Compound Review - What is COMP's Future?

Cryptocurrencies have become the medium of decentralized services with the many features offered by some of the most prestigious cryptocurrencies to exist. Bitcoin may have begun the concept of decentralized transactions, but it is Ethereum the one to provide other services at the table. Perhaps the most intriguing feature that cryptocurrencies nowadays offer is the Decentralized Finance (DeFi) field. DeFi has shown how cryptocurrencies can replace banks or other financial institutions when it comes to financial services, due to the omission of additional fees and increased security. One particular cryptocurrency that has been excelling in this field is Compound (COMP).

Compound (COMP) has grown to be one of the most essential cryptocurrencies in today’s market. But there are a lot of components that make Compound into the network that it is today, as well as a potentially lucrative investment. In this article, we are going to go through the most important information about COMP so that you have a better idea about Compound. Let’s begin with some brief information about Compound.

What is Compound (COMP)?

Compound is a cryptocurrency network that focuses more on the Decentralized Finance (DeFi) sector. Created in 2017 by Robert Leshner and Geoffrey Hayes, this cryptocurrency has been climbing the cryptocurrency ranks ever since it was released. Its creators were previously involved in the online delivery service of Postmates. They co-created Compound Labs Inc, which is the company behind the Compound cryptocurrency. While Leshner remains the CEO, Hayes is the CTO of Compound. Despite Postmates, both Leshner and Hayes were also involved in blockchain-based projects in the past. Today, the team behind Compound has grown and consists of several professional engineers in the field.

So what exactly is Compound? Compound strives to be one of the best networks to provide DeFi services, but not limited to. The main idea of Compound network is to incentivize its users to put their idle tokens to use. If you are currently holding tokens and are not actively using them, you can use networks such as Compounds to grow your token amounts by using Ethereum-based assets, such as Wrapped BTC (WBTC), Basic Attention Token (BAT), and many others. Through the use of such tokens in the Compound pool, you can earn interest and generate a profitable amount of tokens.

But such features of the Compound networks are not the only components that make it special. The native token COMP that operates in the Compound network has proved to be efficient in the governance aspect of the network. Furthermore, COMP has had quite a success in terms of price in recent years, reaching the top 50 ranks in the crypto market.

How Compound (COMP) Works?

Using the Compound pool, users of the Compound network can deposit Ethereum-based tokens. Not only that the users can deposit cryptocurrencies and serve as lenders, but they can also borrow those same Ethereum-based cryptocurrencies from the pool and pay interest fees. Each Ethereum-based token has its own pool in the Compound network.

To illustrate, when lending cETH tokens in the ETH pool within the Compound network, you can receive additional cETH after a certain period of time. Using this method, users can earn interest for their idle tokens and make huge profits. The interest rates change every day, depending on the network congestion.

When lending tokens in the Compound network, users have to provide a collateral amount, which can range from 50% to 75%, depending on the nature of the loan, the network, and supply and demand factors. The higher the demand, the higher the interest rates for borrowers and lenders. The lower the demand, the lower the interest rates for both parties. If the collateral falls below the required amount, there can be a liquidation of the assets, which is automatic and unchanged. This can occur if a huge drop in the price occurs. Nevertheless, borrowers are allowed to buy a portion of their loan to continue the loan in the same way that it started.

The native token of Compound, COMP, can be used by users to propose new changes in the Compound network. Such tokens can be used for voting, or simply providing new ideas to the network. Using COMP tokens, the network users can propose to the network to add new cryptocurrencies in the pool options, besides the ones that are already offered.

However, not everyone can propose changes in the network using COMP tokens. It is required that a user owns at least 1% of the total COMP supply in order to be able to propose new changes to the network. After doing so, a user needs to wait at least three days until his/her proposal is accepted or rejected. To be exact, 400,000 votes must be compiled if the proposal is to be accepted or rejected. If 400,000 votes are in agreement, then the new change can be integrated into the Compound network in the next couple of days.

COMP tokens cannot be mined in the same way that cryptocurrencies such as Bitcoin can. Instead of using mining rigs that are expensive to buy and maintain, users mine COMP through lending and borrowing. The network incentivizes its users in this way so that they use Compound features even more. This is achieved through the use of smart contracts, which are sets of codes that eliminate the need for a third party to be involved. Thousands of COMP tokens are distributed every day to both the lending and the borrowing parties in the Compound network.

Now let’s look at the tokenomics of Compound. Compound has a limited supply of 10 million COMP. The circulating supply is around 5.4 million COMP. 4.2 million out of the total supply is designated to be owned by users of the network, and it is vested during the course of four years. 2.4 million COMP is going to be allocated to Compound labs, while another 2.2 million are planned to be allocated to the founders of Compound, also vested in the span of four years. 775,000 COMP are strictly assigned in the governance aspect of the network, and the remaining 332,000 are planned for Compound team members that can join in the future. As neither a Proof-of-Work (PoW) or Proof-of-Stake (PoS) network, Compound is secured through its collateralization system that we explained above. If collateral falls, liquidators can purchase it at a discount of 5%. In this way, collateral levels remain stable and the network remains secure.

If you want to buy COMP tokens, you can use cryptocurrency exchanges that are legit, safe, and trusted worldwide. Some of them might be Coinbase, Binance, Huobi Global, etc.

In terms of storing COMP tokens, you can use either software (hot) or hardware (cold) wallets. The best hot wallets for COMP are Exodus, Coinomi, Enjin Wallet, etc. The best cold wallets for COMP are Ledger and Trezor.

Compound (COMP) Price History

The COMP token was launched in June of 2020 at a price of around $64.64. Compound looked very promising from the very start, consequently making investors bullish about its price and purchase more COMP tokens. Because of this, the price of COMP reached $337 in less than four days from its launch. However, the price started declining in the following months of 2020, ranging from $90 to $170.

At the start of 2021, the price of COMP was $145. Following the bullish trend caused by the BTC halving of 2020, the price of COMP started to increase during the first quarter of 2021. It reached $500 for the first time at the beginning of February. In May of this year, Compound reached its highest of all time at $911, which is more than a 500% increase in just four months. Compared to its launching price, that amount was 1300% more, making Compound a very profitable investment so far.

However, the price of COMP has dipped again after hitting a new price record. A the time of writing this, the price of COMP is around $377.50.

With this price and a circulating supply of 5.3 million COMP, the market capitalization of Compound is around $2 billion. This places Compound at number 41 in the cryptocurrency rankings, indicating that it still has the potential to grow in the future. The fully diluted market cap of Compound is around $3.7 billion.

What is the Future of Compound (COMP)?

Compound is still in its infancy, despite already joining the ranks of some of the most promising cryptocurrencies in the market. Recently, Grayscale, one of the largest institutional investors in the world, has announced that they have launched a DeFi fund that consists of Uniswap (UNI), Aave (AAVE), and Compound (COMP). 8.38% of the DeFi fund from Grayscale consists of Compound (COMP) tokens. Such an initiative to further develop the DeFi sector can easily drive the price of Compound higher. Grayscale’s CEO Michael Sonnenshein is known for his continuous support on DeFi, and this is what he had to say:

“Grayscale continues to focus on creating opportunities for investors to access new, exciting parts of the digital asset ecosystem. The emergence of decentralized finance protocols provides clear examples of technologies that can redefine the future of the financial services industry.”

If Compound continues to have the support of whale investors, its future is looking bright.

In the long run, the supply of Compound may eventually run out, making COMP even scarcer. A shortage of COMP tokens may cause an increase in the price of Compound since its demand is likely to remain high. Moreover, Compound is likely to receive bigger support from various institutions, such as it has received from the likes of Coinbase, Paradigm, a16z, BainCapital, etc.

Compound (COMP) Price Predictions

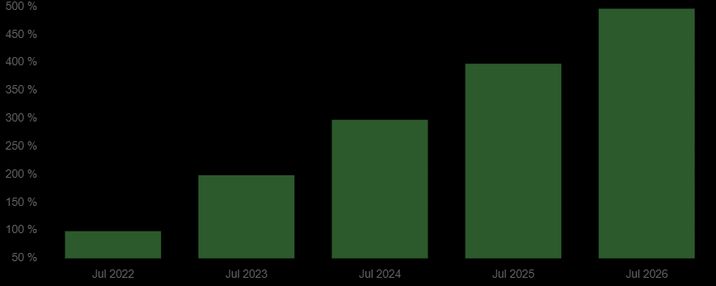

Based on many analysts and the price factors of Compound, its price may easily exceed its all-time high and surpass $1,000 in the next 12 months. With the DeFi sector becoming more popular since it is more efficient and profitable than traditional options, the demand for COMP tokens is likely to increase. Keep in mind that Compound also has a limited supply of 10 million COMP, so its price is deflationary. If another bullish trend occurs in 2022, COMP may easily go as high as $2500. As for the next five years, since the remaining supply is planned to be vested in a four-year span, and Bitcoin may have another halving event in 2024, Compound can possibly reach $10,000 in the long run. This is based on the possibility that cryptocurrencies become more popular, gain more global support, and DeFi slowly replaces traditional financial institutions.

Wallet Investor also predicts that Compound can increase in the long run, reaching close to $2,500 in the next five years. A fully diluted market cap with that price would be around $25 billion, which would hypothetically put COMP in the top 10 list, other things equal.

YouTuber K Crypto also predicted that Compound can increase massively in the long run due to the support that it has from institutional investors. The price of COMP can easily reach $4,000 in the long run.

Crypto Academy, another reliable prediction site, predicts that COMP may reach $1,700 by the end of 2021if the bullish trend starts again in the last quarter of the year. As for the end of 2022, the price may range from $1,800 to $2,200. The long-term prediction of Crypto Academy sees COMP reach the $3,500 mark.

Conclusion

All in all, we can conclude that we are only at the beginning phases of the DeFi world, as decentralization looks to replace traditional financial institutions once and for all with better interest rates, higher security, and fewer fees. Cryptocurrencies such as Compound are what can revolutionize the world of DeFi and the market itself. Whether Compound can continue in the same way that it has started, only time can tell.