The Best AI Tools for Crypto Investments in 2025

Crypto investing is often considered more complex than traditional investing — and that’s largely true, as it follows its own set of rules. Unlike traditional financial instruments, cryptocurrencies tend to be more volatile and are largely unregulated by governments or legal systems. Moreover, crypto investing involves both high risks and the potential for high returns. To avoid mistakes and potential losses, many crypto investors use AI tools. These tools are designed to automate trading strategies, analyze market data, and help manage portfolios.

What is Vibe Crypto Investing

Vibe crypto investing — it’s when you do what the AI tells you to do: buy or sell. No second-guessing, just vibes and algorithms. You trust the bot more than your gut, ride the waves of market chaos, and hope the machine knows better. It’s part intuition, part automation, and all-in on the wild ride that is crypto.

In this article, we will talk about some well-known AI tools for vibe crypto investing — and find out why they are not a silver bullet.

3commas.io

This is an automated trading platform that offers bots for strategies like Dollar Cost Averaging (DCA) and Grid trading. It supports integration with over 15 exchanges and includes portfolio management features.

Many users consider it a great option for comprehensive automated trading and portfolio tracking — especially if you are tired of checking your charts every night. It also features a Smart Trading Terminal that lets you connect to over 20 exchanges to monitor real-time price changes.

Price:

- $0/month — Trial version

- $49/month — Pro

- $79/month — Expert

- Custom plans available

Cryptohopper

Cryptohopper is a cloud-based trading bot that lets you customize strategies and access marketplace trading signals. It supports arbitrage, market making, and social trading.

Its main advantage is the ability to learn and copy strategies based on other traders’ experience. It also integrates with major exchanges like Binance, Coinbase Pro, and Kraken.

Price:

- $0/month — Trial version, Pioneer

- $29/month — Explorer

- $69/month — Adventurer

- $129/month — Hero

Intellectia.ai

This is an advanced AI trading bot that uses machine learning to optimize strategies in real time, constantly adapting to market changes. Unlike rigid algorithmic strategies, it learns from past trades and market sentiment to improve its decisions over time.

The platform’s creators claim that Intellectia.ai uses machine learning models like XGBoost and multilayer perceptron (MLP) networks to predict market trends.

Price:

- $14.95/month —Basic

- $29.95/month — Pro

- $49.95/month — Max

- $89.95/month — Expert

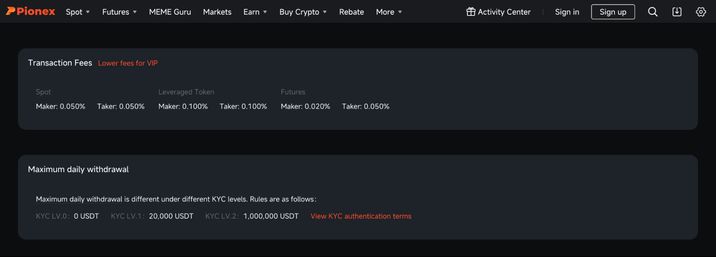

Pionex

This is a trading platform with 16 built-in free bots, including Grid Trading, Arbitrage, Trailing Buy/Sell, and DCA bots — many of which are designed to profit in sideways markets. What sets it apart is that it charges no commissions for bot transactions.

Price: unlike most competitors, Pionex does not require a separate subscription for bot usage, making it one of the most accessible automated trading solutions. The platform does charge transaction fees, but they are considered quite reasonable.

Bitsgap

Bitsgap is an all-in-one platform for automated cryptocurrency trading that connects to over 15 leading exchanges through a single interface. It offers various trading bots, including GRID and DCA, to automate strategies and take advantage of market fluctuations.

The platform also provides a smart terminal for manual trading, technical analysis tools, and portfolio management features, making it a strong option for traders who want to optimize performance and streamline their operations.

Price:

- $28/month — Basic

- $65/month — Advanced

- $142/month — Pro

Why AI Tools Aren’t a Silver Bullet

Despite the appeal of automated AI tools for cryptocurrency trading, it’s important to keep the following in mind:

- Market volatility: The crypto market is known for its unpredictability. Not even the most advanced AI algorithms can guarantee accuracy during sharp price swings.

- Technical risks: Software failures, connection issues with exchanges, or delays in order execution can all lead to financial losses.

- Setup complexity: Some bots require in-depth knowledge to set up and optimize effectively, which can be challenging for beginners.

- Security: Giving bots access to your exchange accounts via API involves risks. It’s important to make sure the tool you use is reliable and secure.

In conclusion, AI tools can be a valuable addition to your trading strategy — but they shouldn’t be relied on entirely. It's essential to do your own research, stay informed about market trends, and use automation with caution.