Algorand (ALGO) Review and 2021 Price Prediction - Is ALGO Worth Buying?

Algorand (ALGO) is one of the many widely acknowledged cryptocurrencies nowadays. With a protocol aiming to give users ultimate decentralization and security, the blockchain expedites the transaction and displays the stakes through just a simple process. ALGO has without a doubt made its way into one of the top cryptocurrencies in 2021.

In this article, you’ll have a better understanding of Algorand’s price prediction for 2021 and beyond. We’ll get into a deep dive about what Algorand is, its price analysis, future price predictions, and of course if it’s a worthwhile investment for you this year. So, without further ado, let’s get started.

What is Algorand (ALGO)?

Algorand is a high-performance, next-generation blockchain with the goal of enabling users to prosper through decentralized projects and applications. All because of its efforts to address Bitcoin’s well-known scaling issues while preserving stability and decentralization, the project has earned the moniker “Blockchain 3.0.”

The majority of all this is primarily owed to the founder of Algorand, MIT professor Silvio Micali, whose knowledge distinguishes it from other high-performance blockchains. Professor Micali was awarded the prestigious Turing Award for computer science, and his numerous ideas have inspired most of the recent improvements throughout the blockchain industry.

As decentralized finance, also known as DeFi, is taking the forefront of crypto’s future, now is an excellent opportunity to talk about how Algorand is trying to become a top-tier platform for DeFi use cases without sacrificing speed, reliability, scalability, and transaction costs.

ALGO is the native utility coin for the Algorand blockchain. It’s the gas token, comparable to Ether on the Ethereum blockchain, that’s used to pay for transactions and smart contract calculations. But at the same time, it’s also used to sustain Algorand's network operations, providing holders of the coin with passive income in the form of network incentives.

All aside from its in-network perks and benefits, synthetic variants of the ALGO token, such as Wrapped ALGO (wALGO), an ERC-20 token that can be traded 1:1 for ALGO, are increasingly being weaved into DeFi apps created on Algorand as well as on other blockchains.

Algorand (ALGO) Price Analysis

Algorand began its long journey back in June 2019 with a solid trading value of $2.89, according to Coinmarketcap. The token followed by a sharp fall shortly after the start of its voyage, plummeting to $1.43 at the end of July.

Following this, the ALGO bears began to take control and the digital currency began to fall once again. As a result, by the end of September, the token had plummeted to $0.18. In addition to that, due to price fluctuations, the token traded for $0.23 at the end of 2019.

ALGO, on a more bearish note, remained negative throughout the beginning of 2020, trading around roughly $0.21. The price had risen to $0.45 by the end of February before plummeting to $0.12 by the middle of March. This sharp downturn was owed to the crypto market crash as a result of the COVID-19 outbreak.

By mid-August 2020, the token had notably achieved $0.65 and had claimed a resistance level, following which the price began to hang. Algorand reached $0.33 in December, bringing the year 2020 to a noble close.

At the time of writing, ALGO is valued at $0.91 and is currently ranked as #36 in terms of market capitalization. It has a current market cap of $2.7 billion and a circulating supply of 3,051,403,173 ALGO.

Algorand (ALGO) 2021 Price Prediction

ALGO started in 2021 with a trading value of $0.37, following a negative trend in late 2020. Later on, when the token’s price began to rise, the price began to reinforce. In mid-February, the token hit annual highs of $1.71 before dipping and continuing to move sideways.

If Algorand focuses on developing its platform and upgrading its software, it is bound to grow, according to Coinpedia. If the market remains pessimistic, the price may even fall to as low as $0.30. Coinpedia predicts that the maximum price ALGO may reach is $15 by the end of 2021.

DigitalCoinPrice, a noble crypto price forecasting site, claims to be a successful wager for Algorand’s currency. They predict that the price may overall grow in 2021, posing a more optimistic prediction. 2021 might conclude with a price of roughly $1.92 according to DigitalCoinPrice.

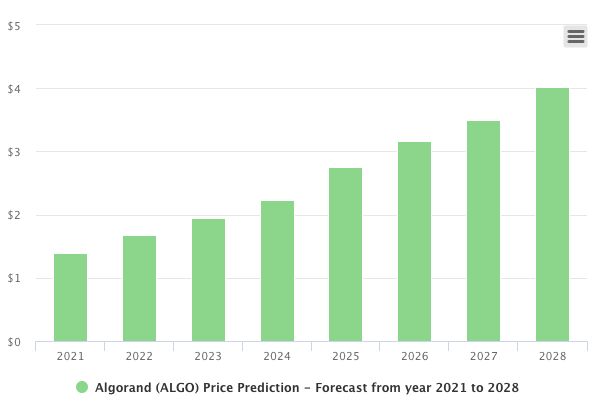

In addition to that, analysts at Longforecast anticipate that by the end of 2021, the price could have risen to a range of $3.61 to $4.48, and by the middle of 2025, it may have risen around roughly $7.89 and $9.79. Last but not least, analysts and experts at CoinArbitrage predict that the price of Algroand might be $2.46 by the end of 2021.

Algorand (ALGO) 2022, 2023, 2024, and 2025 Price Predictions

There are a number of price predictions being put forth by crypto experts on the long-term price predictions for ALGO. Let’s take a look.

Algorand might start off 2022 with a market value of $16.85, and it might deteriorate further according to Coinpedia. The community may focus on improving both the protocol and the user base, bumping the price up. They predict the value of ALGO to reach $35 by the end of 2022.

In addition to that, ALGO might be listed on a variety of exchange platforms in the next five years, and if so, the price is set to rise. With specific cooperation with other projects and businesses, it may be able to attract a larger community of people, including users and advertisers. It may add more security to its platform and place a greater emphasis on openness. If the bears continue to control the market for an extended period of time, the token may potentially fall. ALGO’s price is estimated to reach $60 in five years, according to Coinpedia.

DigitalCoinPrice has also set its long-term forecasts for Algorand. For the next few years, the price graph could remain dubious. If you invest now in ALGO, it’s virtually a lucrative investment. Algorand is predicted to be worth $3.89 by 2025, according to DigitalCoinPrice.

According to WalletInvestor, Algorand is a wise long-term investment. They predict the price of ALGO to surpass $2.30 by the end of 2021 and climb up to $9.40 by the end of 2025. Their long-term forecasts are often much better compared to the short-term. Additionally, ALGO has already demonstrated some nice price climbs so there are definitely some positive hopes for the future.

Furthermore, Algorand is showing signs of improvement and may be able to maintain its positions in the next couple of years, according to CoinArbitrage. As per their price predictions, the price of Algorand might rise to an all-time high of $7.96 by the end of the next three years.

RippleCoinNews also sees a bright future for Algorand. In the year 2022, Algorand may begin trading at a price of $6.50, or the token may depreciate. They note that the team should concentrate on improving the protocol as well as the user base. They predict that by the end of 2022, the coin should be worth $10. On top of this, they note that ALGO should become available on a number of trading platforms, and with that the price should rise. Otherwise, the token might decline if the bearish trend continues. RippleCoinNews predicts ALGO to be worth $22 at the end of the next five years.

What’s Next for Algorand (ALGO)? What to Expect in 2021?

The protocol associated with Algorand is rapidly expanding, with an average of 500,000 transactions per day now being placed on its chain. More than 500 companies worldwide are using Algorand to build apps, producing a slew of fresh transactions while taking advantage of the platform’s unique layer-1 smart contracts and other outstanding features and perks. Algorand overall is enhancing DeFi solutions’ smart contract capabilities to support billions of users globally and tens of millions of daily transactions at a very low transaction charge.

According to Silvio Micali, Algorand has been adding new functions to the protocol in the meanwhile, and its performance will increase in 2021 without compromising decentralization. Overall, the size of blocks will increase from 5,000 to 25,000. Block production times will also be reduced from 4.5 to 2.5 seconds. Additionally, they plan to stick out their block proposal time, which is the time it takes observers to notice which block is a contender for permanent inclusion in the chain, and it will remain at 0.5 seconds. Lastly, thanks to a true approach to block pipelining, the number of completed transactions per second (TPS) will increase from 1.000 to 46.000.

Algorand aspires to create a way for every account to not only participate in consensus but also actively govern and align network incentives with such governance as a next step toward responsible decentralization of the network. More exactly, it proposes the mechanisms and incentives that would provide decentralized, secure, and efficient governance.

The Algorand Foundation has proposed a redesigned, long-term model that will last until 2030 or later. On the Algorand blockchain, this new paradigm will focus on ecosystem support, community incentives, and decentralization of decision-making and governance. A brand new community rewards system will be placed at the heart of these programs, benefiting current and future users who commit to participate in the governance of the Algorand network and ecosystem, and demonstrate their commitment by locking their ALGOs for a potentially long period of time.

Is Algorand (ALGO) a Good Investment?

Algorand has created Pure PoS, a novel Proof-of-Stake mechanism that makes cheating by a minority of the money impossible and the majority of the money foolish, rather than bribing people’s honesty with fines. In this sense, the system behind Algorand’s PoS successfully crushes any attempt by a tiny segment of the economy to exert control over the whole sector.

Non-forkable chains are one of the main characteristics that distinguish Algorand. When a blockchain breaks into two branches, only one chain remains, creating a lot of confusion. After each member has been chosen, he or she must disseminate a single, short, and quick calculated message. This assures that the maximum number of short messages disseminated is 1000, regardless of the number of users in the system. Algorand, therefore, provides a scalable blockchain solution.

There is no set number of individuals in charge of selecting or approving the following block. Committees are selected at random and in secret from time to time so that everyone can participate in the creation of a new block.

Algorand is taking the crypto world by storm and authoring a new chapter in the global banking sector’s history by using blockchain technology to break down the technological and geographical hurdles to its progress.

Conclusion

A future where everyone generates and trades values efficiently, openly, and securely, is what Algorand envisions. The Algorand Foundation is encouraging worldwide trust and security through a borderless, decentralized financial ecosystem with the Algorand blockchain at its center, using the ALGO token and a wide, attractive array of products.

Algorand overall offers a low-barrier-to-entry suite of blockchain based products and services by combining beautiful technology with simple, intuitive interfaces. Algorand promises to solve the blockchain trilemma of being decentralized, stable, and safe without sacrificing any of these characteristics using the Pure Proof-of-Stake consensus mechanism.