As Crypto Exchanges Grow, Will Governments Require Crypto Wallets?

Since the explosion of cryptocurrency popularity in 2017, cryptocurrency exchanges are also seeing unprecedented increases in growth every year, with old players in the game growing more powerful and newer entrants into the market aiming to get a slice of the market share for themselves.

This has led to the wrath of numerous governments placing stringent regulations on the use and purchase of cryptocurrencies; this regulatory environment has warmed somewhat since and people are now speculating as to whether governments are going to require crypto wallets.

The Rise of Cryptocurrency Wallets And Exchanges

Cryptocurrency exchanges are currently experiencing massive growth and increases in customer base, with swaths of exchanges being set up since the launch of Bitcoin.

This is even after the market-shaking event whereby Mt. Gox, the largest exchange in the world at the time shut down due to a crippling cyberattack where Bitcoin was stolen in 2014. Governments have been forced to take notice of cryptocurrency.

Since these events, dominant players in the game have emerged, with the following exchanges being the largest by trading volume (10/05/2020).

- Binance: $11,813,342,462.

- Bitmex: $5,736,547,483.

- Bybit: $3,402, 331,088.

- bitFlyer: $2,315,663,178.

- FTX: $1,731,384,670.

Of course, the popularity and increasing presence of cryptocurrency exchanges also have a great influence on the number of cryptocurrency wallets that are being registered. This is because to actually effectively trade on an exchange, a wallet is required.

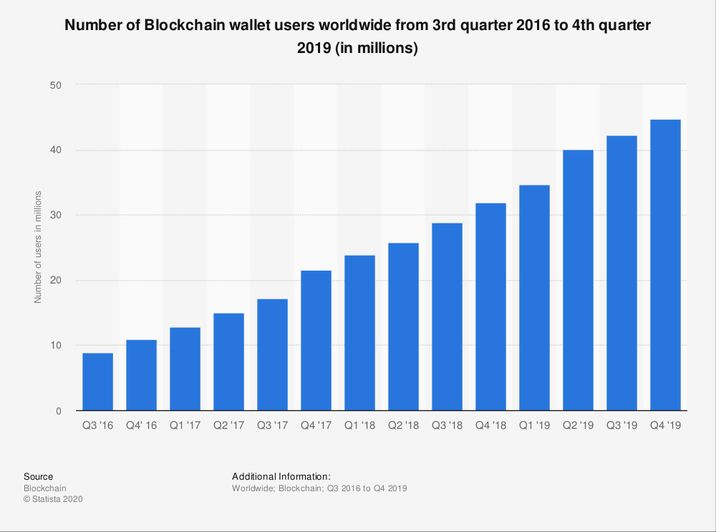

The more successful exchanges become, the more wallets are going to be required. This is reflected in the figures with under 10 Million blockchain wallets registered in 2016 compared to 40 Million in 2019.

Additionally, the development of different types of cryptocurrency wallets, with numerous different players in the industry has led to increases in the prevalence of wallets through market saturation and greater customer choice and differentiation. For example, mobile wallets are great for individuals that are always on the move; whereas a Trezor Wallet is most effective for individuals who need a physical, disconnected device for security.

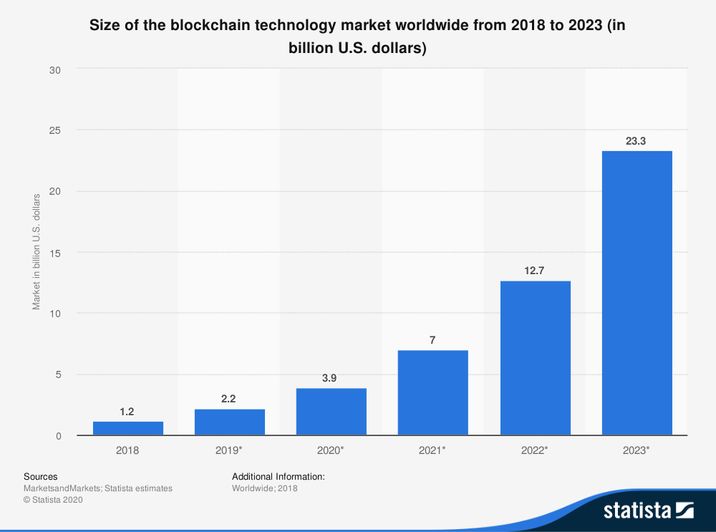

The blockchain technology market is only expected to increase in size, going from $1.2 Billion in 2018, to an estimated $23.3 Billion in 2023. If this occurs, many more cryptocurrency wallets are going to be required by new users and more trades are going to be made on exchanges by these users as a result of these increases. World governments will be given even more reason to consider cryptocurrencies if this occurs.

Government Cryptocurrency Wallets

As mentioned previously, governments around the world have taken incredibly hostile stances on cryptocurrencies in the past, with multiple countries outlawing them with outright bans. Despite this, countries around the world are starting to take notice of the increasing success and sustained confidence of both digital currencies as a whole, and as a consequence, cryptocurrency wallets. Examples of countries that have attempted to launch cryptocurrencies can be found below.

Even the governments of major world powers have been studying the effectiveness of digital currencies for a number of things, namely Russia that has looked into the possibility of using digital currency to facilitate rapid and cheap transfers of money across state lines and investments, although these plans have been put on ice.

Additionally, with the growing influence and power of cryptocurrencies, there is a new wave of liberal finance that seeks to be free from government control, this hasn’t stopped governments of countries from toying with the idea of creating a centralized digital currency most likely a stable coin, pegged to the national currency.

It is uncertain how the adoption of a Central Bank Digital Currency (CBDC) will fare in nations, with blockchain platforms providing leading-edge competition and promises of greater privacy and autonomy.

Due to the massive increases in cryptocurrency adoption, if governments wish to become involved in cryptocurrency use, or the use of digital currencies it is likely they will need crypto wallets; due to the fact that they are currently an integral part of digital currency infrastructure and due to the fact that non-custodial wallets are safer than centralized storage solutions.

Central Banks around the world are also dragging their feet with CBDC programs, with 85% stating they are unlikely to bring anything to fruition in the near term. This gives the opportunity for wallet platforms and the crypto community to drive light years ahead of similar, centralized government projects, which may further engage governments to use crypto-wallets; to adapt to the more developed system of digital currency management and not to fall behind.

Conclusion

Initially, governments and financial institutions widely disregarded cryptocurrencies and envisioned that they would not last. A few years on and the market has since gone from strength to strength despite causes for concern.

From what has been discussed, it can be seen that more and more individuals are being drawn to the autonomy and freedom of cryptocurrencies; freedom that will not be provided by government CBDC programs.

It is incredibly likely that more and more governments will use digital currency wallets in the future, to reduce currency transfer expenses and the time taken for these transfers and for other utilities. In the event that CBDCs are not taken up successfully, or are not developed in pace with current blockchain solutions, governments may have to bend to the will of the people who will be using proven, safe and autonomous solutions rather than the less developed alternative.

The number of people using cryptocurrency wallets will keep increasing and it would not be surprising to see governments using them in the near future, the rise of wallets will be aided by the increasing popularity and usage of cryptocurrency exchanges.