlie Munger - Not the biggest crypto fans..

Warren Buffet and Charlie Munger are best known for being the brains behind Berkshire Hathaway. Berkshire is a publicly listed conglomerate holding company that has consistently produced outsized returns relative to the market indexes over the last few decades.

Buffett and Munger are undeniably some of the best, most well respected investors in history. They have led Berkshire Hathaway to an annual average return of 20% compared to the SnP500’s annual average return of 10%.

In their recent annual meeting both Buffett and Munger were damning in their condemnation of Bitcoin and cryptocurrencies.

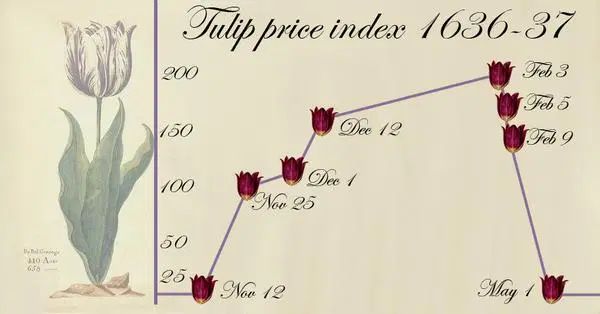

When asked about Bitcoin Buffet was initially reluctant to express his views at risk of “Annoying the Bitcoin community” however he later loosened up and referred to Bitcoin as a modern day “Tulips bulb” in reference to the first recorded bubble in Amsterdam in 1636.

The Tulip mania saw the price of Tulip Bulbs 10x in the course of 8 months and at their peak they cost the same as a small house in amsterdam.

Previously Buffet had called Bitcoin “rat poison” and a “delusion”. So safe to say he is not the biggest crypto fan.

Similarly Charlie Munger did not hold back with his criticism of Bitcoin and cryptocurrencies. He said “I think the whole damn development is disgusting and contrary to the interests of civilization”.

He also said that he hates bitcoin’s recent gain arguing that the currency was “created out of thin air” and is the number one “go to payment for criminals”.

So are they right?

It is hard to argue with Buffett and Munger given their excellent investment track record in the stock market over the course of their lives. They are undeniably some of the greatest investors and thinkers in finance and investment history. However, I think they have missed the point of cryptocurrencies.

When analysing their points and concerns about Bitcoin and cryptocurrency it is helpful to first understand their investment thesis and outlook over the years.

Buffett and Munger are very much value investors. They are the disciples of the great investor Benjamin Graham and they look for undervalued companies that have strong balance sheets and moats, meaning there is a high barrier to entry for competitors.

Berkshire Hathaway holds companies such as Coca Cola, Heinz Kraft and Geico. They have resisted investing in growth stocks throughout the years and focus purely on companies with positive cash flows and strong balance sheets.

The premise of value investing is to assess the intrinsic value of the underlying asset. Buffer and Munger are two of the greatest investors to have used this approach.

However, I feel both Buffett and Munger are using this strategy and framework to evaluate cryptocurrencies. They are both analysing the underlying of Bitcoin as if it were a company. Bitcoin and cryptocurrencies do not behave like companies.

Cryptocurrencies are the building blocks and the framework of a new world wide financial system. They are disrupting the need for centralised parties to validate and verify transactions by replacing them with blockchain technology.

Buffett is quoted as saying cryptocurrencies “basically have no value”. The decentralized nature of crypto gives rise to a new paradigm and hence cannot be analysed or assessed as a traditional stock or company.

Metcalfe’s Law

Bitcoins value comes from its scarcity and network effects. The maximum number of Bitcoin’s in existence will never exceed 21million.

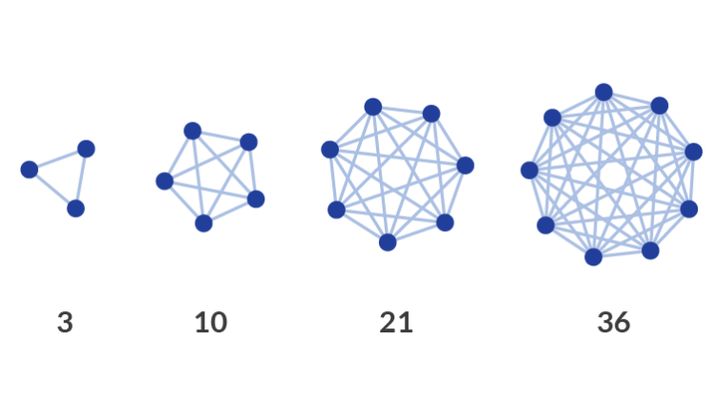

Metcalfe’s law states that the value of the network is proportional to the square of the number of connected users. Bitcoin’s value as a distributed decentralised network increases in value with each new node or connected user.

Bitcoin and other crypto currencies derive their value from their utility and the problems that they solve. This is a point that was not addressed at Berkshire Hathaway’s annual meeting.

Cryptocurrencies aim to make the financial system for all. Due to their decentralized nature they remove the need for centralized third parties. In the past these centralised companies charged incredibly high fees for international money transfers that disproportionately impacted poorer countries and individuals that often availed of remittance payments. Cryptocurrency provides a fairer solution to this issue.

Comparing Bitcoin to the Tulip mania in Amsterdam in 1636 is not a valid comparison. Satoshi Nakamoto’s whitepaper ushered in a new age of monetary history whereby the individual has full autonomy and does not need the permission of a third party to transact value. The utility enabled by cryptocurrencies benefits all the participants in the system. The same cannot be said for the Tulip Mania. Tulip Mania was fuelled by greed however the cryptocurrency revolution is fuelled by promise and potential.

Bitcoin and criminality

It has long been an argument of Bitcoin detractors that it is a means of facilitating criminal activity. Charlie Munger shares this view, he said that “Bitcoin is a go to payment method for criminals”.

Many studies have been conducted to determine the level of criminal activity using bitcoin. According to ChainAnalysis’s 2021 report, criminal activity represented 2.1% of all the cryptocurrency transactions volume.

Bitcoin transactions are recorded on the blockchain and visible to anyone. Transactions are more transparent on the bitcoin blockchain. The argument that criminals use cryptocurrencies to conduct their illicit activity is a weak one.

The counter argument could be made that criminals use fiat currency for their transactions so we should ban all fiat currency. Bitcoin is not to blame for criminal activity and does not encourage it.

Paradigm Shifts and Value investing

Cryptocurrencies have marked a significant paradigm shift in our financial system and culture. Value investors are not particularly interested in new innovative technology as they are more concerned with the cash flows of a business today. That is a perfectly reasonable strategy.

It comes as no surprise then that two of the most well known value investors are not interested in crypto currencies. The invention of Bitcoin marks a landmark moment in our technological advancement as a society and its true potential may not be fully realized until after it has transformed our society.

Similar to the internet in the early 2000’s a lot of people recognised that it was a major advancement and opportunity however the true potential in terms of the many Billion dollar companies that were created is only apparent in hindsight.

The value of cryptocurrencies in terms of the benefits they have provided for all in this new financial system is still evolving and in its infancy.

Conclusion

In summary Buffett and Munger will never invest in or buy cryptocurrency, and that is fine. They are value investors by trade and one would not expect them to embrace a new technology such as the blockchain. Throughout their investing careers they have avoided investing in new innovation and have favoured investing in well established companies.

Both the cryptocurrency community and Buffett can be correct. Buffet may continue to provide outsized returns in the stock market as a value investor and cryptocurrency can still become a major distributor in our financial system and society. They are not mutually exclusive.

The benefits of crypto will become ever more apparent over the next few years, similar to how the internet evolved over the last two decades, and it will provide value and autonomy to individuals across the globe.