What is Binance Coin? - Everything You Want to Know About BNB

The world of cryptocurrencies is expanding each day as new cryptocurrencies are launched daily. The crypto bull run has not only enabled people to make profits but has also increased the fame of cryptocurrencies recently.

If one wants to invest in cryptocurrencies, the easiest way to do it is through crypto exchanges. One of the most prominent crypto exchanges is Binance. This exchange has its native cryptocurrency, the Binance Coin (BNB).

Binance Coin is becoming one of the world’s biggest cryptocurrencies, outperforming many other cryptocurrencies that existed before BNB. Currently, it sits as the third biggest cryptocurrency in the world based on market capitalization, being behind Bitcoin (BTC) which is the first, and Ethereum (ETH) as the second.

While this ranking would suggest that BNB is less likely to fail and can outgrow its previous price records, it is important to analyze in-depth every aspect of this cryptocurrency before deciding to invest in it. This analysis would require a look at the background of BNB, the way it works, its price history, as well as the future goals of this massive cryptocurrency.

What is Binance Coin (BNB)?

Binance Coin was created by Chanpeng Zhao in China, who is also the founder of the Binance exchange. It was launched 11 days before the Binance exchange and was released in 2017 through Initial Coin Offering (ICO). Initially, Binance Coin was an ERC-20 token.

These tokens are based on the Ethereum network and are used to complete the many services that the Ethereum network offers, such as transactions or running decentralized applications (dApps). When the Binance Chain mainnet was released in April 2019, these ERC-20 BNB tokens were converted to BEP BNB tokens that would serve on this Binance Chain mainnet and no longer be of use for the Ethereum network.

These BEP BNB tokens have many functions on the Binance Chain mainnet. These services could be transactions, utility (serving as fees for running services), as well as fueling the Binance exchange. Unlike cryptocurrencies such as Bitcoin or Ethereum that use either Proof-of-Work (POW) or Proof-of-Stake as consensus mechanisms, Binance Coin uses Byzantine Fault Tolerance (BFT).

Binance Coin has a limited supply of approximately 170.5 million BNB. As of April 2021, around 153 million (around 90%) BNB are in circulation.

Now let’s look at how Binance Coin works based on the main characteristics we just mentioned.

How Does Binance Coin (BNB) Work?

As suggested earlier, Binance Coin uses Byzantine Fault Tolerance (BFT) as a consensus mechanism. Now, what distinguishes BFT from POW and POS? Let’s briefly explain how consensus works on blockchains and why it is important.

The whole idea of blockchain-based cryptocurrencies is to have decentralized services. That is, getting rid of third parties or central authorities that would normally control everything. In order to do that, each transaction would need to be verified by every participant on the blockchain, known as nodes. For a transaction to be verified, these nodes should share the same information to verify transactions and add the information on the blockchain so that other nodes get updated. If the majority of the nodes do not share the same information, then the transaction would not be valid.

This is the idea behind Proof-of-Work (POW) and Proof-of-Stake (POS). Nodes responsible for proper verification are rewarded free coins by the network for the required computational costs. But since these processes are prone to many flaws, a shared consensus becomes a harder thing because the information might be delayed due to technical issues. Hence, this problem is known as Byzantine Fault, based on the war strategy dilemmas of the past.

BFT emerged from this Byzantine Fault concept. Hypothetically speaking, if some nodes run a blockchain, most of them need to share the same verdict in order for the blockchain to properly continue its work. But if a group of nodes has problems with sharing transactions where ‘fault’ is caused, the blockchain tolerates them and accepts new information despite the faults. As such, this consensus tolerance is known as Byzantine Fault Tolerance (BFT).

A feature of BFT is that the mining process does not occur in the blockchain because there is no Proof-of-Work. Due to this, Binance Coin cannot be mined. Only validators earn from the security they provide to the blockchain.

Binance Coin goes through the process of burning. In order to promote an inflation-free market, circulating BNB coins are burned, based on the number of transactions that occur within three months. The burning of BNB coins is planned to continue until 50% of the initial total supply is burned, meaning that the total BNB coins can be 100 million BNB.

How do You Store Binance Coins (BNB)?

BNB can be stored in both hot and cold crypto wallets. While hot wallets are online and more suitable for day traders (frequent traders), cold wallets are safer because they are offline, not vulnerable to hackers, and more suitable for swing traders (long-run traders).

Some of the best hot wallets that support BNB are Trust Wallet, Atomic Wallet, Guarda Wallet, Coin.Space Wallet, etc. These are some of the safest online crypto-wallets.

The best cold wallets that support BNB are Ledger and Trezor, preferably the new models, namely that of Ledger Nano X and Trezor Model-T. These are the safest crypto wallets so far in the crypto sphere.

Since BNB is the native coin of Binance exchange, the best way to buy BNB is through Binance, which can be done with bank transfer, credit card, debit card, etc. It is worth mentioning that Binance takes lower transaction fees when compared to other online cryptocurrency exchanges.

Now that we have covered the fundamentals of the Binance Coin, let’s look at the BNB price history and how this history can influence the future of BNB.

Binance Coin (BNB) Price History

According to Coinmarketcap, the initial price of BNB back in July of 2017 was $0.1. Within a month, the price went as high as $2.6. For the next 4 months, the price ranged from $1 to $2, until the first proper bull run finally started in December of that year. The price went to a new high of $22 on January 13th, 2018. It then declined again to around $7 in the following weeks. The price went close to $17 again in June of that year but dropped back to around $4 by December.

At the beginning of 2019, another BNB bull run started, as the price was steadily increasing again. The price went as high as $38.5 by the end of June 2019. The price dropped back and had another increase at the beginning of 2020. The highest price by February was around $26, which then dropped again to roughly $9. The price of BNB had steady increases ever since that, reaching around $38 by January 1st of 2021.

Along with many other cryptocurrencies, BNB began the biggest bull run of its history during the first 4 months of 2021. The price was increasing at a quick rate, exceeding $300 within two months. By April 13th, BNB reached its highest price of all time with a value of $637. This was around a 1570% price increase when compared to the very first day of 2021.

Currently, Binance Coin has a market capitalization of $77 billion. As big as it has gotten, it still has a long way to go to reach Bitcoin and Ethereum, with both having a market cap of hundreds of billions more than BNB.

Interestingly enough, every BNB bull run was either initiated at the end of a year or the very beginning. But can the same be said for the years to come? Let’s look at what the future of the Binance Coin has to offer.

What Is The Future Of Binance Coin (BNB)?

When talking about the future of the Binance Coin, it is important to talk about the future of the Binance Exchange itself, since BNB is the native token of Binance.

Binance user number is increasing each day, and this has a direct correlation to the price of BNB as well. Binance is looking to achieve an “open platform” by launching the Binance Broker Program, a program that offers much more services through API. So the growth of Binance can grow the Binance Coin as more users may need the coins.

When discussing the future of BNB, it is worth mentioning the BNB supply and the burning process. If the burning process goes as it is planned by the people that run Binance, it may not be very long until the remaining total supply of the Binance Coin becomes 100 million BNB. Not only that this can affect the nature of BNB, but also its future price.

BNB Price Predictions

Now, let’s see what the experts predict about the future price of the Binance Coin.

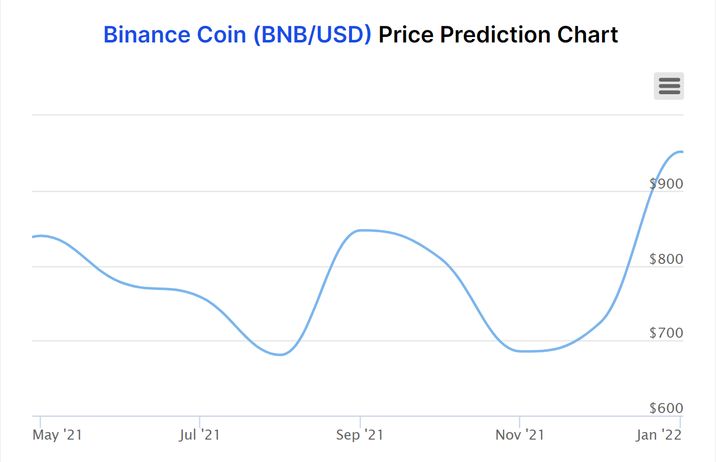

Digitalcoinprice predicts that the price of BNB may keep increasing in 2021, with the price reaching as high as $840 in September, and then have a slight decline to $727 by December.

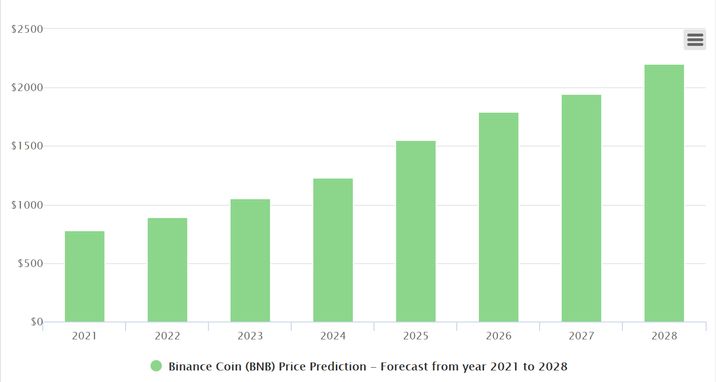

As for the long run, their prediction suggests that the price of BNB can go close to $900. By 2023, the price can reach a value of $1050. This increasing rate may continue, with the price exceeding $1200 in 2024 and more than $1500 in 2025. Binance Coin may finally reach $2000 by 2028 as per Digitalcoin.

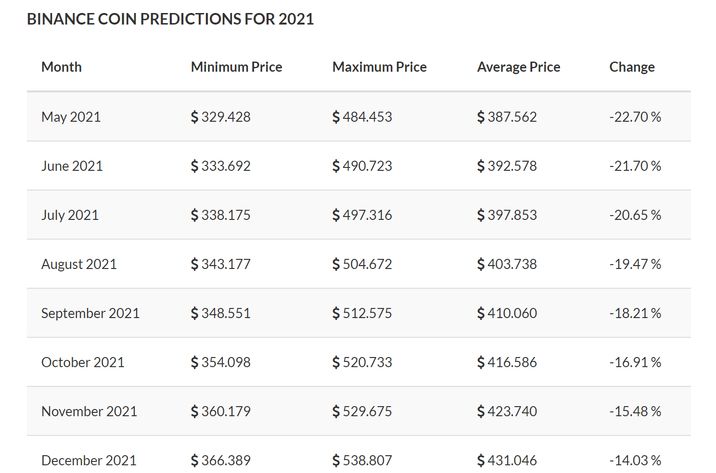

Tradingbeasts, on the other hand, predicts that the average price of BNB may slightly decrease in the following months, with the lowest price being in May at around $330. However, the price may steadily rise again, reaching as high as $538 by December of this year.

As for the long run, Tradingbeasts predict that the price of BNB may keep increasing at the same rate in 2022, with the price ranging from $373 to around $677, surpassing its current highest record. In 2023, the price may range from $470 to $836, with the latter being reached at the end of the year. Last but not least, Tradingbeasts predicts that BNB price can range from $577 to around $790 in 2024.

Walletinvestor also predicts that the price of BNB can increase. The average price for 2021 may range from $450 to $550, with the highest price being reached at the very end of the year. In 2022, the minimum may be $500 while the maximum might be close to $800. In 2023, the average can be around $900, while the maximum which is predicted to be reached by the end of the year can be around $990.

According to Walletinvestor, the $1000 mark can finally be reached in 2024, as the price may range from a minimum of $820 to a maximum of $1200. 2025 and 2026 may continue at the same rate, where the maximum prices can be $1400 and $1570, respectively.

Conclusion

To conclude, the Binance Coin has established itself as one of the most important cryptocurrencies over recent years. It has managed to exceed expectations in terms of usefulness as well as its price. Binance Coin has had tremendous success now ranking as the third cryptocurrency in the market. The success of this cryptocurrency is expected to continue, as we analyzed above with the increase in the price of BNB in the short and long term.

Binance Coin is one of the few cryptocurrencies whose background indicates that its future is bright. Whether it is the future plans of Binance, BNB limited future supply of 100 million, or simply the ranking of the Binance Coin as the third biggest cryptocurrency in the world, people are encouraged to buy more BNB than ever before due to the fear of missing out on the increasing journey of BNB.