What is PancakeSwap? - Everything You Want to Know About CAKE

Anyone with the slightest interest in cryptocurrencies has been fascinated by the food-based farming craze for months now. Many platforms and networks have emerged as a result of the latest wave of DeFi protocols that enable users to stake their funds in exchange for the protocol’s tokens, including PancakeSwap.

The Ethereum network has taken hold over the majority of this operation. With its large groups of users, developers, and frameworks, it has gained the ability to create powerful decentralized apps. This is all because of its title for being one of the first blockchains to support smart contracts.

In this article, we will take a look at PancakeSwap, a decentralized exchange based on Binance Smart Chain (BSC). What is PancakeSwap? How does PancakeSwap work? Where is it headed in the near future and more?

What is PancakeSwap (CAKE)?

PancakeSwap is a decentralized exchange (DEX) and automatic market maker (AMM) which operates on behalf of the Binance Smart Chain. It allows traders and investors to exchange BEP-20 tokens quickly and safely. Users will share, add liquidity, farm, stake, yield, and win CAKE tokens in a lottery using Pancake Swap's native token, CAKE.

The platform, like Uniswap, has a shared trading experience for liquidity pools. PancakeSwap is the most famous DApp on the Binance Smart Chain, and many cryptocurrency pundits are convinced that it has untapped potential.

The Binance Smart Chain was first launched on the market in September 2020 as a fourth-generation blockchain in order to work alongside the Binance Chain. At this point in time, the Binance Smart Chain is far more evolved and developed than its predecessor chain. Now, the app can help with purchases that are both faster and cheaper. With its new speed, the network is able to produce a block every 3 seconds.

PancakeSwap works with an automated market maker, or otherwise known as an AMM. This allows a user to trade against a liquidity pool rather than being matched with another user through an order book. These pools are large sums of money gathered by many buyers. In return for liquidity suppliers, or LP tokens, they bring them into a tank. They can also make use of these tokens so that they can reclaim their share as well as a portion of the transaction fees.

PancakeSwap is becoming super popular because it solves a lot of the problems that have up until now plagued the industry. All thanks to its innovative approach and commitment to security, PancakeSwap has developed itself as a viable alternative to Uniswap, the present DEX and DeFi leader.

How PancakeSwap (CAKE) Works?

PancakeSwap works via an automated market maker (AMM). In this case, there’s no order book that is used to align buyers and sellers. Instead, the network makes use of dynamic algorithms and liquidity pools to link these parties directly. AMMs are beneficial because they offer higher speeds, faster processing, and less slippage. As a result, many of today’s most popular websites, such as Uniswap and SushiSwap, are AMMs.

PancakeSwap Liquidity Pools

Users may provide their funds, otherwise referred to as liquidity, to pools in exchange for liquidity provider (LP) tokens. The value of each individual token increases in tandem with the pool's average value. People will profit directly from these permissionless liquidity pools without having to actually trade their investments. On PancakeSwap, you can stake in over 69 separate liquidity pools. Users receive yields in which the prizes are paid out in CAKE, the platform's native token.

Syrup Pools

With SYRUP pools, PancakeSwap also adds several exclusive pools to the picture. There are liquidity pools in which some pay out incredibly well. The APY on some of these pools ranges from 43.33 percent to 275.12 percent. The benefit is that when you stake in SYRUP pools, you can also win other tokens besides CAKE. In UST, LINA, SWINGBY, and other games, users can receive additional prizes.

LP Tokens

As mentioned earlier, users receive LP tokens in exchange for providing liquidity, through simply participating. Through LP tokens, a portion of the trading fees provided by the platform is redistributed to these users specifically. 0.17 percent of the average 0.2 percent fee is immediately redistributed to LP token owners.

PancakeSwap DEX

PancakeSwap is best known for its simple DEX system (decentralized exchange). The DEX was designed solely from the ground up to provide new users access to all of the features and tools they need to easily exchange tokens. Tokens can be traded in a matter of 3 seconds. On top of that, there is also a wide variety of tokens to choose from.

PancakeSwap Yield Farm

Along with PancakeSwap comes yield farming pools. Yield farming and staking are quite similar in the sense that you lend your crypto to different projects using smart contracts in exchange for rewards. The key difference, however, is that farming protocols normally do not have any lockup times as opposed to staking.

PancakeSwap Staking

Users can freely and easily opt to win more tokens by staking their tokens on PancakeSwap explicitly on the site. Staking is a safer choice than trading for those new to the crypto market because it doesn’t require as much effort. When staking, you don't need to track various sites or master advanced trading strategies. It simply works by depositing your cryptocurrency into a staking pool for a set period of time, and letting the app take care of the rest. The quantity you stake and the length of time you stake determine your incentives.

PancakeSwap (CAKE) Price History

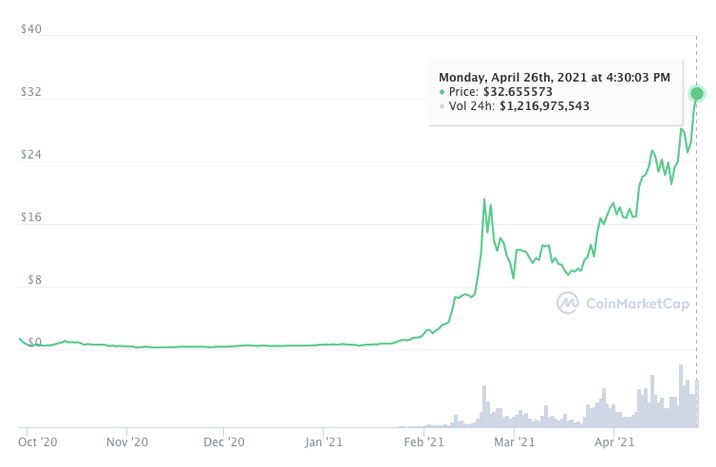

PancakeSwap has yet to keep an ICO for its native currency CAKE, owing to the token's youth according to CryptoCoinSociety. Pancake Swap started its crypto journey on September 29th, 2020. Since it is still in its early stages, there is no observational data on its price. The coin began with a trade volume of $1.37, according to Coinmarketcap. The token had dropped to $0.47 in just a few days but had managed to hold on to $1.09 until mid-October that year. Then followed a short bear run, where the currency suddenly plunged to $0.22 in early November. Following that, the price gradually increased and changed over the year, eventually reaching $0.58 at the end of 2020.

Pancake Swap's market capitalization rose by about $3.6 billion after the start of 2021. CAKE rates spiked to $19.5 on February 19th, 2021. It has grown by over 1,500% since the beginning of the year.

According to Coinmarketcap, CAKE hit a fresh all-time high of $34.84 on April 26th. With a market cap of $5.3 billion and a cumulative stock of 161,806,221 CAKE tokens in circulation, the coin is ranked #28 on the market.

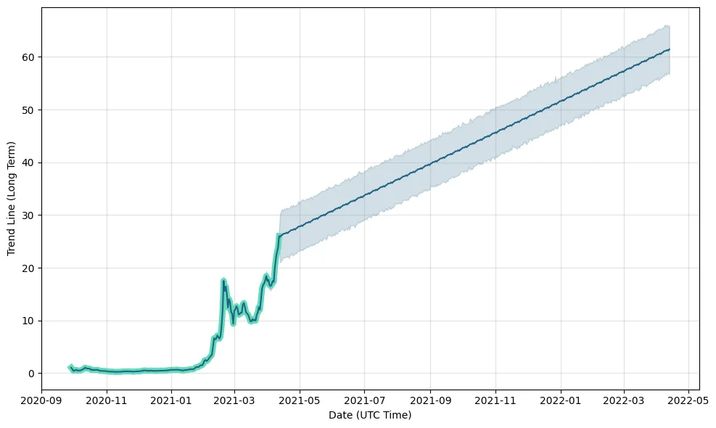

CAKE is trading at $32.87 at the time of writing. What is that number going to look like in future’s time though? Many analysts have published their future price predictions for PancakeSwap. Let's take a look at where CAKE may be headed in a few years.

What is the Future Of PancakeSwap (CAKE)?

PancakeSwap is still in its early stages. This makes all of us wonder where it’s headed and whether or not it will succeed as a leader in DeFi. However, PancakeSwap, like every other DeFi protocol, has its own set of risks and upbringings. Let’s take a look.

Binance Smart Chain is catching the hearts of both CeFi and DeFi users because of its reliability and protection. Pancake Swap brings all of the benefits of Uniswap to Binance Smart Chain without the fees. DeFi protocols are now taking the lead in terms of what factors differentiate various cryptocurrencies. They are bringing in loads of profit, but almost half of these sites are less than two years old. Binance Smart Chain is a cutting-edge DeFi network that has spawned a slew of exciting projects, including PancakeSwap.

PancakeSwap is continuously attempting to tackle many of the persistent problems when it comes to decentralization. If Ethereum's scalability and high gas fees problems aren’t figured out soon, we should foresee an increase in demand for PancakeSwap, which could be bullish for CAKE as well. The DEX now has access to a massive trading network as well as a scalable, high-throughput platform with low fees putting them at the forefront of DeFi technology. Additionally, if CAKE's price increases in lockstep with its volume as time goes on, the company's stock could very much rocket to new heights.

PancakeSwap (CAKE) Price Predictions

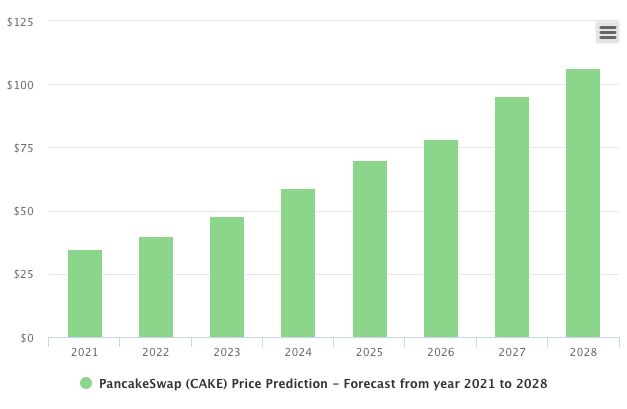

CAKE's price started off at $0.61 at the beginning of 2021. The coin then continued to climb as the bulls regained dominance. The price is predicted to increase this year because it is dependent on Binance, the world's largest exchange, among many others. According to Coinpedia, if it works hard to boost the website, it could reach a high price of $60. By the end of this year, the token is estimated to be worth $80.

WalletInvestor, on the other hand, predicted an average price of $51 for CAKE by the end of 2021. Similarly, according to DigitalCoinPrice, Pancake Swap's average price by the end of 2021 may be $28.37. In March, FXStreet expected a Pancake Swap (CAKE) price of $21.70, and CAKE was trading about $12 at the time, with resistance at the $13 mark.

Although a brief glance at various technical assessments can suggest that CAKE has a bearish future, it's important to remember that price forecasts are confined to various technical variables. Furthermore, there is a scarcity of technological evidence on which to construct a stable basis in the first place.

Strong fundamentals are an important aspect of organic cryptocurrency growth, and Pancake Swap's network has a ton of ability to add more to would-be DeFi, but taking these figures at face value is challenging. Some may argue that it requires more time to mature due to its newness on the market. Perhaps it will be better to wait until 2022-2025 to see what happens with prices.

According to Coinpedia, Pancake Swap could have a fun bull run in 2022. The price is likely to increase as CAKE introduces new liquidity pools and draws more players. By the end of 2022, the token's exchange value could hit $150. CAKE is also projected to be a much-needed open exchange in the next five years as DeFi expands. It may be particularly adept at capturing the interest of investors and traders. By strengthening the website, it has the ability to leapfrog other exchanges. CAKE's price is expected to be $280 in 2025, according to Coinpedia.

Without a doubt, decentralized banking will be the manner in which the general public uses financial services in the future. It's just a matter of time before the future arrives, and how much of a role Pancake Swap can take. Their expectations are lofty, but in an increasingly competitive environment, a firm foundation is needed.

Conclusion

Each and every day, PancakeSwap (CAKE) is playing a bigger part in the DeFi industry. More and more users are becoming interested in learning about different DeFi startups that use various technologies and innovations. PancakeSwap is fulfilling users’ aspirations for the DeFi space by giving them a wider community of new experiences, unique incentives, and improved overall results in collaboration with Binance.

It’s not difficult to see why it’s become so popular when you consider all of the functionality and benefits of using PancakeSwap. The network is extremely open and compliant with the majority of ERC-20 projects that are currently in development. The BNB token is also used to pay transaction costs, which are relatively low as opposed to the Ethereum-based DeFi protocols. With Ethereum's increasing costs and congestion continuously plaguing the industry, it's only natural that PancakeSwap will continue to rise in popularity in the near future.