How to Stake Ethereum for Maximum Returns in 2025

Ethereum is a decentralized blockchain and development platform. The main goal of Ethereum is to build and deploy applications and smart contracts. But this blockchain network also offers many features, including the ability to earn tokens as a passive income. In this article, we will talk about Ethereum staking, its profitability, and how to stake Ethereum in 2025 with Coin Wallet.

Understanding Ethereum Consensus Algorithm

In cryptocurrency systems, different consensus algorithms are used to achieve agreement among all participants in a blockchain network. This term refers to a general agreement on how transactions are recorded in a network.

For example, consensus algorithms such as Proof-of-Work (PoW) and Proof-of-Stake (PoS) are widely used. But what exactly is the difference?

Proof-of-Work (PoW) is a concept used for recording transactions in blockchains by miners. The network consensus is reached after there is proof that the work has been done with no attempts to alter data.

Miners take part in a competition to solve a cryptographic puzzle to find a winning hash. If a miner wins, they get the right to confirm financial transactions by writing blocks to the blockchain. Therefore, miners compete with each other to create the next transaction blocks.

Miners use their own computing power. The winning miner is rewarded with cryptocurrency tokens for spending their resources to find a solution. Today, PoW is considered a less relevant tool despite its reliability.

Proof-of-Stake (PoS) is a more modern consensus mechanism that was created as an alternative to Proof-of-Work (PoW). Coin owners, called validators, offer their assets as collateral (this is called a 'stake') to validate transactions, open new blocks, and get rewards.

Validators also compete for the right to add a new block, but the network selects the winner through a random selection process. In general, while miners solve puzzles, validators stake tokens for the privilege of earning transaction fees. For example, Ethereum used to use the Proof-of-Work mechanism, but it has switched to the Proof-of-Stake mechanism now.

PoS also enables passive income through a process called 'staking'.

What is Ethereum staking?

Cryptocurrency staking is the ability to 'freeze' a certain number of coins in a wallet or on an exchange for a certain period of time to generate passive profit. Coins are locked to support blockchain systems using Proof-of-Stake (PoS) consensus algorithms or to provide liquidity to DeFi protocols.

Ethereum staking is the same process, but coin owners must stake 32 ETH to activate their ability to validate transactions. If you don't have this amount, you have to join a validator pool and share any rewards.

After that, the network chooses validators randomly, and they begin to validate transactions. Validators get rewards in ETH and distribute them proportionally based on the amount staked.

History of Ethereum staking

Vitalik Buterin described Ethereum in the white paper at the end of 2013. Later, the project received many upgrades. The largest-scale upgrade of Ethereum took place in September 2022 when the blockchain was transferred to the Proof-of-Stake consensus mechanism. This upgrade was named ‘The Merge.’ Since that moment, coin owners have been given the opportunity to provide blockchain security and earn rewards.

Is Ethereum staking still profitable?

The maximum supply of Ethereum is approximately 120.64 million ETH. According to Beaconcha.in (the open source Ethereum explorer), 33.9 million ETH is staked (26th March 2025), with over 1 million active validators in the network.

Ethereum validators typically earn an annual percentage yield (APY) ranging from approximately 2% to 4% for staking their ETH. For comparison, Cardano validators tend to earn approximately 2.66% in annual rewards.

Also, market experts say that Ethereum staking seems to remain a profitable venture, particularly when compared to traditional financial instruments like US interest rates. Ethereum staking yields are expected to exceed these rates, partly due to a general decrease in US federal fund rates and an increase in transaction fees on the Ethereum network, which contribute to higher staking rewards.

The amount of Ethereum staked has continued to grow, with a significant portion of the total supply now being used to secure the network, demonstrating sustained confidence in the profitability and stability of Ethereum staking.

Overall, the current market trends and economic forecasts suggest that Ethereum staking is likely to remain an attractive investment option.

How can you stake Ethereum with Coin Wallet?

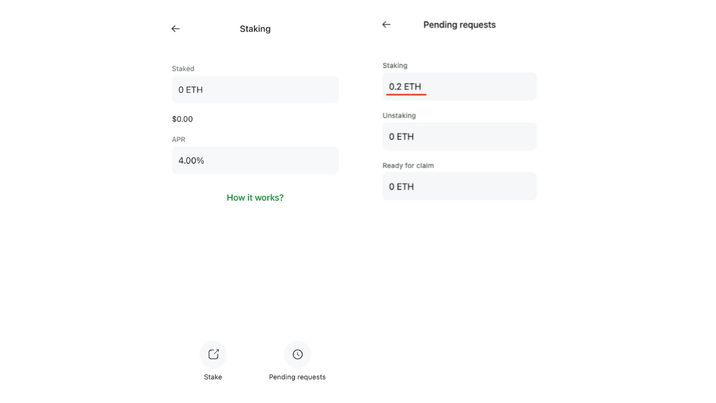

Ethereum staking starts with 0.1 ETH. If you want to stake more, you need to add another 0.1 ETH. Staking can take up to 5 days. Your staked Ethereum earns rewards every day. These rewards are automatically restaked and added to your staked balance. To use your staked funds, you may need to unstake and claim them, which takes about 5 days.

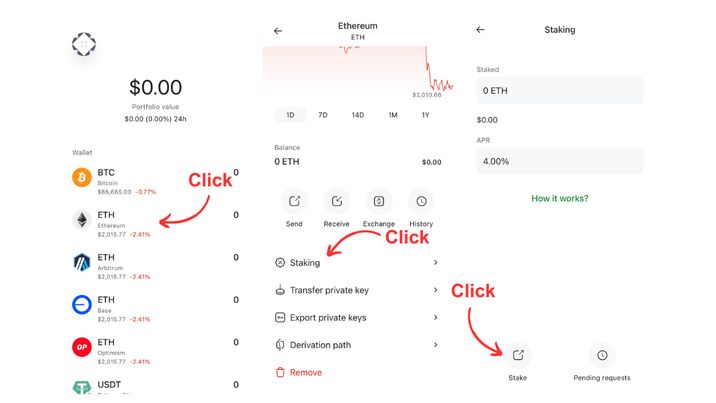

Step 1. Open Coin Wallet, select ETH, and then click on Staking.

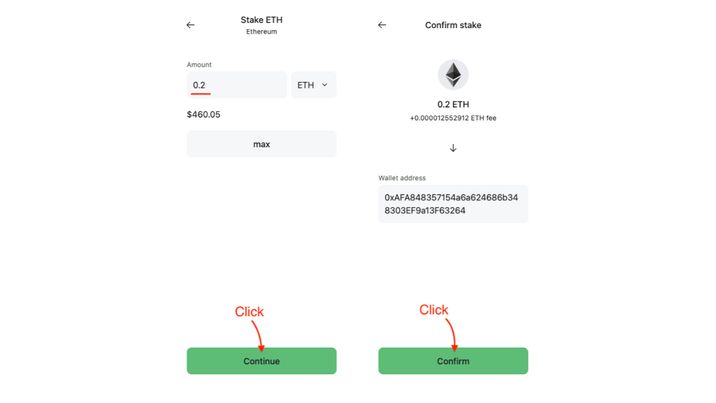

Step 2. Click on the ‘Stake’ button and choose the amount of ETH you want to stake and then confirm it.

Step 3. The amount of staked ETH will be visible on the ‘Pending requests’ page.

That's all for now! You have successfully staked Ethereum. To receive more information about how to unstake and claim your ETH, read our support article.