COVID-19 Vs Crypto Market: How Coronavirus Is Changing The Way The World Sees Crypto

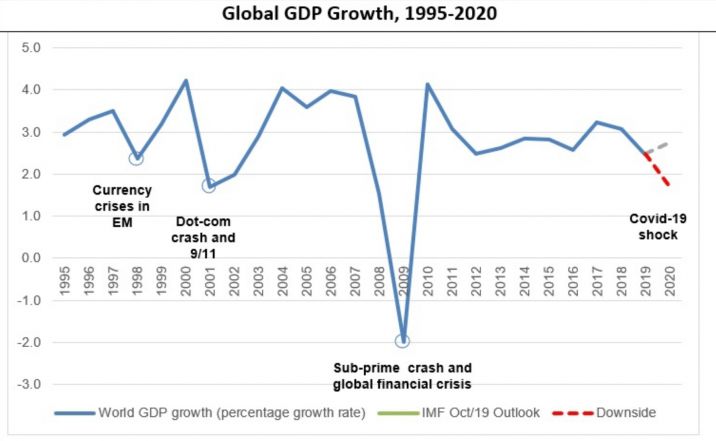

Since the beginning of the year, the world as we know it has been turned upside down by a virus from the coronavirus family, known as COVID-19. In the months following the alarming outbreak of this deadly new disease, financial markets have been left in ruins and many people have lost their jobs. The UN has speculated that the total cost of the pandemic will surpass $1 Trillion by its end. This presents a challenging and interesting picture of the crypto market, which is well-known for its volatility and we will soon learn how coronavirus is changing the way the world sees and uses crypto.

Like with almost all assets at the beginning of the coronavirus crisis, Bitcoin and the crypto market experienced a crash as a result of a “liquidity crisis” which affected all other assets classes. This is where investors tried to convert as much of their assets into cash as possible.

Despite these initial lows, the value of Bitcoin has even rebounded, whilst other asset classes are still creeping upwards or losing their value. Many cryptocurrency exchanges are currently experiencing a large increase in users and trading volume on their platforms. This is indicative of a new faith being found in the crypto market, especially Bitcoin, which is being seen as an uncorrelated asset.

How COVID-19 Impacts The Way We Use Crypto

The increased ease and development of trading and utilizing cryptocurrency has happily coincided with the coronavirus pandemic, as has the rise of digital banking. Specifically, this year, the majority of cryptocurrency trading and wallet apps have made it easy to purchase digital currencies with the use of a credit card. This allows for people to send small sums of money, without KYC protocols and stable coins are currently in high demand as a replacement for cash and cards, with Tether specifically experiencing an explosion in popularity; making it the third-largest cryptocurrency.

In addition to this cryptocurrencies are currently garnering a different reputation for themselves. Whilst they are still seen as the gold standard for volatility and speculative vehicles; they are now gaining a reputation as assets that can provide shelter during a crisis. As a result of this, cryptocurrencies are going to be increasingly used as uncorrelated “safe haven assets” in addition to their potential as an investment.

With regard to newer traders, the COVID-19 pandemic has provided them with a new opportunity. Due to safely staying at home, a large number of retail investors are gaining the opportunity to more consistently monitor the overall market conditions; allowing them to better educate themselves on the market and improve their overall trading.

Interestingly, blockchain technology is already being utilized to assist with the global pandemic. International Business Machines Corp and Ernst & Young are among the companies exploring these options. Some of the proposed projects involve using the blockchain to efficiently connect healthcare providers with suppliers of vital equipment and Ernst & Young are attempting to create a blockchain whereby governments, healthcare providers, airlines, and other groups can keep track of individuals who have been tested and may be immune to coronavirus.

The healthcare benefits of blockchain are finally being sufficiently noticed.

Is COVID-19 Paving The Way To Global Adoption of Crypto?

It would not be a stretch to say that COVID-19 has changed the way that the world is viewing money. There has previously been a view that the banking system since 2009 has been working well and that banks should avoid risky and untested assets such as cryptocurrencies.

What the pandemic has shown us is that the new banking system is far from secure and scarce assets will be in demand and whilst a large number of banks will opt for gold as the asset of choice, an increasing number will choose Bitcoin, as demonstrated pre-pandemic in Germany where 40 banks have applied for cryptocurrency licensing.

Additionally, lawmakers and politicians are also beginning to take notice of digital currencies as a result of the COVID-19 pandemic. One month before the country went into lockdown, the Bank of England released a paper highlighting the advantages of a retail Central Bank Digital Currency.

Furthermore, in the United States, policymakers rushed to implement a digital dollar into the CARES Act; these efforts ultimately failed, but they have drawn attention to the concept of a digital dollar, which is now being widely discussed.

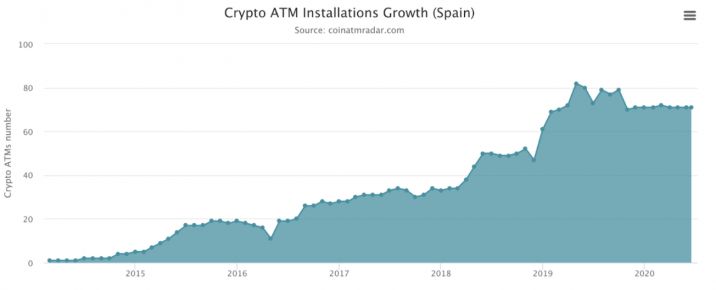

Finally, retail interest in cryptocurrencies is also skyrocketing as Bitcoin ATMs have surpassed 8000 functional units across the world during the coronavirus pandemic and as previously mentioned, cryptocurrency exchanges are currently experiencing surges in user interaction. Even in China, searches for Bitcoin on the country’s search engine increased by 183% in 30 days.

How Will Crypto Perform After COVID-19?

Despite the initial crash in value seen in cryptocurrencies due to the aforementioned liquidity crisis, cryptocurrencies quickly rallied and began to recover well against other asset classes. Additionally, there has been increasing talk of governments utilizing digital currencies as a result of the pandemic and even a large number of banks are beginning to consider the benefits of holding cryptocurrencies as a sheltered asset.

This combination of factors could see institutions that have traditionally rubbished cryptocurrencies and painted them as an unstable, unreliable and unsafe asset class make a U-turn and begin to see the inherent value in cryptocurrencies, particularly in volatile global situations.

Additionally, retail confidence in cryptocurrencies has also increased during the pandemic, as 66% of people in Europe believe that cryptocurrencies will still be around in ten years; Italy, a country whose struggle against coronavirus has been well-publicized is interestingly the most confident in cryptocurrencies, with 72% of people surveyed believing that the digital assets will still be around in ten years.

As both retail and institutional confidence in cryptocurrencies increases, we are still not at a stage where global adoption is on the horizon, but the COVID-19 pandemic may just push the crypto market in the right direction.