Bitcoin Mining Difficulty Updates All-Time High

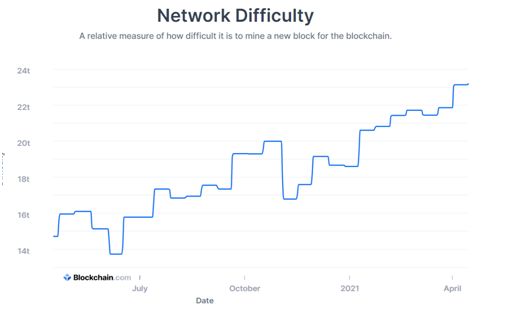

There has never been more difficult to mine Bitcoin. The mining difficulty indicator continues to gradually increase, and, as of April 2021, it updated the all-time high (ATH) after a 6% uptick on April 2. On April 15, the measurement updated the ATH again after a small increase.

Besides the fact that the price of Bitcoin has consolidated near the record high above $64,000, which attracts more miners, another major reason behind the indicator’s ascension is the release of new-generation ASIC (application-specific integrated circuit) devices.

For those unfamiliar, the mining difficulty has to do with the amount of computing power required to mine Bitcoin. This gauge has constantly been increasing since the cryptocurrency’s launch more than a decade ago, given that mining involves competition. Nevertheless, on smaller timeframes, the measurement can climb or decline depending on the amount of power consumed, which is determined by the hashrate produced by the Bitcoin network at a given time.

The mining difficulty gauge is relative and uses the difficulty level during the launch of Bitcoin as the main reference. Back then, the network had the lowest mining difficulty ever, and it is displayed by the indicator as 1. Today, Bitcoin’s mining difficulty is over 23.2 trillion, according to data from blockchain.com.

At the beginning of April, the measurement rose from 21.87 trillion to 23.13 trillion, updating the record peak. It edged up again on April 15 to the current level of 23.218 trillion.

Note that the indicator doesn’t display short-term fluctuations similar to price moves. Instead, the network itself is programmed to adjust its difficulty level every 2,016 blocks, which happens to be about two weeks or so. This function was designed by the entity known as Satoshi Nakamoto to make sure that new blocks are mined at a stable rate and large miners don’t eat too much hashrate.

The latest surge, which is the second-largest one since the begging of the year, might have to do with tens of thousands of new mining machines coming online this quarter.

Compass Mining CEO Whit Gibbs told Coindesk that this is only the beginning of a large amount of hashrate that will come online next year. He said:

“Today’s moderately large difficulty increase is not surprising, and I expect it’s only a taste of what will come later in this year and into 2022, as delayed machine shipments start arriving and being deployed. The pending flood of hashrate about to enter the market will only continue pushing bitcoin’s mining difficulty higher, which should track with bitcoin’s price.”

Bitcoin Mining Difficulty, Explained

Mining difficulty shows how time-consuming and computationally difficult it is to find the right hash for every subsequent block. This measurement is used by Proof of Work (PoW) blockchains only.

As you may know, Bitcoin miners check all BTC transactions from the so-called memory pool (mempool) and add them into new blocks that are created every 10 minutes. Miners are required to solve a complex cryptographic puzzle that would enable them to add the next block and get the reward in the form of newly minted coins. While there are many mining candidates for every block, there is only one winning node. Thus, there more miners fight for the next block, the more difficult it is to crack the hash.

Miners have to figure out the cryptographic hash value of the chain’s previous block, as the value is hidden and must be referenced when adding the next block. The mining node cannot just guess the hash value. Instead, it tries one hash number after another and thus spends computing power to find the needed value. The more computer power a miner is able to invest, the more hash power it has, thus boosting its chance to solve the puzzle before everyone else and get the reward.

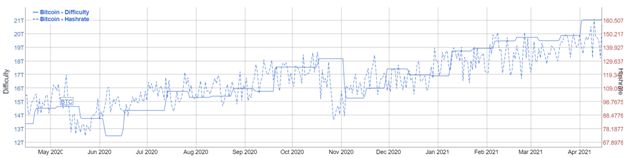

This is why the mining difficulty is closely related to the network’s total hashrate, i.e., the total computing power used by all miners at a given time. You can see how the relationship between Bitcoin’s mining difficulty and the hashrate on the chart provided by BitInfoCharts.

https://bitinfocharts.com/comparison/difficulty-hashrate-btc.html#1y

According to data from blockchain.com, Bitcoin’s hashrate was 165 exahashes per second (EH/s) as of April 15. An exahash is one quintillion hashes per second. The figure actually declined from the ATH hit on April 12 at over 171 EH/s, which has to do with a major power outage in China caused by a coal mine explosion in Xinjiang. Nevertheless, the general trend is pointing upward, suggesting that the network uses more and more computing power.

Initially, the first miners could use CPUs (central processing units) of their desktop computers and laptops to mine Bitcoin. Eventually, they realized that graphics cards (GPUs) performed better, although they required more energy. However, as the competition between miners increased, these processors became less relevant. Instead, miners started to use ASICs, which have been developed specifically for cryptocurrency mining.

Today, even the most powerful ASICs might not do the trick, and miners have no choice but to join forces in mining pools to combine their ASIC-based hash rates. This reflects the increasing mining difficulty. The rewards generated by mining pools are then fairly distributed among participants.

Bitcoin Rally Impacts Reward and Transaction Fees

The Bitcoin rally is affecting the mining difficulty, but it also impacts the dynamic of transaction fees and the way rewards are obtained. Bitcoin’s protocol has a predetermined reward scheme according to which the reward size halves every three or four years. Currently, the reward per mined block is 6.25 BTC. Thanks to the Bitcoin rally, the reward is considerable even though this is the smallest reward size since the coin’s launch.

Last month, miners secured over $1.5 billion in revenue on aggregate, which is the most ever for a single month.

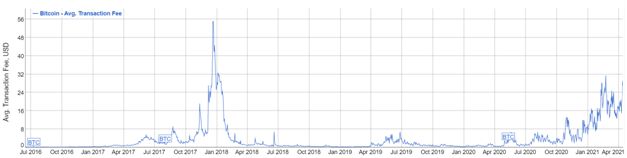

The price rally also influences the transaction fees, which have increased in dollar terms. Nevertheless, they are far from the record high reached at the end of 2017, when the average fee peaked at above $50. Currently, the average transaction fee is $29, the highest since mid-February.

https://bitinfocharts.com/comparison/bitcoin-transactionfees.html

All in all, the Bitcoin mining difficulty is expected to increase further in the years to come, as more upgraded ASICs are being released.