How to Earn Solana (SOL): Practical Ways to Generate Passive Income

At the beginning of November, CoinMarketCap reported that Bitwise’s Solana ETF attracted over $126 million in its first full week of trading, marking eight consecutive days of inflows, while Bitcoin and Ethereum funds saw a combined $2.6 billion in outflows. Some cryptonians may see this as an opportunity to profit from Solana. However, there is one nuance: Solana cannot be mined. So what should you do in this situation? Let’s find out.

Key Takeaways

- Solana cannot be mined in the traditional way because it uses Proof-of-Stake and Proof-of-History instead of Proof-of-Work, eliminating the need for GPU- or ASIC-based mining.

- Staking is the primary method of earning SOL.

- Becoming a validator is possible but resource-intensive, requiring powerful hardware, significant SOL capital, and 24/7 uptime, which is why most users choose delegation instead.

Solana's Summary

Solana is a blockchain with a unique Proof-of-History (PoH) + Proof-of-Stake (PoS) consensus mechanism, which means that traditional mining does not exist here. In Solana, blocks are not confirmed by GPU computations but by staking SOL with validators. In simple terms, you will not “mine” SOL, but you can delegate your coins to a validator and receive rewards for helping secure the network.

Proof-of-History makes it possible to embed time stamps directly into blocks, which enables extremely fast transaction processing.

Read more: Solana Transaction ID Example

Why Solana Cannot Be Mined

In classic PoW networks (Bitcoin, Ethereum before the Merge), new blocks are mined by solving cryptographic puzzles using powerful hardware. Solana does not use PoW and instead relies on PoS and PoH. This means the network does not require energy-intensive GPU or ASIC work, and SOL cannot be mined in the usual sense.

Instead, transaction validation is performed by validators who stake (hold as collateral) SOL. Proof-of-History organizes events by time, simplifying verification and making the network very fast and energy-efficient.

Staking SOL: the Main Way to Earn

The main way to earn SOL is through staking: you lock (deposit) your coins to support the network and receive a percentage of rewards. When you stake, your coins stay in your wallet, but they are “delegated” to a validator you choose. The validator receives rewards for processing transactions, and part of this reward is distributed to you.

On average, the annual return for staking Solana is about 5–8% (as of 2025 — around 7%). For example, if you stake 1,000 SOL at a 6% return, you will receive about 60 SOL per year.

Steps to Start Staking

Suitable wallets must include the staking option. Create a Solana wallet and deposit SOL. Transfer some SOL into your wallet (for example, 100–1000 coins). Here’s what the beginning of your staking journey might look like overall.

- Select the “Stake” option. Open the staking section in your wallet and choose the amount of SOL you want to stake.

- Choose a validator. A validator is a node in the network that you trust with your delegated coins. Wallets typically provide a list of available validators. Choose one with a good reputation, low commission, and high uptime (reliability). You can delegate SOL to any validator through your wallet.

- Confirm the transaction. After choosing a validator, click “Stake” and confirm the operation. Your SOL will begin generating passive income — you will receive rewards automatically (usually several percent annually) directly to your account. The percentage depends on the total share of staked SOL in the network and the validator’s commission.

Thus, even an ordinary holder can earn SOL without any complex hardware. You only need a wallet and your own SOL. You can increase or withdraw your stake whenever you want (unstaking usually takes several epochs, around 1–2 days).

Read more: The Best Crypto Wallets for Solana 2025

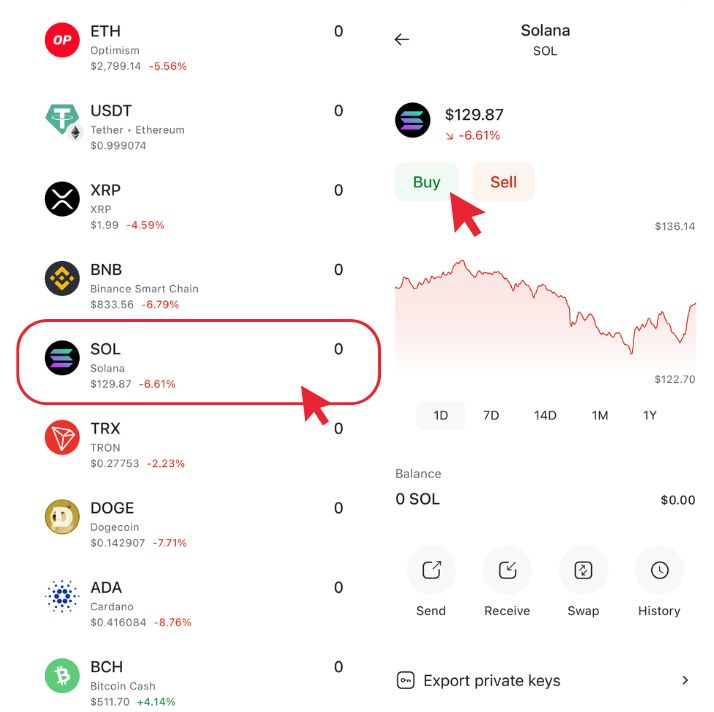

Solana in Coin Wallet

Coin Wallet doesn’t offer a staking option, but it is suitable for secure storage and other operations.

For Solana users, Coin Wallet stands out for its speed and full set of essential features. You can buy SOL directly in the app using a bank card, Apple Pay, Google Pay, or bank transfer — making it easy to get started. The wallet also supports exchanges: you can quickly swap Solana with over 200 other cryptocurrencies in just a few taps.

Read more: How to create Solana wallet

Becoming a Solana Validator

On Solana, anyone can run a full validator node and earn rewards from entire blocks, but this process is very resource-intensive. You need powerful hardware: at minimum a 12-core CPU with 48 threads, 128 GB of RAM, and a high-speed internet connection. You also need a large amount of SOL for staking and must ensure stable 24/7 uptime.

Therefore, becoming a validator makes sense only if you have strong technical capabilities and significant capital. Most users prefer simple delegation, leaving node setup to professionals or staking-management services. There are platforms (such as Staked or Bison Trails) that handle the technical aspects of staking, allowing you to stake SOL with minimal effort.

Tips and Risks

- Validator selection: Always check the validator’s reputation. If a validator frequently goes offline or behaves incorrectly, part of your coins may be “slashed” through network penalties. To reduce risk, delegate your SOL to trusted and reliable validators.

- Commissions: Validators charge different fees (commissions) from the rewards. Typically, it is 5–10%. Choose a balance between good returns and reliability.

- Unstaking time: After you begin staking, it may take several epochs (Solana epoch = 2–3 days) to fully withdraw SOL. Consider this if you need fast liquidity.

- Security: Never share your private key or seed phrase. Use only official wallets and websites when connecting to staking platforms.

The Bottom Line

Solana cannot be mined because it is a PoS, PoH blockchain rather than PoW. However, staking SOL provides passive income.

If you are ready to make a major investment, you can run your own validator (very powerful servers required) and receive full block rewards. Despite some risks (such as slashing), staking remains a simple and energy-efficient alternative to mining on Solana.