How to Sell Crypto for Cash

Hi crypto fans ⚡

Having crypto accounts filled with coins is a great idea, but sometimes each of us wants to feel the power of money in our hands. That's natural, and besides, we need to pay bills and so on. That's why right now a lot of people are looking for a way to sell crypto for cash and not pay enormous fees.

This article will help you solve this task and sell crypto using Coin Wallet and some other platforms.

How to Sell Crypto Without Paying Taxes and Fees

In the United States, selling crypto without overpaying in taxes and fees requires an understanding of both platform costs and IRS tax rules. With a self-custodial wallet like Coin Wallet, you don’t pay any deposit or holding fees — you only pay network and service fees when you send assets out. For example, sending Bitcoin in Coin Wallet incurs the blockchain network fee plus a 0.5 % service charge (with minimum and maximum limits), and for many other tokens you pay only the network fee required to confirm the transaction on the blockchain.

For minimizing platform fees, peer-to-peer sales or using wallets that allow free internal transfers can help you avoid exchange commissions. However, U.S. tax law treats cryptocurrency as property, so selling crypto for cash — even from a self-custodial wallet — is generally a taxable event if you realize a gain. You must report capital gains or losses on your federal tax return, with short-term gains taxed at ordinary income rates and long-term gains potentially taxed at reduced rates depending on how long you held the asset and your income level.

In other words, if the sale price is higher than your purchase price (cost basis), a capital gain occurs. This gain must be reported, and the appropriate tax must be paid. Even peer-to-peer cash transactions are formally subject to taxation.

However, if you sell cryptocurrency for the same price you originally paid for it and do not realize an actual profit, there is no tax due because the capital gain is zero. That said, the transaction must still be reported.

Careful planning — choosing the right selling method, documenting your cost basis, and understanding holding periods — can help you minimize what you pay in fees and taxes when converting crypto to cash.

How to Sell Crypto Online Using Coin Wallet

Coin Wallet is a self-custodial wallet that may be used for buying and selling crypto. Its interface is very easy to use so you can handle this task.

In Coin Wallet, you can sell crypto for fiat like dollars, euros, pounds, or even some local options — just follow these simple steps:

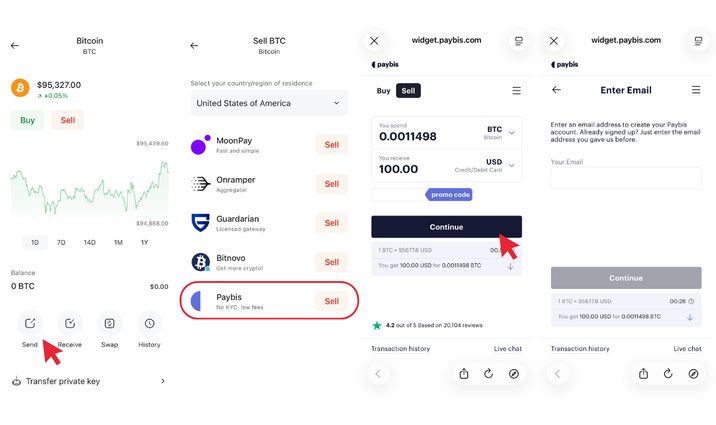

- Choose your coin from the list — let’s say Bitcoin.

- Tap the “Sell” button under the coin’s price.

- Select your country or region of residence.

- From the list, choose a payment gateway like Onramper, MoonPay or so on. In our example, we're going to use Paybis. Then click “Sell”.

The Best Apps to Buy and Sell Crypto

Where can you sell crypto? You can use any service or platform you like. It can be an exchange, a wallet, or even your traditional bank account, if it has crypto functions. We've already discussed Coin Wallet, and now, let’s talk about other platforms.

How to Sell Crypto on Crypto.com

According to Crypto.com’s official help materials, users can sell supported cryptocurrencies directly in the Crypto.com App by choosing the Sell option and converting crypto into fiat currency. The fiat balance can then be withdrawn to a linked bank account, typically via ACH in the U.S. Crypto.com applies a spread to the exchange rate, and additional fees may apply depending on the withdrawal method and currency, so the final amount should always be reviewed before confirming the transaction.

How to Sell Crypto on Robinhood

Robinhood allows users to sell supported cryptocurrencies within the app. When you sell crypto on Robinhood, the proceeds are credited to your cash balance, which can then be withdrawn to your bank account. Keep in mind that selling crypto on Robinhood is a taxable event in the U.S.

How to Sell Crypto on Trust Wallet

Based on Trust Wallet’s official guidance, the wallet itself doesn’t offer direct fiat withdrawals. However, users can sell crypto through integrated third-party providers available in the app or by transferring assets to an external exchange that supports fiat cash-outs. As a non-custodial wallet, Trust Wallet does not charge selling fees, but users must pay blockchain network fees and any service fees charged by the selected provider.

How to Sell Crypto on MetaMask

MetaMask doesn’t directly process cash withdrawals but enables users to sell crypto through integrated third-party on-ramp and off-ramp providers. These providers allow users to sell supported assets from within the wallet and receive fiat to a bank account, debit card, or PayPal, depending on location and provider availability. Fees typically include a service fee set by the provider and standard network fees, which are displayed before the transaction is finalized.

The Final Thought

Selling crypto for fiat is a practical step, but it should always be done thoughtfully. Choosing reliable and transparent services helps reduce risks, unexpected fees, and potential issues with withdrawals. It’s also important to remember that selling crypto for fiat is a taxable event in many jurisdictions, including the United States, so proper reporting should not be ignored.

By using trusted tools, understanding the rules, and staying informed, you can sell crypto more confidently. If you’re looking for a secure and user-focused solution, consider joining the Coin Wallet community and exploring the options it offers.