An In-Depth Look Into UniSwap (UNI) - What is UNI’s Future?

Uniswap (UNI) is a decentralized exchange built on the Ethereum blockchain and powered by a series of smart contracts. Users who engage in Uniswap are rewarded with a share of the transaction fees and freshly created UNI tokens, incentivizing them to maintain the overall liquidity of the exchange.

The Uniswap protocol is one of the most widely used decentralized finance (DeFi) protocols. It uses a wide variety of crypto assets, including its native UNI coin, to provide a service that is essentially equivalent to a regular exchange – but with the added benefits of decentralization.

Do you want to learn more about Uniswap but aren't sure where to start? You have come to the right place. This article will touch on the topic of what UniSwap really is, how it works, its price history, roadmap, as well as future price predictions. By the end of it, you will know all you need to know about Uniswap and get you ready to start trading using the most user-friendly platform available.

What is UniSwap (UNI)?

Uniswap (UNI) is a decentralized, Ethereum-based trading mechanism. More specifically, it's an automated liquidity mechanism. To make transactions, there is no need for an order book or a centralized party compared to other conventional trading systems. Uniswap allows users to trade without having the need for any middlemen, therefore providing a high level of decentralization and resilience to censorship.

The system is a free and open-source program. On the Uniswap GitHub, you’re able to see it for yourself. However, without an order book, how do trade actually take place? Uniswap manages to accomplish just this. It operates on the basis of a paradigm in which liquidity suppliers are able to create and contribute to liquidity pools. This method makes use of a decentralized pricing system to smooth out the depth of the order book.

We'll go through how it works in detail further down. For the time being though, keep in mind that users can exchange between ERC-20 tokens without the usage of an order book. With UniSwap, there is no listing procedure since the Uniswap protocol is decentralized. To put it simple, any ERC-20 coin may be created as long as traders have access to a liquidity pool. As a result, there are no listing costs charged by Uniswap. In this way, the Uniswap protocol serves generally as a public good.

Hayden Adams designed the Uniswap protocol in 2018. But it was Ethereum co-founder Vitalik Buterin who initially outlined the underlying technology that inspired its implementation and is regarded as the actual founder of UniSwap.

How UniSwap (UNI) Works?

Uniswap is made up of two types of smart contracts; one for the "Exchange" and another for the "Factory." When specific criteria are met, these are automated computer programs that are directed to perform specified duties. The factory smart contract is used for the purpose of introducing new tokens to the platform in this case, while the exchange contract handles all token exchanges, or "trades."

Automated Liquidity Protocol

Uniswap uses an automated liquidity protocol to tackle the liquidity issue of centralized exchanges. This is accomplished by motivating those who trade on the exchange to become liquidity providers (LPs). UniSwap users pool their money to build a fund that is used to execute all of the platform's deals, and then are compensated through transaction fees depending on the size of their stake in the pool.

Each token mentioned, such as UNI, has its own pool to which users can contribute, and the prices for each token are set by a computer-based algorithm. A buyer or seller does not have to wait for the opposite party to complete their part in order to conclude a transaction using this method. Instead, they may execute any deal at any point at a known price as long as the pool has enough liquidity to support it.

Each liquidity provider receives a token that symbolizes their staked commitment to the pool in return for putting up their cash. For instance, if you contributed $10,000 to a liquidity pool with a total value of $100,000, you would in turn, receive a token representing 10% of the pool's value. This token can then be exchanged for a portion of the trading commissions. Every trade that takes place on the platform is charged a fixed 0.30 percent fee by UniSwap, which is then automatically sent to a liquidity reserve.

When a liquidity provider decides to withdraw their stake from a pool, they get a percentage of the total fees from the reserve based on the amount they staked in that pool. The token they got, which keeps track of how much stake they owe, is then also thrown away.

Following the Uniswap version 2 (V2) update, a new protocol fee was implemented that can be switched on or off by the community and transfers 0.05 percent of every 0.30 percent trading charge to a UniSwap fund that will be used to finance future development. This fee option is now disabled; however, if it is enabled in the future, liquidity providers will begin to receive 0.25 percent of pool trading fees.

UniSwap (UNI) Price History

For the past few months, the price has been parabolic for UNI, as has the whole crypto market. Since UniSwap is introducing the third edition soon, the rate is projected to rise in the near future (Uniswap V3). Users on the TradingView site, who are in charge of the UniSwap technical research, anticipate that the UNI token will be among the top five cryptocurrencies this upcoming summer.

According to Coinmarketcap, Uniswap debuted in the crypto market on September 17th, 2020 with a trading price of $2.94. After being listed on numerous exchanges across the world, the price skyrocketed to $6.96 just two days after its initial launch. Surprisingly, UNI fell to $3.98 by mid-September before rebounding to $5.02 by the end of the month.

Bears later dragged the market down, and the price fell to $2.57 in early October 2020. UNI continued to trade between $2 and $3 until the end of October, with minor fluctuations. Due to tremendous selling pressure, UNI plummeted below $1.80 by early November. Then, by mid-November, the price had achieved its resistance level and had held at $3 with little swings until December. By the end of 2020, the coin was priced at an average of $4.62.

What is the Future Of UniSwap (UNI)?

There is no set timeline or roadmap for the UniSwap project. The Uniswap Team will continue along the path of platform decentralization as they have up until now, attempting to improve it as they go along. We may expect Uniswap V3 to be built in the near future, with the hopes of greatly increasing the protocol's flexibility and capital efficiency.

The Uniswap team intends to release the V3 version, according to their official website. The goal for V3 is to substantially enhance the AMM experience for both swappers and liquidity providers that drove the development of this version. The team's primary goal is to overall address existing concerns such as capital efficiency and slippage.

The team also plans to improve the general usability of the UniSwap interface. On top of this, the team intends to provide solutions such as d reduced transaction costs, reduced latency trading, and faster settlement. If we sum up all these characteristics, it appears that the V3 version will address the issue of excessive transaction fees as well as other significant issues that they faced until now.

The current token supply of UniSwap (UNI) is 1,000,000,000. Over the period of four years, all of these UNI tokens will be entirely available. UniSwap will adopt a 2% annual inflation rate after four years, once all of these tokens have been distributed, with the aim to preserve network involvement.

UniSwap community members had gotten 60% of the 1 billion UNI token supply via airdrop (ETH addresses that had actively traded with the UniSwap protocol). According to their four-year strategy, the remaining 40% will be divided among UniSwap team members, investors, and advisers.

UniSwap (UNI) Price Predictions

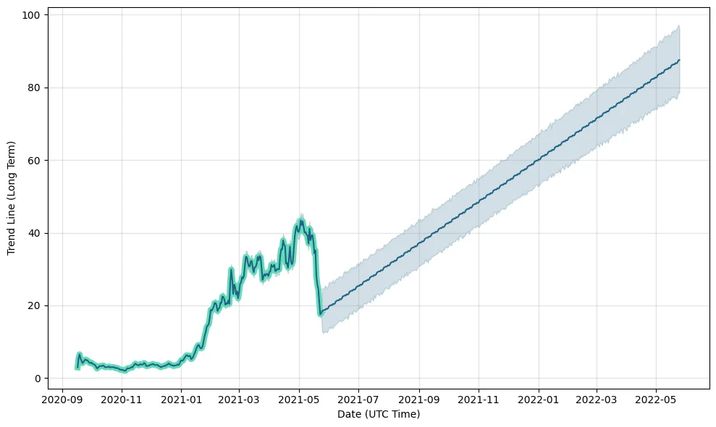

Let’s take a look at what experts have to say about the price of UNI in the upcoming years. TradingBeasts forecasts that the currency will trade between a high of $45.49 and a low of $30.23 in 2021, with a change of 16.31% and an overall average price of $36.59. The UNI token will trade at an average of $40.79 in 2022, fluctuating between a high of $59 and a low of $47.7, representing a 55.06% change.

According to TradingBeasts, the UNI token will lurch between $47.08 and $70 in 2023, averaging $55.8 in the meantime, meaning an overall price shift of 84.92%. TradingBeasts predicts UNI to fluctuate between a high of $77.95 and a low of $52.77 in 2024, with an average price of $62.96 and a price change of 108.53%.

Coinpedia notes that the trading price of UniSwap in the beginning of 2021 was $4.97. As the trend began to improve, UNI began to recover. On May 3rd, UNI effectively set a new all-time high of $44.97, according to Coinmarketcap. It may potentially go higher if certain enhancements to its protocol are made, and the price might even grow month after month. UniSwap might be worth $75 by the end of 2021, according to Coinpedia.

UniSwap may start off the year 2022 with a cost of $78, predicts Coinpedia. If the market becomes bullish, the price might rise dramatically. Marketers may be interested in UniSwap since it makes it very simple to trade money. Coinpedia forecasts UniSwap to be worth roughly $180 by the end of 2022.

UniSwap's user base will also expand throughout the next five years. The team at UniSwap may choose to focus on newer projects in order to improve its protocol and make it more user-friendly. If the bulls gain dominance over the bears, the price might rise to new heights. As it produces liquidity, it may also attract additional investors. By the end of five years, Uniswap might be worth $300, according to Coinpedia.

The UniSwap exchange is a beneficial investment, according to DigitalCoinPrice, and its price might reach $52.89 per token by the end of 2021. By the end of 2023, the price is expected to rise to $72.74, and by the end of 2025, it may soar to $104.66, predict the analysts at DigitalCoinPrice. According to LongForecast, by the end of 2021, the price of UNI might range from $58.46 to $67.26. UniSwap might go as high as $76.89 in the future according to LongForecast. Additionally, the UNI is expected to reach $250 by 2026, according to Walletinvestor, and will expand by more than 300% in the meanwhile.

According to the technical analysis at RippleCoinNews, the UNI will trade between the range of $30.76 and $50.24, with an average price of $40.86 for the year 2021. UNI is also expected to fluctuate between a low of $60.90 and a high of $70.99 in 2022, with an average price of $65.74. UniSwap is expected to fluctuate between $80.46 and $100.97 in the year 2023, with an average of $85.9, according to RippleCoinNews.

Conclusion

UniSwap is a cutting-edge concept that has brought the crypto industry's most popular decentralized exchange (DEX). When compared to other centralized exchanges, UniSwap offers a number of advantages and benefits to traders. There are no listing fees or native tokens required by UniSwap, and its decentralized exchange has one of the lowest prices for gas. This project is entirely open-source and permissionless, which implies that anybody may construct an ERC market, promoting overall decentralization.

Furthermore, the upcoming Uniswap V3 has the potential to reshape the DeFi ecosystem and become a powerful rival for other prominent exchanges if it can resolve significant concerns such as gas costs and slippage.