How to Bridge Tokens Across Blockchains Without Losing Your Assets

According to Chainalysis, the largest amount ever stolen through a bridge was over $2 billion in crypto, primarily in 2022, through 13 known exploits. Meanwhile, crypto bridges can solve a number of problems. For example, you may need to transfer your USDT coins from the Ethereum network to the BNB Chain or Polygon networks in order to save on fees. In this case, you must use a bridge.

We have designed this article to explain how crypto bridges work in practice and to help you understand common mistakes that users often make when using bridges.

What Is a Crypto Bridge?

A crypto bridge is a set of smart contracts and servers—essentially, a cross-chain bridge protocol—that allows users to transfer coins from one blockchain to another. Since blockchains are not directly connected, assets cannot be transferred physically. That is why a bridge is required.

The word “bridge” was not chosen by chance. In the physical world, a typical bridge connects two riverbanks to create a road and infrastructure. In the crypto world, the logic is similar, as a crypto bridge performs the same function: it links two blockchains that lack a direct connection.

How Does a Crypto Bridge Work?

Since a blockchain is a high-privacy system, you cannot just send an ETF to the Solana blockchain, for example. That is why developers created another way — to prove that tokens were locked on the blockchain. Thus, a crypto bridge can be understood as a trust and verification agreement between two systems.

In the past, crypto bridges were centralized and worked like a bank, but today, smart contracts are widely used. They receive and lock tokens themselves and make decisions independently to send an equivalent amount to another network. That is how bridges became part of DeFi.

In other words, when you use a bridge, you are actually communicating with a smart contract in one network and then with another in a different network. At that moment, complex verification logic operates between them.

What exactly happens?

Firstly, you need to find a reliable cross-chain bridge protocol. Each blockchain usually develops its own bridge. For example, official ETF Layer 2 bridges are used for transferring between Ethereum and Layer 2 networks: Arbitrum Bridge, Optimism Bridge, Base Bridge, and zkSync Bridge.

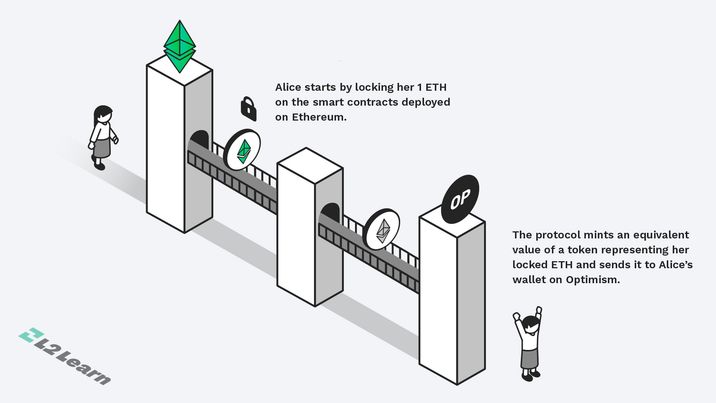

Secondly, you need to define the amount of tokens you want to transfer, and a direction — for example, from Ethereum to Polygon. Then you send tokens to the bridge smart contract, which locks the coins — they are stored at its address and cannot be spent or transferred. The fact of locking is recorded as an event in the blockchain. Moreover, it serves as proof that a certain number of tokens has indeed been removed from circulation in the first network.

Now the mechanism for confirming the bridge is launched. The main goal is to ensure that the locking really happened and all data is verified. These operations can be performed by validators, multisignature mechanisms, or other cryptographic proofs — depending on the architecture.

After confirmation, the bridge initiates the issuance of tokens in the target network, where a new smart contract is created. It is called a bridge token.

1 bridge token = 1 crypto token

Its value depends entirely on the fact that real tokens are still locked in the source network and that the bridge correctly maintains a one-to-one correspondence.

Finally, a few seconds later, you will see your tokens in the new network. The transfer via the bridge is complete.

What Are Bridge Tokens in Cryptocurrency and How Do They Work?

Since different blockchains do not link to each other, a bridge cannot simply transfer an ETF token to Polygon. For that, there are special bridge tokens. They resemble a duplicate of the original cryptocurrency tokens, and they are called wrapped tokens, or cross-chain tokens. In our case, when you bridge an ETF token to Polygon, you receive a bridged ETH.

However, there are some additional operations that allow a bridge token to function properly:

- Mint is used to create new tokens.

- Burn is used to destroy existing tokens.

When you send tokens through the bridge, the original token is locked, and the bridge mints a new token that represents the locked original. This new duplicate token is the bridge token.

There is also a reverse operation. If you want to retrieve the original token, a problem arises — the bridge token already exists, and simply duplicating the original token again is not allowed. That is why the bridge burns the bridge token. After that, you can safely unlock and release the original token back into circulation.

Any violation of this logic — for example, issuing tokens without proper locking or the inability to unlock the original assets — leads to a loss of trust and a devaluation of bridge tokens. That is why the security of bridges and the accuracy of their verification processes are considered critical for the entire cross-chain infrastructure.

Thus, mint and burn are mechanisms for synchronizing the balance between networks. Minting ensures that exactly as many tokens appear in the new network as were removed from the old one. Burning ensures that these tokens disappear before the original becomes available again. Without these operations, a token could exist in two networks at the same time, which would lead to inflation and a loss of value.

Which Platforms Offer the Most Reliable Bridge Tokens for Cross-Chain Transfers?

In short, the most reliable bridges for cross-chain are those with minimal trust in external participants and maximum verification at the protocol level. Below are some platforms on the crypto market, which you can use. For the first time, make sure that each service is verifying and not a scam.

Official Ethereum → L2 bridges

This is the gold standard for security today. These bridges inherit Ethereum's security. Even if L2 breaks, funds can be returned via L1. Minting and burning are controlled by the protocol, not validators.

👉 If the task is to transfer assets from Ethereum to L2, there is no better option.

Cosmos IBC

The Inter-Blockchain Communication (IBC) protocol is a standard framework that enables secure interoperability and data exchange between independent blockchains. It is the only widely used system where cross-chain interaction is built into the protocol rather than added on top.

IBC uses light clients and cryptographic proofs rather than multi-signatures and trusted relays. This greatly reduces the class of attacks. Moreover, some tutorials will probably be useful for you.

👉 The best option within the Cosmos ecosystem.

Large universal bridges

Used when different L1s and ecosystems need to be connected.

However, the risk is higher because they rely on validators, oracles, or relayers. Even with audits, there remains a trust assumption: if control is compromised, unauthorized minting is possible.

👉 Suitable for working operations, but not for storing large amounts of capital.

The Best Bridge Token Services for Transferring Ethereum Tokens to Other Chains?

Portal Bridge is a bridge built on the Wormhole protocol that enables fast and direct token transfers between Ethereum and a variety of other networks. It supports a wide range of chains and is actively used to move ERC-20 tokens.

Symbiosis Finance is not just a bridge, but a multi-chain solution with swap + bridge capabilities: users can not only move assets between networks, but also exchange them in a single interface. It supports dozens of blockchains (Ethereum, BNB Chain, Polygon, Solana, and others).

Stargate Finance is a bridge built on LayerZero that provides transfers between multiple EVM-compatible networks with good liquidity and fast confirmation times.

Synapse is a protocol that supports a wide range of networks (Ethereum, Avalanche, Polygon, Fantom, BNB Chain, and others) and allows for the transfer of both tokens and data.

Hop Protocol is a bridge that is well suited for fast transfers between Ethereum L2s (e.g., Arbitrum, Optimism, Polygon) and is especially useful if you need to frequently transfer stablecoins between L2s.

What Are the Risks Involved in Using Bridge Tokens on Decentralized Exchanges?

Using bridge tokens on decentralized exchanges introduces risks that don’t exist with native assets, because their value depends on an external bridge rather than the blockchain they trade on.

The primary risk is bridge failure. Bridge tokens are backed by assets locked on another chain, and if the bridge’s validation or minting logic is compromised, tokens can be created without real collateral. DEXs will continue to trade these tokens until the failure is discovered, at which point the token rapidly de-pegs and liquidity collapses, leaving traders and liquidity providers with severe losses.

A second major risk is de-pegging during stress. Even without a hack, congestion, pauses, or limits on a bridge can prevent arbitrage from restoring the 1:1 price. Automated market makers will mechanically reprice the token downward, amplifying losses for LPs who cannot exit quickly.

Liquidity fragmentation further increases danger. The same asset may exist as multiple bridged versions across chains and protocols, each with shallow liquidity. This leads to high slippage, unstable pricing, and easier market manipulation on DEX pools.

Finally, there is redeemability risk. Bridges can be paused, frozen by governance, or shut down entirely. When redemption is no longer possible, the bridge token becomes a discounted claim on an inaccessible asset, and DEX liquidity turns into trapped capital.

Read more: How Crypto Scammers Use Bridges — and How You Can Protect Yourself

Frequently Asked Questions

What Does Bridge Mean in Crypto?

In crypto, a bridge is a protocol that allows users to transfer tokens between different blockchains. Since blockchains cannot communicate directly, a bridge locks or burns tokens on one chain and mints equivalent tokens on another, enabling cross-chain interoperability.

How Can I Use Bridge Tokens to Move Assets Between Different Blockchains?

To use bridge tokens, you send your assets to a bridge smart contract on the source blockchain. The bridge locks or burns the original tokens and issues equivalent bridge tokens on the destination blockchain, which you can then use in DeFi applications or exchanges.

How Do I Choose the Right Bridge Token for Moving Stablecoins?

When moving stablecoins, choose bridge tokens backed by audited, well-established bridges with high liquidity and strong security records. Prefer bridges that maintain a reliable 1:1 peg and support fast redemption to reduce de-pegging and liquidity risks.

How Do Bridge Tokens Compare to Wrapped Tokens in Cross-Chain Transactions?

Bridge tokens and wrapped tokens both represent assets from another blockchain, but bridge tokens are typically issued through cross-chain bridges, while wrapped tokens often rely on custodians or single-chain contracts. Bridge tokens offer broader cross-chain flexibility but introduce additional bridge-related security risks.