5 Best PERP Decentralized Crypto Exchanges (DEXs) in 2026

Yet in the United States, perpetual futures occupy a regulatory gray area: unlike standard futures contracts regulated by the Commodity Futures Trading Commission (CFTC), most perp products have historically been offered offshore or through platforms that avoid clear U.S. oversight, because the absence of expiration and funding-rate mechanics doesn’t fit neatly into existing rules.

Still, traders continue to flock to these markets because perps combine 24/7 access, deep liquidity, and high leverage — often far more capital-efficient than spot DEXs or CEX monotonic order books — allowing participants to hedge, speculate, or arbitrage with precision.

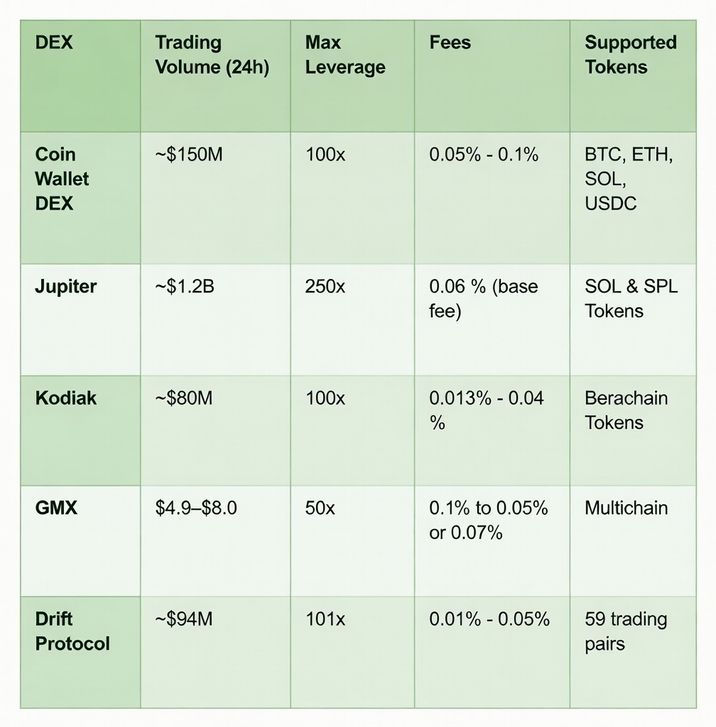

The crypto market is enormous and rich in different exchanges. We decided to choose five PERP DEXs and analyze them to understand which one is more comfortable and profitable.

Read more: Perpetual DEX Crypto Explained: Best Platforms for Low Fees and High Leverage

List of Top PERP Decentralized Exchanges

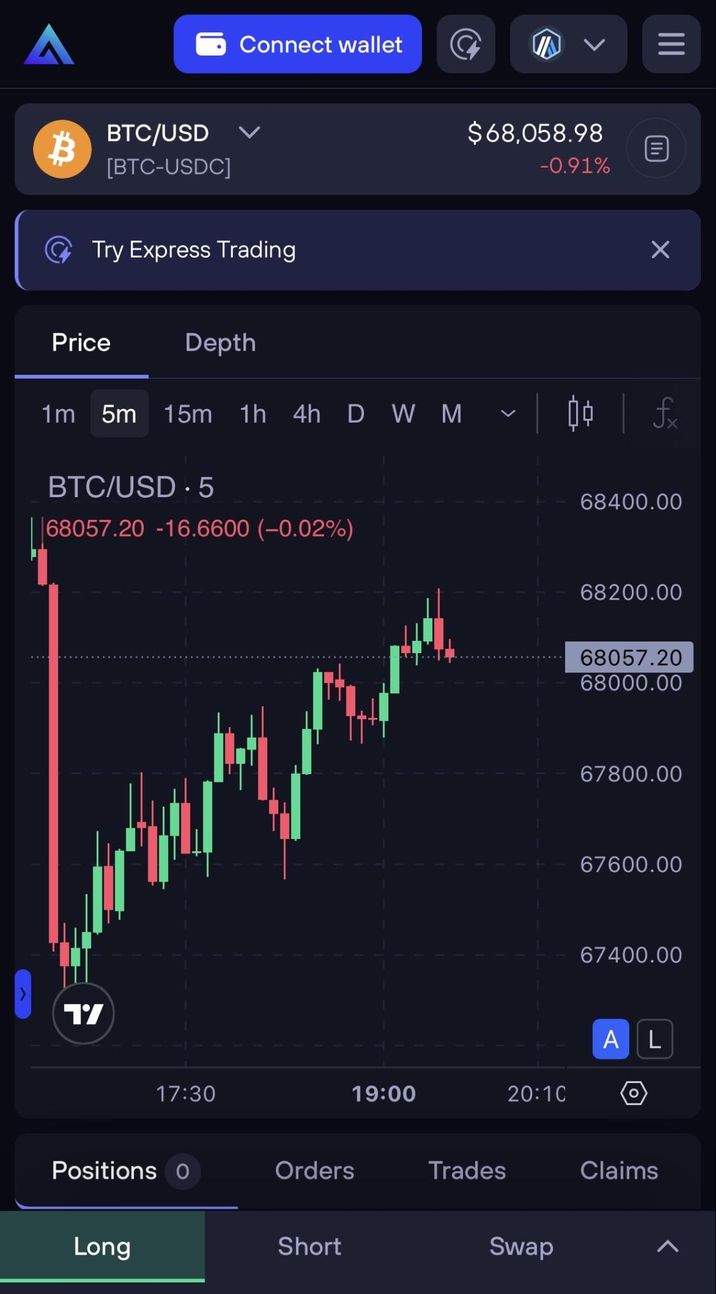

Coin Wallet DEX: Best for Perpetual Futures

Coin Wallet DEX established itself in 2025 as a powerhouse in decentralized derivatives. It utilizes a hybrid model in which order matching is highly efficient. This means that it uses an order book and on-chain settlements — that is, it is similar to a centralized exchange in terms of mechanics but offers the advantages of decentralization: transactions and settlements are carried out through smart contracts.

Pros

✅ Full self-custody of funds.

✅ Seamless integration with the Coin Wallet app and other self-custody wallets.

✅ High leverage options for major pairs (BTC/USD, ETH/USD).

Cons

❌ Fewer trading pairs than aggregators like Jupiter.

❌ Newer liquidity pools than those of established giants.

Highlights:

- No mandatory KYC.

- No recorded hacks or smart contract exploits since launch.

- Trading Fees: Taker: 0.05%; Maker: 0%.

- Leverage: Up to 100x.

- Security Rating: High (audited self-custodial architecture).

Read more: How to Trade on DEX: Coin Wallet's Tutorial

Jupiter: The Solana Liquidity King

Jupiter is the most advanced liquidity aggregator on Solana. It doesn't just offer its own perp DEX; it "scouts" the entire network to find the best price. In 2026, its JLP (Jupiter Liquidity Pool) remains a top choice for those seeking yield or leverage.

Pros

✅ Best-in-class user experience (UX) and interface.

✅ Massive liquidity due to aggregation.

✅ Limit orders and DCA (Dollar Cost Averaging) tools included.

Cons

❌ Reliant on Solana network uptime.

❌ Perpetual trading is limited to a few core assets.

Highlights:

- No KYC required.

- High resilience; no smart contract hacks, although Solana network congestion can occasionally impact speed.

- Trading Fees: Exchange fees vary; the base fee is 0.06%.

- Leverage: Up to 250x.

- CoinGecko Trust Score: 10/10.

Kodiak: Berachain’s Liquidity Powerhouse

Kodiak combines both types of trading — it is not only a spot exchange but also a perpetuals platform, integrating both into a single DeFi DEX.

It is uniquely integrated with the chain’s Proof of Liquidity system, meaning that by trading or providing liquidity on Kodiak, users help secure the entire blockchain.

Berachain is an EVM-compatible Layer 1 blockchain known for its Proof of Liquidity (PoL) model. Unlike traditional Proof of Stake systems, validators are incentivized to provide liquidity to DeFi protocols.

Pros

✅ "Set-and-forget" liquidity management (Kodiak Islands).

✅ Built on a Proof-of-Liquidity consensus mechanism, optimizing yields.

✅ User-friendly mobile interface.

Cons

❌ The Berachain ecosystem is distinct and requires bridging of assets.

❌ Niche focus compared to general-purpose DEXs.

Highlights:

- No KYC.

- Clean track record; heavily audited prior to the Berachain mainnet launch.

- Trading Fees: Maker ~0.013%; Taker fee ~0.04%.

- Leverage: Up to ~100x.

- Security: Audited by top firms (Panda Factory, Bault, Meta-Aggregator, Fungible, etc.).

GMX: Multichain PERPs on Arbitrum and Avalanche

GMX doesn’t have an order book. Instead, GMX uses a liquidity pool called GM Pools.

GMX routes every order through GM Pools and quotes the oracle index price rather than relying on an order book or external market makers. To ensure accurate pricing without wicks, GMX uses Chainlink Data Stream oracles so that liquidations occur only at fair market prices.

In this case, the main risk is as follows: If the market trends for an extended period and traders make money en masse, the GLP pool may incur losses. Accordingly, LPs bear the risk relative to professional traders.

Pros

✅ No order book, as trading occurs through the GLP liquidity pool.

✅ Low slippage due to oracle prices and aggregated quotes.

✅ The opportunity to earn as an LP through GLP.

✅ Fully on-chain — less censorship, greater user autonomy.

Cons

❌ Limited list of assets.

❌ Smart contract risk (potential bugs or exploits).

❌ Risk for LPs: if traders are systematically profitable, the pool incurs losses.

❌ High risk of liquidation due to leveraged trading.

❌ Fewer order types and instruments compared to centralized exchanges.

Highlights:

- No KYC.

- The GMX V1 exploit occurred in July 2025, when a vulnerability in the smart contracts was exploited, allowing a hacker to withdraw approximately $42 million from the GLP pool.

- Trading Fees: Open and close fees range from the previous 0.1% to 0.05% or 0.07%, with differentiated rates depending on whether the position helps balance long and short exposure.

- Leverage: Up to ~50x.

- Security: An active bug bounty program on Immunefi.

Drift Protocol: Solana's Premier Trading Hub

Drift Protocol is built on the Solana blockchain. All operations are executed through smart contracts and users’ self-custodial wallets, without any centralized intermediary. In the crypto community, Drift is widely known as one of the largest PERP DEXs on Solana, with deep liquidity and high trading volume.

Pros

✅ All trades and settlements are executed on-chain via smart contracts.

✅ Thanks to Solana, trading fees are much lower than those on many Ethereum-based protocols.

✅ Suitable for algorithmic traders, as it offers SDKs and APIs for automation.

Cons

❌ Optimized specifically for Solana and reliant on its high throughput and low latency.

❌ Relies on Pyth and other oracles for price feeds — incorrect data can lead to erroneous liquidations or losses.

❌ Drift liquidity is provided through an AMM hybrid model, which may be less efficient than traditional order books during periods of high volatility.

Highlights:

- No KYC.

- No widely known hacks, but there are risks related to smart contract interactions.

- Trading Fees: Maker ~0.01%; Taker ~0.05%.

- Leverage: Up to ~20x–~101x on major markets.

- CoinGecko Security Score: ~88%.

Frequently Asked Questions

What are perpetual futures in crypto?

Perpetual futures in crypto are derivative contracts that let traders speculate on the price of a cryptocurrency without owning the asset. Unlike traditional futures, perpetual futures have no expiration date. Traders can hold positions as long as they maintain enough margin. Prices stay close to the spot market through a funding rate mechanism.

What are perpetual futures contracts?

Perpetual futures contracts are crypto derivatives that allow traders to go long or short on digital assets with leverage. These contracts do not expire, which makes them different from standard futures contracts. They use a funding rate system to keep the contract price aligned with the real market price.

What is a perpetual DEX?

A perpetual DEX is a decentralized exchange that offers perpetual futures trading. It runs on blockchain smart contracts and allows users to trade directly from their crypto wallets without a centralized intermediary. Perpetual DEX platforms often provide leverage, on-chain settlement, and no KYC requirements.

What are the risks of perpetual futures?

Perpetual futures trading carries significant risks. These include liquidation risk due to leverage, high market volatility, funding rate costs, and smart contract risks on decentralized platforms. Traders can lose their entire margin if the market moves against their position.

Are perpetual futures illegal in the U.S.?

Perpetual futures are not automatically illegal in the U.S., but they are heavily regulated. Many offshore crypto exchanges restrict access to U.S. users because derivatives trading must comply with the CFTC’s regulations. U.S. traders should always check whether a platform is legally authorized to offer crypto derivatives services.