Perpetual DEX Crypto Explained: Best Platforms for Low Fees and High Leverage

As of 2025, perpetual decentralized exchanges have become a major force in crypto markets, with on-chain perpetual trading volumes surpassing $1 trillion per month globally, reflecting explosive adoption among DeFi users and traders.

In this rapidly evolving landscape, identifying the best perpetual DEX for your needs means comparing factors like liquidity depth, fee structure, and user experience. Whether you’re a leverage trader seeking tight spreads or a DeFi enthusiast exploring perpetual DEX crypto opportunities, this guide highlights the top perpetual DEX platforms that stand out in 2025.

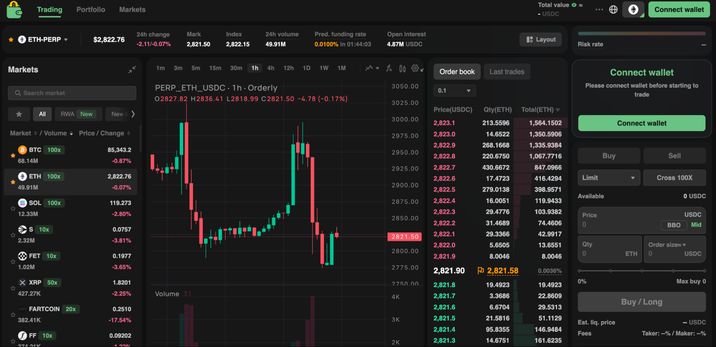

Coin Wallet DEX — the Perpetual DEX with 100× Leverage

Coin Wallet DEX is a new entrant in the decentralized exchange space, offering a perpetual DEX with integrated support for its native Coin Wallet.

Coin Wallet DEX combines the mechanics of a centralized exchange (order book, fast order matching) with the security and transparency of DeFi. In practice, this means that orders are matched via an order book, just like on traditional exchanges, while trades, transactions, and collateral custody are handled on-chain.

On Coin Wallet DEX, you can trade futures with leverage of up to 100× — one of the highest levels available among decentralized platforms. Here is how it works: you can open long and short positions on major cryptocurrencies, significantly increasing your market exposure. These positions are perpetual (no expiration date), meaning you can hold them for as long as you like while paying funding fees. A 100:1 leverage ratio, for example, allows you to control a $10,000 position with just $100 in collateral.

Read more: How to Trade on Coin Wallet PERP DEX

Coin Wallet DEX stands out by not holding user funds in a centralized manner. As a result, there is no risk of a server breach compromising deposits. All settlements are executed via smart contracts with verifiable code. Users retain full control over their private keys, which means that even if the frontend is compromised, attackers cannot withdraw your assets.

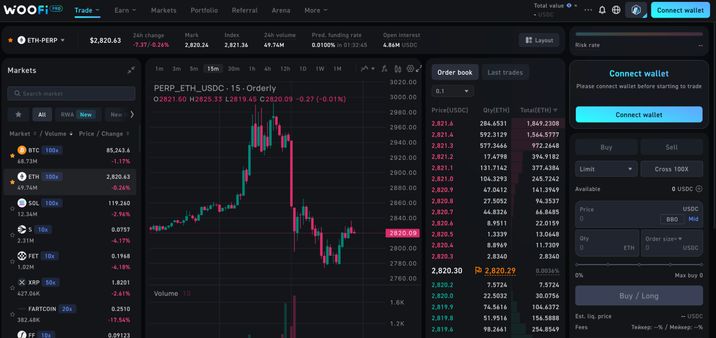

WOOFi Pro Is the First PERP EVM-based Project on Orderly

The exchange aims to replicate the trading experience of a CEX while preserving self-custody of funds.

“The only major difference between a CEX is that you don’t KYC and you self custody the funds. The way it’s meant to be” the developers note.

WOOFi Pro is a long-time partner of Orderly and the largest broker in the network as of early 2024, with cumulative trading volume exceeding $1.4 billion. Its infrastructure has been tested under heavy load: the platform consistently generates $50,000–$100,000 in monthly revenue, earning a share of fees as an Orderly builder.

Security is supported by audits of Orderly (by Zellic and others) and by WOO’s strong reputation. The project is backed by major investors, including Kronos Research and Binance Labs, and has operated in the CeFi space since 2019.

WOOFi Pro also offers up to 20x leverage and more than 18 trading pairs, including BTC, ETH, major altcoins, and even ARB (Arbitrum). Trading is completely gasless across all supported networks because Orderly covers transaction costs, which clearly sets WOOFi Pro apart from other on-chain competitors.

As a result, users often highlight the low fees. The base taker fee is around 0.025%, but the effective cost is lower thanks to loyalty programs, including the return of 80% of revenue to WOO stakers. For makers, trading is nearly free, which attracts large volumes and helps maintain tight spreads.

As CoinGecko analysts have noted, WOOFi Pro consistently ranks among the most effective Orderly builders. This is supported by the strong loyalty of the WOO community and the exchange’s well-designed economic model.

Read more: List of Best Decentralized Exchange (DEX) 2025

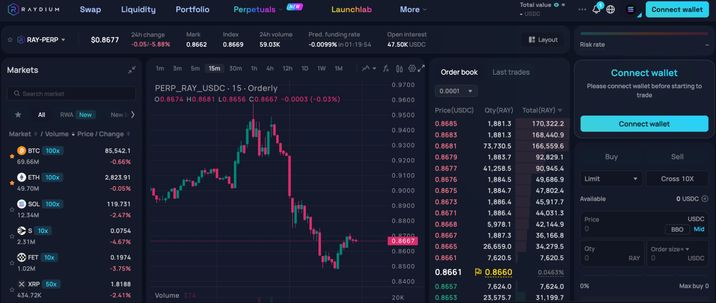

Raydium Perps — a Futures King on Solana

Raydium is a legendary DEX on Solana, well known for its AMM and the Serum order book. In January 2025, Raydium integrated Orderly’s infrastructure and launched the first perpetual DEX on Solana with aggregated cross-chain liquidity.

According to company representatives, this step allowed the Solana ecosystem to catch up in perpetual derivatives: “Despite dominating spot trading, Solana has lagged behind EVM networks when it comes to perps due to a lack of liquidity and optimized infrastructure.”

The Raydium Perps interface and smart contracts have been audited and are built on Solana’s battle-tested architecture, which supports the reliability of the service. Execution quality is also proven by results: zero outages under heavy load, with Orderly processing up to $2 billion per day without downtime.

All trades are executed with no network fees. Orderly handles settlement, which is unusual for Solana DeFi, where transaction fees, while low, have traditionally existed. Traders can use leverage of up to 50x, and system stability is backed by a shared margin collateral pool (OmniVault) holding more than $50 million in USDC, USDT, and ETH across the network.

QuickSwap (Falkor) — Polygon Perpetuals and Expansion to Multichain

QuickSwap is the leading DEX in the Polygon ecosystem, best known for its liquidity pool swaps. In spring 2024, the team launched QuickPerps: Falkor, a perpetual futures platform on Polygon PoS. The exchange offers strong features, including zero gas fees and up to 50x leverage for traders.

QuickSwap Perps runs on battle-tested Orderly infrastructure and has undergone an audit. While the Polygon network is already known for low fees, QuickSwap went a step further by fully subsidizing gas costs — users do not pay anything for order placement or execution.

This is made possible through the integration of a “vault” contract. Traders deposit USDC into the vault on Polygon, and the funds automatically become available in the Orderly Network for cross-chain trading. This architecture eliminates bridge-related risks: “no bridges are required when depositing from Polygon to Orderly, which is significantly safer than alternative DEX models.”

Read more: How to Trade Safely on Decentralized Exchanges (DEX)

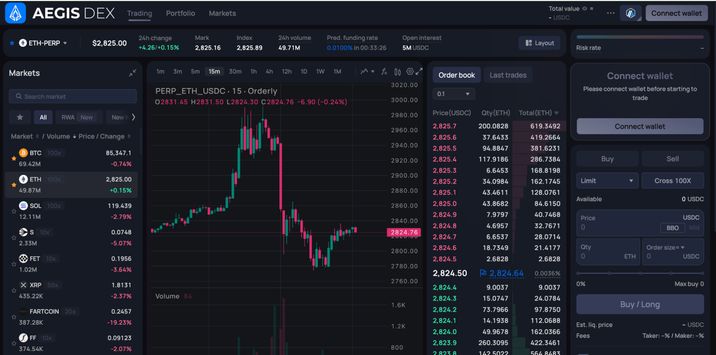

Aegis DEX — a New Entrant with Real Yield and the YUSD Stablecoin

Aegis DEX is one of the first DEXs built using the Orderly One platform in fall 2025. The exchange attracted attention with a distinctive concept: a BTC-backed stablecoin, YUSD, and a promise of real yield for liquidity providers and traders. Aegis positions itself as a trading venue focused on capital efficiency and real on-chain returns.

Aegis’s early success signals strong market trust. Within just 10–12 days after launch, the DEX ranked second among all Orderly-based exchanges by trading volume. According to Orderly data, by October 11, 2025, Aegis had surpassed $200 million in cumulative volume — an impressive result for a new platform. Such growth is difficult to achieve without trader confidence in the platform’s security.

The Aegis team has not yet been publicly disclosed, but it is known that the project is integrated with a number of institutional players. The website mentions partners from the custody, wallet, liquidity provision, and even auditing sectors.

In terms of functionality, Aegis DEX is similar to its peers: multi-chain deposits (USDC, USDT, YUSD), gasless trading, leverage of up to 20–25x (with potential expansion later), and all major trading pairs. However, Aegis may focus on specific markets, such as YUSD-denominated pairs or carry trade strategies.

Frequently Asked Questions

What Is Perpetual DEX?

A perpetual DEX is a decentralized exchange that allows users to trade perpetual futures contracts directly on-chain without intermediaries. It enables leverage trading while preserving self-custody of funds and typically operates without expiration dates.

Which Perpetual DEX Platforms Offer the Lowest Trading Fees?

Platforms built on shared liquidity layers such as Orderly-powered DEXs often offer some of the lowest fees. Gasless trading, maker fee rebates, and loyalty or staking programs can reduce effective trading costs close to zero.

How Do Perpetual Decentralized Exchanges Manage Liquidity Pools?

Most perpetual DEXs use shared liquidity pools or unified margin vaults that aggregate capital from multiple sources. This approach improves capital efficiency, reduces slippage, and allows liquidity to be reused across markets and chains.

What Are the Security Features of Top Perpetual DEX Platforms?

Leading perpetual DEXs rely on audited smart contracts, self-custodial fund management, and battle-tested blockchain infrastructure. Additional protections include isolated margin systems, risk engines, and transparent on-chain settlement.

How to Transfer Funds from a Wallet to a Perpetual Decentralized Exchange?

Users typically connect their wallet and deposit supported assets into a smart contract or vault. In some advanced setups, funds are deposited on one chain and become available for trading across multiple networks without using traditional bridges.