An In-Depth Look Into SushiSwap (SUSHI) - What is SUSHI’s Future?

Sushiswap is a decentralized cryptocurrency exchange platform forked from Uniswap. It's an Ethereum-based system and its main goal is to bring together a community of crypto users and fans to work on a platform where they can sell and acquire crypto assets.

In this article, we’re going to take an in-depth look into SushiSwap (SUSHI). What is SushiSwap? How does SushiSwap work? Its price analysis, predictions, and future are all going to unfold. Let’s begin.

What is SushiSwap (SUSHI)?

SushiSwap is an Ethereum-based platform that aims to entice and attract a network of users to build a platform where they can buy and trade crypto assets. The way that SushiSwap achieves this purpose is by using a set of liquidity pools, similar to platforms like Uniswap and Balancer. In this way, traders buy and sell cryptocurrencies from those pools, changing out one token for another, after users use smart contracts in order to lock up assets.

SushiSwap is also one of a growing number of decentralized finance (DeFi) services that allow users to exchange cryptocurrencies without the use of a central operator or a centralized government. Decentralized exchanges are gaining momentum because they provide a safe environment for peer-to-peer cryptocurrency transactions without the need for an intermediary. It also comprises its own AMM which implies that assets are priced using a pricing algorithm rather than an order book, the way regular exchanges do.

What this means is that holders of SushiSwap's native coin, SUSHI, can vote and make choices about the program. Anyone with a balance in the asset can suggest modifications and voice their opinion on how it works, as well as vote on other users' recommendations.

SushiSwap's architecture, like Uniswap's, serves to reduce overall market concentration. Users can trade freely by using liquidity pools and non-custodial wallets directly. As a result, SushiSwap is more secure and less likely to be hacked as well as offers consumers greater currency selection options. When compared to the AMM, SushiSwap was created in order to provide people more influence over the AMM and its future improvements.

How SushiSwap (SUSHI) Works?

As mentioned above, SushiSwap's main purpose is to simulate a regular exchange by allowing users to purchase and sell different crypto assets. Tokens exchanged on SushiSwap are kept through the use of smart contracts, rather than by a single central body, and users can lock crypto on the program, which can then be accessed by traders. Those that trade against locked assets have to pay a fee, which then is equally allocated to all liquidity providers depending on how much stake they own in the pool. Let’s talk about some of the features of SushiSwap.

SushiSwap Farms

By linking their Ethereum wallet to the SushiSwap farming software and locking two assets into a smart contract, liquidity providers are able to contribute to SushiSwap pools. SushiSwap's USDT/ETH liquidity pool, for example, consists of deposits made up of equal value in USDT and ETH.

Following that, buyers can then also trade tokens inside the pool according to the specifics of the protocol's regulations. SushiSwap smart contracts take the buyer's tokens and transfer an equal number of tokens back, making sure that the overall pool price remains constant.

Providers are then compensated with protocol fees as well as a piece of the 100 freshly minted SUSHI every day in exchange for them maintaining liquidity in these pools. Providers may withdraw their payments as well as their "harvest," which is the Bitcoin gained via farming, at any point in time they wish to. In other words, individuals can opt-out of the liquidity pool whenever they’d like.

Users can also earn additional cryptocurrency after harvesting their SUSHI by making use of the SushiBar app, which lets users stake their SUSHI and in return earn the xSUSHI token, which is made up of SUSHI tokens purchased on the open market and a part of the exchange's fees.

BentoBox

BentoBox is a lending function of SushiSwap that was introduced in December 2020. The platform has yet to open, despite being scheduled to do so in January. How does SushiSwap's platform stand out from the others when it comes to loan opportunities? Let’s take a look.

Each token of a trading pair is typically stored in a single contract. SushiSwap keeps all tokens in one vault on what’s called BentoBox. This is done not just with loan contracts, but also with other types of contracts as well. Developers also have the ability to create extensions that leverage the BentoBox with different protocols.

The following are the advantages of BentoBox and its model, according to the original announcement that was released:

- Each protocol manages its own funds, namely those that the user allows.

- Tokens that have been authorized in the vault are accepted by all protocols that use BentoBox.

- Allows internal token transfers to have minimal flat gas prices.

Loans on the BentoBox are enhanced because of the deployment of numerous decentralized oracles. At one point, the ecosystem had experienced an increase in price reporting dysfunctions as a result of developers relying on just one or two faulty oracles. SushiSwap solves this problem by allowing users to decide which oracle they want to employ when making use of the loan platform.

SushiSwap (SUSHI) Price History

Sushiswap was originally founded by two anonymous engineers in 2020. Although their history is brief, it is full of suspenseful narrative twists and debates. Sushiswap was a huge success in the beginning, with over $1 billion in sushi contracts invested as of September 6, 2020.

However, a problem was exposed after one of the network's founders, Chef Nomi, sold all of his $14 million worth of Sushi tokens unexpectedly, causing their value to plummet by more than half. This caused a lot of trust to be lost by many SUSHI holders. Sushiswap was at that point generally thought to be a scam, with many users proclaiming it a money-making scheme. On September 11, Chef Nomi apologized to users and refunded all payments to Sushiswap.

On August 28, 2020, the SUSHI token was introduced. SUSHI was first priced at $3.44 around the time of launch. Both the cap market and the price grew as a result and by September 1, the price had risen to $10.19. After that, the price of SUSHI began to gradually and steadily decrease throughout the months and by the middle of November, it started to expand. The price of SUSHI, however, had progressively declined as a result of the bull market's effects, reaching $2.69 by the end of 2020.

Regardless, the market pulled through and the price continued to grow throughout the year. It slowly continued increasing for a bit until January 9, when it dropped from $4.67 to $3.40. On January 16, however, it had soon climbed back up again to $7.37. Since then, the currency has been flowing perfectly on the peaks with only minor fluctuation.

What is the Future Of SushiSwap (SUSHI)?

SushiSwap has a great roadmap planned ahead for its upcoming future. The team at SushiSwap says that the "new" version will continue offering automatic marketing as well as the chance for yield-hungry DeFi investors to receive yield farming incentives, but it will be packaged in a new way with a large list of new uses and features.

The Miso Launchpad

Miso is a token launchpad that will act as a decentralized version of the Binance Launchpad, which has released a number of successful tokens. Miso's audits are slated for Q2/2021, so with that said, we should be seeing auctions and crowdsales on SushiSwap as early as this summer.

MIRIN

MIRIN is a proposed enhanced version of the current SushiSwap protocol, with a primary goal of propelling the project to the forefront of not just DeFi, but also the worldwide crypto exchange industry. They want to have centralized cryptocurrency exchanges allowing their customers to also participate in decentralized liquidity pools, getting them to provide additional yield-earning options to their users.

BentoBox

As mentioned previously, BentoBox is a new platform that will be rolled out in the next few weeks as part of the new SushiSwap. This feature is one of the biggest steps in SushiSwap’s roadmap. The Sushi-themed software will provide SushiSwap customers yet another way to make money, this time through decentralized crypto loans.

New Integrations

The majority of AMMs can only trade on one blockchain. SushiSwap, on the other hand, plans to provide non-custodial, cross-chain liquidity by partnering with Rune and Moonbeam. The algorithmic stablecoins FRAX and DSD, as well as the BAO yield farming system, will also be incorporated. The project's core developers are also looking to incorporate ArcherDAO to mitigate the impact of miner extractable value (MEV). Lastly, the chefs at SushiSwap want to also provide incentives to encourage additional teams to build solutions for the new SushiSwap ecosystem.

SushiSwap (SUSHI) Price Predictions

Last November, the SUSHI/ETH yield reached 1500%, according to experts. The requirement to obtain SUSHI tokens in order to compete in the pool ended up in favorable price revisions at the beginning of 2021. Sushi is overall expected to remain positive throughout this year with a market cap of $1,349,649,894 and a current price of $10.61. At the time of writing the circulating supply of Sushi is roughly 127,244,443 SUSHI, with a 24-hour price movement of over 20%.

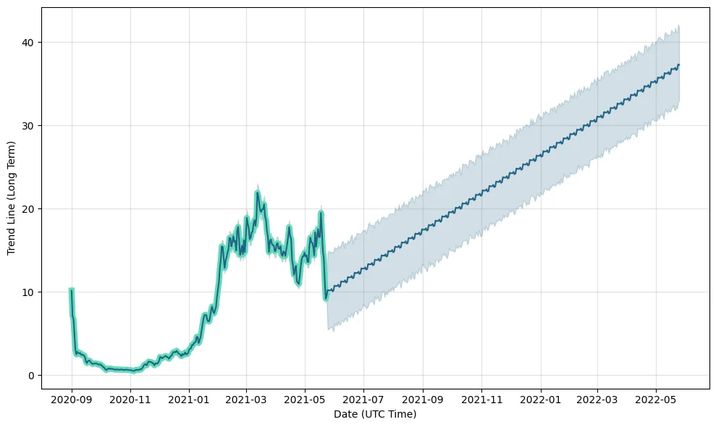

Sushiswap may find it difficult to maintain a modest trading volume while more and more coins are being introduced to the market, diluting the supply, as the SUSHI/USD price climbs with higher trading activity. Even while the 100 percent return is regarded as necessary, it puts a halt to any further price increases, possibly bringing Sushiswap to $40 for the first time in the year 2022.

Sushiswap's potential is bolstered by a strong support network of rich Asian business people. Sushiswap's pricing has demonstrated volatility and dynamism, as the coin has been used in a variety of activities. The asset price might climb again, reaching $65 to $70 by the end of 2023, based on many analyst opinions, Sushi price estimates, and statements from the team at SushiSwap.

The price change of SUSHI is also expected to take off on a great adventure between 2023 and 2025, according to an enthusiastic prediction, with very high expected growth rates in the next five years. However, it’s important to take a look at what forecasting platforms and crypto experts also have to say about SushiSwap’s price future.

According to Walletinvestor, SUSHI is expected to rise by more than 40% in the near future.

More specifically, WalletInvestor predicts that the currency might average $40.19 in 2021, with a low of $36.18 and a high of $44.96. WalletInvestor is cautiously enthusiastic about the coin's future prospects that by 2026, they expect the coin to have surpassed the $130 threshold.

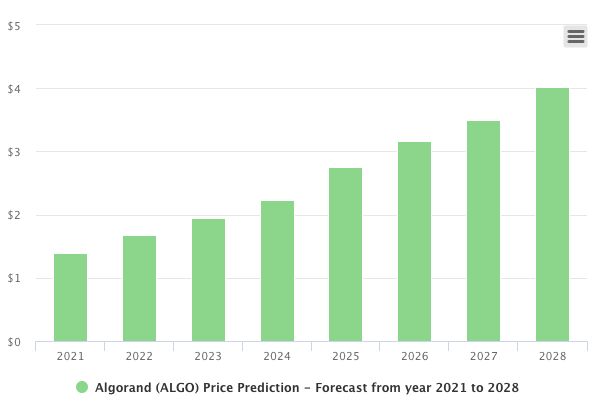

The CoinArbitrageBot forecast predicts that SUSHI is a good investment since its price is expected to rise in the long term. They forecast that the currency might yet tumble to about $5.85 or increase to $24.15 in 2021, according to CoinArbitrageBot researchers.

DigitalCoinPrice has also predicted SUSHI’s future as well. By the end of the year, they forecast the price to have risen to $32.93, a 64.26% increase. The DigitalCoinPrice forecast indicates a definite positive trend. They predict the coin to break the $100 barrier by 2028.

Conclusion

SushiSwap is a decentralized exchange that was created on the Ethereum Blockchain. We may argue that the cryptocurrency has risen from the ashes after hitting all-time lows during the year, however, the coin's future prospects appear to be bright. It appears that the past investments made by traders and SUSHI fans may double in size as long as their plans go as followed.

SushiSwap is a fascinating experiment that tests the competitive advantage of Uniswap, another popular DeFi protocol. SushiSwap is a fork of Uniswap that differs mainly in terms of community governance. No matter what level of success SushiSwap achieves in the end, it demonstrates that in DeFi, no product or service has an unambiguous advantage.