How to Use the Crypto Fear and Greed Index to Outplay the Market

Why Do Investors Buy at the Top and Sell at the Bottom?

In the world of investing, there is a paradox: most people know the rule "buy low, sell high," but in practice, they do the exact opposite.

When the market is growing and green candles are hitting all-time highs, the investor is seized by the fear of missing out (FOMO). He buys. When the market falls and the portfolio turns red, panic sets in. He sells, locking in a loss.

As we all know, the cryptocurrency market, due to its youth and volatility, consists of about 90% emotion. Winners here are not those who try to guess price movements every minute, but those who can read the collective emotions of the crowd and act against them. That is why, the main tool for measuring this emotional background is the Crypto Fear & Greed Index.

It is a kind of market thermometer that shows when investors are overheated with euphoria and when they are frozen with horror. Let us see how it works in reality.

Disclaimer: The information presented in this article is for educational purposes only and does not constitute individual investment advice or a call to buy or sell any assets.

Cryptocurrencies are a high-risk asset class; investing in them can lead to a total loss of funds. Always do your own research (DYOR) before making financial decisions.

What is the Crypto Fear & Greed Index

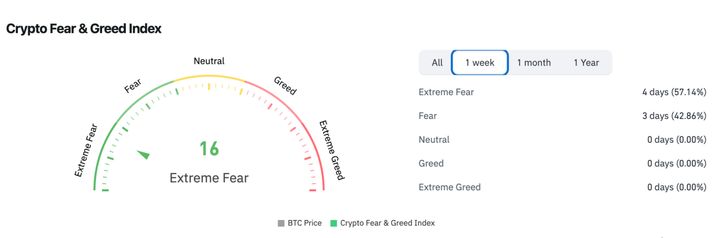

Visually, the index is a simple speedometer with a scale from 0 to 100. This number is the essence of the current mood of Bitcoin and major altcoin market participants.

The scale is divided into four understandable zones. Values from 0 to 24 signal "Extreme Fear": investors are in panic, the news background is negative, and assets are being sold at any price.

The zone 25–49 indicates simple "Fear" or caution. The middle of the scale, around 50, speaks of neutrality and uncertainty.

When the needle goes past 55, the "Greed" zone begins. The market comes alive, and optimism grows.

Values above 75 are "Extreme Greed." At this moment, social networks are overflowing with promises of eternal growth, and newcomers are massively opening exchange accounts, hoping for easy money.

Mechanics: What Moves the Needle?

Many mistakenly believe that the index is based only on the Bitcoin price. Actually, it is a complex algorithm analyzing data from several independent sources to eliminate random noise.

The first and main factor is volatility. The index compares current price fluctuations with average values over the last 30 and 90 days. Sharp, atypical spikes are usually interpreted as a sign of fear.

The second important component is market momentum and trading volume. High buying volumes in a growing market push the needle toward greed.

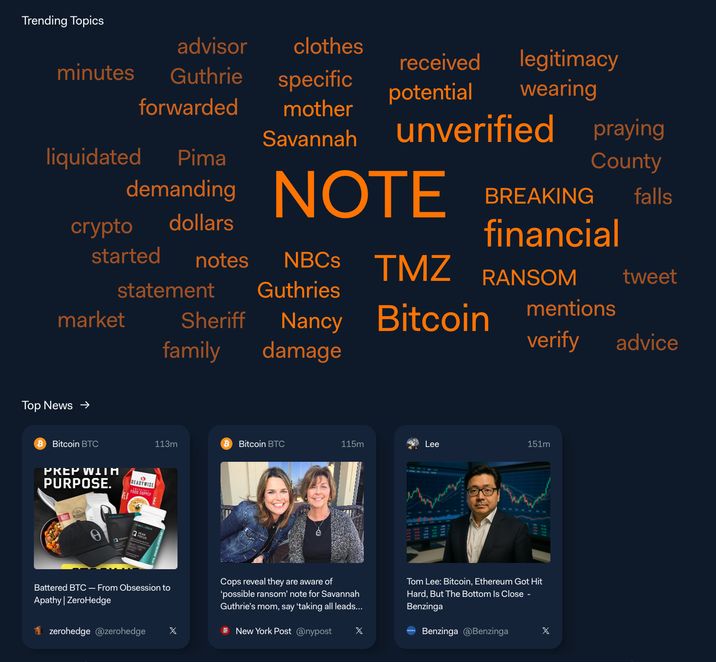

However, dry exchange figures are not everything. The algorithm actively analyzes social media (specifically X ex-Twitter and Reddit), counting the number of hashtags and the tone of crypto asset mentions.

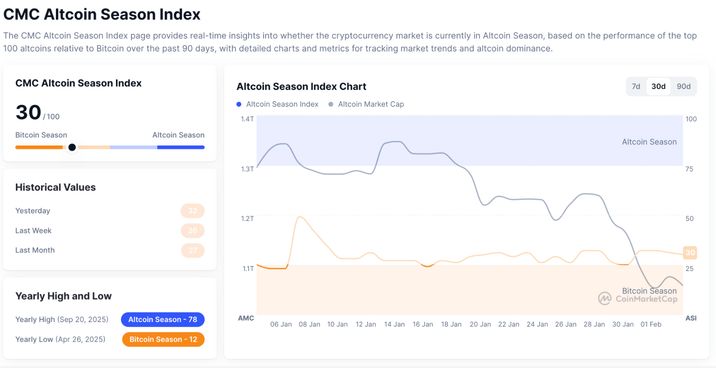

Bitcoin dominance is also taken into account: usually, when investors are scared, they flee from risky altcoins to the "safe haven" of Bitcoin, increasing its dominance. Conversely, a decrease in dominance often signals "altseason" (altcoin season) and growing greed.

Read more: What Is an Altcoin Season and How Can You Use It for Making Profit?

Google Trends data completes the picture—analyzing search queries like "Bitcoin crash" or "buy crypto."

Buffett’s Golden Rule in the Crypto World

Warren Buffett may be skeptical about Bitcoin, but his main principle works here even better than in the stock market: "Be fearful when others are greedy, and be greedy when others are fearful."

The psychological trap is that people feel comfortable buying when everyone around is rejoicing at growth. This gives a false sense of security.

The Fear and Greed Index helps break this pattern by offering counter-arguments:

- Extreme Fear often means that the asset is oversold and irrationally cheap.

- Weak hands have exited the market, and this is a potential entry point.

- Extreme Greed signals overheating. When every taxi driver starts giving advice on buying cryptocurrency, a correction is usually just around the corner.

Trading Strategies Based on the Index

Using the index should not be blind following the needle; however, it can become the basis for making informed decisions.

- Contrarian Strategy (Bottom Fishing) implies accumulating positions at moments when the crowd is in panic. Historically, buying Bitcoin during periods when the index fell below 10-15 points brought the best returns over the long run.

It is psychologically difficult—to buy when "blood is spilling"—but this is exactly what distinguishes a professional from an amateur. - Profit Taking Strategy (DCA Out) helps fight one's own greed. When the index enters the 75+ zone, it is wise not to wait for the "peak," which is impossible to predict, but to start selling the asset in parts. The higher the greed, the larger the part of the position you can close. However, it is important to remember about traps. There is a concept called "dead cat bounce"—a short-term rise in a falling market.

At such moments, the index may briefly show greed, misleading you before the price crashes again. Therefore, the index must always be confirmed by other data.

Main Mistakes and Limitations

The Fear and Greed Index is not a magic ball. It has critical limitations that every investor is obliged to know.

First, it is a lagging indicator. It reacts to what already happened today or yesterday. It does not predict tomorrow.

Second, markets can remain irrational longer than you might expect. During strong bull trends (like in 2017 or 2021), the index can stay in the "Extreme Greed" zone (80+) for months. If you sell assets immediately upon the first entry into this zone, you can miss a significant part of the profit.

Also, the index is powerless against "black swans"—sudden events like the bankruptcy of a major exchange, harsh regulatory bans, or geopolitical shocks. The algorithm simply does not have time to account for their instant impact.

What Platforms Provide Real-Time Crypto Fear and Greed Index Data?

1. Alternative.me (Primary Source)

This is the specific site that created the original Crypto Fear & Greed Index, cited by all global media from Bloomberg to CNBC. To see the canonical value of the index. The site also shows the history of changes (yesterday, last week, last month), which helps track dynamics.

2. Coinglass (Greed Analysis via Derivatives)

The American market is heavily tied to futures and options. Coinglass shows data on Open Interest and Funding Rates. If the fear index shows "Greed," but on Coinglass you see record funding rates (longs are paying shorts)—this is a sure sign of an overheated market and an imminent "squeeze" (a sharp price drop to wipe out leveraged traders).

3. Bitcoin Magazine Pro (Fundamental Metrics)

It offers free charts that overlay psychology onto blockchain mathematics. Pay attention to the NUPL (Net Unrealized Profit/Loss) indicator. It works like an on-chain version of the fear index: it shows whether the market is in a state of capitulation (fear) or euphoria (greed), based on the real profitability of wallets, not just surveys.

4. LunarCrush (Social Storm)

Artificial intelligence that analyzes millions of posts on social media (X/Twitter, Reddit, YouTube). It allows you to see a spike in mentions of a specific coin before it rises in price. This tool also helps distinguish organic interest from paid hype.

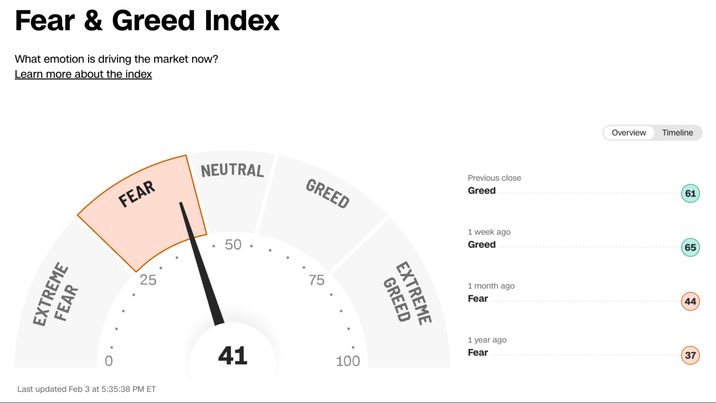

5. CNN Fear & Greed Index (For Macro Context)

This is the original index for the stock market (S&P 500), from which the crypto version was copied.

The crypto market correlates more and more with the US stock market. If panic (Extreme Fear) reigns in traditional markets, it is unlikely that Bitcoin will start an independent rapid rise at that moment.

6. Binance Fear & Greed Index (Native Platform Tool)

As the world’s largest cryptocurrency exchange, Binance has developed its own sentiment tracker to provide users with a comprehensive view of market psychology directly within its ecosystem. It is particularly useful for active traders who want to see how the "crowd" on the world’s most liquid platform is feeling.

Frequently Asked Questions

How Often Does a Crypto Price Change?

Unlike traditional stock markets that operate on a fixed schedule, the cryptocurrency market is active 24/7, 365 days a year. Prices fluctuate constantly—often every second or millisecond—driven by real-time supply and demand across global exchanges. This continuous trading environment is what contributes to the high volatility often seen in digital assets.

What Does the Fear and Greed Index Mean?

The index is a sentiment barometer that quantifies the emotions of market participants on a scale from 0 to 100. A low score (Fear) suggests that investors are worried, which can lead to an oversold market and potential buying opportunities. A high score (Greed) indicates that the market may be due for a correction because investors are becoming overly optimistic or “irrational.” It serves as a tool to help you trade based on data rather than impulses.

Where Can I Find Historical Charts of the Crypto Fear and Greed Index?

Several reliable platforms provide long-term historical data for the index: Alternative.me, Look Into Bitcoin, Coinglass, TradingView.

Which Companies Provide API Access to the Crypto Fear and Greed Index?

For developers and traders looking to automate their strategies, several providers offer API access: Alternative.me API, Coinglass API, CoinAPI.io, CryptoCompare.