6 Best Crypto Decentralized Exchanges of 2026 in the USA

The regulatory landscape for decentralized finance (DeFi) in the United States has shifted dramatically between 2025 and 2026. According to recent insights from The Conference Board and legal analysis regarding the SEC's "Dealer" rule, the operating environment for DEXs has tightened significantly. While the introduction of the GENIUS Act in 2025 aimed to provide a framework, it also brought stricter scrutiny. Many platforms are now facing pressure to implement "permissioned pools" or partial KYC protocols to comply with AML standards, narrowing the gap between centralized and decentralized compliance requirements.

Read more: The SEC’s Crypto Task Force: What Does It Really Mean for You?

In light of these changes, the market has evolved. Notably, Coin Wallet launched its own decentralized exchange for perpetual futures in 2025, offering a self-custodial solution that balances compliance with privacy. We regularly analyze the market to ensure our users have the most up-to-date tools. Based on our observations, we have compiled the definitive list of the top decentralized exchanges for 2026.

If you want to get more information about the most popular DEXs, such as Uniswap, Curve Finance, and PancakeSwap, read our material here. In this article, we have compiled some alternative services.

Key Takeaways You Should Know About DEXs

- You must use a self-custodial wallet like Coin Wallet, MetaMask or Rabby to connect to these platforms.

- Most top DEXs don't require identity verification, allowing for private, direct-from-wallet trading.

- On Ethereum-based DEXs, be prepared for high gas fees during congestion, though Layer-2 solutions (Arbitrum, Optimism) offer cheaper alternatives.

- While DEXs don't report directly to the IRS, trades are still taxable events (capital gains/losses) that you are responsible for reporting.

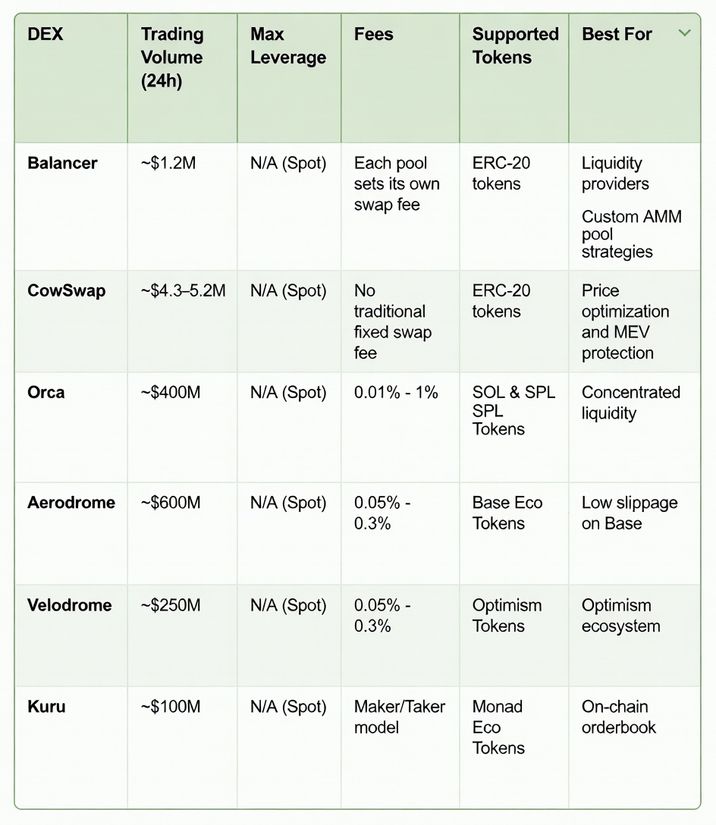

List of Top Decentralized Exchanges

Balancer: Weighted Fees

Balancer is a decentralized finance (DeFi) protocol built on the Ethereum blockchain and other EVM-compatible networks. It combines several key features: a decentralized exchange (DEX), an automated market maker (AMM), and a liquidity/portfolio manager.

The Balancer DEX allows users to swap cryptocurrency tokens directly without a centralized intermediary (meaning it doesn't use traditional order-book exchanges). All trades are executed through smart contracts, making the process automated and trustless.

Unlike many other AMM protocols—such as Uniswap, which typically uses pools of two assets in equal proportions—Balancer allows users to create pools with up to eight tokens. It also lets you set custom weights for each asset, such as a 50/30/20 ratio.

Pros

✅Highly customizable liquidity pools.

✅Asymmetric exposure, improving capital allocation flexibility.

✅Configurable swap fees.

✅Widely used in structured products, DAO treasury management, and index-style pools.

Cons

❌Complexity for retail users—the platform requires deeper DeFi knowledge compared to simpler AMMs like Uniswap.

❌Compared to major DEXs (e.g., Uniswap), Balancer is more LP-focused and less dominant in retail swap volume.

❌Although optimized via Vault architecture, transactions can still be costly during network congestion.

Highlights:

- No KYC.

- Accessible in the U.S.

- A major hack of Balancer v2 occurred on November 3, 2025, when attackers exploited a vulnerability in certain Composable Stable Pools. This resulted in the loss of over $120 million in digital assets across multiple networks, including Ethereum, Base, Arbitrum, and Polygon.

- Trading Fees: Swap fees + protocol fee share (varies by pool).

- Leverage: None.

- DefiSafety review: ~87% PQR.

CowSwap: Coincidence of Wants

The primary goal of the service is to provide users with optimal pricing for asset swaps, minimize slippage losses, and offer protection against MEV (Maximal Extractable Value) attacks, which are common in the DeFi ecosystem.

The name "CoW" stands for Coincidence of Wants. The system tries to match opposing user requests directly (P2P). For example, if one person wants to sell ETH for USDC and another wants to buy ETH with USDC, they swap directly with each other, bypassing liquidity pools. This can result in better prices and lower fees.

Instead of instantly sending a transaction to a standard AMM pool (the way Uniswap does), you sign an "intent" to swap. This is a message stating that you want to exchange one token for another. These intents are collected into batch auctions and processed together.

If a direct match isn't found, the system passes your requests to third parties called solvers. These are network participants who compete for the right to execute the swap optimally by using liquidity from various sources (such as Uniswap, Curve, etc.). The winning solver finds the best execution route for all intents within the batch.

Pros

✅Best prices through optimal trade execution discovery.

✅Protection against MEV attacks (such as front-running and sandwich attacks).

✅Gas fees are often paid directly in the token you are selling; if a transaction fails, you don't have to pay any gas.

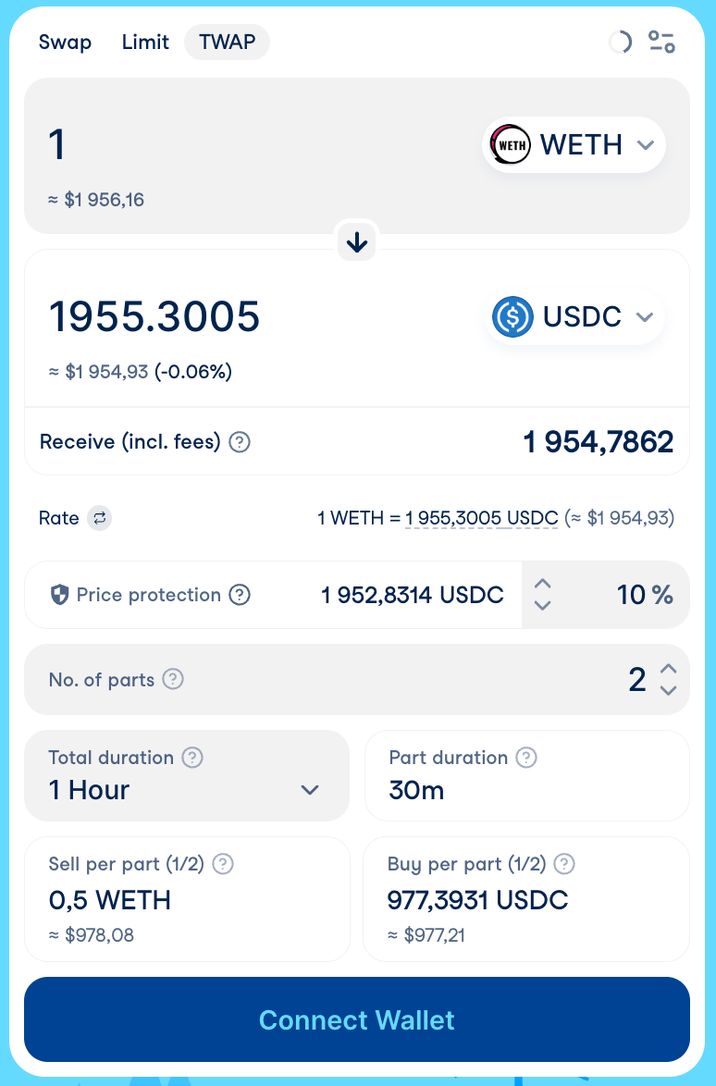

✅In addition to spot swaps, CoW Swap offers limit orders, TWAP (Time-Weighted Average Price) orders, and other flexible trading strategies rarely found on standard AMM DEXs.

Cons

❌Delayed execution due to batch auction model (not instant like AMMs).

❌Orders may be partially filled or not executed at all.

❌Execution depends on solver competition and infrastructure quality.

❌Limited support for illiquid or exotic tokens.

❌Less transparent LP yield mechanics compared to fixed-fee AMMs.

Highlights:

- No KYC.

- Accessible in the U.S.

- Exploited in Feb 2023 (~$166K–$180K), user funds not directly compromised.

- Trading Fees: Variable execution model; not a fixed swap fee.

- Leverage: None.

- CoW Protocol actively participates in bug bounty programs.

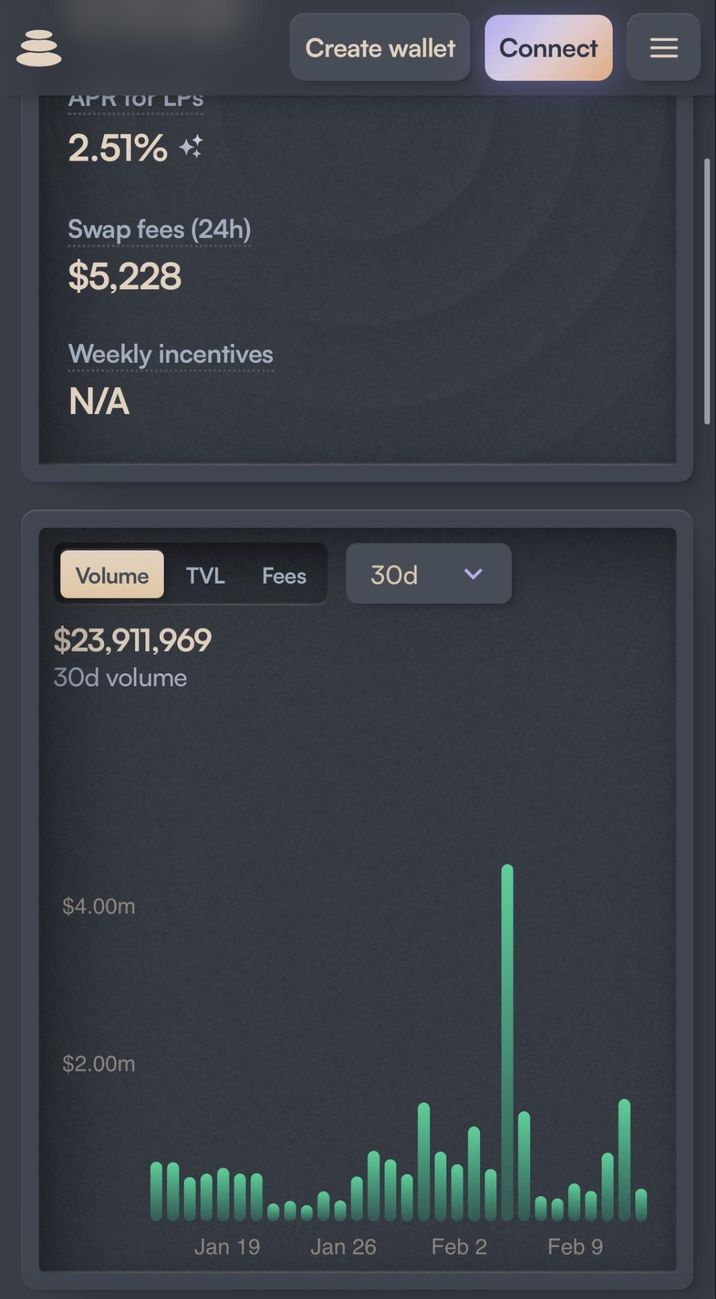

Orca: Pure Efficiency via Whirlpools

Orca is the most user-friendly Automated Market Maker (AMM) on Solana, known for its "Concentrated Liquidity" pools which allow users to use capital more efficiently.

In a traditional DEX (like Uniswap V2), when you provide liquidity, your money is spread across the entire price curve—from $0 to infinity.

Imagine you have a single slice of bread (the market) and a tiny bit of butter (your $1,000). In the old model, you have to spread that butter so thin that it covers the entire slice. If someone takes a bite from the middle (where the actual trading price is), they barely taste any butter.

With Orca Whirlpools, you choose exactly where to put your "butter." You tell the smart contract, for example: "Only use my money if the price of SOL is between $180 and $220."

By concentrating your money into a narrow window around the current price, you achieve Capital Efficiency. You get the same "earning power" as someone who put $10,000 or $20,000 into an old-school pool.

Pros

✅Very low transaction fees due to Solana infrastructure.

✅Near-instant transaction finality (sub-second execution in normal conditions).

✅User-friendly and intuitive interface suitable for beginners.

✅Concentrated Liquidity Model (Whirlpools) improves capital efficiency.

✅Fair Price Indicator helps users assess trade quality before execution.

✅Yield farming and liquidity mining opportunities for LPs.

✅Gas costs significantly lower than Ethereum-based DEXs.

✅Simple swap experience with minimal technical complexity.

Cons

❌Limited strictly to the Solana ecosystem (SPL tokens only).

❌Exposed to Solana network outages or congestion risks.

❌Impermanent loss risk for liquidity providers.

❌Limited advanced trading tools compared to some aggregators.

❌Smart contract risk inherent to DeFi protocols

Highlights:

- No KYC.

- Accessible in the U.S.

- Maintained a clean security record through 2025-2026.Trading Fees: Variable (0.01% for stables, up to 1% for exotic pairs).

- Trading Fees: 0.01% - 1%

- Leverage: None (Spot only).

- CER Security Rating: AA.

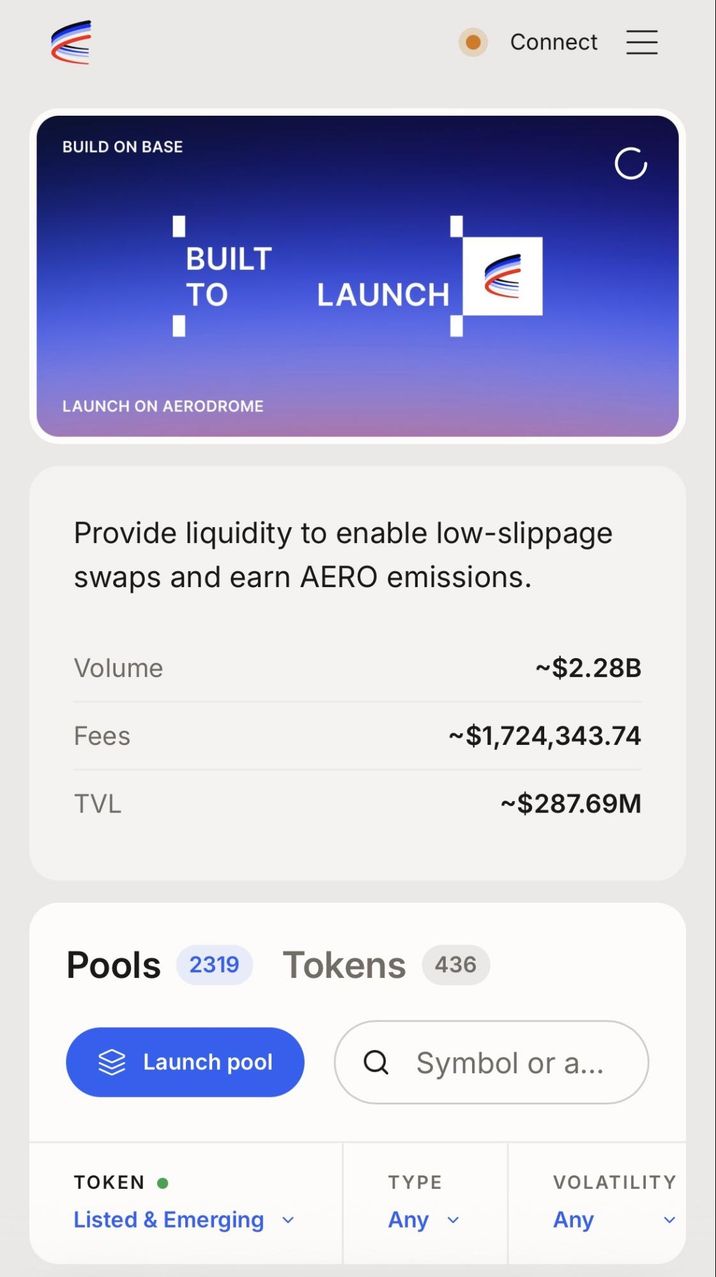

Aerodrome: The Hub of the Base Ecosystem

Aerodrome is the central liquidity hub for the Base blockchain. As the primary DEX for Coinbase’s Base network, Aerodrome has seen explosive growth. It uses a "ve(3,3)" model, meaning it rewards users who "lock" their tokens to vote on where liquidity should go.

Pros

✅Deepest liquidity on the Base L2 network.

✅Incredible liquidity for tokens on the Base network; very low fees.

✅Strong backing from the Base ecosystem.

Cons

❌Complex tokenomics (veAERO) can be confusing for beginners.

❌Past frontend vulnerabilities require users to be vigilant with URLs.

Highlights:

- No KYC.

- Accessible in the U.S; high scrutiny due to Base's connection to Coinbase.

- In late 2024, Aerodrome suffered a DNS Hijack where its website was briefly replaced by a fake one. However, the smart contracts were never breached, and no funds were lost from the protocol itself.

- Trading Fees: 0.05% to 0.3%.

- Leverage: None (Spot only).

- DefiLlama Status: Top TVL on Base.

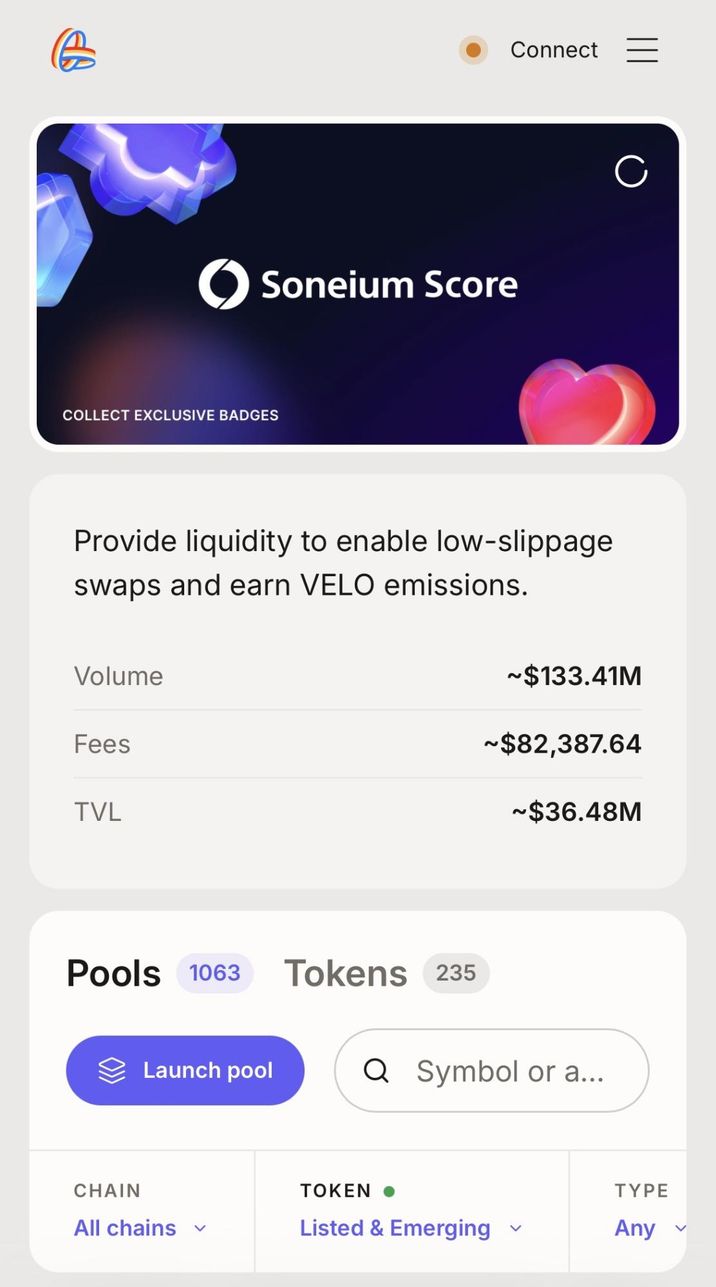

Velodrome: Optimism’s Trading Engine

Velodrome is essentially the sister protocol to Aerodrome, but located on the Optimism network. In 2026, it is moving toward a merger under the "Aero" brand to provide a unified experience across multiple chains.

Pros

✅Essential for trading native Optimism ecosystem tokens.

✅Community-governed with deep incentives for liquidity.

Cons

❌User interface can be cluttered for non-DeFi natives.

❌The VELO token has historically been volatile due to high emission rates.

Highlights:

- No KYC required.

- Accessible in the U.S.

- Similar to Aerodrome, it faced frontend security challenges in the past, but the core protocol has proven to be "battle-tested" and secure.

- Trading Fees: 0.05% - 0.3%.

- Leverage: None.

- CoinGecko Trust Score: 8/10.

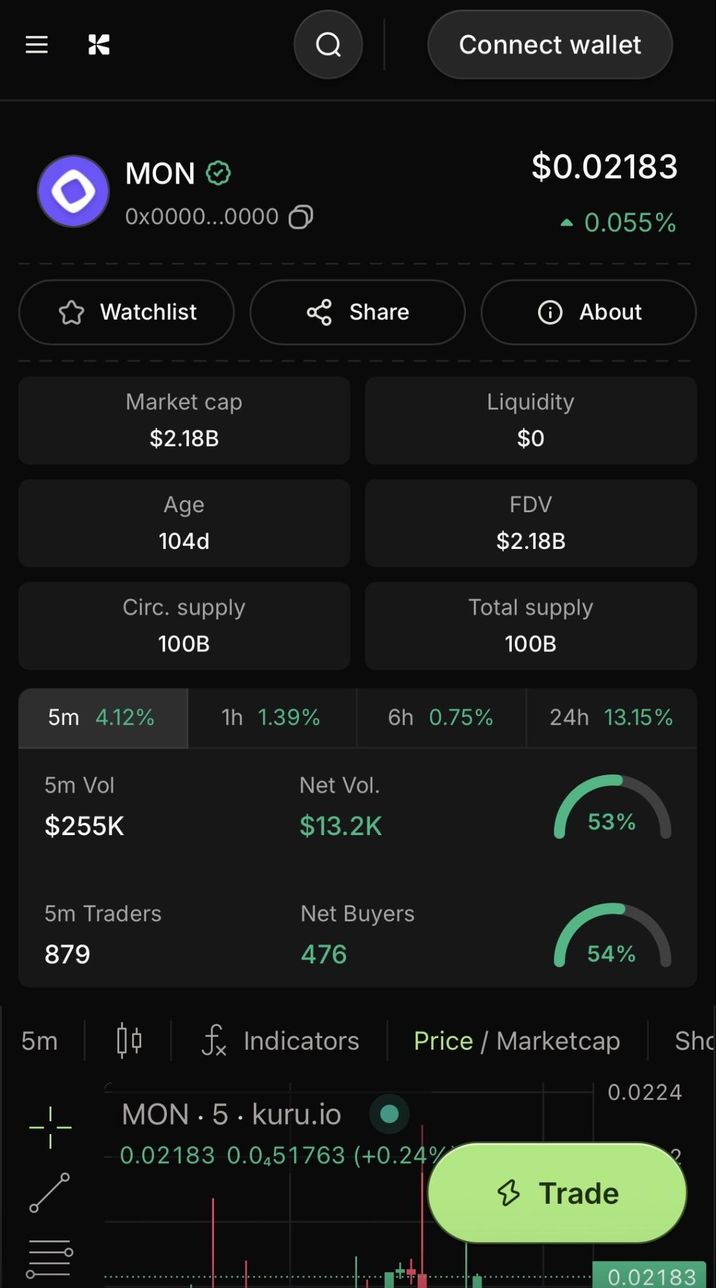

Kuru: The On-Chain Order Book

Kuru represents the next generation of DEXs. Built on the high-speed Monad blockchain, it doesn't use the standard "swap" model. Instead, it features a full Central Limit Order Book (CLOB), just like a professional Wall Street trading desk.

Pros

✅Offers an order book experience similar to centralized exchanges (CEX).

✅Extremely high throughput and low latency.

✅Solves the "MEV" (Maximal Extractable Value) problem better than AMMs.

Cons

❌Liquidity is lower than established chains like Solana or Ethereum.

❌Limited to the Monad ecosystem; less liquidity than Ethereum-based giants.

Highlights:

- No KYC required. It uses "social login" wallets (like Privy) which are self-custodial.

- Accessible in the U.S.

- As a newer platform, it has not yet faced a major security event, but it is currently under high monitoring by security researchers.

- Trading Fees: Maker/Taker model (variable).

- Leverage: Spot trading focus.

- Rating: High (Emerging Tech Leader).

Disclaimer: Cryptocurrency trading involves significant risk. Always DYOR (Do Your Own Research) before using new protocols or services.

Frequently Asked Questions

Which crypto exchange is the best?

For decentralized trading in 2026, Jupiter is widely considered the best for spot aggregation due to its liquidity, while Coin Wallet DEX is the top choice for perpetual futures. Anyway, you should make a choice based on your own research.

What is the best crypto exchange in the US?

If you prefer a regulated centralized exchange, Coinbase remains the standard. For decentralized trading, according to Reddit, Aerodrome (on Base) and Jupiter (on Solana) are the most popular among US users.

Are decentralized exchanges safe?

DEXs are generally safe because they are self-custodial (you keep your keys). However, they carry smart contract risk and are targets for frontend phishing attacks. Always check the URL.

How does a decentralized exchange work?

A DEX uses “smart contracts” to automate trades. Instead of matching buyers and sellers through a middleman, it uses Liquidity Pools (AMMs) where users deposit funds, and traders swap against these funds, paying a small fee to the depositors.

How to use a decentralized exchange?

Download a Web3 wallet (e.g., Coin Wallet, Phantom, MetaMask), buy crypto (ETH, SOL, BTC) and transfer it to your wallet. Then, connect your wallet to the DEX website and select the tokens you want to swap and confirm the transaction.

Decentralized exchange vs centralized?

Centralized Exchanges (CEXs) act as custodians of your funds and require mandatory KYC (Know Your Customer) identity verification. While they offer superior ease of use, they introduce counterparty risk—meaning if the platform becomes insolvent (as seen with FTX), your assets may be lost. Conversely, Decentralized Exchanges (DEXs) are non-custodial, allowing you to maintain full control over your private keys. Though they present a steeper learning curve, DEXs provide a transparent, censorship-resistant environment that eliminates the risk of bankruptcy.