What is Solana? - Everything You Want to Know About SOL

All cryptocurrencies try to offer something different to be distinguished as unique. Some of them have managed to rank up in the crypto market because of the special features they have. A cryptocurrency worth noticing when it comes to this is Solana (SOL). Solana is a cryptocurrency that has managed to bring something new to the table, making it one of the most innovative blockchain-based projects of the 21st century. Solana contains a decentralized clock in its blockchain, making it the first cryptocurrency to decentralize the concept of time in cryptocurrencies.

But that is not all about Solana. Despite its innovative concept of a decentralized clock, Solana also offers other effective features that make it a rather smart investment. Other things, such as the Solana background, future goals, and price history are important to be identified if you really want to know everything about Solana. Therefore, in this article, we will go through the main components of Solana and what makes it a potentially profitable investment.

What is Solana (SOL)?

The team behind Solana is based in California, and the name Solana itself originates from a beach in the region. Anatoly Yakovenko, a software engineer who used to work for companies such as Dropbox and Qualcomm, is the founder of Solana. He released the Solana whitepaper back in 2017.

Yakovenko raised funds for Solana through Initial Coin Offering (ICO). The first four rounds were private, and only the last round of ICO was available to the public. In the first round of ICO, around $3.17 million were raised after 80 million SOL were sold to private investors. $12.6 million were raised in the second round, where around 64 million SOL were sold to private investors. Another 25 million SOL were sold in the third round for $2.1 million. The last private round involved the sale of 9 million SOL for $2.2 million. Last but not least, the public ICO that was held in March of 2020, where an additional $1.7 million were raised for 8 million SOL.

Solana uses Proof-of-Stake (PoS) as a consensus mechanism. In PoS blockchains, mining reward depends on the number of coins held as well as the number of coins you stake. What’s staking? Staking is the process of locking some of your tokens or coins so that the network can use those to improve the efficiency of the network. After the staking period is finished, the network rewards you with additional coins as compensation for the opportunity cost involved with staking.

The native token of Solana is SOL. SOL tokens are used to complete any operation within the Solana blockchain. The total supply of Solana is 489 million SOL, and roughly 270 million SOL are already in circulation. Due to its limited supply, the price of SOL has a deflationary nature.

Just like other cryptocurrencies such as Ethereum, the Solana network can be used to create and launch decentralized applications (dApps). These dApps can be created through the programming language Rust, which simultaneously is the programming language of Solana itself.

How Solana (SOL) Works?

So now that we have covered the basics of what Solana is, let’s look at how Solana works.

As mentioned, Solana uses Proof-of-Stake (PoS) as a consensus mechanism. Similar to Bitcoin, Solana uses the SHA256 algorithm as a hash function. However, since Bitcoin uses Proof-of-Work (PoW), the purpose of the hash function in BTC is simply to solve the hash functions and verify transactions. Solana, on the other hand, uses the SHA256 algorithm to verify transactions through timestamps. These timestamps are the main idea of Solana’s decentralized clock, where a transaction is verified after every tick of its decentralized clock. Approximately every 400 milliseconds, a block of transactions in the Solana blockchain are verified.

Every four blocks of information in the Solana blockchain is referred to as a Solana Cluster. To promote a better mining environment, nodes in the Solana blockchain, which are also known as Leaders, rotate after every Solana Cluster (four blocks) is verified. In a total of 1.6 seconds, a node needs to make sure to verify as many transactions as possible before the leading node is switched.

This makes Solana one of the best cryptocurrencies in the world in terms of time efficiency.

But how exactly does Solana achieve this excellency in its efficiency that has made it one of the best investments for day traders? There are 8 main features that distinguish Solana from every other cryptocurrency.

Proof-of-History (PoH) is one of these 8 features that allows Solana to have flawless functionality in its network. It is not a consensus mechanism, despite its name resembling other consensus mechanisms. PoH is the method used by Solana to sign transactions with a timestamp that depicts the exact time of when the transaction occurred. This saves nodes a lot of time when it comes to verifying transactions. That is why a block of Transactions in the Solana network is generated every 400 milliseconds, which is considerably lower when compared to other big cryptocurrencies.

Tower BFT is another feature of Solana and is regarded as the updated version of Practical Byzantine Fault Tolerance (pBFT). In some other cryptocurrencies, nodes have the chance to vote for decisions regarding the blockchain they operate within. In pBFT, nodes can vote once and not need to vote again in other decisions, since they can leave their previous votes to serve as new votes. Hence, the blockchain collects these previous votes, which as a result saves the network a lot of time.

Usually, in many cryptocurrencies, transactions are collected in a mempool before they are verified. Nodes usually pick bigger transactions first instead of smaller ones. In the Solana blockchain, on the other hand, Gulf Stream allows the blockchain to leave the other non-leader nodes to begin verifying some of the transactions in the mempool so that they are verified quicker and the network does not get crowded with a lot of unverified transactions.

Solana uses smart contracts to determine how the network operates. Solana also has Sealevel, a feature that allows smart contracts to run in a parallel manner without interfering with one another. This has improved the performance of the Solana blockchain.

Pipelining is a hardware structure that directs transactions to another hardware. As a result block validation process is much more efficient.

Turbine is a feature of Solana that allows the transactions to break down into smaller parts so that they are sent to the nodes much faster than in other cryptocurrencies. Additionally, this Turbine system uses less bandwidth.

Cloudbreak is an easy way for the system to read and interpret data by using previous a foundation.

Last but not least, Archivers is another hardware structure used in the Solana blockchain. Through Archivers, nodes are able to access information regarding the Solana network much faster. This information can be transaction-based but also other details about the system.

It is worth mentioning that Solana can be traded through different cryptocurrency exchanges, but you need to make sure that the exchange you use is safe, and supports Solana. The best option for trading Solana is Binance.

It is also very important that you store the private keys of your Solana coins in safe crypto wallets, whether they are online or offline. The best software wallets that support Solana are Exodus, TrustWallet, etc. As for hardware wallets, the only choice so far is Ledger Nano S.

Now let’s look at Solana’s price history so we get a better understanding of what’s to come in the future of SOL.

Solana (SOL) Price History

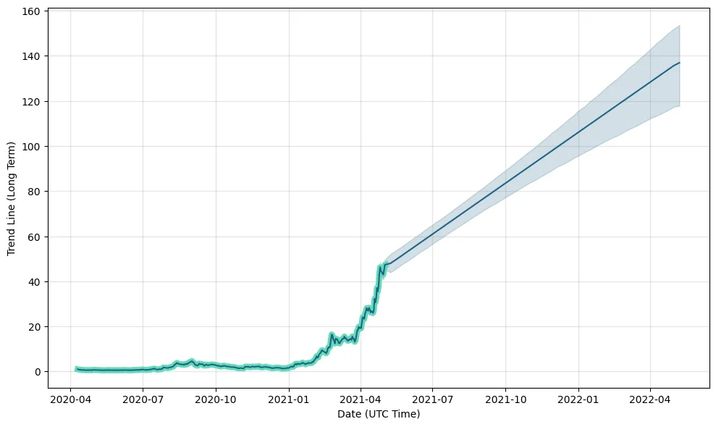

Coinmarketcap suggests that Solana had a starting price of $0.7 on April 11 of 2020. It is a rather high price for a cryptocurrency to debut on, but this price is a result of Solana’s successful ICOs. Investors who had purchased Solana much cheaper during those ICOs used the opportunity to sell some of the SOL immediately. That is why the price of SOL was around $0.5 in May of that year. A few months later, the first SOL bull run started, and the price reached as high as $4.7 by the third quarter of 2020. Late in December, the price ranged from $1 to $2, indicating a sense of stability in the network. The bull run of 2021 has affected Solana as well. At the beginning of the year, the price of SOL was around $1.8. It reached a surgeon $17 by February 24, and it has recently reached its highest price ever with a value of $49.6 on the first week of May 2021.

As of May 9th, Solana has an average price of $44 with a market capitalization of $12 billion. This makes Solana a large-cap cryptocurrency, and it is ranked at 18 in the crypto market.

What is the Future Of Solana (SOL)?

So now that we have gone through the main features of Solana and have seen its price patterns, it is easier to have an understanding of what the future can hold for this innovative cryptocurrency. In the near future, the Solana network is organizing a hackathon where anyone with access to the internet can be a part of and develop a project in the Solana ecosystem. Events like these are another way that the network grows its community and its value as a consequence.

As a network that is constantly updating, Solana is likely to become one of the best cryptocurrencies in terms of time efficiency. Bitcoin had a successful journey because it was the first cryptocurrency in the world; Ethereum had a successful journey because it was the first that offered decentralized services; and so on. Solana, being the first to implement a decentralized clock, can also have a successful journey in the long run. It has already proven to be a good investment for traders so far, and maybe the same can be said about its future. Nonetheless, let’s look at what the experts have to say about the future price of SOL.

Solana (SOL) Price Predictions

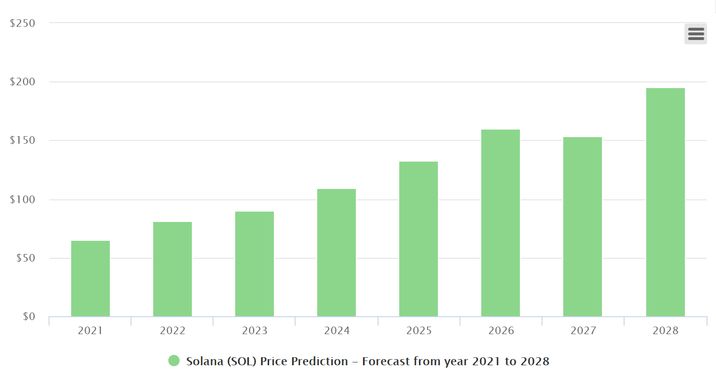

Digitalcoinprice predicts that the Solana price can be around $65 by the end of 2021, $81 in 2022, $90 in 2023, and it may finally reach $100 in 2024, with the average being $109. Bitcoin halving of 2024 might have an impact on the price of SOL in 2025, with the average going up to $133. Can SOL reach $200? Yes, according to Digitalcoinprice. However, the $200 mark might not be achieved until 2028.

Other prediction sites such as Crypto Academy predict that Solana can range from $150 to $200 by the end of 2021 if another bullish run is initiated by the likes of BTC. Moreover, because institutional investors may shift their focus to a promising coin such as SOL, its price can exceed that amount. As for the long-term prediction, Solana may surpass $1000 in 2025 as its supply may get scarcer and Bitcoin has another halving event in 2024.

Walletinvestor also forecast an increase in the price of Solana. They predict that the price of SOL can go up to $100 in 2021. By 2022, the price might range from $97 to $234.

In 2023, an even higher average can range from $160 to $360. In 2024, the price might get very close to $500 by the end of the year, but it may not do so until 2025. In 2025, the price may even exceed $600.

There are also negative predictions regarding the future price of SOL. To illustrate, Tradingbeasts predicts that the average price of SOL might decrease in the following months of 2021, being around $40.

In 2022, however, the price may start to increase again, ranging from $40 to $65. In 2023, the price can range from $57 to $83. In 2024, the average can keep increasing, ranging from $85 to $100.

Conclusion

Solana (SOL) is a cryptocurrency that has a decentralized ‘clock’, where each transaction is signed with a timestamp. There are eight features that make Solana unique from other cryptocurrencies: Proof-of-History (PoH), Tower BFT, Sealevel, Pipelining, Gulf Stream, Turbine, Cloudbreak, and Archivers.

The price of SOL has been increasing continuously ever since it was released in 2020. Moreover, predictions from various experts suggest that the price of SOL can keep increasing. So far, Solana has proved to be a very wise investment for traders.