What is Blockchain?

In 2008, the world had an issue with trust.

For decades, people believed that there were institutions--the government, and big banks--which, like them or not, at least had things under control. But then the bankers started selling houses to people they knew couldn’t afford them. Then they re-sold those deals to other bankers. When enough loans couldn’t be paid back, it started a chain reaction that led to crises for people around the globe. In the aftermath, the government used the people’s money--what they had left of it, at least--to pay back those banks.

One person or persons who’d had just about enough was Satoshi Nakamoto. In the months following the global crash, the anonymous cryptographer(s) developed a network with the goal of removing the world’s need for such institutions.

It was a bold idea, and today it’s worth 600 billion dollars.

Bitcoin

The Bitcoin network wasn’t just a system of digital money, but one which would “allow online payments to be sent directly from one party to another without going through a financial institution.” No bank, no government would need to oversee the system. In fact, the further away they were the better.

This was easier said than done, of course. Powerful institutions exist because people are selfish. Someone who can take your money for themselves probably will, unless there’s someone bigger involved who can protect you. Without a big, powerful institution in the mix, what would stop any one person from stealing another’s digital money?

This problem was what inspired the blockchain.

Satoshi’s “blockchain” was, in its simplest form, a list--a list of every Bitcoin payment that’s ever occurred, all the way back to the very first. What made this list powerful, though, is that you could trust it. You could trust it even if you couldn’t trust anybody else using it. Broadly speaking, there are a few reasons why:

1. Irreversibility

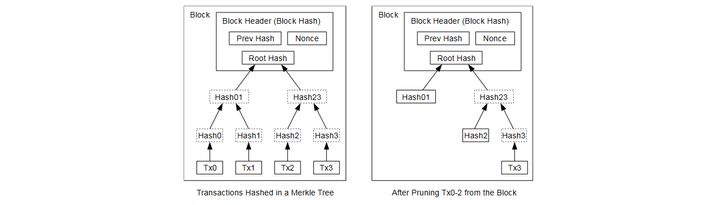

When somebody sends you Bitcoin, that transaction is added to a group of other transactions in a “block.” When that block is processed by miners--the folks who run powerful computers that make sure transactions are legitimate--it’s added to the “chain.”

The “chain” is the real key here. New blocks in the chain--new entries in the list--are cryptographically tied to those which came before them. This may sound confusing, and it rests on a lot of math which is beyond the scope of this article, but the idea is straightforward: any change to a past block will inevitably affect every block which comes after it, because they’re all tied together.

This is crucial for preventing fraud. If somebody pays you, but then they want to take their money back, they can’t do it without messing up the whole blockchain. And that’d be really difficult to cover up, because…

2. Openness

No single body runs Bitcoin--rather, everybody who participates in the network runs it, collectively. This makes stealing Bitcoin even more difficult than robbing banks. Instead of dealing with one company’s CCTV you’re trying to dupe thousands of people around the world, all looking at the same data.

And all those people really do care about preventing fraud--not necessarily because they’re good people, but because they’re incentivized to. The more secure the network is, the more people will trust it with their money, and the more people will invest in it, therefore the higher Bitcoin’s value will be.

3. Decentralization

Since no single entity runs Bitcoin, it is subject to the will of the majority. If one person, company or government were to accumulate over 51% of the network, they would, in effect, control it all, like a majority stakeholder in a company. But Bitcoin is available to anyone in the world with an internet-connected computer. Therefore, the scenario is exceedingly unlikely to occur.

There’s a ton more to say about how Bitcoin works--Proof of Work, (pseudo)-anonymity, and so on. But all you really need to know, to get the gist of it, is that it’s a list. A list that anybody can use, anybody can monitor, and nobody can change.

That makes it a list you can trust with your money, more so than any bank or government out there.

Ethereum

Bitcoin proved to be a perfect system for securely transacting digital currency. But half a decade after Satoshi first proposed his idea, another developer--Vitalik Buterin--came up with a way to improve it.

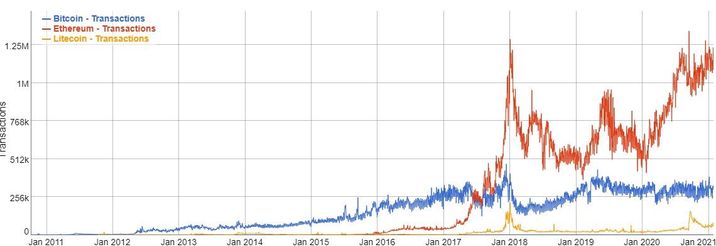

Buterin’s key insight was that blockchain was useful in and of itself, independent of Bitcoin. It was a dish only ever prepared one way, but the same ingredients could be used to cook four-course meals of every imaginable kind. Together with Gavin Wood and others, this insight became Ethereum: the most widely-used blockchain in the world, by some measure.

Ethereum is a layer two solution--not just a blockchain (layer one) but an environment where developers can build things on top of the infrastructure itself. They do it through smart contracts.

Smart contracts are scripts of code which define the rules of a blockchain application. For example, a simple lending-borrowing smart contract might encode that a user who sends one Bitcoin to a “fund” cannot withdraw their deposit for one year. After that year they'll receive it back plus 0.1 Bitcoin in interest.

The important thing about smart contracts is that they are completely unchangeable. And since it’s incredibly difficult to hack a (secure, well-written) smart contract, there’s no need for a central entity--like a government, with ordinary contracts--to enforce it.

With the power of smart contracts, anybody can create their own Ethereum decentralized application, or “dApp”. These dApps can be cryptocurrencies, video games, or anything else imaginable. It’s why Ethereum has been host to almost all of the biggest blockchain events of recent years: the DAO, the DeFi bull market, CryptoKitties and the present NFT boom.

Third Generation

These days, new blockchains to evolve upon the Ethereum model. For example, so-called “Ethereum killers," like Cardano and EOS, offer platforms similar to their predecessor in function, but different in mechanics.

One of those killers, Gavin Woods’ Polkadot, uses blockchains themselves--not dApps--as units in its ecosystem. Its goal is to create a “superhighway” for blockchains, allowing Cardano and EOS and Ethereum and more to all communicate.

As another case study, we can look at Binance Chain. Binance has developed a reputation as arguably crypto’s most trusted centralized exchange (CEX) provider. In 2019, they used their clout to launch a blockchain for crypto tokens. Binance Chain is now largely associated with its most successful project: the company’s own decentralized exchange (DEX), and its native BNB token.

In 2020, the company launched a second, parallel blockchain: Binance Smart Chain. BSC is nothing if not complex, but it’s also in some ways like Ethereum--developer-centric, based in smart contract technology that allows for a wide array of dApps. It distinguishes itself from Ethereum in its mining mechanism, and its cross-compatibility with the original Binance Chain.

As blockchains become more complex and multifaceted, we edge closer towards a third generation: a new way of using decentralized cryptography to trade currencies and run useful software.

Even then, though, the fundamental principles will remain the same. Even the most complex blockchains out there will still just be lists.