How People Lose Money in Crypto Without Even Noticing

The crypto world promises freedom, innovation, and massive financial opportunities — but it also hides traps that even experienced users can fall into. Many investors lose money without realizing it through hidden fees, unnoticed permissions, smart contract mechanics, or simple inattention.

How do people lose money in crypto without even noticing? We decided to find out using real stories from Reddit, media, and blockchain communities. Whether you’re a beginner or an experienced trader, learning these patterns can protect you from silent losses and help you manage your crypto assets more wisely.

Key Takeaways

-

You can lose money in crypto even when your portfolio seems to be growing — for example, through hidden trading fees, impermanent loss in DeFi pools, or high gas costs.

-

Copying the wrong wallet address, approving an unknown contract, or ignoring a spam token can instantly drain your funds — often before you realize what happened.

-

DeFi lending and staking platforms can automatically liquidate your positions or deduct funds through built-in algorithms. Understanding how these systems work is crucial to staying safe.

Fees and Hidden Charges

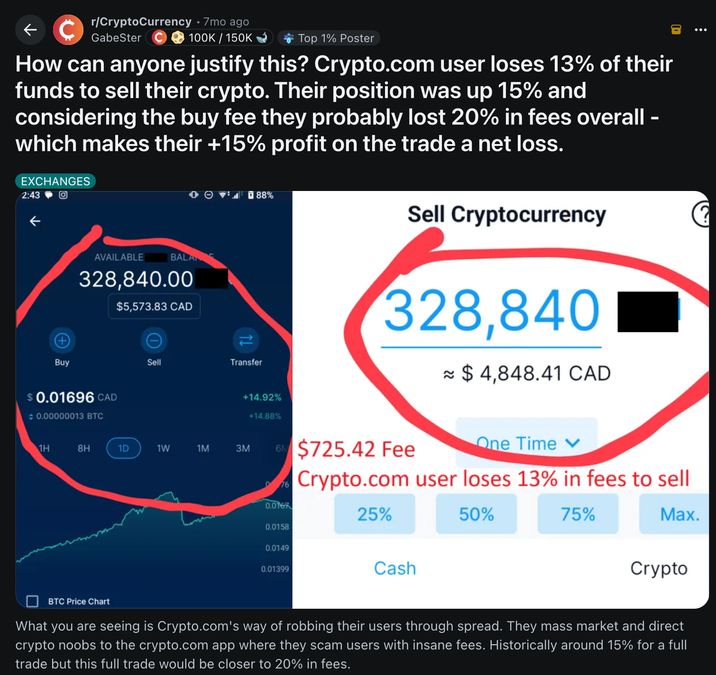

Even simple transactions can lead to losses due to non-transparent fees. For instance, one Reddit user shared their experience with the Crypto.com exchange: although their portfolio had grown by 15%, due to spreads and commissions they actually lost nearly 20% of their funds. As one participant said, “Crypto.com charges users around 15–20% in fees… so even when your trade is up 15%, you end up 20% down.” Hidden spreads (the difference between buy and sell prices) quietly eat into profits.

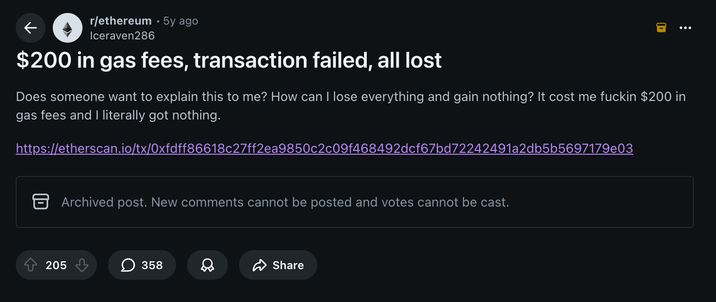

On decentralized exchanges (DEXs), similar surprises happen. If your slippage setting is too tight, the transaction may fail, but the gas fee is still spent. One user complained they lost $200 in gas fees, even though the trade didn’t go through: “It cost me $200 in gas fees and I literally got nothing.” This often happens during high network congestion or volatile periods — the transaction fails, but the gas is gone.

Staking on new DeFi platforms can also drain funds through hidden withdrawal fees or unfavorable terms. Many users realize later that their real yield was much lower than expected due to these silent deductions.

Impermanent Loss in Liquidity Pools

Liquidity providers (LPs) on DeFi platforms often lose money “invisibly” due to price fluctuations between paired assets. This is known as impermanent loss. As analysts from Tangem explain, “Impermanent loss is a temporary loss caused by volatility of trading pairs… showing what the LP lost compared to just holding their tokens.” When prices change sharply, the algorithm rebalances the pool, and the LP may withdraw fewer funds than if they had simply held the assets.

Many beginners don’t realize this loss because they keep receiving trading fees and think they’re profiting — until they withdraw and compare results.

Phishing and Malicious Contracts

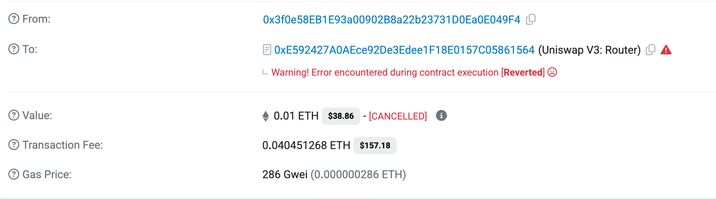

Social engineering and malware are among the most common causes of hidden losses. A Reddit user LVantablack shared how a “friend” on Discord sent them a link to “play a game together.” After installing the app, a trojan infected the PC and stole their MetaMask keys. As the victim wrote, “He got into my MetaMask and drained all my assets.”

Another user on the MetaMask subreddit admitted, “It happened to me a month ago — I unknowingly confirmed a transaction that emptied my hot wallet.”

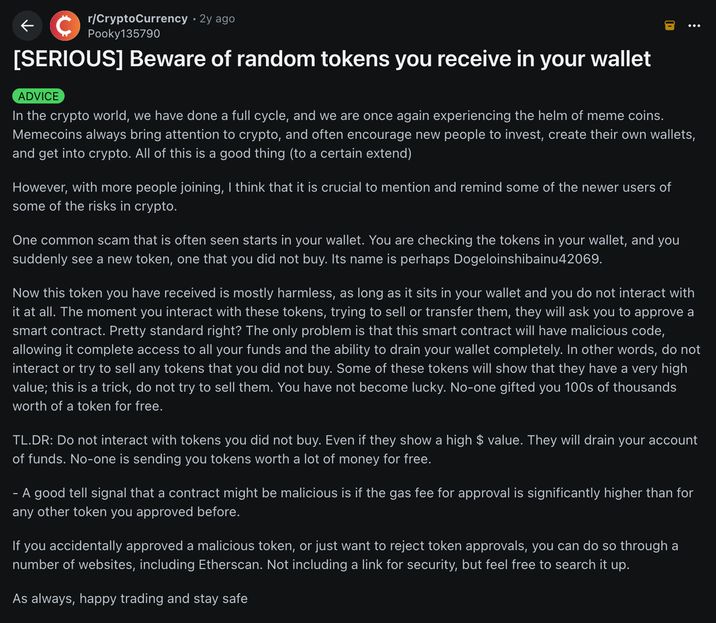

There are also “airdrop” scams: you receive unknown tokens, try to sell them, and the smart contract asks for permission to manage your tokens. As Reddit warns, “Don’t interact with tokens you didn’t buy. Selling them often requires approving a malicious contract that can drain your wallet.”

Spam Attacks and Address Spoofing

Sometimes, pure carelessness causes massive losses. One story reported by CryptoRank described how a victim sent 1,155 WBTC (~$68 million) to scammers after a “dust attack.” Attackers sent tiny “spam” transactions from lookalike addresses. The victim copied one of those addresses and pasted it for a new transaction — sending all their Bitcoin to a fake wallet.

This trick is simple but devastating: even copying an address can be a trap if attackers manipulate your transaction history.

NFT and Worthless Tokens

Another silent killer of value is the collapse of NFT prices. Many investors bought NFT collections during the 2021–2022 boom, but today most of them are worthless. Research shows that over 95% of NFT projects now have zero market value. Those who didn’t sell in time found themselves holding digital assets that no one wants — “dead” tokens that can’t be liquidated.

Automatic Liquidations and Protocol Mechanics

Some DeFi protocols have built-in mechanisms that automatically liquidate or deduct user funds.

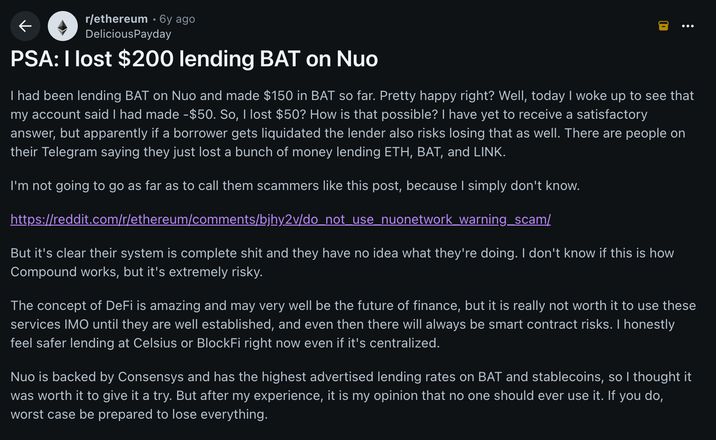

One Reddit user, DeliciousPayday, reported lending $150 in BAT through the Nuo protocol. Later, they found a -$50 balance — meaning they lost about $200. The cause: automatic liquidations. “Apparently if a borrower gets liquidated, the lender also risks losing that as well,” they wrote.

The platform’s risky design caused lenders to share the borrowers’ losses. Similar incidents happen across DeFi lending platforms: automated systems close user positions during volatile markets, and funds disappear before the user even notices.

The Bottom Line

Crypto can be empowering — but it demands awareness, discipline, and constant attention to detail. Most “invisible” losses come from a lack of understanding of how decentralized systems actually function. By learning from real-life cases, you can avoid these silent money drains and use crypto safely, confidently, and effectively.

In short: don’t just protect your wallet — protect your awareness.