How to Trade Safely on Decentralized Exchanges (DEX)

How to Trade Safely on Decentralized Exchanges (DEX)

Recently, we launched Coin Wallet's exchange (DEX) — you can congratulate us 💚 How can you do that? Of course, by becoming a member of our warm crypto community and getting the Coin Wallet app in any way that’s comfortable for you.

This launch is a big new step into a decentralized space, while the crypto world around us is becoming more transparent and not anonymous at all.

Let us introduce our DEX crypto exchange and share some safety advice with you. They will probably be useful for you in order to keep your assets safe when you use any crypto trading platform.

In Short

- Decentralized exchanges (DEXs) let you trade crypto without intermediaries, giving you full control of your assets and privacy.

- Different DEX models — AMMs, order-book DEXs, and hybrid networks — offer distinct mechanics for pricing, liquidity, and execution speed.

- Trading on DEXs requires connecting a Web3 wallet and understanding how smart contracts, fees, and settlements work.

- With Coin Wallet’s new perpetual futures DEX, you can trade with leverage, enjoy CEX-like speed, and keep your funds securely in your self-custodial wallet.

What Is a Decentralized Exchange?

Decentralized exchanges (DEX) are crypto platforms working directly on a blockchain without a central operator. They are used for trading and exchanging crypto coins or other digital assets.

Every day, exchanges are becoming increasingly popular among those who value privacy and data anonymity. In addition, DEXs have a few important advantages.

The first one is that trading on DEXs happens without intermediaries or agents. The exchange doesn’t store funds or control access to them. Users always keep their funds in their own wallets, sign transactions with a private key, and all operations are recorded on the blockchain and verified by its nodes.

How Do Decentralized Exchanges Work?

The general principle of the operation of a decentralized blockchain platform is as follows:

- The user connects a Web3 wallet (Coin Wallet, MetaMask, etc.).

- They select a pair of tokens and the amount to exchange.

- The smart contract determines the price from the liquidity pool.

- The user signs the transaction.

- The blockchain confirms the transfer and settlement.

- The tokens are sent to the user's wallet.

However, there are 3 types of DEXs that have different workflows.

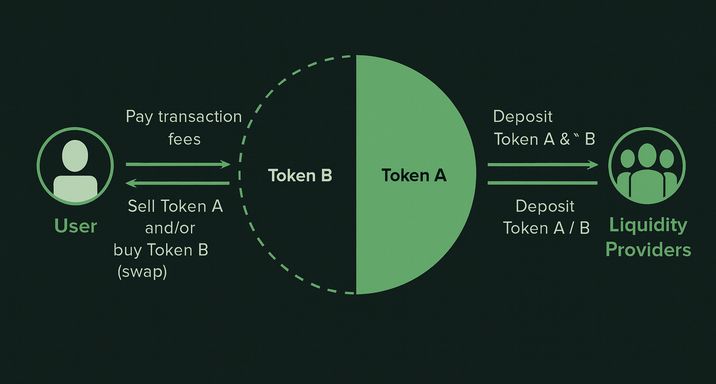

1. AMM (Automated Market Maker) is the most common type of DEX, for example, Uniswap, PancakeSwap, or Curve.

AMM is a smart contract that holds two types of tokens in one “shared wallet” — this is called a liquidity pool. In other words, a liquidity pool is a reserve of tokens used for the automatic exchange of cryptocurrencies. For example, a pool may contain 100 ETH / 300,000 USDC.

Tokens are deposited by regular users, known as liquidity providers (LPs). They deposit both tokens at once, for example, 1 ETH and 3,000 USDC (of equal value). In return, they receive commissions paid by traders.

The price is determined by a simple algorithm. Imagine that the pool is a scale. When many people buy ETH, that means they are giving USDC. There is less ETH in the pool, more USDC, and the price of ETH rises. If the opposite happens, the price falls.

In other words, the price changes automatically, depending on which tokens people add or remove.

Thus, the main principle of AMM is: the more tokens are taken, the more expensive it becomes; the more tokens are added, the cheaper it becomes.

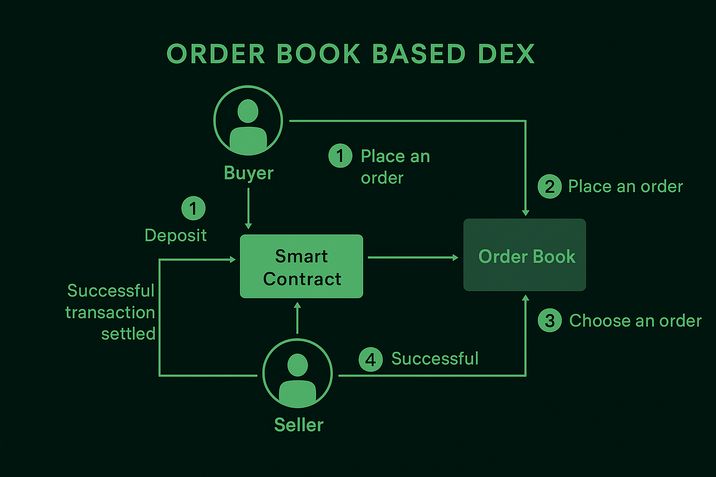

2. Order Book DEX is a traditional model used on most centralized exchanges and some DEXs.

Traders place limit orders themselves: for example, "buy 1 ETH for 1800 USDC" or "sell 0.5 ETH for 2100 USDC." These orders are entered into the order book.

When a matching order appears, the system (smart contract or decentralized matching engine) executes the transaction — the assets are transferred from the seller to the buyer. The funds remain in the users' wallets until the transaction is completed.

There are two approaches to implementation:

-

On-chain order book (OpenBook, Phoenix, Mango Markets) — all orders are stored directly on the blockchain, and all logic (placement, cancellation, matching) is performed through smart contracts.

-

Off-chain + on-chain settlement (dYdX v3/v4, Loopring DEX, 0x Protocol / Matcha) — orders are stored and matched outside the blockchain (for speed and gas savings), and the final execution of the transaction is recorded on-chain.

3. Hybrid DEXs mix two approaches where the network operates as a DEX, and the order book is part of the protocol (Hyperliquid, Sei Network, Injective).

The problem is that conventional blockchains are not suitable for fast trading, which is why hybrid exchanges appeared. Their network has a built-in order book mechanism. In other words, it is not a smart contract written on top, but the network protocol itself that can work with orders. At the same time, transactions are executed on-chain. That is, each trade is an on-chain transaction, but the chain is designed so that these transactions are processed instantly and do not require long confirmation times.

This is as close as possible to a centralized exchange in terms of speed, but it remains within the framework of DeFi. You also own your keys and coins.

Are Decentralized Exchanges Legal?

Decentralized exchanges (DEX) are legal to use in the US and EU, as access to such protocols is not prohibited for ordinary users. The main requirement is to declare income from trading and not to use services that are subject to sanctions. Regulatory risks mainly concern DEX operators and developers, as they may be subject to licensing and KYC/AML compliance requirements if they control the exchange's interface or infrastructure. For users, trading via Uniswap, Curve, dYdX, and other DEXs remains permitted.

What Is Coin Wallet's DEX?

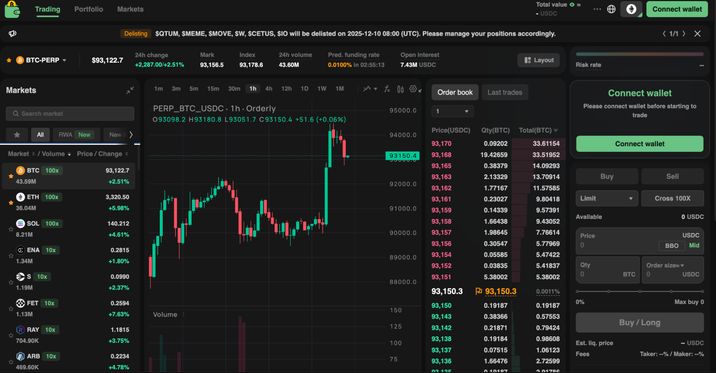

Coin Wallet DEX is a perpetual futures DEX and is built on the Orderly base. This means we use an order book + on-chain settlements — that is, it is similar to a centralized exchange in terms of mechanics, but with the advantages of decentralization: transactions and settlements are carried out through smart contracts.

A perpetual DEX is a decentralized exchange where perpetual futures are traded. These are contracts where you can open longs (betting on growth) and shorts (betting on decline) with leverage, but they have no expiration date — you can hold the position for as long as you want.

On Coin Wallet DEX, you can trade futures with leverage of up to 100x and earn on both the rise and fall of cryptocurrency.

In other words, a Perpetual Futures DEX is a decentralized analog of CEXs such as Bybit or Binance Futures, only without intermediaries and with funds stored in your wallet.

Do Decentralized Exchanges Have Fees?

Yes, DEXs have fees, and they depend on the platform — each crypto exchange has its own. For example, Coin Wallet DEX has:

- Maker Fee = 0%

This is a commission for makers — those who create liquidity by placing limit orders that enter the order book and await execution. If your order adds liquidity (enters the order book), then the commission = 0%. In other words, you pay nothing.

- Taker Fee = 0.05%

This is a commission for takers — those who take liquidity, i.e., place a market order or a limit order that executes immediately and thus remove volume from the order book. The commission = 0.05% means that you pay the exchange 0.05% of the transaction amount.

Do Decentralized Exchanges Require KYC?

No, DEXs don't require KYC because they don't use intermediaries or agents. On the one hand, it's a great advantage because it allows you to maintain your privacy. On the other hand, you have to be ready to take some risks.

Key Tips for Safe Trading on Perpetual DEX Platforms

This is not financial or investment advice. All trading decisions should be made independently and with full awareness of the risks involved. Always use common sense and exercise caution when dealing with money in any form.

1. Maintain a large margin buffer

Avoid getting close to liquidation levels. Perpetual DEX platforms tend to liquidate more aggressively due to oracle-based pricing and higher volatility.

2. Monitor the funding rate

Funding payments can eat into your profits. If the rate is extremely positive or negative, it usually signals a crowded market.

3. Always use stop orders

Set your stops in advance. Relying on manual exits is dangerous — especially on fast-moving DEX markets.

4. Avoid trading during major news events

Volatility spikes, liquidity dries up, and oracle delays can cause unexpected liquidations.

5. Scale into positions gradually

Entering in small batches helps avoid bad entry prices and reduces the impact of sudden market wicks.

6. Trade with a clear plan

Before opening a position, know your profit target, max loss, conditions for adding to the trade, and your exit strategy.